Disclosure: This is NOT legal advice. Laws change frequently. Always verify current regulations in your specific market and consult a local attorney before starting a rental arbitrage business.

Is Rental Arbitrage Legal? Yes, With Conditions

Is rental arbitrage legal? Yes. Rental arbitrage is legal in most U.S. Markets. No federal law prohibits it. No state outright bans the business model itself. But, and this is the part that trips people up, legality depends entirely on three things: your lease agreement, your local regulations, and whether you have written permission from the property owner.

I’ve operated rental arbitrage units across multiple states since 2019. The single biggest mistake I see new operators make? They assume “legal” means “no restrictions.” Wrong. Legal means you can do it, but you need the right paperwork, the right permissions, and the right market. Skip any of those and you’re looking at fines, eviction, or worse.

This guide breaks down exactly what’s legal, what’s restricted, and how to verify legality in your specific market before you sign a lease. I’ve included a state-by-state reference table, the actual permits you’ll need, and the compliance steps that separate a successful rental arbitrage business from one that gets shut down in month three.

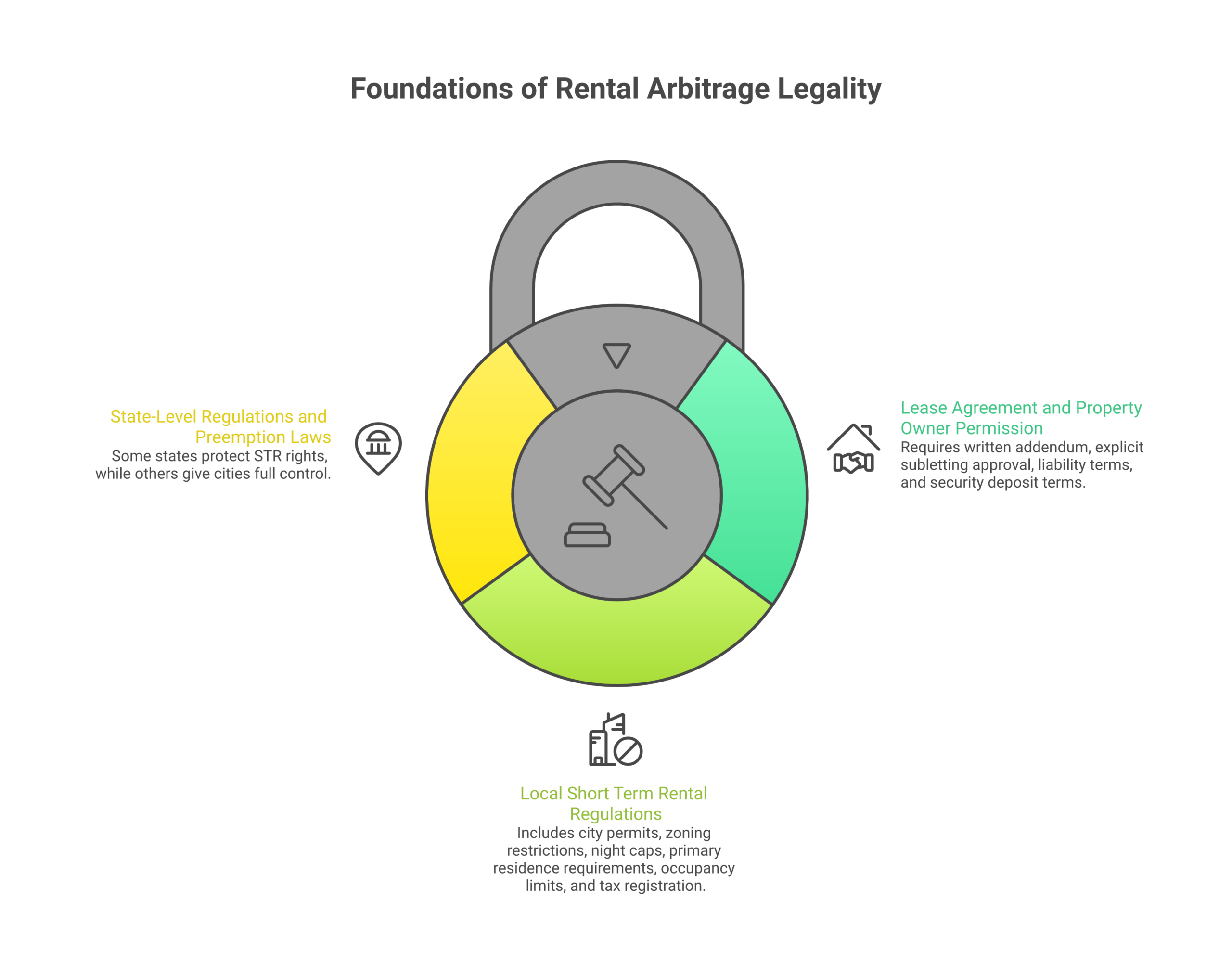

Three Pillars of Rental Arbitrage Legality

Every rental arbitrage legal question comes down to three layers. Miss any one of them and your short term rental business is at risk.

