Your Rental Arbitrage Exit Strategy Determines Whether You Leave Rich or Broke

A rental arbitrage exit strategy is the plan you build, months before you actually need it, for winding down, selling, or transitioning your short-term rental arbitrage operation into something bigger. Most rental arbitrage educators skip this part entirely. They teach you how to get in. Nobody teaches you how to get out.

That’s a problem, because the exit is where real money changes hands. I’ve watched operators walk away from $80,000-a-year arbitrage portfolios with nothing. Zero. Meanwhile, savvy operators sold those same portfolios for $160,000 to $240,000. Two to three times annual net profit. The only difference? A deliberate rental arbitrage exit strategy planned months before the actual exit.

Whether you’re scaling your rental arbitrage business into property ownership, selling the whole operation to a hungry buyer, pivoting to mid-term rentals, or winding down entirely, this guide covers every path with real numbers and tested frameworks. No theory. No fluff. Just the playbook I’ve seen work across hundreds of exits.

Why Every Rental Arbitrage Business Needs an Exit Strategy From Day One

Here’s what separates successful arbitrage operators from everyone else: they plan the exit before signing their first lease agreement.

Unlike property owners who build equity over decades, rental arbitrage hosts are building a cash flow machine on leased assets. That means your entire business model sits on top of someone else’s property. Your lease agreement is your foundation, and foundations have expiration dates.

Three realities make exit planning non-negotiable:

- Lease terms end. Every long-term lease agreement has a termination date. If you haven’t planned for it, you’re scrambling when the landlord decides not to renew.

- Local laws change fast. Cities that welcomed short-term rentals three years ago now prohibit rental arbitrage outright. New York, Los Angeles, Denver, Nashville, the list grows every quarter. You need to research local laws continuously, not just when you launch.

- Markets shift. The short-term rental market isn’t static. AirDNA data shows the STR revenue premium over long-term rent dropped from 170% in 2021 to 124% in 2024. Markets that were goldmines become graveyards.

The operators who build an exit strategy into their Airbnb business plan from day one always come out ahead. They negotiate exit clauses in their leases. They document their SOPs. They maintain landlord relationships that survive the exit. And when the time comes, they extract maximum value instead of leaving money behind.

Six Signs It’s Time to Exit Your Airbnb Rental Arbitrage Operation

Not every exit is a failure. Some of the most successful arbitrage operators I know exited at their peak, and that’s exactly when you should be planning yours. Here’s how to read the signals.

Market Signals That Demand Attention

- Occupancy rates below 55% for three consecutive months. One slow month is seasonal. Three months is a trend. If your market’s average daily rate has dropped 15% or more year-over-year, the short-term rental market is softening in your area.

- Regulatory pressure tightening. When your city council starts holding hearings on STR regulations, that’s your 90-day warning. Don’t wait for the vote. Cities that research local laws and restrictions on short-term rentals rarely grandfather existing operators, and when they do, the permit costs eat your margins.

- Landlord sentiment shifting. If three or more property owners in your portfolio mention wanting to “go a different direction” at renewal time, the local landlord community is souring on arbitrage. This is especially common when property long-term rental rates spike, because landlords realize they can get nearly the same rent without the STR complexity.

- Insurance costs spiking 25%+ annually. Rising premiums for proper insurance eat directly into margin. When they jump dramatically, insurers are pricing in risk you might not see yet. A rental arbitrage host paying $3,600/year in insurance suddenly paying $4,500+ needs to recalculate every unit’s profitability.

- New competition flooding the market. When management companies enter your market with 50+ units and professional pricing algorithms, your 5-unit operation gets squeezed. These companies can operate on thinner margins because of their scale.

Personal and Financial Triggers

- Your time-to-profit ratio is declining. If you’re working more hours for the same or less rental income, you’ve hit an operational ceiling. Either automate, hire a property manager, or exit.

- You’ve accumulated enough capital for property ownership. Many operators use airbnb rental arbitrage as a bridge to buying properties outright. Once you’ve saved $50,000 to $100,000, it’s time to seriously evaluate DSCR loans for Airbnb purchases. Unlike property owners who need traditional mortgages, arbitrage operators can qualify on the rental property’s projected income alone.

- Burnout is real. Managing guest turnover, cleaning crews, maintenance issues, and property owner relationships across 5 to 10 units takes a toll. If you dread checking your phone, that’s a signal worth respecting.

- Life changes. Relocation, family growth, career shifts. These aren’t failures. They’re legitimate reasons to restructure your arbitrage business.

The Four Rental Arbitrage Exit Paths: Which One Fits You?

