Mid-term rental arbitrage is the strategy of signing a long term lease on a property and subletting it as a furnished mid term rental for 30 to 180 days. You’re targeting traveling medical professionals on 13-week contracts, corporate clients on relocation assignments, relocating families between permanent housing, and insurance displacement tenants. No down payment required. No property ownership. Just a lease agreement, the property owner’s written permission, and a furnished unit in the right location.

My mid-term units average 94% occupancy because the demand never stops. Traveling nurses need housing year-round. Corporate relocations don’t pause for holidays. Insurance claims don’t care about “slow season.” And that’s exactly why this business model prints more money than traditional short term rental arbitrage for operators who understand the math.

If you’ve been grinding nightly Airbnb bookings, dealing with 15 turnovers a month, guest complaints at 2 AM, and local regulations that get stricter every quarter, mid-term rental arbitrage is the exit ramp you didn’t know existed.

What Is Mid-Term Rental Arbitrage?

Let me break this down simply. Rental arbitrage is when you sign a long term lease on a property, with the landlord’s written permission, and then sublet it at a higher rate. Most people hear “arbitrage” and think of short term guests booking weekend Airbnb stays. But mid-term rental arbitrage targets stays of 30 to 180 days instead.

That distinction changes everything.

With short term rental arbitrage, you’re dealing with 2-3 day turnovers, constant cleaning, guest communication at all hours, and a regulatory landscape tightening in virtually every major city. Mid-term flips that script. You get one tenant for 1-6 months, one check-in, one cleaning between guests, and, here’s the part most people miss, most cities don’t even classify 30+ day stays as short-term rentals. That means no permits, no occupancy taxes, and no caps on nights you can rent.

The core formula is identical to standard Airbnb business models:

- Monthly rent you pay to the property owner: Your fixed cost under the lease agreement

- Monthly revenue from your mid-term tenant: Your rental income

- The spread minus other expenses: Your profit

The difference? Mid-term tenants pay less per night than short term guests. But they pay every single night for months straight. No vacancies between weekend warriors. No dead Tuesdays. No seasonal crashes. Just consistent, predictable passive income month after month.

And because your lease terms with the property owner are fixed, your costs are locked while your rental business generates premium rates above what a standard long term lease would produce.

Why This Business Model Is Exploding in 2026

I’ve been watching this space closely. Five demand drivers are converging right now to make mid-term the most underrated play in the rental arbitrage business.