1. Lease Agreement & Property Owner Permission

This is the foundation. Your lease agreement must explicitly allow subletting or short term rentals. Most standard leases prohibit subletting entirely. That means you need to either negotiate a new clause or get a separate written addendum from the property owner.

Here’s what the addendum should cover at minimum:

- Explicit permission to list the property on vacation rental platforms (Airbnb, Vrbo, etc.)

- Agreement on how rental income splits work (if applicable)

- Liability and insurance requirements

- Property damage responsibility and security deposit terms

- Termination conditions specific to the short term rental use

- Noise, parking, and guest behavior expectations

Without written property owner approval, you’re violating your long term lease. Period. I’ve seen operators lose their security deposit, get evicted, and face lawsuits because they assumed a verbal “sure, go ahead” was enough. Get it in writing.

2. Local Short Term Rental Regulations

Local laws are where rental arbitrage legality gets complicated. Short term rental regulations vary wildly from city to city, sometimes even neighborhood to neighborhood. What’s perfectly legal in Nashville might get you a $10,000 fine in New York City.

Local regulations typically cover:

- Permit and licensing requirements: Most major cities require an STR permit or business license. Local permit fees range from $50 to over $700 depending on the city

- Zoning restrictions: Some residential zones prohibit commercial short term rental activity entirely

- Night caps: Cities like San Francisco cap unhosted rentals at 90 nights per year. Los Angeles allows 120 unhosted nights

- Primary residence requirements: Some jurisdictions only allow STRs in your primary residence, which creates challenges for the rental arbitrage business model

- Occupancy limits: Maximum guest counts per bedroom or per property

- Tax registration: Transient occupancy tax (TOT), hotel tax, sales tax. These vary by jurisdiction and you’re responsible for collecting and remitting them

3. State-Level Regulations & Preemption Laws

Some states have passed preemption laws that limit how restrictive local governments can be. Others let cities do whatever they want. Understanding your state’s approach tells you whether local laws or state laws carry more weight.

States with strong preemption (limiting local bans):

- Florida: Strong preemption remains in place after a 2024 gubernatorial veto. Cities can regulate safety and operations but can’t outright ban STRs

- Arizona: State law protects property owners’ right to operate STRs, though cities can impose health, safety, and nuisance regulations

- Indiana: Preemption prevents local governments from banning STRs entirely

States with local control (cities set their own rules):

- California: Each city sets its own STR rules. Santa Monica, San Francisco, and LA have vastly different approaches

- New York: Local Law 18 in NYC essentially eliminated 75% of short-term rental listings

- Colorado: Cities like Denver, Boulder, and mountain towns each have unique frameworks

State-by-State Rental Arbitrage Legality Table

This table covers the 20 most active states for short term rental arbitrage. Rating reflects how friendly the state is for the rental arbitrage business model specifically (not just STRs in general). Always verify current local regulations before committing.

| State | Arbitrage Rating | State-Level Rules | Key Restrictions | Best Cities for Arbitrage |

|---|---|---|---|---|

| Florida | Friendly | State preemption protects STR rights. DBPR registration required for 3+ rentals/year under 30 days | Miami Beach bans rentals under 30 days in most residential areas. Cape Coral fined one operator $30,000+ | Orlando, Tampa, Jacksonville, Kissimmee |

| Texas | Friendly | No state-level STR ban. Regulation at city level | Austin fees exceed $700 with density restrictions. Houston requires registration starting 2026 | Dallas, San Antonio, Houston (with registration) |

| Tennessee | Friendly | No state ban. Nashville has specific STR framework | Nashville non-owner-occupied permits limited in some zones. Permit required | Nashville, Memphis, Gatlinburg, Pigeon Forge |

| Georgia | Friendly | 4% state sales tax + $5/night hotel-motel fee. Local regulation | Atlanta limits operators to 2 properties. Savannah requires permits and zones STRs | Atlanta (with limits), Augusta, Columbus |

| Arizona | Very Friendly | State preemption protects STR operator rights. Cities limited to health/safety/nuisance rules | Sedona attempted restrictions, appeals court ruled against mobile home STR ban | Scottsdale, Phoenix, Mesa, Tucson |

| California | Restrictive | New law requires platforms to share host registration data with local governments | SF: 90-night cap. LA: 120-night cap, primary residence required. Santa Monica bans unhosted. Irvine bans in residential | San Diego (with permits), Sacramento, Palm Springs (zones vary) |

