You can make money on Airbnb without owning property. Thousands of people do it right now, and some clear $10,000-$30,000 per month. No mortgage, no down payment, no property ownership required. Seven proven methods make this possible: rental arbitrage, co-hosting, co-listing, property management, Airbnb consulting, cleaning services, and Airbnb Experiences. Each path carries different startup costs, income ceilings, and time requirements. I’ve watched hundreds of students build successful Airbnb businesses using these models over the past three years, and the pattern is always the same: pick one method, execute within 7 days, and adjust from there. This guide breaks down every method with real numbers so you can choose the right starting point.

Can You Really Run an Airbnb Business Without Owning Property?

Yes. And it’s not some loophole or gray area. Operating an Airbnb business without owning real estate has become one of the most accessible paths into the short-term rental market. The model works because it solves a problem on both sides: property owners want passive income but hate managing guests, and entrepreneurs want cash flow but can’t afford to buy property. You’re the bridge.

The short term rental market in the United States grew from $20.7 billion in 2023 to an estimated $24.78 billion by 2029, according to Statista’s vacation rental market report. That growth keeps creating opportunities for people who want to earn from Airbnb properties without the substantial upfront investment of owning real estate. You don’t need to own Airbnb properties to profit from this expansion. In fact, many of the fastest-growing operators in the short term rentals space deliberately avoid property ownership because it frees up capital for scaling operations.

Here’s what most people get wrong: they think Airbnb = buying a house. That’s one model. But the people scaling fastest right now? They don’t own anything. They manage, list, co-host, or service other people’s vacation rentals. The barrier to entry has never been lower.

The seven methods I cover here range from zero upfront capital to about $13,000 for a single rental arbitrage unit. Some let you work remotely from your phone. Others require boots on the ground. Some scale to six figures in 12 months. Others top out at a solid side income. The right choice depends on your situation, and I’ll help you figure out which one fits.

Method 1: Rental Arbitrage (Highest Per-Unit Profit)

Rental arbitrage is the most well-known way to run an Airbnb business without owning property. You sign a long-term lease on an apartment or house, furnish it, and list it on Airbnb at higher nightly rates. The spread between your monthly rent and your booking revenue is your profit. It requires more upfront capital than other methods, but the per-unit returns are the strongest.

How Rental Arbitrage Works Step by Step

The process is straightforward, but execution matters. You find a property in a strong short-term rental market, negotiate a lease with the landlord (getting explicit written permission to sublease for short-term rentals), furnish the unit, create professional listings, and start accepting bookings.

Here’s the math on a real example: You lease a two-bedroom apartment for $1,800/month. After furnishing and listing, you average $4,200/month in booking revenue. Subtract your rent ($1,800), utilities ($150), cleaning fees ($600 for 8 turnovers), and supplies ($50). That leaves $1,600/month in profit from a single unit. Scale to five units and you’re looking at $8,000/month. Ten units? $16,000/month.

The critical first step is landlord permission. I recommend offering 10-15% above market rent. If a unit typically rents for $1,600/month, offer $1,800. That extra $200/month is nothing compared to your $1,600 profit, but it gives the landlord a compelling reason to say yes. Some students also offer property owners a percentage of gross bookings as an additional incentive.

Before signing anything, check your local regulations. Some cities restrict or ban short-term rentals entirely. Others require permits. Read our Airbnb LLC guide to understand the legal structure you should set up before your first booking.

Rental Arbitrage Startup Costs

Airbnb arbitrage requires the most upfront capital of any method here. But “most” is relative. You’re not buying a $300,000 house. Here’s a realistic breakdown for a single unit:

- Security deposit + first/last month’s rent: $3,600-$5,400

- Furniture and decor: $3,000-$6,000 (source from Facebook Marketplace, IKEA, and estate sales to stay on the low end)

- Supplies and linens: $500-$800

- Professional photography: $150-$300

- Smart lock and basic tech: $200-$400

Total estimated startup: $7,450-$12,900 per unit. Some students have launched for under $5,000 by finding move-in specials with no security deposit and furnishing entirely through Facebook Marketplace. If capital is tight, read our guide on starting Airbnb with no money for low upfront investment strategies.

