What Is House Hacking With Airbnb (And Why It Beats Traditional Renting)

House hacking with Airbnb means buying a property, living in part of it, and renting out the rest as short-term rentals to cover your mortgage payment—or eliminate it entirely. I’ve watched this strategy transform people who were paying $1,800/month in rent into real estate investors collecting $300-$1,200 in monthly cash flow while living for free.

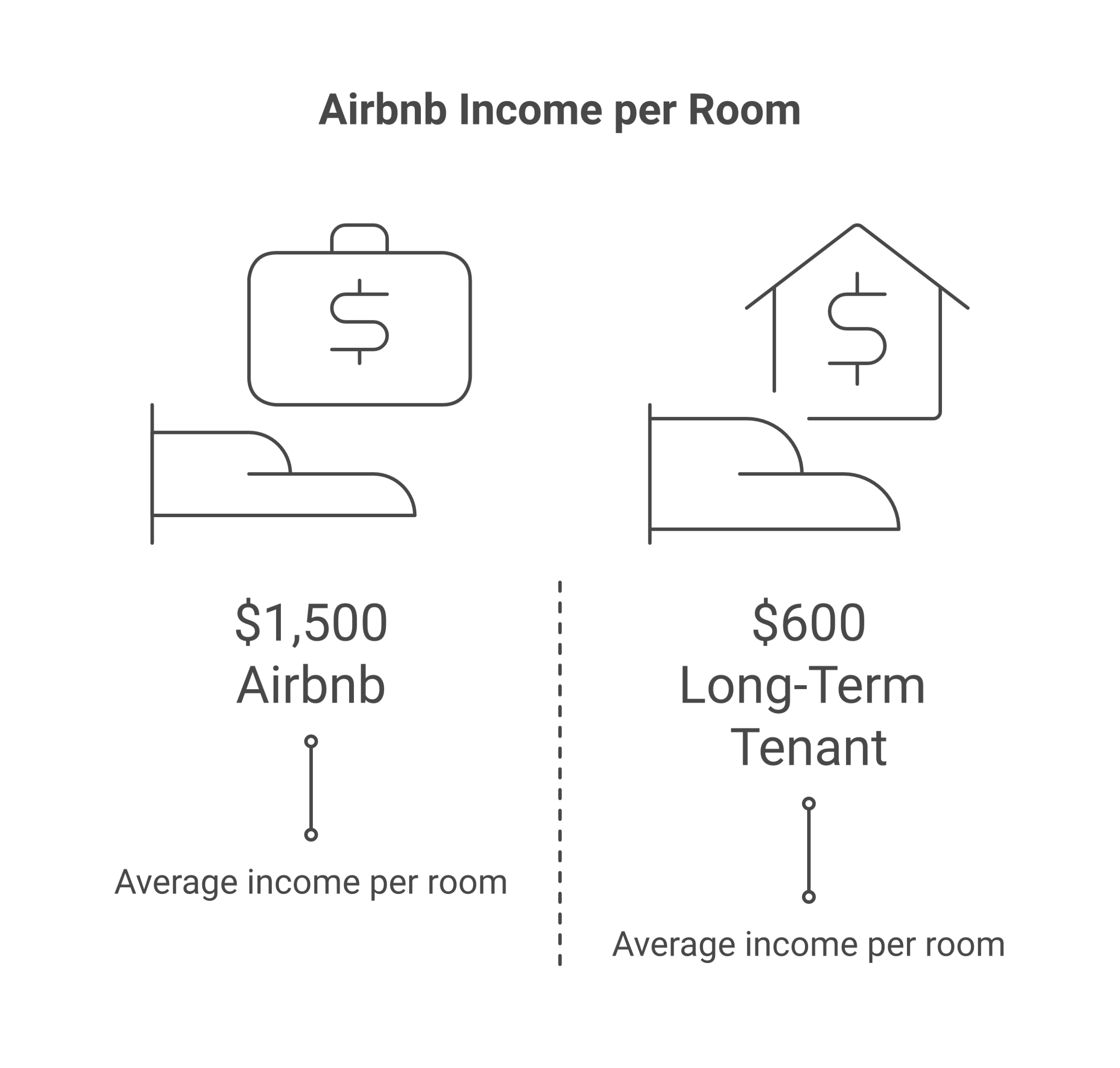

The concept itself isn’t new. People have rented spare rooms and basement apartments to long-term tenants for decades. But Airbnb changed the economics dramatically. A spare bedroom that generates $600/month from a long-term tenant can pull $1,200-$1,800/month as a short-term rental in a mid-tier market. That’s not speculation. Operators in Columbus, Nashville, San Antonio, and Tampa consistently hit those numbers.