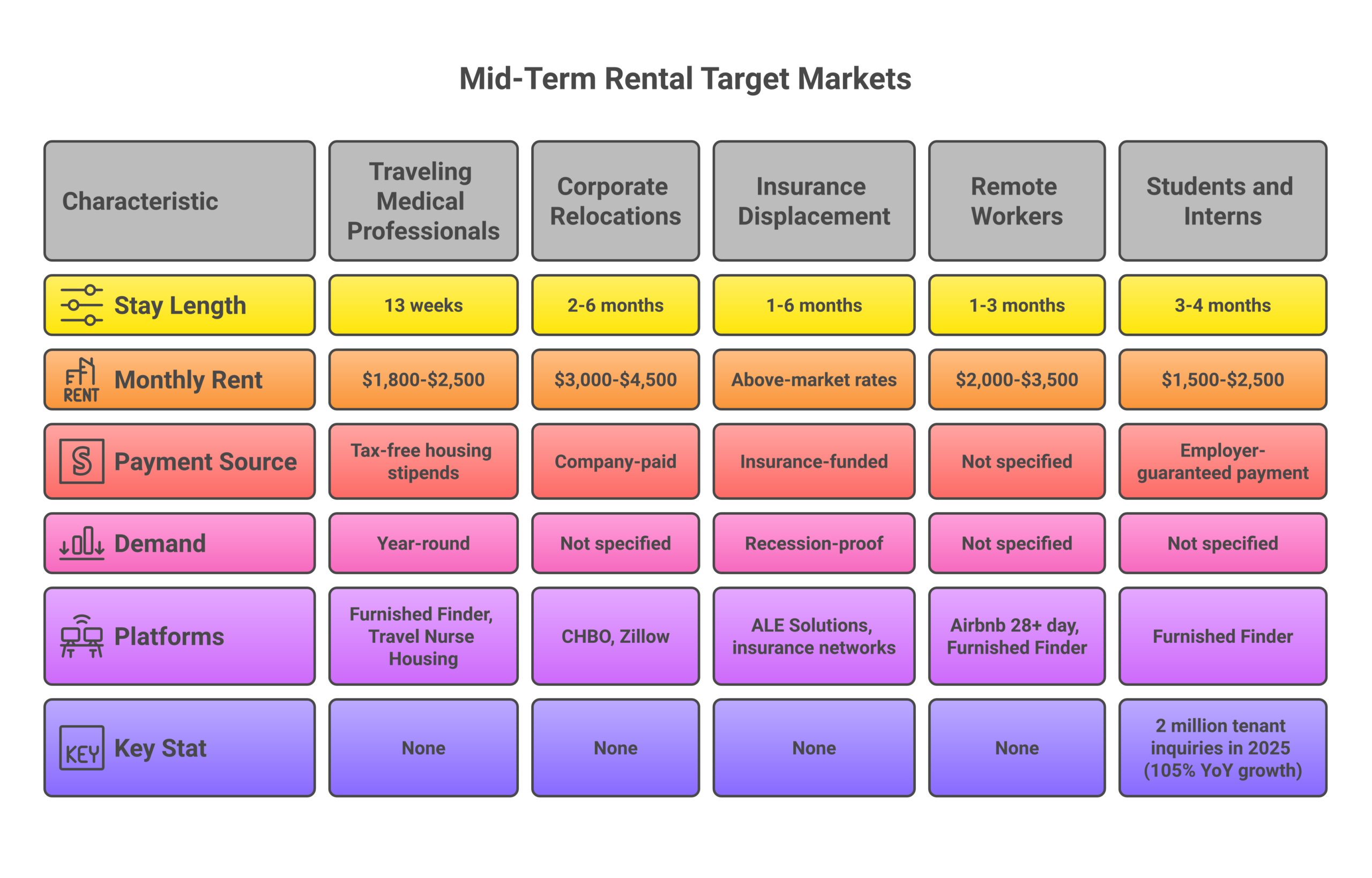

Traveling Medical Professionals on 13-Week Contracts

The travel nursing market hit $46.3 billion in 2025. These nurses take 13-week contracts at hospitals across the country, and they need furnished housing near their assignment. Hotels are too expensive. Unfurnished apartments with 12-month leases don’t work for a 3-month stay. They want a clean, furnished place with WiFi and a kitchen for $1,800-$2,500 per month.

Here’s what makes traveling medical professionals the perfect mid-term tenants: their agencies provide tax-free housing stipends based on GSA per diem rates. A nurse earning $2,200-$3,400 per week gets a separate housing allowance, typically $770-$1,400 weekly depending on the city. That stipend is earmarked for housing. It’s guaranteed income backed by a staffing contract.

States with the highest demand? California, Texas, Georgia, Massachusetts, and New York. Every major hospital system cycles through travel nurses constantly. That’s recurring demand, not seasonal.

Corporate Clients and Relocating Families

Companies relocating employees to new cities need temporary housing during transitions. Construction managers on 3-6 month projects, consultants on quarterly engagements, executives starting new roles, all of them need furnished mid-term housing. Traditional corporate housing companies charge $150-$250 per night for this service (that’s $4,500-$7,500/month). You can undercut them at $3,000-$4,500 per month and still clear massive margins.

Relocating families are another goldmine. A family selling one home and buying another might need 2-4 months of furnished housing. They’re responsible, they treat the property like their own home because their kids live there, and the company footing the bill doesn’t haggle over reasonable rates.

Insurance and Disaster Relocation Housing

After the 2025 LA wildfires displaced tens of thousands of families, insurance companies scrambled to find temporary housing. FEMA’s Continued Temporary Housing Assistance program provides up to 18 months of coverage. Insurance companies pay above market rate for furnished housing because they need availability fast.

Natural disasters are increasing in frequency. Every hurricane, wildfire, and flood creates a surge of displaced families who need furnished housing for 2-6 months while homes are rebuilt. This isn’t a niche. It’s a growing, recession-proof demand source that makes your rental business essentially weather-proof (pun intended).