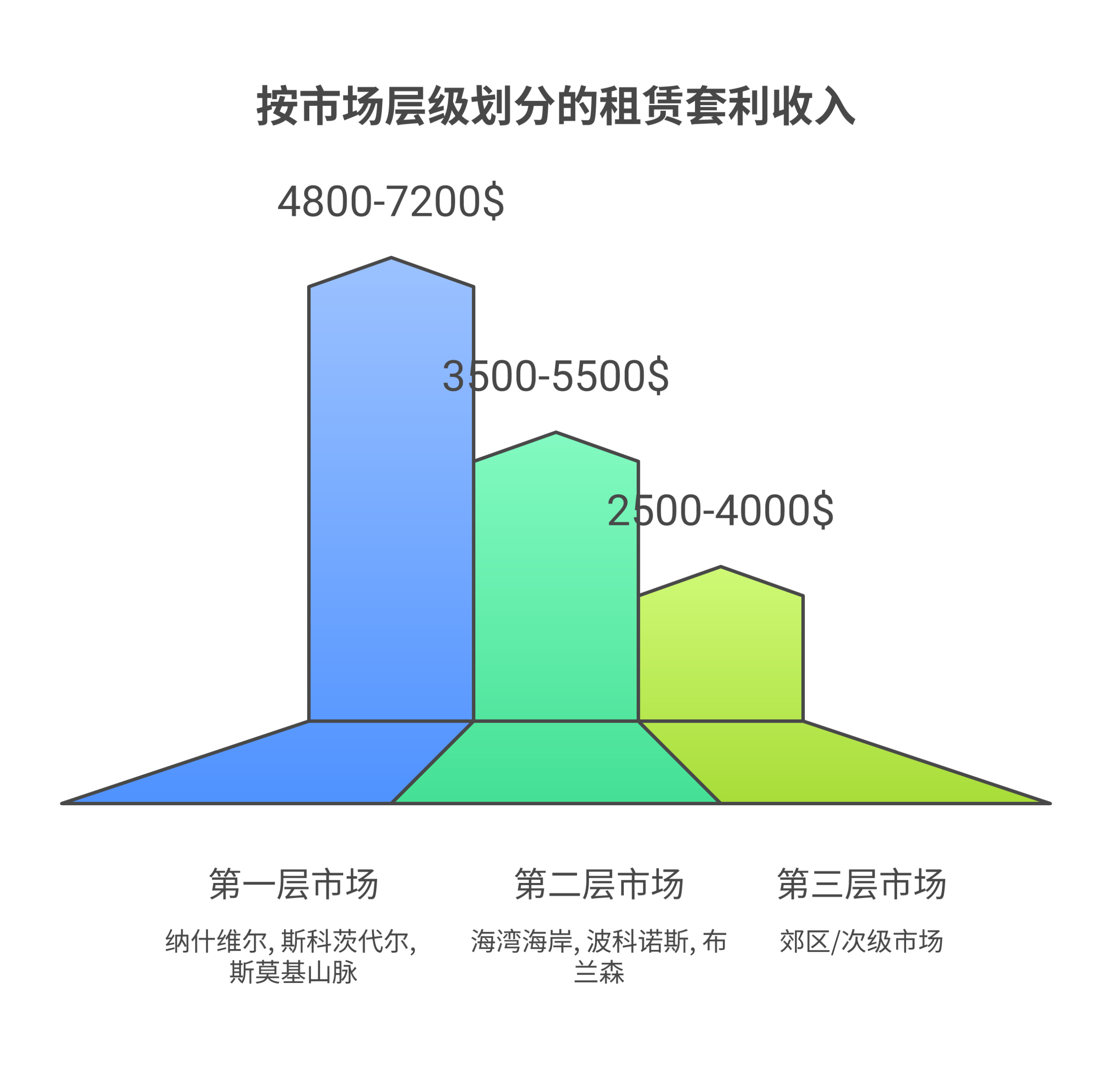

Rental Arbitrage Income by Market Tier

| Market Tier | Avg Gross Revenue | Avg Expenses | Avg Net Profit |

|---|---|---|---|

| Tier 1 (Nashville, Scottsdale, Smoky Mountains) | $4,800-$7,200/mo | $2,800-$3,600 | $2,000-$3,600 |

| Tier 2 (Gulf Shores, Poconos, Branson) | $3,500-$5,500/mo | $2,200-$3,000 | $1,300-$2,500 |

| Tier 3 (Suburban/secondary markets) | $2,500-$4,000/mo | $1,800-$2,500 | $700-$1,500 |

Market selection creates a 3x difference in profit from the same number of units. One student running 3 units in Gatlinburg, Tennessee clears $8,400/month. Another with 3 units in a mid-sized Ohio suburb makes $2,700. Same effort, 3x difference. If you’re going the arbitrage route, your market research matters more than almost anything else.

Rental Arbitrage Pros and Cons

Pros:

- Highest per-unit profit potential ($1,000-$3,600 per unit monthly)

- Full control over your Airbnb listing, pricing, and guest experience

- Scalable as cash flow allows you to add units

- Builds real operational skills for managing properties

- Can pivot to mid-term rental arbitrage for 30-day tenants with lower turnover

Cons:

- Requires the most upfront capital ($7,500-$13,000 per unit)

- Lease liability means you owe rent during slow months

- Need landlord approval, which isn’t always easy

- Local regulations may restrict short-term rentals in your area

- Seasonal markets can create 2-3 lean months per year

For the complete breakdown including lease negotiation scripts and market analysis frameworks, read our full rental arbitrage guide.

Method 2: Co-Hosting (Lowest Risk Entry Point)

Co hosting is the single lowest-risk way to start an Airbnb business without owning property. You partner with existing Airbnb hosts who don’t want to handle daily operations. They own the property and the listing. You manage it. They pay you a percentage of every booking.