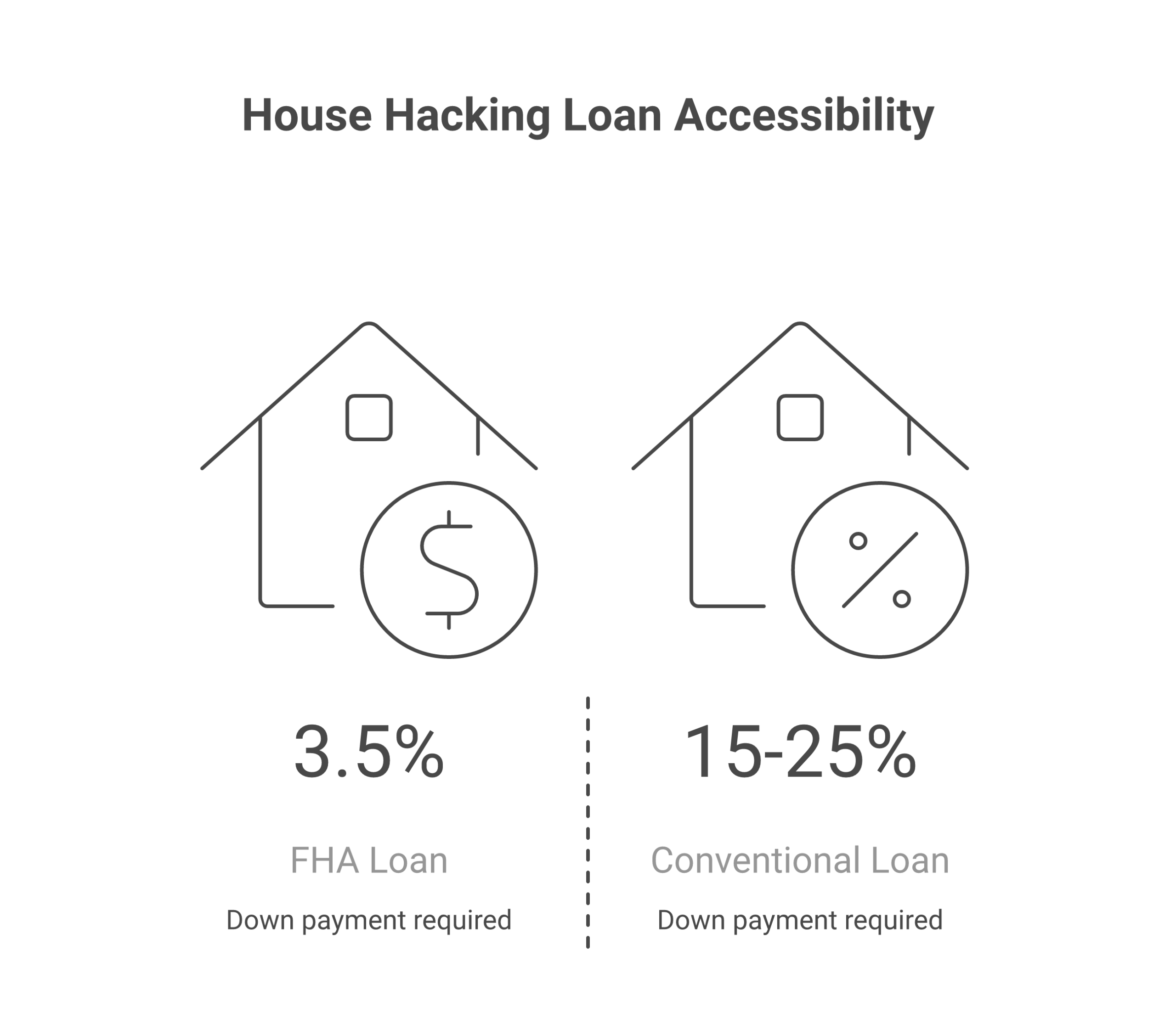

When you combine house hacking with FHA financing—putting just 3.5% down on your primary residence—the barrier to entry drops to roughly $15,000-$25,000 total. Compare that to traditional real estate investing, where a conventional loan demands 15-25% down. House hacking is the most accessible path into real estate investing for anyone with a steady income and decent credit.

This guide covers everything: financing options, property selection, room setup, guest management, tax benefits, legal compliance, and the transition from your first house hack into a full rental portfolio. Whether you’re house hacking Airbnb with a spare room in a single family home or renting half a duplex, you’ll walk away with a concrete plan.

How Airbnb House Hacking Works: Three Proven Strategies

Not every house hack looks the same. The strategy you pick depends on your budget, risk tolerance, and willingness to share space. Here are the three approaches that consistently produce results.

Strategy 1: Room-by-Room Rentals (Single Family Home)

You buy a 3- or 4-bedroom single family home, live in the master suite, and list the spare bedrooms individually on Airbnb. Each spare bedroom gets its own listing, its own smart lock, and its own price point.

Why individual room rentals instead of listing the whole house? Three reasons:

- Higher combined revenue — Two rooms at $70/night ($140 combined) consistently outperform a single whole-house listing at $110/night

- Reduced vacancy risk — One empty room still means the other generates predictable income

- On-site management — You handle guest issues immediately, which translates to better reviews and higher occupancy

The tradeoff is obvious: you share your own home with strangers. For 12-18 months while you build capital and equity? Most operators find it completely worth it. The extra income from spare rooms alone can eliminate your housing costs.

Strategy 2: Multi-Unit FHA House Hack (Duplex, Triplex, Fourplex)

This is the powerhouse strategy for experienced real estate investors and ambitious beginners alike. You buy a multi unit property—duplex, triplex, or fourplex—with an FHA loan at 3.5% down, live in one unit as your principal residence, and run the other units as short term rentals.

The math on a multi unit property is compelling. A triplex in Indianapolis purchased for $310,000 with FHA financing means an $10,850 down payment. You live in Unit A. Units B and C go on Airbnb. Combined Airbnb income from two units in a mid-tier market: $4,200-$5,800/month gross. After expenses, you’re likely netting $1,200-$2,000/month in pure cash flow while living for free.

You’re not just eliminating housing costs. You’re building equity in a $310,000 asset, getting tax benefits on the rental portion, and learning the short-term rental business with minimal financial risk.

Strategy 3: ADU or Basement Conversion

If your property has a basement, detached garage, or enough land for an accessory dwelling unit (ADU), you can create a completely private rental space with a separate entrance. This is the premium play.

Guests pay 25-40% more for listings with a separate entrance compared to shared-space rooms. A basement apartment that pulls $1,400/month as a shared room could generate $1,800-$2,200/month as a private unit with its own door.

Conversion costs range from $5,000-$15,000 for a basic basement remodel (egress window, bathroom upgrade, private entry) to $80,000-$150,000 for a full ADU build. The ROI on a basic conversion typically pays back within 4-8 months through higher nightly rates and occupancy.