| New York | Very Restrictive | Counties now authorized to develop STR registries. Platforms must submit quarterly reports | NYC Local Law 18 removed 75% of listings (only ~2,100 approved). Must be present during stay | Upstate markets: Catskills, Hudson Valley, Lake George |

| Colorado | Moderate | Counties authorized to raise lodging taxes up to 6% via ballot | Denver requires primary residence. Mountain towns have strict caps. Boulder created festival lodging rental license | Colorado Springs, Aurora, suburban Denver |

| North Carolina | Friendly | Local regulation. Generally permissive statewide | Chapel Hill limited to mapped zones with caps. Asheville requires permits | Charlotte, Raleigh, Wilmington, Outer Banks |

| Ohio | Friendly | Local regulation. No state ban | Columbus requires STR license, can suspend for violations. Cleveland has registration requirements | Columbus, Cincinnati, Cleveland |

| South Carolina | Moderate | Local regulation with growing enforcement | Hilton Head raised STR-related fines in 2025. Charleston has specific STR ordinances | Myrtle Beach, Columbia, Greenville |

| Nevada | Moderate | Local regulation. Court challenges ongoing | Clark County ordinance enforcement blocked by federal judge (preliminary injunction). Las Vegas has permit requirements | Las Vegas (with permits), Henderson, Reno |

| Virginia | Moderate | Local regulation with new enforcement tools | Virginia Beach introduced criminal penalties for violations in 2025 | Richmond, Norfolk, Virginia Beach (with strict compliance) |

| Oregon | Moderate | Local regulation. Portland tightening | Portland enacted stricter safety standards. Bend and coastal towns have their own frameworks | Salem, Eugene, Bend (with permits) |

| Indiana | Very Friendly | Preemption prevents local governments from banning STRs | Cities can still require permits and enforce safety standards | Indianapolis, Fort Wayne, South Bend |

| Illinois | Moderate | STRs subject to state Hotel Operators’ Occupation Tax as of July 2025 | Chicago requires monthly data reporting to aldermen. Strict licensing | Suburban Chicago, Springfield, Champaign |

| Hawaii | Restrictive | Transient Accommodations Tax increased to 11% (Jan 2026). New “green fee” (~$100M/year) | Hawaii County requires operator and marketplace county registration. Strict zoning in residential areas | Limited arbitrage viability due to high costs and strict rules |

| Alaska | Friendly | No single state definition. Each municipality sets criteria | Anchorage requires local license per unit. Fairbanks has no dedicated STR registration | Anchorage, Fairbanks (seasonal) |

| Michigan | Moderate | State introducing broader STR policies. Local control dominant | Resort communities have specific caps and registration requirements | Grand Rapids, Detroit, Traverse City area |

| Louisiana | Moderate | Now requires STR marketplaces to collect lodging taxes | New Orleans: Fifth Circuit struck down corporate ownership prohibition. Permits required | New Orleans (post-ruling), Baton Rouge, Lafayette |

This table reflects regulations as of early 2026. Short term rental laws change frequently. Check your specific city’s current ordinances at your local government website or consult our detailed state-by-state regulations breakdown.

How to Verify Rental Arbitrage Legality in Your Market

Don’t guess. Don’t assume. Don’t rely on what someone told you in a Facebook group. Here’s the exact verification process I use before committing to any new market.

Step 1: Check Your City’s STR Ordinance

Go to your city’s official website. Search for “short term rental ordinance” or “transient occupancy” or “vacation rental permit.” You’re looking for the actual municipal code, not a summary article. Most cities publish their STR regulations online.

What to look for:

- Is an STR permit or license required?

- Are there zoning restrictions (STRs only allowed in certain zones)?

- Is there a primary residence requirement?

- Are there night caps (maximum rental nights per year)?

- What are the local permit fees?

- Are non-owner-occupied STRs allowed?

That last question is critical for rental arbitrage specifically. Some cities allow owner-occupied STRs but ban non-owner-occupied ones. Since you’re renting the property long term and subletting it short term, you’re the tenant, not the owner. Some ordinances treat tenant-operated STRs differently.

Step 2: Review County Regulations

City ordinances don’t always tell the whole story. Counties sometimes have their own layer of short term rental regulations. Unincorporated areas near cities often fall under county jurisdiction with different rules. Check your county’s planning or zoning department website.

Step 3: Contact Your City’s Planning or Code Enforcement Department

Call them. Yes, actually pick up the phone. Ask specifically: “I want to operate a short-term rental in a property I’m leasing. What permits do I need and are there any restrictions for non-owner-operated STRs?”