How Co-Hosting Works

A property owner adds you as a co-host through Airbnb’s built-in co-host feature. You take over some or all management responsibilities in exchange for 10-25% of each booking’s revenue, depending on what you handle.

Your responsibilities typically include guest communication (responding to inquiries, sending check-in instructions, handling issues), pricing optimization, coordinating cleaning services, listing optimization, and problem resolution. Some co-hosts work hands-on, meeting guests and doing property inspections. Others operate 100% remotely, managing multiple properties from their phone.

The remote model is what makes co hosting a legitimate side hustle you can run alongside a full-time job. I’ve seen students manage 5-8 properties during evenings and weekends, earning $3,000-$5,000/month before transitioning to full-time. Learn more about this path in our co-host income breakdown.

Co-Hosting Income Potential

- 1-2 properties: $500-$1,500/month (side hustle level)

- 5-10 properties: $3,000-$8,000/month (full-time income replacement)

- 15-25+ properties: $10,000-$25,000/month (business-level income)

Quick math: if a property generates $3,000/month in bookings and your co-host split is 20%, you earn $600/month from that one property. Manage ten at that rate and you’re at $6,000/month. Zero lease liability. Zero furniture costs. Zero substantial upfront investment.

Finding Your First Co-Hosting Clients

The fastest path to your first co-hosting client: search local Facebook groups for Airbnb hosts posting about burnout, frustration with guests, or considering selling their rental properties. Those hosts are your ideal targets. You’re offering them a solution: keep their rental income without the headaches.

Other channels that work: real estate agents who know investors buying vacation rental properties, local Airbnb meetups, and direct outreach to hosts with poorly performing listings in your area (bad photos, few reviews, inconsistent availability). Find a listing that’s clearly underperforming, calculate what it should be earning, and pitch the owner with a revenue projection.

Ready to Make Money on Airbnb Without Buying Property?

See how real students earn $5K-$30K/month with the co-listing model.

Method 3: Co-Listing (Fastest Path to Scale)

Co-listing is the newest and arguably most scalable way to make money on Airbnb without owning property. It combines co-hosting with a more entrepreneurial, listing-creation approach. Instead of just managing an existing listing, you find property owners who aren’t on Airbnb yet, or whose successful Airbnb listings are underperforming, and you build the entire short-term rental presence from scratch.

How Co-Listing Differs from Co-Hosting

A co-host manages what already exists. A co-lister creates revenue that wouldn’t exist without them. That distinction earns you higher commission splits (15-30% vs 10-20%) because you’re the one driving bookings the owner never had before.

Co-listers typically prospect and pitch property owners directly, create Airbnb listings with professional photography and optimized descriptions, set up dynamic pricing strategies, manage all guest communication and reviews, coordinate cleaning services and maintenance, and handle multi-platform distribution across Airbnb, VRBO, and Booking.com.

Why Co-Listing Scales Faster Than Any Other Method

Every other method here has a scaling bottleneck. Rental arbitrage is limited by your upfront capital. Property management requires heavy infrastructure. Co-listing? Your only constraint is your ability to find and pitch property owners. No lease agreements. No furniture. No deposit money.

10XBNB students have used co-listing to scale from zero to 10, 20, even 50+ properties, generating $5,000-$30,000/month in management income without ever signing a lease or buying a single piece of furniture. For a full walkthrough, check our Airbnb co-listing guide.

Method 4: Vacation Rental Property Manager (Build a Company)

Property management takes the co-hosting concept and formalizes it into a full-service business. You’re not just casually helping someone with their listing. You’re running a legitimate vacation rental property manager operation with contracts, systems, insurance, and a growing portfolio of managed Airbnb properties.

What Property Managers Actually Handle

A property manager goes far beyond guest messaging. You handle:

- Formal management agreements: Legal contracts specifying commission, responsibilities, termination clauses

- Full-service operations: Everything from furnishing recommendations to maintenance, restocking, and minor renovations

- Multi-platform listing management: Airbnb, VRBO, Booking.com, direct booking sites, and corporate housing platforms

- Revenue optimization: Advanced dynamic pricing, market research, and competitive positioning

- Team building: Hiring and managing cleaning crews, maintenance contractors, and guest experience coordinators

Property Management Income

Management fees in the short-term rental market range from 15-35% of gross booking revenue. Here’s how the numbers scale:

- 5 properties at 25% fee: ~$5,000/month gross, ~$3,500 net after overhead

- 15 properties at 22% fee: ~$14,850/month gross, ~$9,500 net

- 30+ properties at 20% fee: ~$30,000+/month gross, ~$18,000-$22,000 net

According to the Bureau of Labor Statistics, property managers in the United States earn a median salary of $56,985/year as employees. But as an independent vacation rental property manager running your own business with 15+ doors, you can clear $100,000+ annually. The key difference is that property managers are building a business with recurring revenue and real equity value, not just earning a paycheck.

Don’t overlook the tax implications of managing properties. Our Airbnb tax guide covers 1099 reporting, deductible expenses, and quarterly estimated payments.