Remote Workers and Digital Nomads

Remote work isn’t a trend anymore. It’s structural. And it’s created an entirely new category of renter: the employed professional who works from a laptop and wants to live somewhere different every few months. They don’t need a one-night crash pad. They need a comfortable, furnished space with a good desk and reliable internet for 1-3 months.

These tenants are gold. They’re quiet, rarely home during the day, and they treat your property well because it’s literally their home office. Property damage is almost nonexistent with this demographic.

Students and Interns

Summer interns at tech companies, medical residents rotating through hospitals, graduate students doing semester-long fieldwork. They all need 3-4 month furnished housing in specific cities. They’re reliable, their employers often guarantee payment, and they book well in advance.

Mid-Term vs. Short-Term vs. Long-Term: The Full Comparison

I’ve run all three models. Here’s the honest breakdown so you can see why I’m shifting more units toward mid-term rentals in 2026.

| Factor | Short-Term (1-29 nights) | Mid-Term (30-180 days) | Long-Term (12+ months) |

|---|---|---|---|

| Revenue per night | $120-$250 | $70-$150 | $40-$70 |

| Monthly occupancy | 65-80% | 90-100% | 100% (lease-locked) |

| Effective monthly revenue | $2,400-$6,000 | $2,100-$4,500 | $1,200-$2,100 |

| Cleaning costs/month | $400-$1,200 (8-15 turnovers) | $0-$150 (0-1 turnovers) | $0 |

| Supplies and consumables | $150-$300/month | $20-$50/month | $0 (tenant supplies own) |

| Guest communication time | 5-10 hours/month | 1-2 hours/month | 0-1 hours/month |

| Platform fees | 3-15% per booking | 0-3% (direct bookings common) | 0% (standard lease) |

| Property damage risk | Higher (party guests, bachelor groups) | Lower (professionals, families) | Variable (12+ months of wear) |

| Regulatory burden | Heavy (permits, taxes, caps, bans) | Minimal (30+ days often exempt) | Standard tenant law |

| Seasonal volatility | High (peaks and dead seasons) | Low (year-round demand) | None |

| Furnishing standard | Hotel-quality, Instagram-worthy | Comfortable, functional | Unfurnished |

| Net profit after expenses | $800-$2,500/month | $1,000-$2,800/month | $200-$600/month |

Read that last row again. Mid-term often nets more money than short-term because you’re not bleeding cash on cleaning, supplies, platform fees, and your own time. The top-line revenue is lower, but the bottom line? Frequently higher.

And notice what long term rentals look like in this comparison. You property long term tenants into 12-month leases, collect below-market rent, and clear $200-$600/month if you’re lucky. Mid-term gives you 3-5x the spread on the same unit.

Here’s what that table doesn’t capture: stress. Managing 15 check-ins per month versus 1 is a completely different lifestyle. I’ve talked to hosts who switched to mid-term and said it felt like they got their life back. Not an exaggeration.

Want the full picture before committing? Read the pros and cons of rental arbitrage.

The Numbers: A Real Mid-Term Arbitrage Profit Analysis

Enough theory. Let me walk you through an actual scenario based on real market data.

Scenario: 2-Bedroom Apartment Near a Major Hospital

| Line Item | Monthly Amount |

|---|---|

| Monthly rent to property owner | $1,800 |

| Utilities (electric, water, internet) | $250 |

| Renter’s insurance | $35 |

| Furnishing amortization (12 months) | $375 |

| Cleaning (between tenants, amortized) | $50 |

| Supplies/toiletries | $25 |

| Furnished Finder listing fee (amortized) | $15 |

| Maintenance reserve | $75 |

| Property management software | $30 |

| Total monthly expenses | $2,655 |

| Mid-term rental income | $3,200 |

| Monthly net profit | $545 |

| Annual net profit | $6,540 |

“Wait, $545 a month? That doesn’t sound life-changing.”

Fair pushback. Here’s where it gets interesting. That $3,200/month is the conservative Furnished Finder average for a 2BR near a hospital. In high-demand markets, San Diego near Naval Medical Center, Boston near Mass General, Nashville near Vanderbilt. You’re looking at $3,800-$4,500/month for the same unit. That pushes your profit to $1,145-$1,845/month per unit.