Document who you spoke with, the date, and what they told you. This isn’t legal protection, but it shows due diligence if there’s ever a dispute.

Step 4: Negotiate the Lease Agreement

Once you’ve confirmed the market allows short term rental arbitrage, negotiate your lease. You need explicit written permission from the property owner. Here’s what I include in every arbitrage lease addendum:

- Permission to list on Airbnb, Vrbo, Booking.com, and other vacation rental platforms

- Property owner agrees to STR use for the full long term lease duration

- Agreed-upon liability insurance minimums (I carry $1M minimum)

- Process for handling property damage beyond normal wear

- Monthly rent remains fixed regardless of rental income earned

- Guest behavior standards and quiet hours

Step 5: Register and Obtain Permits

Apply for every required permit before your first guest. Common requirements include:

- City/county STR permit or license

- Business license (sole proprietorship or LLC)

- Tax registration (state sales tax, local occupancy tax)

- Fire safety inspection (some jurisdictions)

- Insurance verification

Pro tip: Many cities now cross-reference vacation rental platforms with their permit databases. If you’re listed on Airbnb without a valid permit number, you’ll get flagged. Some platforms now block listings that can’t verify registration numbers.

Rental Arbitrage vs. Buying a Rental Property: Legal Differences

Before diving into the risks, it’s worth understanding why rental arbitrage has different legal considerations than owning a rental property outright.

When you buy a rental property, you’re the owner. You control the deed, the mortgage, and the rules (within local law). Your biggest upfront cost is the down payment, typically 20-25% for an investment property, which can mean $40,000-$75,000+ out of pocket. You deal with mortgage lender restrictions, property taxes, and long-term maintenance obligations.

With rental arbitrage, there’s no down payment. Your upfront costs are the security deposit (usually one month’s rent), first and last month’s rent, and furnishing costs. Total startup for a single short term rental property might run $5,000-$15,000 compared to $50,000+ for purchasing. But here’s the trade-off: you don’t control the asset. The property owner can choose not to renew your lease. Local regulations can change. You’re building a business on someone else’s property.

That doesn’t make it a bad model. It makes it a different model with different risks. The operators who treat it as a legitimate business, with proper legal structure, insurance, and compliance, build sustainable income. The ones who treat it as a hack get burned.

Cons of Rental Arbitrage: Legal Risks You Can’t Ignore

I’m bullish on this business model. I’ve built a portfolio with it. But I’m not going to pretend there aren’t real legal risks. Here are the cons of rental arbitrage that every operator needs to understand.

Risk 1: Regulation Changes Mid-Lease

This is the one that keeps experienced operators up at night. You sign a 12-month long term lease, invest $15,000 in furniture and setup, and three months later the city passes a new ordinance banning non-owner-occupied STRs. It happens. Houston’s new 2026 registration requirement caught some operators off guard. Austin’s density restrictions eliminated entire neighborhoods from eligibility.

Mitigation: Include a lease termination clause triggered by regulatory changes. Research pending legislation before committing. Focus on markets with stable, established short term rental laws rather than ones currently debating restrictions.

Risk 2: Property Damage Liability

You’re liable for property damage even though you don’t own the property. A guest causes $5,000 in damage, the property owner comes to you. Your security deposit probably covers $2,000-$3,000. The rest comes out of your pocket.

Mitigation: Carry commercial short-term rental insurance ($1M+ coverage). Require security deposits from guests through your platform. Screen guests carefully. Document property condition with photos before every turnover.

Risk 3: Lease Violations and Eviction

If your lease doesn’t explicitly allow short term rentals and the property owner finds out, you’re facing eviction. Even with verbal permission, the property owner can claim you violated the lease terms. Eviction proceedings go on your rental record and make future leasing extremely difficult.

Mitigation: Written permission. Always. No exceptions. Have an attorney review your lease addendum.

Risk 4: Tax Compliance Complexity

Rental income from short term rentals creates tax obligations at multiple levels. Federal income tax, state income tax, local occupancy tax, sales tax (in some states), and self-employment tax all apply. Miss any of these and you’re facing penalties, interest, and potential audits.

Mitigation: Work with a CPA who understands short-term rental taxation. Track every expense. Use accounting software from day one. Set aside 25-30% of rental income for taxes.

Risk 5: Market Saturation and Demand Drops

The short term rental market in many major cities is getting competitive. More supply means lower nightly rates, lower occupancy, and potentially paying rent on a property that isn’t generating enough rental income to break even. Market demand fluctuates seasonally and can drop sharply during economic downturns.

Mitigation: Run conservative profit calculations before signing any lease. Stress-test your numbers at 50% occupancy, not 80%. Diversify across multiple properties in different markets if possible.