Every exit falls into one of four categories. The right choice depends on your financial position, market conditions, and what you want next.

| Exit Path | Best When | Expected Outcome | Timeline |

|---|---|---|---|

| Sell the Business | Profitable, systematized, 12+ months on leases | 2-3x annual net profit lump sum | 2-4 months |

| Scale to Ownership | $50K-$100K saved, strong market, proven operations | Long-term equity + continued cash flow | 3-6 months |

| Pivot to Mid-Term | STR regulations tightening, burnout, insurance rising | 70-85% of STR revenue, 40-50% lower costs | 1-2 months |

| Clean Wind-Down | Market declining, relationships strained, life change | Deposit recovery, reputation preserved | 3-6 months |

I’ve seen operators agonize over this decision for months. Don’t overthink it. Use the framework below to score your situation, then commit.

The Wind Down vs. Scale Up Decision Framework

Before making any moves, answer one question honestly: Is this business worth more as a going concern, or am I better off dissolving it?

| Factor | Wind Down | Scale Up / Sell |

|---|---|---|

| Annual net profit | Below $40,000 | Above $60,000 |

| Lease remaining term | Less than 6 months | 12+ months across portfolio |

| Short-term rental market trend | Declining occupancy/ADR | Stable or growing |

| Systems in place | Owner-dependent operations | Documented SOPs, team in place |

| Property owner relationships | Strained or adversarial | Strong, willing to transfer leases |

| Regulatory environment | Hostile, cities that prohibit rental arbitrage | Favorable or grandfathered |

| Your energy level | Burnt out, dreading the work | Excited about next phase |

Score “Scale Up / Sell” on four or more factors? Your arbitrage business has transferable value. Mostly in the “Wind Down” column? A clean exit protects your reputation and finances better than trying to squeeze out a sale.

How to Sell Your Rental Arbitrage Business for Maximum Value

This is the most profitable exit path for most operators. You’re selling a turnkey short-term rental business, furnished units, active listings with reviews, cleaning teams, and established property owner relationships. Done right, you can generate substantial income from the sale itself.

What You’re Actually Selling

Buyers aren’t paying for your furniture. They’re paying for:

- Proven revenue streams. Active Airbnb/VRBO listings with booking history, reviews, and demonstrated cash flow.

- Transferable leases. Property owners who’ve agreed in writing to allow a new operator on the long-term lease.

- Operational systems. SOPs, cleaning team contacts, pricing tools, guest communication templates. The difference between a $50,000 sale and a $200,000 sale is often just documentation.

- Time-to-revenue. A new rental arbitrage host can start earning Day 1 instead of spending 3 to 6 months building from scratch with a new Airbnb startup.