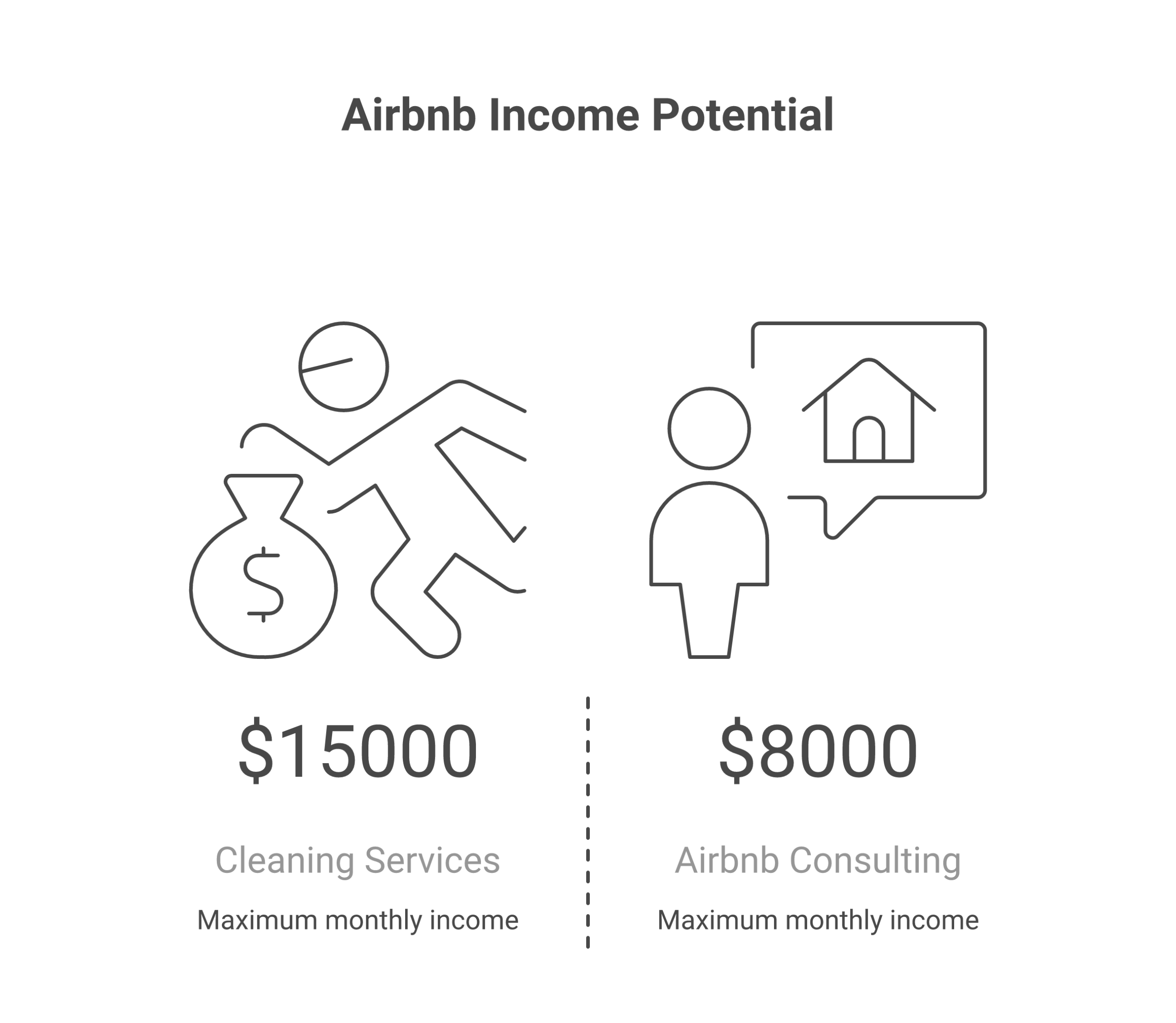

Method 5: Airbnb Consultant ($2,000-$8,000/Month)

If you’ve built expertise in the short-term rental market, packaging that knowledge as an Airbnb consultant is a legitimate business without owning property. You advise property owners on how to maximize their Airbnb venture: listing optimization, pricing strategy, interior design, market research, and operational systems.

What Airbnb Consultants Do

Consultants typically offer services in three tiers:

- Listing audit: $200-$500 one-time fee. You review their Airbnb listing, photos, pricing, and make specific recommendations

- Launch package: $1,000-$3,000. You set up a new Airbnb listing from scratch: photos, description, pricing strategy, automated messaging, and onboarding

- Ongoing advisory: $500-$1,500/month retainer. Monthly check-ins, pricing adjustments, seasonal strategy, and performance reviews

With 3-5 retainer clients and a steady flow of one-time audits, an Airbnb consultant can earn $4,000-$8,000/month. According to Glassdoor, short-term rental consultants in the U.S. Earn an average of $61,000/year. Independent consultants with strong portfolios earn significantly more because they set their own rates and have no income ceiling.