2025-2026 Regulatory Trends Every Operator Must Watch

The short term rental industry is shifting fast. Here are the trends shaping rental arbitrage legality right now.

Platform Accountability Is Increasing

Cities are done chasing individual operators. The new enforcement strategy targets vacation rental platforms directly. Airbnb, Vrbo, and others are increasingly required to verify registration numbers before allowing listings, share host data with local governments, and block bookings that don’t comply with local regulations.

California enacted a law requiring platforms to share host registration data with local governments. New York requires platforms to submit quarterly reports including locations, occupancy nights, guest counts, and taxes collected. This means you can’t fly under the radar anymore.

State-Level Registration Systems Are Expanding

Arizona, Colorado, Florida, Maine, and Michigan are among states moving toward statewide STR registration systems. New York counties (Albany, Columbia, Oneida, Tompkins, Washington) have developed their own registries. This creates another layer of compliance but also brings consistency.

Tax Changes Are Hitting Harder

Multiple states increased STR-specific taxes in 2025:

- Hawaii: Transient Accommodations Tax rose from 10.25% to 11% as of January 2026, plus a new “green fee”

- Delaware: New 4.5% tax on stays of 31 consecutive nights or less

- Rhode Island: Local hotel tax doubled from 1% to 2%, plus a new 5% tax on whole-home STRs

- Illinois: STRs now subject to state Hotel Operators’ Occupation Tax as of July 2025

- Utah: 17 counties adopted transient room tax increases up to 4.5%

- Colorado: Multiple counties approved lodging tax increases up to 6% via ballot

These taxes directly cut into your margins. Factor them into your rental income projections.

Enforcement Is Getting Aggressive

Cities are investing in technology to catch non-compliant operators. Key Biscayne, Florida is using scraping software to identify unregistered operators. Virginia Beach introduced criminal penalties for STR violations in 2025. Fines are escalating everywhere. Cape Coral, Florida fined a single operator $30,000+ across 3 properties.

The era of “ask forgiveness, not permission” is over in the short term rental industry.

FIFA World Cup 2026 Creates Temporary Opportunities

The 2026 FIFA World Cup (11 host cities in the U.S.) is creating temporary STR demand spikes and regulatory adjustments. Kansas City created a special event STR permit ($50 vs. Standard $200). Dallas expects 300-500% STR demand increase. Southampton, NY is temporarily lifting STR limits during the U.S. Open Championship. If you’re operating in or near a host city, this is a short-term revenue opportunity worth planning for.

Federal Regulations: What Applies Nationwide

There are no federal laws that prohibit rental arbitrage or short term rentals. But federal regulations still apply to your rental business in several ways.

Tax Obligations

All rental income must be reported on your federal tax returns. If you’re operating as a sole proprietor, you’ll report on Schedule C and pay self-employment tax. If you’ve formed an LLC, the structure depends on your election (single-member, partnership, or S-corp).

Deductible expenses for your arbitrage business include:

- Monthly rent payments (your biggest expense)

- Furniture and supplies (depreciable or Section 179)

- Cleaning and maintenance costs

- Property management software subscriptions

- Insurance premiums

- Platform fees (Airbnb, Vrbo host fees)

- Utilities (if you’re paying them)

- Marketing and photography

- Professional services (CPA, attorney)

FTC “Junk Fees” Rule

The FTC now requires full upfront price disclosure for STR platforms. This affects how you price your listings. Cleaning fees, service fees, and other add-ons must be transparent from the initial search results. This actually levels the playing field for operators who price honestly.

Fair Housing Compliance

Federal Fair Housing Act applies to short term rentals. You cannot discriminate based on race, color, religion, national origin, sex, familial status, or disability. Your listing descriptions, house rules, and guest screening must comply. Airbnb has its own anti-discrimination policy that mirrors federal requirements.

How to Structure a Rental Arbitrage Business for Legal Protection

Running a legitimate, legally protected rental arbitrage business requires more than just signing a lease and listing on Airbnb. Here’s the structure I recommend based on operating multiple properties.

Form an LLC

An LLC separates your personal assets from your business liabilities. If a guest sues you, your personal savings and property are protected (assuming you maintain proper corporate formalities). File in your state of operation. Cost is typically $50-$500 depending on the state, plus annual renewal fees.

Get Proper Insurance

Standard renter’s insurance won’t cover commercial short term rental activity. You need:

- Commercial general liability: $1M minimum coverage

- Short-term rental specific policy: Covers gaps that Airbnb’s Host Protection doesn’t

- Umbrella policy: Additional $1M+ for catastrophic claims

Expect to pay $1,200-$3,000 per property per year for adequate coverage. It sounds expensive until you’re facing a $50,000 liability claim without it.