Now compare that to short term rental arbitrage on the same unit. Sure, your gross revenue might hit $4,000-$5,000 in peak season. But after $800 in cleaning, $200 in supplies, $400-$600 in platform fees, and 10+ hours of your time at even $25/hour? Your net drops to $500-$1,200. And in the off-season? You might not cover monthly rent.

Mid-term doesn’t have an off-season. Hospitals don’t close in January. Insurance claims don’t stop in February. Corporate projects don’t pause for summer.

Scale to 5 units at $1,200/month profit each and you’re clearing $72,000 per year with maybe 10 hours of work per week. That’s the math that makes this a successful rental arbitrage business.

Curious about the full cost picture? Check the startup costs breakdown to compare furnishing costs across models.

Is Mid-Term Rental Arbitrage Legal?

This is the question everyone asks first, and the answer is overwhelmingly favorable compared to short-term alternatives.

Here are the important considerations around rental arbitrage legal requirements for mid-term stays:

The 30-Day Threshold

Most cities define “short-term rentals” as stays under 30 days. Stays of 30+ days are typically classified as standard residential tenancies. That single distinction eliminates most regulatory headaches:

- No STR permits required in the vast majority of jurisdictions

- No transient occupancy taxes – San Francisco charges 14% on stays under 30 days, but mid-term stays are exempt

- No hosting caps or night limits – many cities cap STR nights at 90-180 per year; mid-term is unaffected

- No neighbor notification requirements in most cities

New York City’s Local Law 18 is the perfect example. It requires registration for rentals under 30 days and essentially banned most short-term Airbnb listings. But 30+ day furnished rentals? Perfectly fine. No registration needed. While short-term hosts scrambled, mid-term operators in NYC didn’t miss a beat.

What You Still Need

Being exempt from STR regulations doesn’t mean zero legal requirements. Every successful rental arbitrage business needs:

- Landlord permission in writing: Your lease agreement must explicitly allow subletting for furnished mid-term rentals. Verbal permission isn’t enough, get it in the lease or an addendum

- Compliance with local laws: Some cities require business licenses for any rental operation. Check your specific city’s local regulations

- A proper sublease agreement: Mid-term tenants in most states gain tenant rights after 30 days, including the right to a formal eviction process. Your lease terms must be airtight

- Appropriate insurance: Standard renter’s insurance won’t cover a subletting operation. See the insurance guide for coverage options

Bottom line: mid-term rental arbitrage operates in a far friendlier legal environment than short-term. But “easier” isn’t “zero effort.” Do the legal homework for your specific market. Our state-by-state legal guide covers the specifics.

Best Platforms for Mid-Term Rental Bookings

Where you list your property matters. Each platform attracts a different tenant type, and the smartest operators list on multiple channels simultaneously to maximize local demand coverage.

Furnished Finder

This is the 800-pound gorilla of mid term rentals. Originally built for traveling nurses, Furnished Finder logged over 2 million tenant inquiries in 2025, a 105% year-over-year increase. The average stay is 107 days. Annual listing fee is roughly $150 per property (not per booking), so there are no commission fees eating into your rental income. If you’re doing mid-term arbitrage and you’re not on Furnished Finder, you’re not serious about this rental business.

Pro tip: include your internet speed, parking situation, and pet policy in the first three lines of your listing. These are the three things traveling medical professionals filter for first.

Airbnb (28+ Day Filter)

Airbnb offers monthly stay discounts and a 28+ day search filter. Many mid-term tenants start their search here out of habit. The platform takes a 3% host fee on bookings, which is reasonable. Set your minimum stay to 30 days and enable monthly discounts of 20-30%. This attracts the right tenants and suppresses the weekend party crowd entirely.

Zillow (Furnished Filter)

A lot of people don’t know this: Zillow has a “furnished” filter for rentals. Corporate clients and longer-term tenants use it frequently. Free to list, massive traffic, and you deal directly with tenants. No platform fees. This is where corporate relocators search because their HR departments trust Zillow.