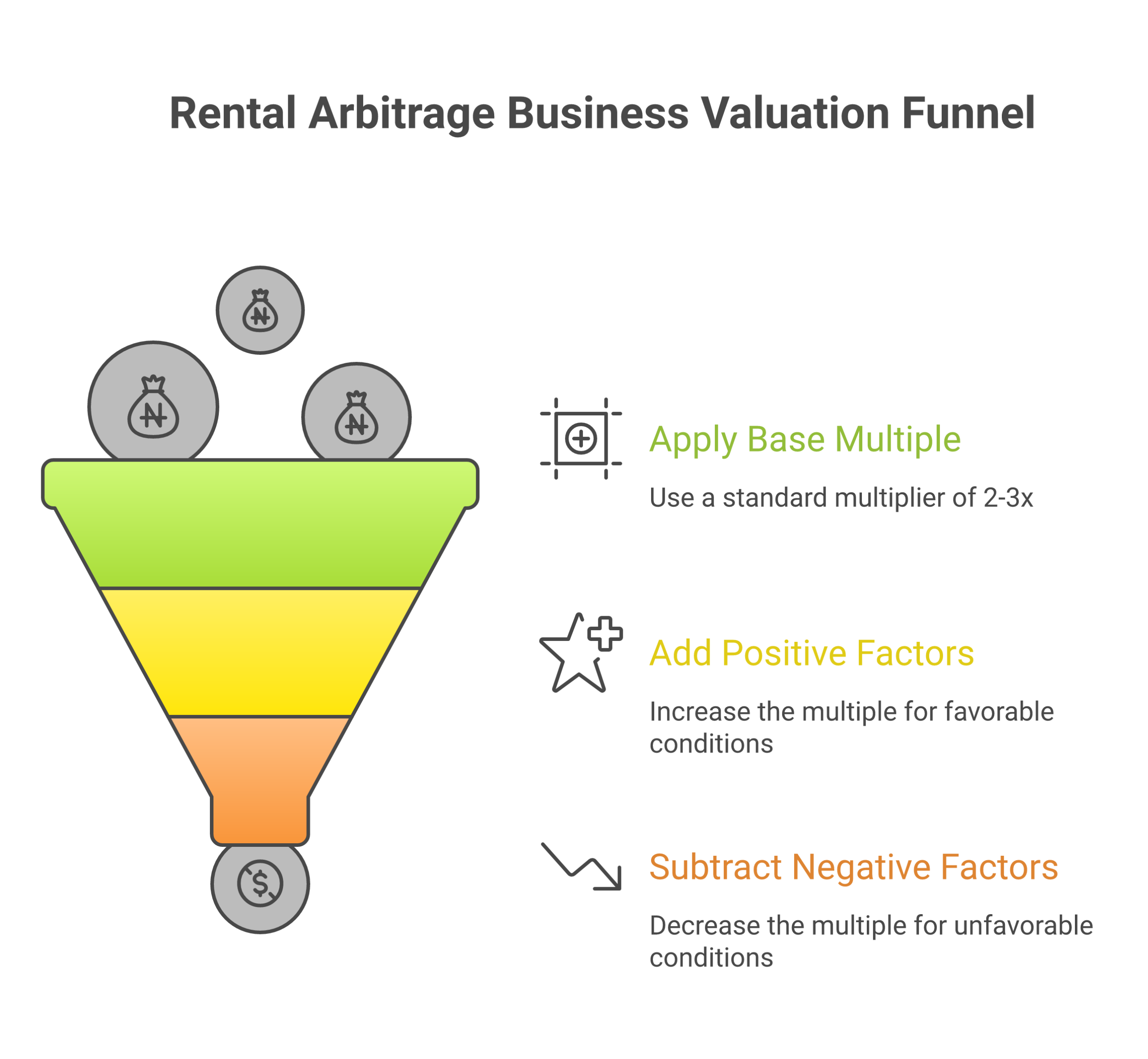

Valuation Methods: What’s Your Business Worth?

Most real estate investors and aspiring operators undervalue arbitrage businesses. Don’t let that happen to you.

Method 1: Standard Multiple (2-3x Annual Net Profit)

The industry standard for small service businesses applies to airbnb arbitrage operations. A portfolio netting $80,000 per year typically sells for $160,000 to $240,000. The multiplier depends on several factors:

| Factor | Lower Multiple (1.5-2x) | Higher Multiple (2.5-3.5x) |

|---|---|---|

| Long-term lease terms remaining | Less than 12 months | 24+ months |

| Owner involvement | Owner does everything | Fully systematized, property manager in place |

| Revenue trend | Flat or declining | Growing 10%+ year-over-year |

| Number of units | 1-3 rental properties | 5+ units with diversification |

| Regulation risk | Pending regulations, research local laws carefully | Established, favorable regulations |

| Review scores | Below 4.5 average | 4.8+ across listings |

| Seasonality | Highly seasonal (60%+ variance) | Year-round demand (less than 30% variance) |

Method 2: Cash Flow Multiple with Asset Add-On

Some buyers prefer this approach, and it often yields a higher valuation for well-furnished operations:

- Arbitrage cash flow component: 18 to 24 months of average monthly net profit

- Asset add-on: 40 to 60% of furnishing replacement value

- Goodwill: $5,000 to $15,000 for established listings with 50+ reviews and Superhost status

Example calculation: A 5-unit portfolio averaging $6,500/month net profit with $35,000 in furnishings and Superhost status on all listings:

- Cash flow: $6,500 x 20 months = $130,000

- Assets: $35,000 x 50% = $17,500

- Goodwill: $10,000

- Total valuation: $157,500

Where to Find Buyers for Your Arbitrage Business

- STR-specific marketplaces: BizBuySell (filter for hospitality), Flippa, and dedicated Airbnb business Facebook groups

- Local real estate investor networks: REIA meetups, BiggerPockets forums, real estate investment clubs

- Your own network: Other rental arbitrage operators are often the best buyers because they understand the business model and can hit the ground running

- Management companies looking to expand: They already have infrastructure and want the revenue streams from multiple properties

Steps to Transfer Operations to a New Operator

- Get property owner consent first. Nothing kills a deal faster than a landlord who refuses the new operator. Have this conversation before listing the business for sale.

- Document everything. Create a complete operations manual: login credentials, vendor contacts, pricing strategies, maintenance schedules, seasonal adjustments. This is what turns a mediocre sale into a premium one.

- Introduce the buyer to your landlords personally. A warm handoff builds trust. I’ve seen transfers fall apart because the seller just forwarded an email introduction. Face-to-face matters.

- Transition Airbnb listings gradually. Co-host with the buyer for 30 days. This lets them learn the operation while maintaining review continuity on each rental property.

- Transfer furnishings with a detailed inventory. Photograph every item. Include replacement costs and vendor sources.

How to Negotiate Lease Termination with Your Property Owner

This is where most operators destroy value. They ghost landlords, break leases, or negotiate from a position of desperation. Your lease agreement is a binding contract, and how you handle its termination defines your reputation in the local real estate market.