FHA Loans: The 3.5% Down Shortcut That Makes House Hacking Possible

The Federal Housing Administration loan program is the financial engine behind most successful house hacks. Without FHA financing, you’d need $45,000-$80,000 for a down payment on an investment property. With FHA, you need a fraction of that.

FHA House Hacking Requirements

Here’s what the FHA loan program offers real estate investors who are willing to live in their investment property:

- 3.5% down payment on properties up to 4 units (duplex, triplex, fourplex)

- Credit score minimum of 580 for 3.5% down (conventional loans typically require 620+)

- Seller concessions up to 6% of the purchase price toward your closing costs

- 12-month occupancy requirement — you must live in one unit as your primary residence

- 2024 FHA loan limits from $498,257 (standard areas) to $1,149,825 (high-cost areas)

- Mortgage insurance premium (MIP) of 1.75% upfront plus 0.55-0.85% annually

FHA vs Conventional Loans for House Hackers

| Factor | FHA Loan | Conventional Loan |

|---|---|---|

| Down payment | 3.5% | 15-25% (investment) |

| Credit score minimum | 580 | 620+ |

| Seller concessions | Up to 6% | Up to 3% |

| Property types | 1-4 units | 1-4 units |

| Occupancy requirement | 12 months primary | Varies by program |

| PMI/MIP | Required (removable via refi) | Required if <20% down |

| Best for | First house hack | Second+ property, scaling |

What FHA Lenders Actually Look At

Lenders evaluate your debt-to-income ratio (DTI), and here’s where it gets interesting for house hackers. Most FHA lenders allow you to count 75% of projected rental income from the other units toward your qualifying income. If the second unit in your duplex projects $2,800/month in Airbnb income, lenders credit you $2,100/month, which dramatically improves your DTI ratio.

You’ll need:

- Two years of W-2 employment history (or 1099 with tax returns)

- Credit score of 580+ (aim for 640+ for better interest rates)

- DTI under 43% (with the 75% rental income credit)

- Reserves of 3-6 months of mortgage payments

- A signed lease or comparable Airbnb revenue data for the rental units

For deeper financing strategies beyond FHA, including how to scale past your first property using debt service coverage ratio loans, read our guide on DSCR loans for Airbnb investors.

The Real Numbers: What Airbnb House Hacking Actually Generates

I’m going to show you two realistic financial breakdowns. Not best-case fantasy numbers. Conservative projections using 60-65% occupancy and real expense ratios.

Scenario 1: 3-Bedroom Single Family Home (Room-by-Room)

Market: Mid-tier city (Knoxville, San Antonio, Richmond). Purchase price: $275,000.

| Item | Monthly Amount |

|---|---|

| Revenue | |

| Spare Bedroom 1 (Airbnb, avg 20 nights/mo @ $70) | +$1,400 |

| Spare Bedroom 2 (Airbnb, avg 18 nights/mo @ $65) | +$1,170 |

| Gross Airbnb Income | +$2,570 |

| Expenses | |

| Mortgage payment (PITI + MIP on FHA) | -$1,780 |

| Airbnb host fees (3%) | -$77 |

| Cleaning (turnover costs, $35/clean) | -$260 |

| Utilities increase (~30% higher with guests) | -$135 |

| Supplies and consumables | -$55 |

| Maintenance reserve (5% of revenue) | -$128 |

| Insurance premium increase (STR endorsement) | -$65 |

| Total Expenses | -$2,500 |

| Net Monthly Cash Flow | +$70 |

| Your Effective Housing Cost | $0 (live free + pocket $70) |

That $70/month cash flow won’t change your life. But look at the full picture: you’re living for free, building equity (roughly $420/month in principal paydown on a 30-year mortgage), and your property is appreciating. The total wealth-building impact is closer to $900-$1,200/month when you factor in building equity and appreciation. Meanwhile, your neighbor is paying $1,800/month in rent and building zero wealth.

Scenario 2: Duplex (Multi-Unit FHA House Hack)

Market: Indianapolis. Purchase price: $295,000.

| Item | Monthly Amount |

|---|---|

| Revenue | |

| Unit B (Airbnb, avg 22 nights/mo @ $115) | +$2,530 |

| Gross Airbnb Income | +$2,530 |

| Expenses | |

| Mortgage payment (PITI + MIP) | -$2,150 |

| Airbnb host fees (3%) | -$76 |

| Cleaning ($55/turnover) | -$330 |

| Utilities (Unit B portion) | -$180 |

| Supplies | -$45 |

| Maintenance reserve (5%) | -$126 |

| STR insurance | -$85 |

| Total Expenses | -$2,992 |

| Net Monthly Cash Flow | -$462 |

| Your Effective Housing Cost | $462/month (vs $1,600+ market rent) |

Even in the conservative scenario where you’re paying $462/month, that’s a 71% reduction in housing costs. During peak season (summer, events, holidays), you’ll likely hit $3,200-$3,800/month in Airbnb income and turn cash-flow positive. And you’re still building equity in a $295,000 investment property the entire time.

Always run your numbers at 55-65% occupancy, not 80%. If the deal works at conservative occupancy, you’ve found a winner. If it only works at peak—walk away.

Cash-on-Cash Return: The Metric That Matters Most

Forget cap rates for a minute. For house hackers, cash-on-cash return tells you exactly how hard your actual dollars are working.

Cash-on-Cash Return = Annual Net Cash Flow ÷ Total Cash Invested × 100

Using the room-by-room example above:

- Total cash invested: $9,625 (3.5% FHA down) + $5,200 (closing costs) + $3,800 (furnishing 2 rooms) = $18,625

- Annual net cash flow: $70/month × 12 = $840

- Annual housing savings: $1,800/month saved × 12 = $21,600

- True cash-on-cash return (including housing savings): ($840 + $21,600) ÷ $18,625 = 120.5%

Even if you only count the direct cash flow ($840 annual), you’re getting a 4.5% return—which doesn’t sound impressive until you remember you’re also living for free and building equity. The S&P 500 averages roughly 10% annually. A well-executed house hack with the housing cost elimination factored in crushes that number.