CHBO (Corporate Housing by Owner)

CHBO connects property operators directly with corporate tenants and relocating families. It’s less known than Furnished Finder but attracts higher-budget tenants. Corporate housing tenants through CHBO typically stay 60-120 days and have company-backed payment, which means zero risk of missed rent.

Insurance Housing Networks

ALE Solutions, Temporary Housing Directory, and similar services connect displaced families with furnished housing. Insurance companies pay above-market rates because they need fast availability. Getting listed takes effort upfront, but the payoff is consistent, above-market bookings. One insurance housing relationship can fill 3-4 months of bookings per year per unit.

Contact the Landlord Directly, For Referrals

Here’s a tactic most guides skip: once you’ve built a relationship with the property owner, ask if they know other landlords with vacant units. Many property owners talk to each other. If you’re running a clean operation, paying on time, and maintaining the property well, your landlord becomes your best referral source for scaling the rental arbitrage business.

Best Markets for Mid-Term Rental Arbitrage in 2026

Not every city works. You need consistent demand drivers: hospitals, military bases, corporate headquarters, and government facilities. Local demand from traveling medical professionals alone can fill a unit year-round in the right market.

| City | Key Demand Drivers | Avg. 2BR Rent | Est. Mid-Term Revenue | Why It Works |

|---|---|---|---|---|

| San Diego, CA | Naval Base (24K), Camp Pendleton (42K), 30+ hospitals, biotech | $2,400 | $3,800-$4,500 | Military + healthcare + corporate triple demand |

| San Antonio, TX | Joint Base San Antonio (80K+), 6 major hospital systems | $1,400 | $2,600-$3,200 | Massive military presence, lowest rent-to-revenue ratio |

| Nashville, TN | Vanderbilt Medical, 500+ healthcare companies, Oracle HQ | $1,700 | $3,000-$3,600 | Healthcare capital + corporate growth |

| Boston, MA | Mass General, Brigham & Women’s, biotech corridor, universities | $2,800 | $4,200-$5,000 | Highest concentration of teaching hospitals in the US |

| Raleigh-Durham, NC | Research Triangle, Duke Medical, UNC Health, tech corridor | $1,500 | $2,800-$3,400 | Research + healthcare + affordable entry point |

| Denver, CO | Banner Health system, military installations, tech companies | $1,900 | $3,200-$3,800 | Year-round healthcare and corporate demand |

| Washington, D.C. | Johns Hopkins, MedStar, government contractors, military | $2,200 | $3,600-$4,200 | Government + military + healthcare trifecta |

| Houston, TX | Texas Medical Center (106K employees), energy sector, NASA | $1,500 | $2,800-$3,400 | World’s largest medical complex = constant nurse demand |

Notice a pattern? The best mid-term markets aren’t typical Airbnb tourist destinations. You don’t need beach access or a downtown party scene. You need hospitals, bases, and corporate offices. That’s actually an advantage. You’re not competing with the flood of hosts chasing the same tourist markets.

San Antonio stands out for beginners. Monthly rent of $1,400 against revenue of $2,600-$3,200 gives you the best margin percentage. And Joint Base San Antonio alone rotates through more than 80,000 military personnel. Many on temporary assignments needing 2-6 month furnished housing.

How to Set Up a Mid-Term Rental Property

Setting up for mid-term costs less and takes less effort than short-term. Your tenants aren’t looking for an Instagram-worthy boutique hotel. They want a comfortable, functional home for the next 3 months. Premium amenities that matter are different from what short term guests expect.

Furnishing Essentials (Not Extras)

Here’s what mid-term tenants actually need. I’ve furnished units for both models, and mid-term setup costs about 40% less.

- Bedroom: Queen bed with mattress protector, nightstands, dresser, hangers, blackout curtains, reading lamp

- Kitchen: Full cookware set, dishes for 4, utensils, coffee maker, microwave, toaster. These people actually cook. They’re not ordering DoorDash every night for 3 months

- Living room: Comfortable couch (not a $300 futon), TV with streaming, coffee table, decent lighting

- Workspace: Desk and ergonomic chair. Non-negotiable for remote workers and nurses charting at home

- Bathroom: Starter toiletries only (first week supply), quality towel sets, bath mat

- Laundry: In-unit washer/dryer is a massive differentiator. If the unit doesn’t have one, a portable washer works as a stopgap

Total furnishing budget for a 2BR mid-term unit: $4,000-$6,000. Compare that to the $7,000-$12,000 I’ve spent on short-term units with custom decor, professional photography staging, and designer touches. Mid-term doesn’t need any of that. Functional and clean beats pretty every time.