The 90-Day Communication Framework

Start the conversation at least 90 days before you want out. Here’s the sequence that’s worked for dozens of operators:

Day 1-7: The Honest Conversation

Call your property owner. Not a text. Not an email. A phone call or in-person meeting. Say something like:

“I’ve really valued our partnership over the past [X months/years]. My business direction is shifting, and I want to give you as much notice as possible so we can figure out the best transition plan together.”

This accomplishes three things: it shows respect, it gives them time to plan, and it positions you as a partner rather than a problem tenant.

Day 7-30: The Proposal

Present a written transition plan that includes:

- Your proposed exit date

- The condition you’ll return the unit in (with photos of current state)

- Any remaining long-term lease obligations and your proposal for handling them

- A potential replacement tenant or operator (if you have one)

Day 30-90: Execution

Remove furnishings gradually. Deep clean each unit professionally. Document the condition with timestamped photos. Return keys in person with a signed walkthrough checklist.

Early Termination Negotiation Tactics

If you’re breaking a long-term lease agreement early, here’s what actually works:

- Offer to forfeit one month’s deposit in exchange for a clean release. Most property owners prefer guaranteed money over the hassle of legal action.

- Find a replacement tenant yourself. If you can present a qualified tenant who’ll sign a new lease agreement, many landlords release you with zero penalty. This works especially well if you can find another rental arbitrage host to take over.

- Propose a graduated exit. Offer to keep paying monthly rent at 50% for two months while the landlord finds a new tenant. Cheaper than your full obligation, but more than they’d get from an empty unit.

- Reference your lease exit clause. If you negotiated an exit clause upfront, and you absolutely should have, this is when it pays dividends.

The goal is always the same: leave every property owner willing to rent to you again. That reputation is worth more than saving $2,000 on a termination fee.

Scaling from Rental Arbitrage to Property Ownership

This is the exit path I get most excited about, because it’s where arbitrage operators build lasting wealth. Unlike property owners who start with large down payments, successful arbitrage operators fund property purchases with the cash flow they’ve already generated. Arbitrage is the engine. Ownership is the destination.

The DSCR Loan Path

DSCR (Debt Service Coverage Ratio) loans were practically designed for this transition. Unlike conventional mortgages that scrutinize your W-2 income, DSCR lenders qualify you based on the rental property’s projected income.

Why they’re perfect for arbitrage operators transitioning to property ownership:

- No tax return requirements. Your arbitrage rental income might look messy on paper. DSCR lenders don’t care. They care about the property’s numbers.

- 20-25% down payment. That $50,000 to $100,000 you’ve saved from your arbitrage business? That’s your down payment on a $200,000 to $500,000 property.

- Close in 21 to 30 days. Faster than conventional loans, which matters in competitive real estate markets.

- You already know the numbers. Your experience as a rental arbitrage host gives you a massive advantage in projecting rental income accurately. Most real estate investors guess. You have data.

Seller Financing: The Creative Path

Some property owners will finance the sale themselves. This works especially well when:

- The property has been on market for 60+ days

- The seller is retiring and wants passive income from your monthly rent payments

- The rental property needs work that scares traditional buyers but doesn’t scare an experienced operator

Typical seller financing terms: 10-20% down, 6-8% interest rate, 5 to 7 year balloon with 20 to 30 year amortization. You’ll pay more in interest than a bank loan, but the flexibility and speed can make it worthwhile for real estate investors who want to move fast.

The Hybrid Approach: Arbitrage + Ownership Simultaneously

The smartest operators I know don’t choose between arbitrage and property ownership. They run both simultaneously:

- Keep your top 3 to 5 performing arbitrage units running for cash flow

- Use that rental income to service your first DSCR loan payment

- As your owned rental property stabilizes, exit your weakest arbitrage units

- Reinvest profits into property number two through additional property purchases

- Within 24 to 36 months, you’ve transitioned from arbitrage to a portfolio of owned properties generating equity AND cash flow

This is the rent-to-own mindset applied to an entire business model. You’re using other people’s properties to fund buying your own. That’s the real power of rental arbitrage as an entry point into real estate.

Pivoting Instead of Exiting: The Mid-Term Rental Strategy

Sometimes the smartest exit from traditional airbnb rental arbitrage isn’t an exit at all. It’s a pivot.

Mid-term rental arbitrage (30+ day stays) offers serious advantages when short-term rental regulations tighten or you want to reduce operational intensity without abandoning your lease agreements:

- 72% fewer guest turnovers compared to short-term (30-day tenant vs. 3-day average stay)

- Lower cleaning and maintenance costs (fewer turnovers = fewer cleans = lower operating expenses)

- Often exempt from STR regulations (most cities define “short-term” as under 30 days, so research local laws to confirm)

- Insurance companies treat them more favorably than nightly rentals, reducing your proper insurance costs

- Revenue is typically 70-85% of short-term rental income but with 40-50% lower operating costs, so your actual profit margin can be higher

This pivot lets you keep your leases, your property owner relationships, and your listings, while dramatically reducing the headaches that might be pushing you toward an exit. Travel nurses, corporate relocations, and digital nomads all need 30-90 day housing, and they’re far less price-sensitive than weekend tourists.