But don’t inflate your projections. Underestimate revenue by 15% and overestimate expenses by 10% when underwriting. Conservative math is what separates operators who build wealth from those who get burned.

Choosing the Right Property: What to Buy and Where

The property you pick determines 80% of your outcome. Get this wrong and no amount of Airbnb hosting skill will save you.

Property Selection Criteria

Score every potential house hack against these factors:

- Proximity to demand drivers — Universities, hospitals, tourist attractions, convention centers, major employers. The property 15 minutes from downtown that costs $40,000 more will outperform the bargain 45 minutes away every time

- Bedroom count and layout — 3+ bedrooms for room-by-room, or 2+ units for multi-family. Separate entrance opportunities are gold

- Local STR regulations — Verify the city allows owner-occupied short term rentals before making an offer. This kills more deals than bad numbers

- HOA restrictions — If the property has an HOA, read the CC&Rs cover to cover. Many HOAs explicitly ban stays under 30 days

- Comparable Airbnb revenue — Check AirDNA or Mashvisor for actual nightly rates and occupancy in the specific neighborhood

- Condition and renovation needs — Minor cosmetic work is fine. Avoid properties needing major structural repairs unless you’re using an FHA 203(k) renovation loan

Best Markets for Airbnb House Hacking in 2026

The ideal market has affordable purchase prices, strong Airbnb demand, and favorable STR regulations. These cities consistently produce results:

Top Tier (Proven Performers)

- Columbus, Ohio — Median home price ~$265,000, strong OSU demand, STR-friendly. A duplex near campus generates $2,800-$3,600/month from one Airbnb unit

- San Antonio, Texas — No state income tax, growing tourism, median ~$275,000. The Alamo area and Pearl District are consistent booking magnets

- Indianapolis, Indiana — One of the most affordable major metros (~$230,000 median), Indy 500 and convention demand, landlord-friendly state

- Knoxville, Tennessee — Gateway to Smoky Mountains, ~$290,000 median, university demand fills gaps between tourist seasons

Emerging Markets

- Huntsville, Alabama — NASA/defense contractor demand, median ~$260,000, fastest-growing city in the state

- Chattanooga, Tennessee — Outdoor tourism boom, ~$250,000 median, fiber internet (attracts digital nomad guests)

- Tulsa, Oklahoma — Tulsa Remote program draws relocators, ~$195,000 median, Route 66 tourism

- Richmond, Virginia — History tourism, food scene, university demand, ~$310,000 median

For a deep dive on the best markets and how to analyze them, see our guide to the best cities for Airbnb arbitrage.

Markets to Avoid

Skip any market where the median home price exceeds $500,000 unless your income easily supports it. Also avoid cities with STR bans that don’t exempt owner-occupied properties—places like New York City (registration nightmare), Santa Monica (effectively banned), and Honolulu (heavy restrictions).

Setting Up Your House Hack: Guest-Ready on a Budget

Furnishing doesn’t require an interior design budget. Here’s what actually moves the needle on bookings and reviews.

The $1,500 Room Setup

Per room, budget roughly $750-$1,200:

- Queen bed frame + mattress: $350-$500 (IKEA MALM + Zinus Green Tea is the house hacker’s go-to combo)

- Bedding (white, hotel-style, 2 sets for rotation): $80-$120

- Nightstand + lamp: $60-$90

- Dresser or closet organizer: $80-$150

- Smart lock for the bedroom door: $45-$80 (August or Wyze)

- Towel set (white, 4-piece): $30-$40

- Blackout curtains: $25-$35

- Wall art (2-3 pieces): $40-$60

- Hangers, mirror, trash can: $30-$50

That’s your functional, reviewable, photo-ready space. Don’t overthink it. Guests care about cleanliness, a comfortable mattress, and fast WiFi. Everything else is secondary.

The Separate Entrance Premium

Rooms with a separate entrance command 25-40% higher nightly rates. If your property has a basement unit, side door, or bedroom with direct patio access, prioritize that space for Airbnb hosting.

Some operators invest $2,000-$5,000 adding a separate entrance—new door, small porch, dedicated pathway. The ROI typically pays back within 3-5 months through higher rates and occupancy.

Shared Space Rules

When guests share your kitchen and living areas:

- Designate specific shelves in the fridge and pantry for guest use

- Provide basics (coffee, tea, snacks)—budget $40/month

- Post a clear, friendly house rules card in each room

- Keep shared bathrooms stocked and spotless (the #1 factor in room reviews)

Managing Guests When You Live On-Site

Living with Airbnb guests sounds uncomfortable until you build the right systems. Then it’s surprisingly hands-off.

Boundaries That Actually Work

Treat your property like a small boutique hotel, not a friend’s spare couch:

- Smart locks on every room — Guests get unique codes, no physical key exchange

- Self-check-in always — Automated messages with door code, WiFi password, house rules

- Quiet hours posted (10 PM – 8 AM standard)

- Professional distance — You’re a host, not a roommate. Friendly but not familiar

Automation Tools for Airbnb Hosting

Automate everything you can:

- Hospitable or Guesty — Automated guest messaging (check-in instructions, checkout reminders, review requests)

- PriceLabs or Wheelhouse — Dynamic pricing that adjusts nightly rates based on demand, local events, and seasonality

- Noise monitors (Minut or NoiseAware) — Essential when you share walls with guests

- Turno (formerly TurnoverBnB) — Coordinates cleaning schedules with your booking calendar

For a complete breakdown of every tool worth using, check our guide to Airbnb automation tools.