Lease Agreement and Legal Setup

You need two documents locked down before anything else in your rental arbitrage business:

- Your master lease with the property owner: Must explicitly permit subletting for furnished mid term rentals. Don’t try to hide this from your landlord. Approach the landlord directly with a professional pitch. Read our guide on making money without owning property for the full approach

- Your sublease agreement with tenants: A mid-term lease agreement should cover stay duration, monthly rent, security deposit, house rules, utilities included, and early termination terms. This isn’t Airbnb where the platform handles disputes. You need a real lease with clear lease terms

Important: collect a security deposit equal to one month’s rent. Mid-term tenants have fewer issues than short term guests, but 3 months of occupancy creates more wear than a 3-day stay. The security deposit protects you against unusual property damage.

Thinking about the legal structure? An LLC provides liability protection for your rental business. Here’s the full LLC setup guide for rental arbitrage operators.

Premium Amenities That Win Bookings

These amenities actually move the needle for mid-term tenants (based on what I’ve seen convert on Furnished Finder):

- High-speed internet (100+ Mbps): Include the speed in your listing. Traveling medical professionals charting from home and remote workers won’t book without it

- Parking: Especially near hospitals where nurses work odd shifts. One dedicated parking spot is the difference between a booking and a pass

- Pet-friendly: Traveling nurses with pets have fewer housing options. Charge a $250-$500 pet deposit and you’ll capture bookings competitors miss

- All utilities included: Mid-term tenants don’t want to set up utility accounts for 3 months. Bundle everything into one monthly price. It simplifies the math for them and lets you charge a premium

- Flexible move-in dates: Nurse contracts start on specific dates. Being flexible on move-in/move-out timing gets you booked faster

Property Management Software for Mid-Term Operations

Once you scale past 2-3 units, you need property management software to keep things organized. Here’s what actually matters for mid-term operations (not the same feature set short-term hosts need):

- Lease tracking: Know when every tenant’s lease ends so you can send renewal offers 30 days before expiration

- Maintenance request management: Mid-term tenants expect responsive maintenance like any renter. A system beats text messages

- Financial tracking: Per-unit P&L, expense categorization, and tax-ready reporting

- Multi-channel listing management: Sync availability across Furnished Finder, Airbnb, Zillow, and CHBO

Platforms like Guesty, Hospitable, and RentRedi work well for mid-term operations. Budget $15-$50/month depending on unit count. This is cheap insurance against missed renewals, double-bookings, and tax season chaos.

For a full breakdown of tools that streamline operations, see our automation tools guide.

The Hybrid Strategy: Combining Short-Term and Mid-Term

Here’s where smart operators really separate themselves. You don’t have to pick one model. The hybrid strategy uses mid-term as your floor and short-term as your ceiling.

Here’s how it works in practice:

- Set your Airbnb minimum stay to 30 days with a competitive monthly rate as your baseline

- During peak seasons (holidays, local events, conferences), switch to nightly pricing at 2-3x the nightly equivalent

- During slow seasons, lock in a mid-term tenant for 2-3 months at a guaranteed rate

- Between mid-term tenants, open for short-term bookings to fill the gap and earn more money per night

Example calendar for a Nashville unit showing how this generates more money than either model alone:

- January-March: Mid-term tenant (traveling nurse, 13-week contract) at $3,200/month = $9,600

- April: Short-term bookings during spring tourism at $180/night × 22 nights = $3,960

- May-July: Mid-term tenant (summer intern at Oracle) at $3,000/month = $9,000

- August-September: Short-term during CMA Fest and football season at $200/night × 40 nights = $8,000

- October-December: Mid-term tenant (corporate relocation) at $3,400/month = $10,200

- Annual total: $40,760 gross revenue

Compare that to pure short-term ($32,000-$38,000 with seasonal gaps) or pure mid-term ($36,000-$39,600 without the peak-season premium). The hybrid approach typically generates 15-25% more annual revenue than either model alone.