Getting Started as a Consultant

You don’t need a certification. You need results. Start by managing 3-5 properties as a co-host, document your process and outcomes, then use those case studies to pitch consulting services. “I took this listing from $1,800/month to $4,200/month in 60 days. Here’s how” is the only credential that matters in this industry.

Method 6: Airbnb Cleaning Services ($3,000-$15,000/Month)

Every successful Airbnb listing needs reliable cleaning services. Every single one. And most hosts struggle to find cleaners who understand the specific demands of short-term rental turnovers. That gap is your opportunity.

Why Cleaning is a Smart Entry Point

Cleaning gives you direct access to Airbnb hosts. You see their operations from the inside. You see their revenue numbers. You see their pain points. And when you’ve earned their trust through consistent, reliable cleaning, upgrading to a co-hosting arrangement feels natural. Many of our most successful students started as cleaners, built trust with 5-10 hosts, and then transitioned into managing those same properties at 20-25% commission.

Cleaning Service Income

Airbnb cleaning rates run $75-$200 per turnover, depending on property size and market. A solo cleaner handling 3-4 turnovers per day earns $300-$600 daily. Build a team of 3-4 cleaners and you’re running a $10,000-$25,000/month cleaning services operation.

Startup costs are minimal: cleaning supplies ($200-$500), a reliable vehicle, and basic business registration. Total low upfront investment of $500-$1,000 to get started. Compare that to the $7,500+ for rental arbitrage and you see why cleaning appeals to people with limited capital.

Method 7: Airbnb Experiences (No Property Needed At All)

Airbnb Experiences is the most overlooked method on this list. While everyone fights over property listings, Experiences hosts face far less competition and earn strong hourly rates doing something they enjoy.

What Airbnb Experiences Are

These are activities hosted by locals: guided tours, cooking classes, photography walks, surfing lessons, wine tastings, craft workshops, and more. Travelers book through Airbnb’s platform, and hosts set their own pricing and schedule. No property. No lease. No furniture. Your “asset” is your knowledge, skill, or local expertise.

Income from Airbnb Experiences

- Walking food tour in Nashville: $65/person, 8 guests max = $520/session. Run 4/week = $8,320/month gross

- Cooking class in Scottsdale: $85/person, 6 guests max = $510/session. Run 3/week = $6,120/month gross

- Photography tour in NYC: $95/person, 5 guests max = $475/session. Run 5/week = $9,500/month gross

Airbnb takes 20% from each booking. So that $8,320/month food tour nets roughly $6,656 after the platform fee. Subtract your costs (food samples, transportation) and you’re looking at $4,500-$5,500 in profit for 16 hours of work per week. The real earners create multiple Experiences: a BBQ tour, a live music walk, and a hidden bars pub crawl running simultaneously can push monthly income past $15,000.

Complete Method Comparison: All 7 Approaches Side by Side

Here’s every method compared so you can pick the right starting point for your situation. This table covers startup costs, income potential, and key factors for each approach to making money on Airbnb without property ownership.

| Factor | Rental Arbitrage | Co-Hosting | Co-Listing | Property Mgmt | Consulting | Cleaning | Experiences |

|---|---|---|---|---|---|---|---|

| Startup Cost | $7,500-$13,000/unit | $0-$500 | $0-$500 | $500-$2,000 | $0-$500 | $200-$1,000 | $0-$500 |

| Monthly Income | $1,000-$3,600/unit | $500-$1,500/property | $500-$2,000/property | $800-$1,500/property | $2,000-$8,000 | $3,000-$15,000 | $3,000-$10,000 |

| Time to First Dollar | 30-60 days | 7-21 days | 14-30 days | 30-60 days | 14-30 days | 7-14 days | 21-45 days |

| Risk Level | Medium-High | Low | Low | Medium | Low | Low | Low |

| Scalability | Limited by capital | High | Very High | Very High | Moderate | High | Moderate |

| Best For | Highest per-unit profit | Beginners, side hustle | Fastest scaling | Building a company | Expert-level earners | Hands-on workers | Creative locals |