The Cleaning Equation

For the first 3 months, clean everything yourself. You’ll learn what guests notice, what they damage, and what actually matters for reviews. Then hire a cleaner at $35-$50 per turnover and charge guests a cleaning fee that covers 80-100% of that cost.

Your time is better spent optimizing listings, adjusting pricing, and growing the business—not scrubbing bathrooms at midnight.

Legal Compliance: The Section That Saves You From Fines

This is where house hacking trips people up. Not the hosting—the paperwork. Skip this and you risk fines ranging from $1,000 to $10,000+ depending on your city.

Zoning and STR Regulations

Most residential zones allow owner-occupied short term rentals. But “most” is not “all.” Before you buy:

- Check your city’s short-term rental ordinance (search “[city name] short-term rental regulations 2026”)

- Look for owner-occupancy exemptions — many cities that restrict investor STRs still allow homeowner-hosted rentals

- Determine whether you need a business license, STR permit, or both

- Check state-level preemption laws (some states override city STR bans)

Cities like Austin, Denver, and Portland have strict STR rules but carve out specific exceptions for owner-occupied properties. That’s the house hacking advantage: you qualify for permits that pure real estate investors can’t get.

HOA Restrictions

If you’re buying a condo or townhouse with an HOA, read the CC&Rs before making an offer. Many HOAs explicitly ban rentals under 30 days. This is a dealbreaker, not a negotiation point. If the HOA says no short term rentals, move on.

Insurance Requirements

Standard homeowner’s insurance does not cover short-term rental activity. You need:

- Short-term rental endorsement on your existing policy ($200-$500/year extra)

- Dedicated STR policy from Proper Insurance or CBIZ ($1,200-$2,400/year)

- Airbnb’s AirCover — Provides $1M host liability but does not replace property coverage

Don’t skip insurance. One guest injury with a standard homeowner’s policy could mean a denied claim and personal liability exposure. Our Airbnb insurance guide covers every option.

Mortgage Compliance

Your FHA loan requires you to live in the property as your primary residence for 12 months. That’s federal law. You must genuinely reside there—your driver’s license, mail, and daily life reflect this address. You can rent out other units or spare rooms from day one. You cannot buy the place, list everything on Airbnb, and live elsewhere.

After 12 months, you’re free to move out and convert the entire property to rental use—either short term rentals or long term rentals. Many operators do exactly this, then repeat the process with a new FHA loan on their next primary residence.

Tax Benefits of House Hacking (Real Money Saved)

House hacking creates a unique tax situation because you’re both a homeowner and a rental operator. You stack deductions that neither pure homeowners nor pure investors can combine on their own.

Deductions You Can Claim

- Mortgage interest — Deductible on the rental portion (50% rented = 50% of interest as business expense)

- Depreciation — The rental portion depreciates over 27.5 years. On a $300,000 property at 50% rental use, that’s roughly $5,454/year in paper losses that offset your rental income

- Operating expenses — Cleaning supplies, guest amenities, smart locks, furniture, software subscriptions, all deductible against rental income

- Utilities — The rental proportion (50% for a duplex, or room square footage percentage for spare room rentals)

- Home office deduction — If you manage your Airbnb hosting from a dedicated workspace in your unit

- Travel and mileage — Supply runs, contractor meetings, real estate meetups

A house hacker grossing $28,000 in Airbnb income might show only $8,000-$12,000 in taxable rental income after deductions and depreciation. That’s a massive difference come April.

Our Airbnb tax guide covers every deduction in detail, including the 14-day rule and when to file Schedule E vs Schedule C.

The Section 121 Capital Gains Exclusion

This is the tax benefit most house hackers overlook. If you live in the property for 2 of the last 5 years, you qualify for the Section 121 exclusion: up to $250,000 in profit ($500,000 married filing jointly) is completely tax-free when you sell.

Buy a duplex for $300,000. Live in it for 2 years while Airbnb house hacking. Sell for $380,000. That $80,000 gain? Tax-free. Try getting that deal with a pure investment property where you’d owe capital gains tax on every dollar of profit.

House Hacking vs Rental Arbitrage: Choosing Your Path

Both strategies use Airbnb to generate income from rental properties. But they suit different financial situations and goals. If you’re weighing the two, this comparison should clarify which path makes more money for your specific situation.

| Factor | House Hacking | Rental Arbitrage |

|---|---|---|

| Upfront capital needed | $15,000-$25,000 (FHA down + furnishing) | $3,000-$8,000 (deposit + furnishing) |

| Monthly cash flow | $0-$1,200 (plus equity) | $800-$3,000 (no equity) |

| Building wealth long-term | Yes — building equity + appreciation | No — pure cash flow play |

| Risk level | Lower (you own the asset) | Higher (dependent on lease) |

| Scalability | Slower (one property at a time) | Faster (add units without buying) |

| Privacy impact | Low (you share your space) | None (you don’t live there) |

| Building equity | Yes — every mortgage payment builds ownership | No — landlord keeps the equity |

| Exit strategy | Sell, refinance, convert to long term rentals | End lease and walk away |

| Financing terms | FHA 3.5% down, 30-year fixed | No financing needed |

| Tax benefits | Depreciation, mortgage interest, Sec 121 | Business expense deductions only |

Choose house hacking if: You want to build long-term wealth through real estate investing, have stable W-2 income, qualify for an FHA loan, and can tolerate sharing your space for 12-18 months while you save more money.

Choose rental arbitrage if: You want faster cash flow with less upfront capital, don’t want to buy property yet, want to test markets before committing, or already own your own home.

The smartest operators do both. Start with a house hack to eliminate housing costs, save aggressively for 12-18 months, then launch arbitrage units with the capital you’ve built. That combination creates both predictable income from arbitrage and long-term building wealth through property ownership.