Use Property Management Software

Property management software isn’t just convenient. It’s a compliance tool. Good software handles:

- Automated tax collection and remittance

- Guest ID verification (increasingly required by local laws)

- Occupancy tracking (for night cap compliance)

- Booking records (for tax audits)

- Multi-platform listing synchronization

When you’re managing multiple properties across different jurisdictions, each with different short term rental regulations, having centralized software is the difference between compliance and chaos.

Maintain Detailed Records

Keep records of everything:

- All permits and licenses (with renewal dates)

- Lease agreements and addendums

- Insurance policies and certificates

- Tax filings and payments

- Guest communications

- Property condition documentation

- Revenue and expense tracking

If a city inspector, the IRS, or a property owner ever questions your operation, you want a paper trail that demonstrates full compliance.

Airbnb Rental Arbitrage: Platform-Specific Legal Considerations

Most rental arbitrage operators list primarily on Airbnb, so understanding Airbnb’s specific policies matters.

Airbnb’s Regulatory Compliance

Airbnb requires hosts to comply with all applicable local laws. In regulated markets, you must enter your permit or registration number when creating a listing. Airbnb verifies these numbers in many jurisdictions and can remove listings that fail verification.

Since late 2023, Airbnb has been proactively removing listings in cities with strict short term rental laws where hosts can’t verify compliance. NYC alone saw roughly 75% of listings removed after Local Law 18 enforcement began.

Airbnb Host Protection Insurance

Airbnb provides Host Protection Insurance (up to $1M in liability) and AirCover for Hosts (up to $3M in property damage coverage). These are secondary coverages, not primary insurance. They don’t replace the need for your own commercial policy, and they don’t cover everything. Read the exclusions carefully.

Airbnb’s Anti-Arbitrage Policies

Airbnb doesn’t prohibit rental arbitrage explicitly. But they do require that you have legal authority to list a property. If a property owner reports that a tenant is listing without permission, Airbnb will remove the listing. They’ve also introduced identity verification requirements that make anonymous or unauthorized listings harder to maintain.

Building a Successful Rental Arbitrage Business: Legal-First Approach

The operators who build a successful rental arbitrage business over the long term aren’t the ones who cut corners on compliance. They’re the ones who treat legal requirements as a competitive moat.

Why Compliance Is a Competitive Advantage

As enforcement increases and platforms crack down on unregistered listings, compliant operators gain market share. Your competitors who are operating illegally will get shut down. Your listings stay active. Your reviews accumulate. Your occupancy stays consistent.

I’ve watched entire markets lose 30-40% of their STR inventory when new enforcement kicked in. The operators who were already compliant saw their bookings jump because supply dropped while market demand stayed constant.