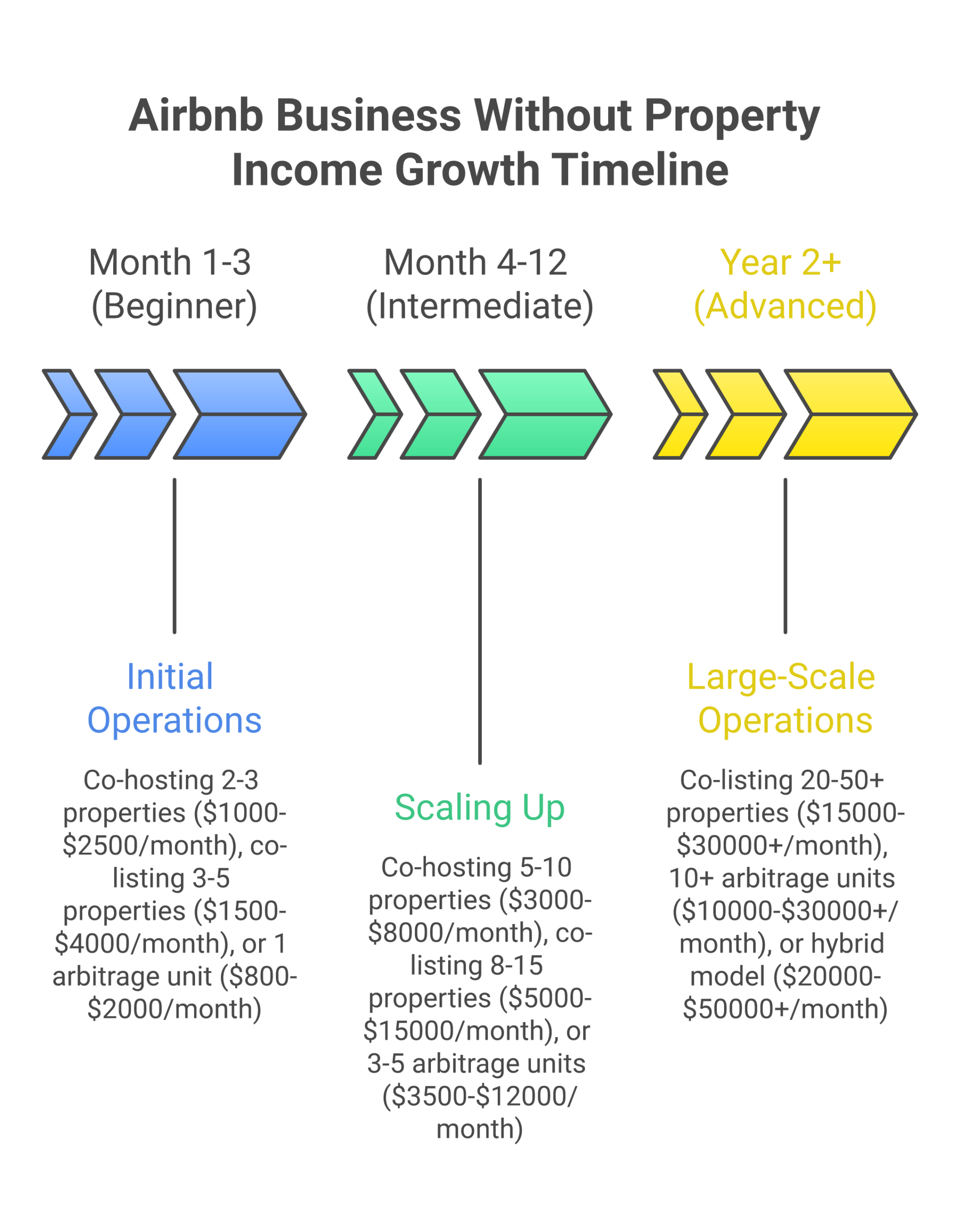

How Much Can You Realistically Earn? (Real Income Data)

I’m tired of seeing guides throw around vague income claims with zero specifics. Here are real numbers based on what we’ve seen across hundreds of students running their own Airbnb business in 2025-2026.

Beginner Phase (Months 1-3)

- Co-hosting 2-3 properties: $1,000-$2,500/month

- Co-listing 3-5 properties: $1,500-$4,000/month

- 1 arbitrage unit: $800-$2,000/month

- Cleaning services (solo): $2,000-$4,000/month

- 1 Experience, 2 sessions/week: $1,200-$2,400/month

Intermediate Phase (Months 4-12)

- Co-hosting 5-10 properties: $3,000-$8,000/month

- Co-listing 8-15 properties: $5,000-$15,000/month

- 3-5 arbitrage units: $3,500-$12,000/month

- Property management 5-10 doors: $3,500-$8,000/month

- Cleaning with team: $6,000-$15,000/month

Advanced Phase (Year 2+)

- Co-listing 20-50+ properties: $15,000-$30,000+/month

- Arbitrage portfolio 10+ units: $10,000-$30,000+/month

- Property management company 20+ doors: $12,000-$25,000+/month

- Hybrid model combining methods: $20,000-$50,000+/month

These aren’t theoretical projections. They come from watching students start their Airbnb journey and build over 12-24 months. The differentiator is never luck. It’s having a system and executing it consistently. Use our Airbnb profit calculator to run the numbers for your specific market.

How to Start Your Airbnb Business Today (Step-by-Step)

Stop researching. Start executing. Here’s the step-by-step action plan to launch an Airbnb venture without owning property:

- Pick your method. Based on the comparison table above, decide which approach fits your capital, time, and risk tolerance. Less than $1,000? Co-listing or co hosting. Have $8,000+? Rental arbitrage. Want the fastest dollar? Cleaning services.

- Do your market research. Use AirDNA or Airbnb’s search function to find high-demand areas near you. Look for markets with occupancy rates above 65%, average nightly rates above $150, and limited hotel competition. See our best cities for Airbnb arbitrage analysis for current data.