Short Term Rentals vs Long Term Rentals: The Income Gap

The fundamental question every house hacker faces: should you Airbnb or find traditional tenants? The numbers make the case clearly.

| Metric | Short Term Rentals (Airbnb) | Long Term Rentals (12-mo lease) |

|---|---|---|

| Monthly revenue (spare bedroom) | $1,200-$1,800 | $500-$700 |

| Annual income potential | $14,400-$21,600 | $6,000-$8,400 |

| Vacancy risk | Spread across many guests | Concentrated in one tenant |

| Management effort | Higher (turnovers, messaging) | Lower (collect rent monthly) |

| Unexpected expenses risk | Moderate (more wear from turnover) | Lower (less turnover) |

| Flexibility | Block dates for personal use anytime | Locked into 12-month lease |

| Income predictability | Variable (seasonal fluctuations) | Predictable income monthly |

Short term rentals generate 2-3x more money than long term rentals from the same space. The tradeoff is more work and less predictable income month to month. But for house hackers, that extra income is the difference between paying $1,800/month for housing and paying nothing.

Some operators hedge by doing both: Airbnb one room and long-term lease another. The Airbnb income covers the mortgage while the long-term tenant provides a predictable income baseline. Smart risk management.

Want to know exactly what you could earn? Use our Airbnb profit calculator to model scenarios for your specific market.

The Transition Path: House Hack to Real Estate Portfolio

House hacking isn’t the destination. It’s the launchpad. Here’s the playbook that turns a single house hack into financial independence.

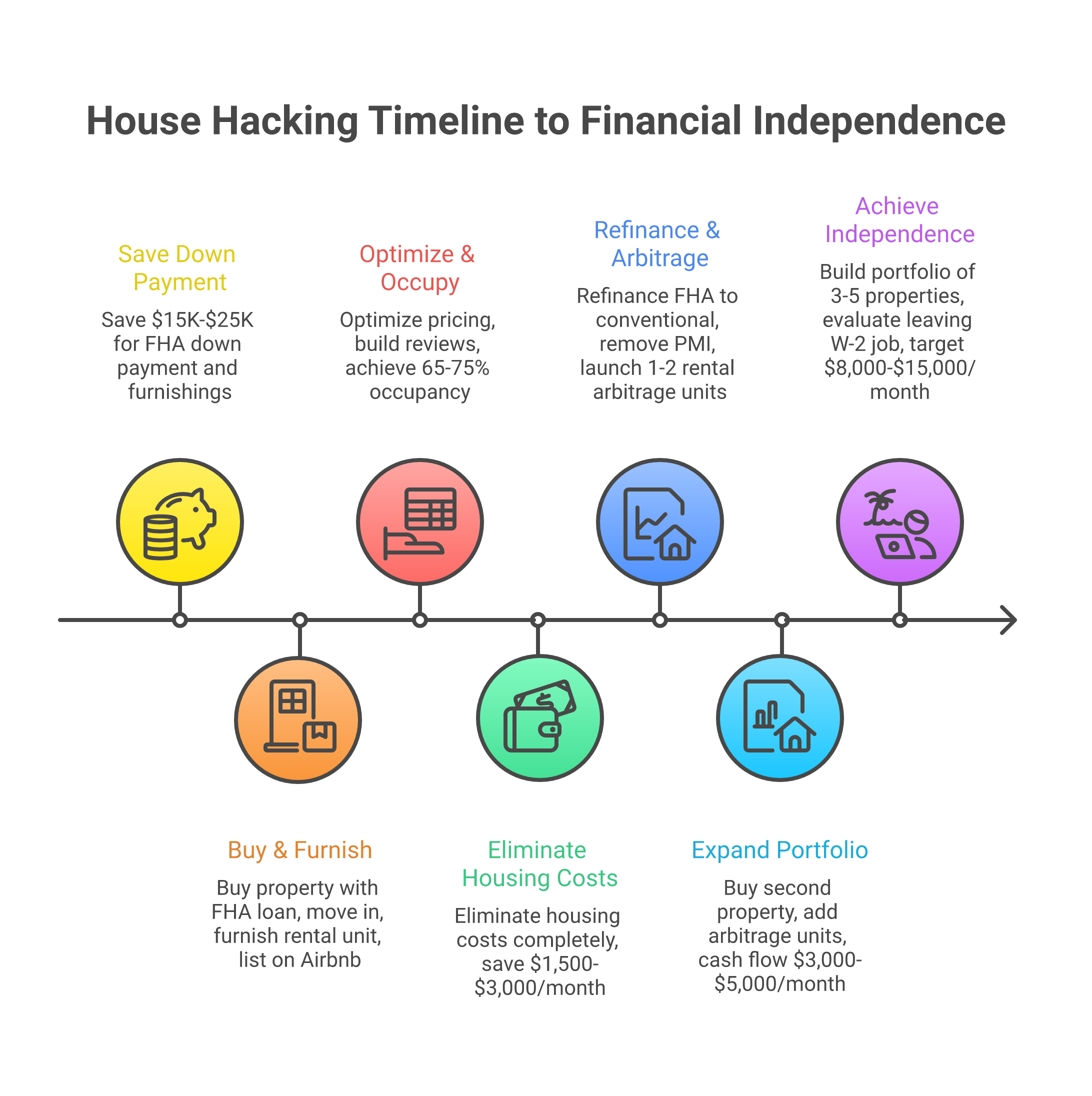

Months 1-12: Build the Foundation

- Buy a multi unit property or single family home with FHA financing (3.5% down, minimal down payments)

- Move in, furnish the rental unit(s), list on Airbnb

- Eliminate your housing costs entirely

- Save the $1,500-$3,000/month you would have spent on rent

- Learn Airbnb hosting, dynamic pricing, and guest management firsthand

Months 12-24: Scale Up

- Refinance your FHA loan into a conventional loan (removes MIP, frees up FHA eligibility for your next purchase)

- Use savings to launch 1-2 rental arbitrage units

- Apply every lesson from your house hack to the arbitrage properties

- Monthly cash flow target: $3,000-$5,000 across all properties

Months 24-36: Build the Portfolio

- Buy your second investment property (conventional loan, 15-25% down)

- Add 2-3 more arbitrage units using cash flow from existing properties

- Implement property management software (Guesty, Hostaway) for efficiency

- Evaluate replacing your W-2 income. Target: $8,000-$15,000/month from rental properties

This is the path from “I can’t afford rent” to “I’m a real estate investor generating five figures monthly.” It starts with one house hack and the willingness to share your space temporarily to build something permanent.