The short-term rental industry is evolving, and operators who can flex between short-term and mid-term models based on market conditions have a significant competitive advantage. It’s not exiting. It’s adapting.

Tax Implications of Exiting Your Rental Arbitrage Business

Don’t let taxes blindside you on the way out. The structure of your exit determines how much you actually keep. I’ve seen operators lose 15-25% more than necessary because they didn’t plan the tax side of their exit strategy.

Selling the Business: Asset Sale Structure

Most arbitrage business sales are structured as asset sales (not stock sales, since most operators use LLCs). Here’s what that means:

- Furnishings and equipment: Taxed as ordinary income to the extent of depreciation recapture, then as capital gains. If you’ve been depreciating your furniture through your LLC – and you should be, expect some recapture.

- Goodwill: Taxed as long-term capital gains if you’ve held the arbitrage business for over a year. At 0%, 15%, or 20% depending on your bracket per IRS capital gains rules, this is the most tax-favorable component.

- Lease value: This gets complicated. The IRS may treat transferred long-term lease agreements as ordinary income. Talk to your CPA about this specifically.

Winding Down: Final-Year Deductions to Capture

If you’re winding down rather than selling, maximize your final-year deductions to offset your rental income:

- Remaining depreciation on furnishings (take the full loss in your final year)

- Lease termination fees (fully deductible as a business expense)

- Professional cleaning and repair costs for unit turnbacks

- Moving and storage costs for furnishings you’re keeping for future property purchases

- Professional fees (lawyer, accountant, business broker)

If you’ve structured your operation through an LLC, the dissolution process has its own implications. File your final LLC return and issue final K-1s to all members. For a deeper dive, reference the Airbnb tax guide for rental arbitrage operators.

Maintaining Property Owner Relationships After You Exit

Your landlord network is one of your most valuable assets, even after you leave the short-term rental business. I know operators who exited arbitrage, moved into real estate development, and came back to those same property owners years later for joint ventures.

The Exit That Opens Doors

- Return units in better condition than you received them. It costs $500 to $1,000 per unit for professional deep cleaning and minor repairs. Worth every penny for your reputation.

- Provide a 30-day overlap. Offer to keep paying monthly rent for 30 days after you’ve vacated so the property owner has zero gap in rental income.

- Send a handwritten thank-you note. Old school? Absolutely. Effective? Incredibly. Landlords talk to each other. Being “that operator who actually left things better” is a reputation that generates referrals for years.

- Offer to be a reference. Tell your landlords they can give your number to future tenants. This small gesture cements goodwill that pays dividends when you need real estate connections later.

Stay in Touch Post-Exit

After you exit, check in with your former property owners quarterly. A simple “Hope the property is doing well, let me know if you ever need anything” text keeps the relationship warm. When you’re ready to invest in property purchases, these landlords become your deal pipeline. They know other property owners. They know which buildings are about to hit the market. That network has value that far outlasts any single lease agreement.