Scaling Your Mid-Term Rental Arbitrage Business

One unit proves the concept. Three units replace a salary. Five to ten units build real wealth. Here’s how to build a successful rental arbitrage business that scales.

Unit Acquisition Strategy

Don’t sign 5 leases in month one. That’s how people go broke. Here’s the timeline that works:

- Months 1-3: One unit, one market. Learn the tenant acquisition process, nail your operations, build reviews on Furnished Finder

- Months 4-6: Add a second unit in the same market. You already know the landlords, hospitals, and local demand patterns

- Months 7-12: Scale to 3-5 units. Consider a second market if your first is saturated. Each new unit should be cash-flow positive within 60 days

Building Your Referral Moat

After 6 months of operation, your competitive advantage shifts from pricing to relationships. Contact local travel nurse staffing agencies directly, companies like Aya Healthcare, Cross Country Nurses, and AMN Healthcare place thousands of nurses per month. If you become their go-to housing provider in your city, you’ll have a pipeline that no new competitor can replicate overnight.

Same with corporate relocation departments. Once an HR department at a Fortune 500 company trusts your housing, they’ll send every transferee your way. These referral relationships compound over time and become your moat.

When to Consider an Exit

Mid-term rental arbitrage portfolios have real resale value. A portfolio of 5-10 units with established tenant pipelines, Furnished Finder reviews, and staffing agency relationships can sell for 12-24x monthly net profit. That’s $60,000-$240,000 for a portfolio netting $5,000/month.

Planning ahead? Read the exit strategy guide to understand your options.

Common Mistakes That Kill Mid-Term Profitability

I’ve watched operators blow this opportunity by making avoidable errors. Here are the ones I see repeatedly.

1. Pricing Like a Short-Term Rental

You can’t charge $150/night and expect a traveling nurse to book 90 nights at that rate. Mid-term pricing should be 30-50% below your nightly STR rate. The volume and consistency make up the difference. If your 2BR goes for $150/night on Airbnb, price your term rental at $3,000-$3,500/month (effectively $100-$117/night). That’s competitive for mid-term and still wildly profitable.

2. Skipping the Lease Agreement

Some operators skip the formal sublease because “it’s basically Airbnb but longer.” Wrong. A mid-term tenant without a lease agreement can create legal headaches that short term guests never could. In many states, a tenant staying 30+ days has full tenant rights, including the right to a formal eviction process. Always use a proper lease. Always collect a security deposit. Always.

3. Under-Furnishing the Kitchen

Short term guests microwave leftovers. Mid-term tenants cook real meals every day for months. If your kitchen has two pots and a dull knife, you’ll get bad reviews and tenants won’t extend their lease terms. Invest in a complete, quality kitchen setup. It costs maybe $300 more and pays for itself in tenant satisfaction and extensions.

4. Not Screening Tenants

With direct bookings on Furnished Finder or Zillow, screening is on you. Run background checks, verify employment, for traveling medical professionals, ask for their contract assignment letter. One bad mid-term tenant can cost thousands in property damage and lost rental income over 3 months.

5. Overlooking Insurance

Standard renter’s insurance won’t cover your subletting arrangement. Companies like Proper Insurance and CBIZ offer policies designed for arbitrage operators. Budget $100-$200/month per unit. One liability claim without coverage can wipe out years of profit. Details in our insurance guide.

6. Targeting Markets Without Demand Drivers

Don’t try mid-term arbitrage in a beach town with no hospitals, no corporate offices, and no military base. The local demand drivers are completely different from short-term. Nashville works. Myrtle Beach doesn’t. San Antonio works. Key West doesn’t. Match your market to the tenant profile.

7. Ignoring Property Management Software

Once you’re past 2 units, managing lease expirations, maintenance requests, and financial tracking on spreadsheets breaks down. Invest $30-$50/month in property management software. The time savings alone pays for it when you’re managing 3+ units.

Getting Started: Your First Mid-Term Arbitrage Unit

Ready to actually do this? Here’s the step-by-step path to launching your first unit.