For a complete roadmap on the entire process, read our guide on how to start an Airbnb business.

Building an Airbnb Business Plan for Your House Hack

Every successful house hack starts with a plan. Not a 40-page MBA document—a practical one-page plan that covers the essentials.

Your Airbnb business plan should answer five questions:

- What property am I targeting? — Type, location, price range, unit count

- What’s the financing strategy? — FHA loan terms, down payment source, DTI projections

- What’s the revenue projection? — Conservative Airbnb income at 60% occupancy

- What are the total expenses? — Mortgage, insurance, utilities, supplies, maintenance, unexpected expenses reserve

- What’s the exit strategy? — Sell, refi, convert to long term rentals, or repeat

Keep it simple. The plan exists to validate the numbers before you write an offer, not to impress a bank. When the math works at conservative assumptions, pull the trigger.

Mobile Homes and Non-Traditional House Hacks

House hacking doesn’t require a traditional stick-built home. Some of the most creative operators use non-traditional properties to achieve even better returns.

Mobile Homes

Mobile homes represent the lowest barrier to entry in house hacking. You can purchase a used mobile home for $20,000-$60,000 in many markets, live in one section, and rent an empty room or second bedroom on Airbnb. Lot rent runs $300-$600/month in most parks.

The math on mobile homes is different. No FHA loan (though some qualify for FHA Title I loans up to $69,678 for manufactured housing). Lower appreciation. But the cash-on-cash returns can be extraordinary because your total investment is so small.

House Hacking a Single Family Home With an ADU

If your municipality allows accessory dwelling units, building one behind your single family home creates a completely separate rental property on the same lot. ADU construction runs $80,000-$150,000 depending on size and finishes, but the extra income from a private one-bedroom Airbnb unit ($1,800-$2,800/month in strong markets) can generate 15-25% annual returns on the build cost.

Several states (California, Oregon, Washington) have passed laws making ADU construction easier by overriding local zoning restrictions. Check your state’s ADU legislation before assuming it’s not possible.

How Much Do Airbnb Hosts Make From House Hacking?

Real numbers vary dramatically by market, property type, and execution quality. Here’s what I’ve seen across dozens of operators:

| Strategy | Gross Monthly Airbnb Income | Net After All Expenses | Effective Housing Cost |

|---|---|---|---|

| 1 spare bedroom (room rental) | $1,200-$1,800 | $800-$1,400 | $200-$800 reduced |

| 2 spare rooms (room rental) | $2,200-$3,200 | $1,400-$2,400 | $0 (often cash-flow positive) |

| Duplex (one unit on Airbnb) | $2,500-$4,000 | $1,800-$3,200 | $0 to -$500 (you get paid) |

| Triplex/Fourplex | $4,000-$8,000 | $2,500-$5,500 | $0 (significant cash flow) |

These are mid-tier market numbers. In high-demand tourist areas (near national parks, beach towns, ski resorts), multiply by 1.5-2x. In low-demand secondary markets, discount by 20-30%.

For a deeper analysis of what’s achievable, read how much Airbnb hosts actually make.

Setting Up Your Business Structure

Should you form an LLC for your house hack? Probably not on day one, but definitely before your second property.

Your first house hack is in your personal name—FHA loans require it. Protect yourself with proper insurance: a strong STR policy plus an umbrella policy ($1M coverage runs about $200-$400/year). That provides sufficient liability protection for a single owner-occupied property.

When you expand to a second investment property or launch arbitrage units, an LLC provides asset protection, tax flexibility through pass-through taxation, and professional credibility with landlords who want to see a legitimate business entity on the lease.

Our Airbnb LLC guide covers exactly when and how to set one up, including state-specific filing requirements and costs.

Common House Hacking Mistakes (And How to Avoid Them)

After watching dozens of operators go through this process, these are the mistakes that cost real money:

1. Buying Based on Purchase Price Alone

A cheap property in a dead market generates dead returns. A property near demand drivers (universities, hospitals, attractions, employers) at a slightly higher price outperforms every single time. Location determines 80% of your Airbnb income.

2. Underestimating Furnishing and Setup Costs

Budget $1,500-$2,500 per room, not $500. Cheap furniture photographs badly, breaks within months, and generates mediocre reviews that tank your occupancy. You don’t need luxury—you need quality basics that look clean and modern.

3. Running Numbers at Peak Occupancy

If your house hack only works at 85% occupancy, you’re one slow month from financial stress. Run everything at 55-65%. If it cash flows at conservative numbers, you’ve found a real deal. Peak occupancy should be gravy, not the baseline.

4. Skipping Proper Insurance

Standard homeowner’s insurance will deny claims related to short-term rental activity. Period. Get STR coverage before your first guest arrives. This is not optional.

5. Treating Guests Like Roommates

Professional boundaries from day one. Automated check-in, clear house rules, quiet hours, designated shared spaces. The more professional your setup, the better your reviews and the fewer headaches. You’re running a business, not hosting friends.