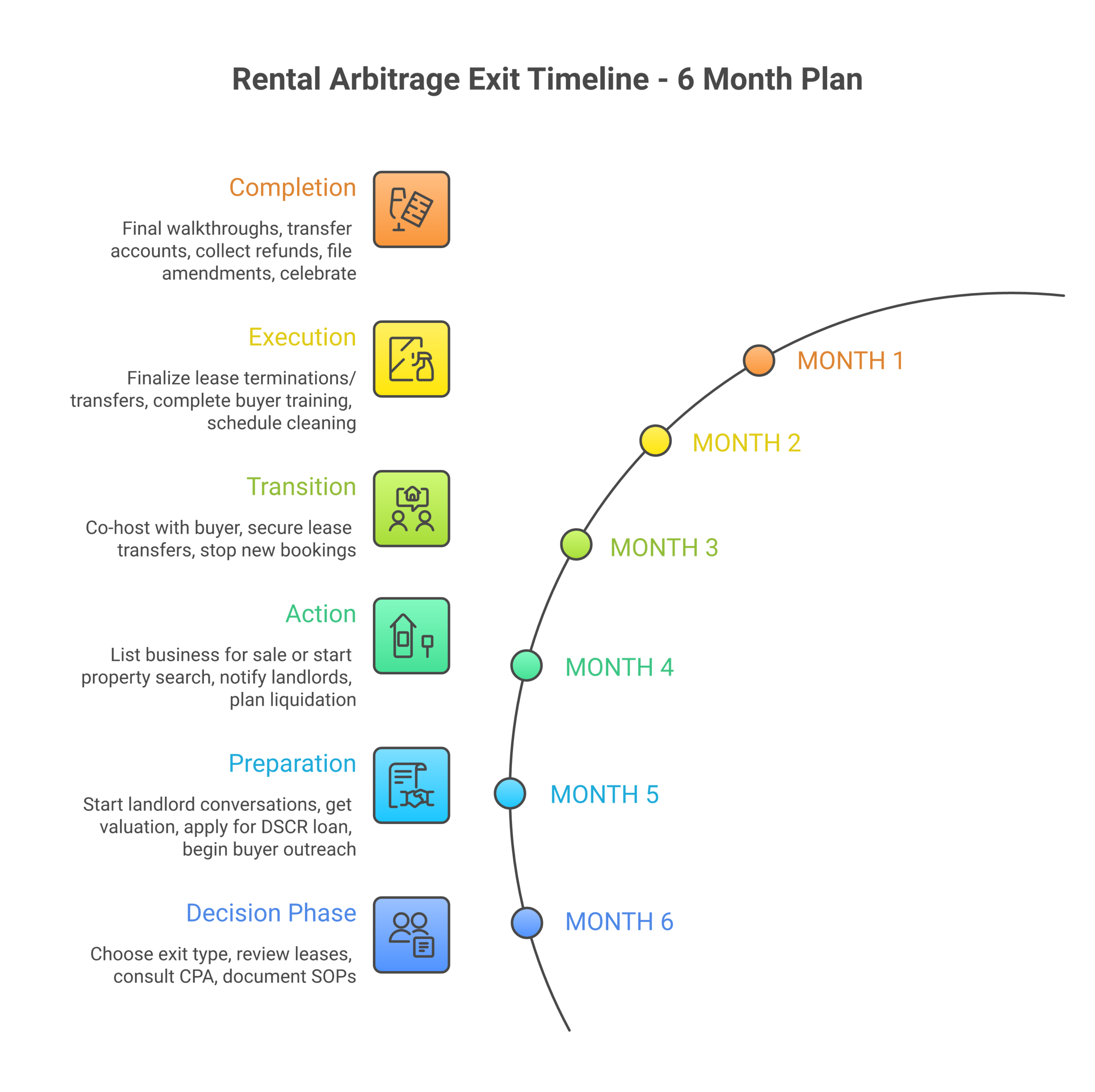

Building Your 6-Month Exit Timeline

Whether you’re selling, scaling, or winding down, here’s the battle-tested timeline that successful arbitrage operators follow. Rushing this process below 90 days almost always results in forfeited deposits, damaged relationships, or both.

6 Months Before Exit

- Decide on exit type (sell, wind down, pivot, or scale to property ownership)

- Begin documenting all SOPs and operations for your short-term rental business

- Review all lease termination clauses in every long-term lease agreement

- Consult with your CPA on tax optimization (the SBA’s guide to closing or selling a business is a solid starting point)

- Start soft landlord conversations (“business changes coming”)

4-5 Months Before Exit

- If selling: Get your arbitrage business professionally valued, begin listing

- If scaling: Apply for DSCR loan pre-approval, start rental property search

- If winding down: Formally notify all property owners in writing

- Begin buyer outreach through STR communities, real estate investor groups, and management companies

3 Months Before Exit

- If selling: Begin co-hosting with buyer for the 30-day handoff period

- Secure lease transfers with property owner approval for each rental property

- Stop accepting bookings beyond your target exit date on all platforms

- Start furnishing liquidation plan for wind-down units (Facebook Marketplace, local consignment, bulk sale to new operator)

1-2 Months Before Exit

- Finalize all lease terminations or transfers

- Complete buyer training period (if selling your arbitrage business)

- Schedule professional deep cleaning for all units

- Gather all deposit return documentation

- File any necessary LLC amendments or dissolutions

Exit Week

- Final walkthroughs with property owners (document everything with timestamped photos)

- Transfer all accounts, logins, and vendor relationships to buyer

- Collect security deposit refunds

- Send thank-you notes to every landlord, cleaner, and maintenance contact

- Celebrate. You built something real. Whether you’re moving to property ownership or closing this chapter entirely, that deserves recognition.

Airbnb Rental Arbitrage Legal Considerations During Exit

The legal side of exiting rental arbitrage catches operators off guard more than anything else. Here’s what you need to know, because airbnb rental arbitrage legal exposure doesn’t end when you hand back the keys.

Lease Obligations That Survive Termination

Even after you vacate, certain obligations from your long-term lease agreement may persist:

- Damage liability. Most lease agreements hold you responsible for damage discovered within 30-60 days of move-out. Document everything obsessively during your final walkthrough.