- Pick your market: Choose a city from the table above, or any metro with major hospitals, military installations, or corporate headquarters. Research local regulations to confirm 30+ day stays are exempt from STR requirements in your target area

- Find the right property: 2BR apartments near hospitals are the sweet spot. Use Zillow and Apartments.com to identify units in the $1,400-$2,000 monthly rent range within 15 minutes of a major hospital

- Get landlord approval: Approach the landlord directly with a professional pitch. Offer above-market rent, a longer long term lease commitment, and guaranteed property care. Most property owners say yes when you present it as a professional furnished housing operation. Not “I’m going to Airbnb your apartment”

- Set up your LLC: Protect yourself with a proper business structure before signing any lease agreement

- Furnish the unit: Budget $4,000-$6,000 for a complete 2BR setup. Buy quality but not luxury. IKEA plus Amazon basics gets it done

- List on multiple platforms: Furnished Finder (day one), Airbnb with 30-day minimum, Zillow furnished filter, and CHBO for corporate clients

- Price competitively: Research what similar furnished units rent for on Furnished Finder in your area. Price 5-10% below the top listings to book fast while building reviews

- Build referral relationships: Contact local travel nurse staffing agencies, corporate housing departments, and insurance adjusters. These relationships become your moat over time

Total startup cost for your first mid-term unit is typically $5,500-$8,000 (first month’s rent, security deposit, furnishing, and setup). No down payment on a property purchase. No mortgage qualification. Just a lease, some furniture, and a willingness to run a real rental business.

Frequently Asked Questions

How much can you make with mid-term rental arbitrage?

A typical 2BR unit generates $500-$1,800 in monthly net profit depending on the market. In high-demand cities like San Diego, Boston, or Nashville near major hospitals, expect the higher end. Annual net profit runs $6,000-$21,600 per unit. Scale to 3-5 units and you’re looking at a legitimate full-time passive income stream with part-time hours. The key is picking markets with strong local demand from traveling medical professionals and corporate clients.

Is mid-term rental arbitrage legal?

Yes, in most markets. The 30-day threshold is the critical regulatory line. Most cities define short-term rentals as stays under 30 days, meaning your mid-term operation falls outside STR permit requirements, occupancy taxes, and hosting caps. You still need the property owner’s permission in your lease agreement and compliance with local laws. Mid-term operators face far fewer legal hurdles than short-term hosts, but always check your specific city’s local regulations.

What’s the difference between mid-term and short-term rental arbitrage?

Short term rental arbitrage targets 1-29 night stays (tourists, weekend travelers). Term rental arbitrage in the mid-term space targets 30-180 day stays (traveling nurses, corporate relocators, insurance displacement, digital nomads). Mid-term has lower per-night revenue but higher occupancy (90-100% vs 65-80%), dramatically lower other expenses, less management time, and minimal regulatory burden. Net profit is often higher with mid-term once you account for cleaning, supplies, and platform fees.

Do you need a down payment or to own property?

No. That’s the entire point of rental arbitrage. You lease the property from a property owner with a standard lease agreement. No down payment, no mortgage, no property ownership required. Your startup costs are first month’s rent, a security deposit, and furnishing. Total investment: $5,500-$8,000 per unit versus $50,000-$100,000+ to buy a property.

What are the best platforms for finding mid-term tenants?

Furnished Finder dominates with over 2 million inquiries in 2025 and an average 107-day stay. Airbnb with 28+ day minimum is second. Zillow’s furnished filter attracts corporate relocators and relocating families. CHBO connects you directly with corporate clients. For premium above-market rates, build relationships with insurance housing networks and travel nurse staffing agencies.

What property management software should I use?

Guesty, Hospitable, and RentRedi all handle mid-term operations well. You need lease tracking, maintenance management, multi-channel listing sync, and financial reporting. Budget $15-$50/month. The investment pays for itself in avoided double-bookings, missed renewals, and tax preparation time. At 3+ units, property management software becomes non-negotiable.

Can I combine mid-term and short-term strategies?

Yes, and you should. The hybrid model uses mid-term tenants as your income floor (no vacancies) and short-term bookings during peak seasons as your ceiling (premium nightly rates). This approach generates 15-25% more money annually than either model alone. Lock in mid-term tenants during slow seasons, switch to nightly during high-demand periods.