6. Ignoring Seasonality and Unexpected Expenses

Every market has slow seasons. Build a reserve fund of 3-6 months of mortgage payments before you start. Water heaters break. Guests damage furniture. Unexpected expenses happen. A $3,000-$5,000 emergency fund prevents a manageable setback from becoming a financial crisis.

7. Not Building Equity in Your Analysis

House hackers who only look at monthly cash flow miss the biggest wealth-building component. On a $300,000 property with a 30-year mortgage, you’re paying down roughly $5,000-$6,000 in principal during year one alone. That’s forced savings that compounds alongside property appreciation. Factor in building equity when evaluating whether a deal makes sense.

Building Wealth Through House Hacking: The Long Game

The operators who achieve financial independence through real estate investing almost always started with a house hack. Here’s why the strategy compounds so powerfully:

- Zero housing cost — You save $1,500-$2,500/month that peers spend on rent. Over 3 years, that’s $54,000-$90,000 in saved capital

- Forced savings through building equity — Every mortgage payment increases your ownership stake. Year 1 alone: $5,000-$6,000 in equity buildup

- Property appreciation — Historical average of 3-5% annually. On a $300,000 property: $9,000-$15,000/year

- Tax benefits — Depreciation, mortgage interest deduction, and operating expense write-offs reduce your tax burden by thousands annually

- Skill development — You learn real estate investing, property management, and the short-term rental business while someone else pays for the education

Over a 3-year house hacking period, the total wealth impact on a $300,000 property looks roughly like this:

- Housing cost savings: $54,000-$90,000

- Equity buildup: $15,000-$18,000

- Property appreciation (3-5%): $27,000-$45,000

- Tax savings: $6,000-$15,000

- Total 3-year wealth impact: $102,000-$168,000

That’s the real return on a $15,000-$25,000 initial investment. No stock, bond, or savings account comes close.

Financing Terms Beyond FHA: Options for Your Second Property

After your first FHA house hack, you need different financing terms for subsequent properties. Here are the options experienced real estate investors use to keep scaling:

- Conventional loans — 15-25% down, better rates than FHA once you have equity and income history. No MIP/PMI if you put 20%+ down

- DSCR loans — Qualify based on property income, not personal income. Ideal for scaling when your W-2 DTI is maxed out

- Cash-out refinance — Pull equity from your first house hack to fund the down payment on property #2. Requires at least 20-25% equity

- Home equity line of credit (HELOC) — Access equity as a revolving credit line for down payments or renovations

- Seller financing — Negotiate directly with sellers for custom financing terms. Common with motivated sellers and off-market deals

The typical scaling pattern: FHA house hack #1 → refinance to conventional → DSCR or conventional for property #2 → cash-out refi to fund property #3. Each cycle builds more equity and cash flow, accelerating the path to financial independence.

Frequently Asked Questions

Can I house hack with an FHA loan and rent rooms on Airbnb?

Yes. FHA loans require you to live in the property as your primary residence for at least 12 months. You can rent out other units in a multi unit property or spare rooms in your own home on Airbnb from day one. The requirement is that you genuinely live there—your driver’s license, mail, and daily life should confirm this is your principal residence.

How much money do I need to start house hacking with Airbnb?

With an FHA loan, plan for $15,000-$25,000 total. That covers your 3.5% down payment ($8,750-$17,500 depending on purchase price), closing costs ($3,000-$6,000), and furnishing one rental unit ($1,500-$4,500). Some buyers negotiate seller concessions to reduce closing costs, bringing the total as low as $12,000-$15,000 with minimal down payments.

Is house hacking with Airbnb legal everywhere?

No. Short-term rental regulations vary by city. However, many cities that restrict investor-owned STRs specifically exempt owner-occupied properties. Always research your local STR ordinance, zoning requirements, and HOA rules before purchasing. The safest approach: research STR regulations as part of your property search, not after closing.

How much can I realistically make house hacking Airbnb?

In mid-tier markets, renting 2 spare bedrooms on Airbnb typically generates $2,200-$3,200/month gross, netting $300-$1,200/month after all expenses including your mortgage payment. A duplex house hack can net $500-$2,000/month. These numbers assume 60-70% occupancy—achievable in most markets with decent listings and competitive pricing.

What’s the difference between house hacking and rental arbitrage?

House hacking means you own the property, live in it, and rent part of it. You build equity, gain tax benefits, and keep the asset long-term. Rental arbitrage means you lease from a landlord (with permission) and sublease on Airbnb for profit. Arbitrage requires less capital and no mortgage but offers no equity and depends entirely on your lease agreement. Many operators start with house hacking, then add arbitrage units using the savings.

Do I need an LLC for house hacking?

Not for your first house hack. FHA loans must be in your personal name, and proper insurance (STR policy + umbrella coverage) provides adequate liability protection for a single owner-occupied property. Consider forming an LLC when you expand to a second investment property or launch rental arbitrage units. Read our LLC formation guide for the right timing and process.

What happens after the 12-month FHA occupancy requirement?

After 12 months, you can move out and convert the entire property to short term rentals or long term rentals. Many house hackers refinance their FHA loan into a conventional loan (removing MIP), then use a new FHA loan to purchase their next house hack. This strategy lets you acquire multiple rental properties with minimal down payments over several years, steadily building wealth and cash flow toward financial independence.

Can I house hack a single family home or does it have to be a multi-unit?

Both work. A single family home house hack involves renting spare bedrooms or a spare room individually on Airbnb while you live in the master. A multi unit property lets you rent entire units. Multi-unit typically generates more money, but single-family is simpler to find, finance, and manage as a first deal.

What if I can’t find a multi-unit property in my budget?

Start with a single family home and rent an empty room or two on Airbnb. The room-by-room strategy works with any house that has at least one spare bedroom. You won’t generate as much cash flow as a duplex, but you’ll still slash your housing costs and start building equity. It’s a proven entry point for real estate investing with minimal risk.