- Utility obligations. If utilities were in your name, ensure final bills are paid and accounts transferred or closed. Unpaid utility bills can become liens.

- Subletting restrictions. If your lease agreement didn’t explicitly permit short-term rental arbitrage, which is more common than people admit, your property owner could theoretically pursue damages for unauthorized subletting during the entire tenancy. This is rare but real. It’s why airbnb rental arbitrage legal compliance matters from day one.

Protecting Yourself from Post-Exit Liability

- Get a written release from every property owner. A simple letter stating you’ve fulfilled your lease obligations and the property owner has no further claims against you. This is worth its weight in gold.

- Maintain your proper insurance for 60 days post-exit. Guest injuries or property damage claims can surface weeks after a stay ends. Don’t cancel your liability coverage the day you hand back keys.

- Keep records for 7 years. Tax records, lease agreements, correspondence with property owners, and guest records. If anyone ever questions the rental arbitrage legal status of your operations, you want documentation.

Real-World Exit Strategy Examples from Successful Arbitrage Operators

Theory is useful. Real results are better. Here are three patterns I’ve seen repeated across the short-term rental industry:

The Clean Sale: Marcus from Nashville

Marcus built an 8-unit rental arbitrage business generating $12,400/month net profit over 18 months. When Nashville’s STR regulations shifted, he decided to sell rather than fight the regulatory tide. He documented every SOP, got all 8 property owners to agree to lease transfers, and sold the entire portfolio for $285,000, approximately 1.9x annual net. The buyer was another operator who already understood the business model. Total time from decision to closed deal: 47 days.

Why it worked: Marcus had documented systems, willing landlords, and he sold before the regulations actually hit. Timing is everything in a rental arbitrage exit strategy.

The Scale-Up: Priya from Phoenix

Priya ran 4 short-term rental arbitrage units for 2 years, saving 35% of her net profit ($42,000 total). She used that as a down payment on a $210,000 rental property via a DSCR loan, kept her top 2 arbitrage units running to cover the mortgage during stabilization, then exited the remaining arbitrage units 6 months later. Today she owns 3 properties free and clear of arbitrage lease obligations. Her equity position: $180,000+. From arbitrage cash flow to real wealth in under 4 years.

Why it worked: Priya used the hybrid approach, property ownership funded by active arbitrage cash flow. Unlike property owners who need large capital reserves, she bootstrapped from operations. See what’s possible in the best cities for Airbnb arbitrage.

The Graceful Wind-Down: James from Portland

Portland’s regulations made short-term rental arbitrage increasingly difficult. Rather than scrambling, James gave all 5 property owners 120 days’ notice, converted 2 units to mid-term rentals (travel nurses loved them), sold the furnishings from the other 3 units for $8,200 on Facebook Marketplace, and returned every unit in pristine condition. Three of those landlords later referred him to property owners looking for management, which became his next short-term rental business. The wind-down took 4 months. Zero burned bridges. Zero legal disputes.

Why it worked: James prioritized relationships over speed. The referrals he earned from a clean exit were worth more than any sale price. That’s the compound interest of doing exits right.

Common Exit Mistakes That Destroy Value

After watching hundreds of exits across the short-term rental industry, good and bad, here are the patterns that cost operators the most:

- Waiting too long to start. The best time to plan your rental arbitrage exit strategy is when business is good. The worst time is when you’re desperate. Start planning at least 6 months ahead. Successful arbitrage operators always have an exit plan, even when they don’t intend to use it.

- Ghosting property owners. This isn’t just unethical. It’s expensive. Broken leases without communication lead to lawsuits, forfeited deposits, and a destroyed reputation in the local landlord community. You might need these relationships again for future real estate deals.

- Undervaluing the business. I’ve seen operators sell $100,000/year businesses for $50,000 because they didn’t know what the arbitrage business was worth. Get a proper valuation. Talk to a business broker who understands STR operations and the short-term rental market.

- Ignoring tax planning. An asset sale structured properly vs. Haphazardly can mean a 15-25% difference in your tax bill. Spend $500 on a CPA consultation before closing any deal. That consultation could save you $10,000+.

- Trying to sell a broken operation. If occupancy is tanking, reviews are slipping, and property owners are frustrated, fix those issues first or accept a lower multiple. Buyers do due diligence, and a declining short-term rental business sells for pennies on the dollar.

- Not having systems documented. An arbitrage business that lives entirely in your head sells for 1.5x. A business with documented SOPs, vendor lists, and training materials sells for 2.5x+. The documentation is worth real money.

- Burning bridges on the way out. The short-term rental industry is smaller than you think. Property owners talk. Management companies share notes. Real estate investors remember names. Every exit is also a reputation event.

How Much Do Rental Arbitrage Hosts Actually Make at Exit?