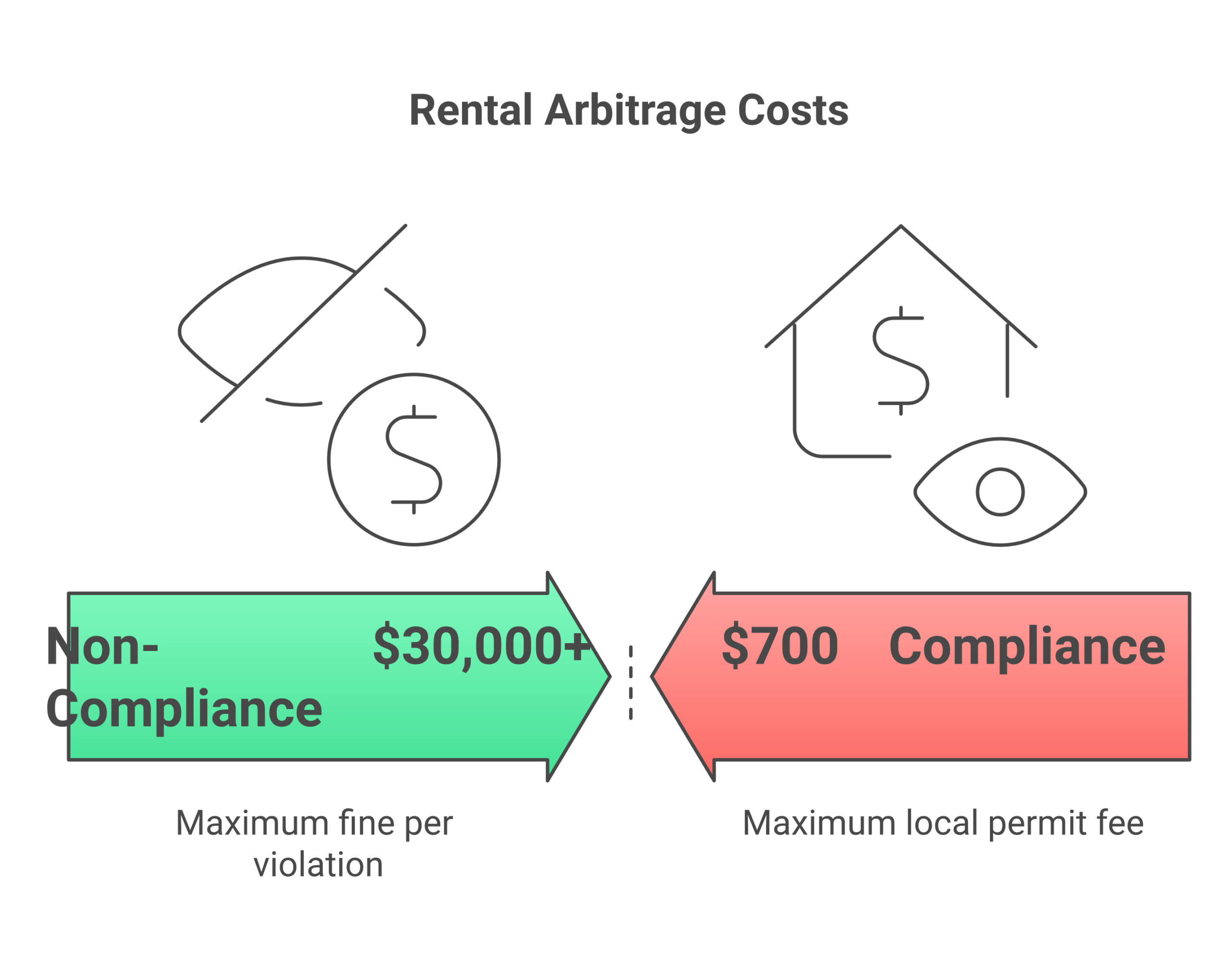

The Cost of Non-Compliance

Let’s put real numbers on it:

- Fines: $500-$30,000+ per violation depending on the city

- Eviction: Lose your security deposit + moving costs + furniture liquidation

- Lost revenue: Listing removed mid-season, still paying rent with zero rental income

- Legal fees: $2,000-$10,000+ if the property owner sues

- Reputation: Eviction on your record makes it nearly impossible to lease new properties

Compare that to the cost of doing it right: a few hundred dollars in local permit fees, a few hours of research, and proper insurance premiums. The math is obvious.

Start With One Property, Then Scale

Don’t try to launch five properties in five different cities simultaneously. Start with one unit in one market where you’ve thoroughly verified the short term rental regulations. Learn the compliance requirements. Build relationships with your property owner and local officials. Prove the model works.

Then scale to multiple properties, either in the same market (where you already know the rules) or in new markets where you repeat the verification process. Our complete guide to starting an Airbnb walks through this process step by step.

Cities With the Strictest Short Term Rental Restrictions (2026)

If you’re considering rental arbitrage in any of these major cities, proceed with extreme caution. These markets have the tightest short term rental laws in the country, and non-compliant operators face aggressive enforcement.

New York City

Local Law 18 is the gold standard of STR restriction. As of 2023, hosts must register with the city, be present during the stay, and can only rent out their primary residence. The result: roughly 75% of listings were removed, leaving only about 2,100 approved operators. Rental arbitrage in NYC is effectively dead for most operators. The only viable path is mid-term stays (30+ days), which fall outside the STR definition.

San Francisco

Unhosted rentals capped at 90 nights per year. Must be your primary residence. Registration required. The city actively audits compliance. For rental arbitrage specifically, the primary residence requirement makes this market nearly impossible unless you’re operating from a unit you actually live in.

Los Angeles

Home sharing ordinance limits unhosted rentals to 120 nights per year. Primary residence only. Operators must register and display their registration number on all listings. Non-primary-residence STRs require an Extended Home-Sharing Permit, which has its own restrictions and fees.

Miami Beach

Rentals under 30 days are illegal in most residential districts. Enforcement is aggressive, the city uses technology to identify non-compliant listings. Fines and de-listing orders are common. This is one of the most hostile markets for short term rental arbitrage in the entire country.

Boston

Owner-adjacent or owner-occupied only. Investors cannot operate non-owner-occupied STRs in most of the city. Registration required. Annual reporting mandated. The restrictions specifically target the rental arbitrage model.

These restrictions don’t mean you can’t build a successful vacation rental business. They mean you need to look at markets where the regulations actually support the model. Plenty of mid-size cities welcome vacation rentals with clear, reasonable permitting processes. That’s where the opportunity is.

Frequently Asked Questions

Can I do rental arbitrage without telling my landlord?