- Set up your business structure. Register an LLC. Open a separate business bank account. Get proper insurance. The U.S. Small Business Administration has free resources for choosing the right structure. Write a simple Airbnb business plan to clarify your target market, revenue projections, and growth strategy.

- Find your first property partner or lease. For co-listing and co hosting: reach out to property owners on Craigslist, Facebook groups, and local real estate meetups. For arbitrage: pitch landlords with a professional deck explaining the benefits of short-term rental tenants. For cleaning: offer a free first clean to an Airbnb host and upsell from there.

- Create exceptional guest experiences from day one. Invest in professional photography. Write benefit-focused descriptions. Set competitive pricing based on comparable listings. First impressions drive reviews, and reviews drive bookings. Successful Airbnb listings always have one thing in common: they create exceptional guest experiences that generate 5-star reviews.

- Build your operations system. Set up automated messaging for guest communication, a reliable cleaning team, and a pricing tool like PriceLabs. Systemize from day one so you can scale without burning out.

- Learn from people who’ve already done it. The fastest way to avoid expensive mistakes is following a proven blueprint. The 10XBNB program gives you the exact systems, scripts, and strategies that students use to build $10K-$30K/month Airbnb businesses without owning a single property.

The Business Without Owning Property: What Nobody Tells You

Running an Airbnb business without property ownership sounds easy when you read blog posts about it. I want to give you the honest picture, including the hard parts most people skip.

Managing Properties Is Real Work

Whether you’re co hosting, co-listing, or running rental arbitrage, you’re managing properties. That means late-night guest calls, cleaning emergencies, maintenance surprises, and difficult guests. The income is real, but so is the work. If you’re not willing to respond to a guest at 11 PM when their lockbox code doesn’t work, this isn’t the right business for you.

The solution is systems. Automated messaging handles 80% of guest communication. A reliable cleaning team prevents most property issues. A noise monitor catches parties before neighbors complain. The operators who burn out are the ones who try to do everything manually.

Seasonality Will Test You

Most vacation rentals in the short-term rental market experience 2-3 slower months per year. If you’re doing rental arbitrage, you still owe rent during those months. Build 2-3 months of expenses as a cash reserve before you scale past your first unit. Diversify across markets or platforms to smooth the seasonal dips.

Regulations Change

Cities are increasingly regulating short term rentals. What’s legal today might require a permit next year. Stay informed about local regulations, join your local host association, and have a backup plan. Property managers and co-hosts who work in markets with clear, stable regulations sleep better at night. Before you try to own Airbnb properties or commit to any market, research the regulatory environment thoroughly.

You Need Multiple Properties to Replace a Salary

One arbitrage unit won’t replace your income. One co-hosting client won’t either. Plan to manage 5-10 properties minimum before you quit your day job. The students who succeed treat this as a real Airbnb business from day one, not a casual experiment.

Vacation Rental Franchise vs. Independent: Which Path?

A vacation rental franchise is another way to enter the short-term rental market without owning property. Companies like Vacasa, Evolve, and iTrip offer franchise models where you manage properties under their brand, using their technology and booking platform.

Franchise vs. Independent Comparison

| Factor | Vacation Rental Franchise | Independent (Own Brand) |

|---|---|---|

| Startup Cost | $55,000-$100,000 (franchise fee + setup) | $0-$2,000 |

| Ongoing Fees | 5-8% royalty on gross revenue | None |

| Brand Recognition | Built-in from day one | Must build from scratch |

| Technology | Provided | Choose your own stack |

| Flexibility | Limited by franchise agreement | Complete freedom |

| Profit Margin | Lower (royalties reduce margin) | Higher (keep 100% of management fee) |

My honest take: franchises make sense if you have $55,000+ to invest and zero experience in the short-term rental market. For most people starting an Airbnb business from scratch, the independent route (co-listing or co hosting) gets you to positive cash flow faster with far less financial risk. You can always formalize into your own brand later.

Airbnb Photographer and Other Support Roles

Not everyone wants to manage multiple properties or build an Airbnb business. If you prefer freelance, project-based work, several support roles let you earn from the Airbnb ecosystem without property ownership.

Airbnb Photographer

Professional photos are the single biggest factor in listing performance. An Airbnb photographer charges $150-$500 per shoot, with most shoots taking 1-2 hours. According to ZipRecruiter, the average hourly rate for real estate and Airbnb photography ranges from $25-$68/hour, with top earners reaching $95/hour. Build a portfolio of 10+ listings and referrals keep your calendar full.

Listing Copywriter

Writing compelling Airbnb listing descriptions is a skill most property owners lack. Copywriters charge $100-$300 per listing optimization, including title, description, house rules, and automated messages. With the growing number of Airbnb properties in every market, demand is steady.

Interior Designer / Home Stager

Hosts want their listings to photograph well and get 5-star reviews. Designers who specialize in short-term rental staging charge $500-$3,000 per property. The niche is narrow enough that you face limited competition but broad enough to build a full-time income.