Let’s ground this in real numbers. Here’s what I’ve seen across different portfolio sizes and exit types, because understanding the financial reality helps you plan your rental arbitrage exit strategy with precision.

| Portfolio Size | Annual Net Profit | Typical Sale Price | Wind-Down Recovery | Best Path |

|---|---|---|---|---|

| 1-2 units | $15,000-$30,000 | $25,000-$60,000 | $3,000-$8,000 (furnishing sale) | Scale or wind down |

| 3-5 units | $40,000-$80,000 | $80,000-$200,000 | $8,000-$20,000 | Sell or scale to ownership |

| 6-10 units | $80,000-$160,000 | $200,000-$480,000 | $15,000-$40,000 | Sell to management companies |

| 10+ units | $160,000+ | $400,000+ | $30,000+ | Sell or transition to ownership portfolio |

The gap between “sell” and “wind-down recovery” is massive. A 5-unit portfolio worth $150,000 as a going concern might only yield $12,000 in liquidated furnishings. That’s a $138,000 difference. This is why exit planning, and specifically, maintaining the option to sell, is critical for every rental arbitrage host.

Want to understand what you could be earning before you plan your exit? Check the Airbnb profit calculator to model your numbers, or see what operators are making across different markets in our breakdown of how much Airbnb hosts actually make.

Frequently Asked Questions About Rental Arbitrage Exit Strategies

How much can I sell my rental arbitrage business for?

Most rental arbitrage businesses sell for 2 to 3 times annual net profit. A portfolio generating $80,000/year in net profit typically sells for $160,000 to $240,000. The exact multiple depends on long-term lease terms remaining, operational systems, review scores, short-term rental market conditions, and whether the arbitrage business runs independently of the owner. Highly systematized portfolios with 24+ months of lease terms and a property manager in place can command up to 3.5x.

Can I transfer my Airbnb listings to a new operator?

You can’t directly transfer an Airbnb account, but you can co-host with the new rental arbitrage host for a transition period (typically 30 days), then have them create new listings using the same rental properties. The booking history doesn’t transfer, but the property reviews tied to the listing do if you use the co-host model correctly. VRBO and Booking.com have similar processes. The key is maintaining review continuity during the handoff to preserve the value of your short-term rental business.

What happens to my security deposits when I exit?

Security deposits are returned per your lease agreement terms, typically within 14 to 30 days of vacating. Return units in excellent condition with documentation (photos, walkthrough checklist signed by the property owner) to maximize your refund. If you’re transferring the lease to a new operator, the deposit typically transfers too, negotiate reimbursement from the buyer as part of the sale price.

Should I sell my arbitrage business or transition to property ownership?

It depends on your capital position and goals. If you have enough for a down payment (typically $50,000 to $100,000 for DSCR loans), transitioning to property ownership builds long-term equity that rental arbitrage can’t match. If you need the lump sum for other investments or life changes, selling generates substantial income immediately. Many successful arbitrage operators do both: sell 60% of their portfolio and use the proceeds as a down payment on their first owned rental property.

How do I handle existing bookings when winding down?

Honor every existing reservation. Cancel nothing. Set your listing calendar to block all dates after your target exit date, and let current bookings play out naturally. If you must exit faster, Airbnb’s extenuating circumstances policy or direct guest communication with a partial refund and relocation assistance can work, but this should be an absolute last resort. Cancelled bookings destroy your listing’s ranking.

Is rental arbitrage legal to exit mid-lease?

Breaking a long-term lease agreement mid-term is legal but may carry financial penalties specified in your lease. Most states allow early termination with proper notice and payment of a lease-break fee (typically 1-2 months’ monthly rent). Some jurisdictions require landlords to mitigate damages by actively seeking new tenants, which reduces your exposure. Research local laws in your area, because airbnb rental arbitrage legal obligations vary significantly by state. See Nolo’s guide to breaking a lease for the legal framework.

How long does it take to wind down a rental arbitrage operation?

Plan for 3 to 6 months from decision to completion. A clean wind-down of a 5-unit portfolio typically takes 4 months: month one for property owner notifications and planning, months two and three for honoring remaining bookings and gradually removing furnishings, and month four for final cleanings, walkthroughs, and deposit recovery. Rushing the process below 60 days almost always results in forfeited deposits, damaged relationships, or both.

What if my landlord wants to prohibit rental arbitrage mid-lease?

If your existing lease agreement explicitly permits short-term rentals or subleasing, the property owner generally cannot prohibit rental arbitrage mid-lease without your agreement. However, if your lease is silent on subletting, local laws may give the landlord grounds to restrict it. This is why airbnb rental arbitrage legal protection starts with your lease. If you face this situation, consult a local attorney before making any moves, and start planning your exit strategy regardless, because a hostile landlord relationship rarely improves.