Technically you could. But you shouldn’t. Operating without your landlord’s knowledge violates virtually every standard lease agreement. If caught, you face eviction, loss of your security deposit, and potential legal action. The property owner has every right to prohibit subletting, and Airbnb will remove your listing if the property owner reports it. Always get written permission.

What happens if my city bans short-term rentals after I start?

This depends on your lease terms and the specific regulation. Some cities grandfather existing permitted operators. Others give a wind-down period (30-180 days). If you have a lease termination clause triggered by regulatory changes, you can exit without penalty. Without that clause, you’re stuck paying rent on a property you can’t legally use for short term rentals.

Do I need an LLC for rental arbitrage?

You’re not legally required to form an LLC to operate a rental arbitrage business. But it’s strongly recommended. An LLC provides personal liability protection, tax flexibility, and professional credibility when negotiating with property owners. Formation costs $50-$500 depending on your state. The protection is worth multiples of that.

Is rental arbitrage legal in apartments?

It depends on the lease agreement, building rules, and local regulations. Many apartment complexes and HOAs explicitly prohibit short-term rentals. Even if local laws allow it, your lease or HOA bylaws might not. Always check all three layers: local law, building rules, and lease terms.

How much insurance do I need for rental arbitrage?

At minimum, carry $1M in commercial general liability insurance. If you’re operating multiple properties, consider an umbrella policy for additional coverage. Airbnb’s AirCover is secondary insurance. It doesn’t replace your own policy. Budget $1,200-$3,000 per property per year.

Can I operate rental arbitrage in a rent-controlled apartment?

In most rent-controlled jurisdictions, subletting a rent-controlled unit as a short-term rental is either prohibited or heavily restricted. Cities with rent control typically have the strictest STR regulations. Check your specific jurisdiction, but this is generally not a viable path for rental arbitrage.

What’s the difference between rental arbitrage and property management?

In rental arbitrage, you sign the long term lease, pay the monthly rent, furnish the property, and keep the difference between your rent and your short term rental income. The financial risk is yours. In property management, you manage someone else’s property for a fee (typically 15-25% of revenue). The property owner bears the financial risk. Both are legitimate business models, but the legal requirements differ.

How do I handle taxes on rental arbitrage income?

Report all rental income on your federal and state tax returns. Collect and remit any required local occupancy taxes and sales taxes. Keep detailed records of all expenses (rent, furnishing, cleaning, insurance, software, platform fees). These are deductible against your rental income. Work with a CPA who understands the short term rental business model. See our complete Airbnb tax guide for detailed breakdowns.

How many properties can I manage with rental arbitrage?

There’s no federal limit on how many properties you can operate. Some cities limit the number of STR permits per operator (Atlanta caps at 2, for example). Your practical limit depends on your operational capacity, available capital, and the regulations in each market. Most operators start with 1-2 units, prove profitability, then scale to 5-10+ units. At that point, property management software becomes essential for handling bookings, guest communication, cleaning schedules, and compliance across multiple jurisdictions.

What if my property owner sells the property during my lease?

Your lease survives a property sale in most states. The new owner inherits your lease agreement, including any STR addendum. However, the new owner might not be as supportive of short term rental activity. I recommend addressing this scenario in your original lease addendum: specify that STR permission transfers to any successor owner for the remaining lease term. Without that language, you might face pressure to stop operating even though your lease technically allows it.

Bottom Line: Rental Arbitrage Is Legal When Done Right

Rental arbitrage is legal in the vast majority of U.S. Markets. The business model itself isn’t illegal anywhere at the federal level. But “legal” doesn’t mean “no rules.” Every successful vacation rental business operator I know treats compliance as non-negotiable.

Here’s your action checklist:

- Research your target market’s short term rental laws and local regulations

- Verify that non-owner-occupied STRs are permitted in your specific zone

- Negotiate a lease agreement with explicit written permission from the property owner

- Form an LLC and obtain proper insurance

- Apply for all required permits and register for tax collection

- Set up profit tracking and compliance documentation

- Start with one property, prove the model, then scale

The operators who skip steps 1-5 are the ones who end up in the “rental arbitrage horror story” threads on Reddit. The operators who follow them build a successful rental arbitrage business that generates consistent rental income for years.

One more thing. The vacation rentals landscape is evolving rapidly. What worked two years ago in terms of compliance may not be enough today. Mid-term stays (30+ days) are emerging as a way to sidestep strict short term rental property regulations in some markets, since many cities define “short term” as under 30 days. That opens a different revenue model, lower per-night rates but virtually zero regulatory friction. Worth exploring if your target market has heavy restrictions.

Ready to find the best markets? Check our best cities for Airbnb arbitrage guide for markets with favorable short term rental regulations and strong market demand. Or start with our complete Airbnb business plan to map out your first property.