Which Method Should You Choose? (Decision Framework)

Your starting point depends on three factors: available upfront capital, time commitment, and risk tolerance. Here’s the decision simplified:

- No money to invest? Start with co hosting or co-listing. Both require virtually zero capital and teach you the business while you earn. Co-listing is the fastest path to your own Airbnb business because you create new revenue for property owners and earn higher commission splits.

- Have $8,000-$15,000 to deploy? Rental arbitrage gives you the highest per-unit returns and full control. But go in with eyes open about lease liability and seasonal risk. Read our how to start an Airbnb guide before signing your first lease.

- Want the fastest path to scale? Co-listing wins. You can manage 10+ Airbnb properties within 90 days without spending a dollar on furniture or deposits.

- Want to build a company? Property management is the play. Longer ramp, but you’re building an asset with recurring revenue and enterprise value.

- Have a unique skill or expertise? Become an Airbnb consultant, Airbnb photographer, or Experience host. Lower income ceiling but higher hourly rate and more creative freedom.

- Want to start earning this week? Cleaning services. You can book your first client in 3-5 days.

Many successful Airbnb entrepreneurs combine methods. They start with co hosting to learn operations, graduate to co-listing for scale, then add arbitrage units for maximum per-unit profit. The methods build on each other. A student running 8 co-listed properties and 2 arbitrage units could earn $8,000 from co-listing plus $4,000 from arbitrage: $12,000/month from a hybrid approach.

Your Next Step

Learn the exact system our students use to build Airbnb income from scratch.

Frequently Asked Questions

Is it legal to run an Airbnb without owning the property?

Yes, in most jurisdictions. Rental arbitrage requires explicit written landlord permission and compliance with local short-term rental regulations. Co hosting and co-listing are legal virtually everywhere because the property owner maintains the primary listing relationship with Airbnb. Always check your city and county ordinances, obtain required permits, and consult a local attorney if you’re unsure. Regulations vary dramatically between neighboring cities.

How much money do I need to start an Airbnb business without owning property?

Depends on your method. Co hosting, co-listing, and consulting need $0-$500. Cleaning services need $200-$1,000 for supplies and registration. Airbnb Experiences cost $0-$500. Rental arbitrage requires $7,500-$13,000 per unit. Property management needs $500-$2,000 for business setup. If you have limited upfront capital, start with co-listing to build cash flow, then reinvest into arbitrage units once you have funds. Our guide on starting Airbnb with no money covers every zero-capital strategy.

What are the best markets for starting an Airbnb without owning property?

Markets with high tourism demand, limited hotel supply, and favorable regulations perform best. The Smoky Mountains (Tennessee), Gulf Shores (Alabama), Scottsdale (Arizona), Joshua Tree (California), and the Poconos (Pennsylvania) consistently show strong occupancy and nightly rates for vacation rentals. Avoid oversaturated urban markets where regulations are tightening. Read our best cities for Airbnb arbitrage report for current data.

Can I do this part-time while working a full-time job?

Yes. Co hosting, co-listing, consulting, and Airbnb photography are all well-suited to part-time operators. Most guest communication happens via app messaging. Automated tools handle pricing adjustments. Budget 5-15 hours per week when starting out. Many students managed 3-5 properties on nights and weekends before going full-time once their Airbnb income exceeded their salary.

Do I need experience in real estate or hospitality?

No prior experience required. The skills you need (guest communication, listing optimization, pricing strategy, vendor management) can all be learned. What matters most is following a system and executing consistently. Hundreds of 10XBNB students came from teaching, nursing, tech, military service, and retail before building a successful Airbnb business.

What happens if a guest damages the property?

Airbnb provides AirCover for hosts, which includes up to $3 million in damage protection per booking. For additional security, require a security deposit, screen guests before accepting, and carry short-term rental insurance. For arbitrage properties, communicate with your landlord about coverage and consider adding a rider to your renter’s insurance. See our insurance guide for details.

How do I handle taxes on Airbnb income from properties I don’t own?

All Airbnb income is taxable regardless of property ownership. Arbitrage income goes on Schedule C with deductions for rent, furniture depreciation, cleaning, and supplies. Co hosting and co-listing income is self-employment income, also on Schedule C. You’ll owe self-employment tax (15.3%) plus income tax on net profit. Make quarterly estimated payments to avoid penalties. Our Airbnb tax guide covers the full picture.

How is running an Airbnb without property different from owning real estate?

The biggest difference is risk. Owning real estate means mortgage payments, property taxes, maintenance costs, and market value risk. With arbitrage, co hosting, or property management, you avoid all of that. You trade lower risk for slightly lower margins. But you also skip the need for owning real estate entirely. No down payment. No credit check for a mortgage. No 20% equity required. The tradeoff: you don’t build equity in the property itself, but you do build a business with real cash flow.

Can I manage Airbnb rentals in a city I don’t live in?

Yes, especially with co hosting and co-listing. You need a reliable local team: cleaners, a maintenance contact, and optionally a local backup person for emergencies. Many property managers operate Airbnb rentals in 2-3 markets simultaneously, managing everything remotely through property management software and local teams. The key is systems, not physical presence.