Should you form an LLC for your Airbnb business? Yes. For the vast majority of short-term rental hosts, a limited liability company is the single best legal and financial move you can make. An LLC creates a separate legal entity that walls off your personal assets from your rental business liabilities, gives you flexible tax treatment, and establishes the credibility landlords and lenders demand. I’ve watched hosts lose their personal savings over a single guest injury because they never set up a basic business structure. This airbnb LLC guide walks you through everything: the real reasons to form one, LLC vs other structures, step-by-step formation in any state, costs, tax implications, multi-property strategies, and the exact tipping point where an S-Corp election starts saving you thousands.

Disclaimer: This article is for educational purposes only and does not constitute legal or tax advice. Consult a qualified attorney and CPA for guidance specific to your situation, state, and financial circumstances.

What Is an LLC and Why Airbnb Hosts Need One

A limited liability company LLC is a business entity that separates your personal finances from your business operations. Think of it as a legal firewall. When you form an LLC, the law treats your business as its own “person”. It can own property, hold bank accounts, enter contracts, and get sued. But here’s the part that matters: if someone sues the LLC, they can only go after assets inside the LLC. Your personal home, your retirement accounts, your car, your personal savings, all of that stays protected behind the wall.

For Airbnb hosts, this protection isn’t theoretical. You’re inviting strangers into a physical space. Things break. People get hurt. Neighbors file complaints. Local laws change overnight. Every one of those situations creates financial and legal exposure that lands squarely on you if you’re operating without a proper business entity.

Here’s what an LLC actually does for your airbnb business:

- Personal liability protection – A lawsuit targets the LLC, not your personal bank account or home equity

- Asset protection across properties – Each LLC can hold separate properties, limiting cross-contamination of risk

- Tax flexibility – Choose to be taxed as a sole proprietor, partnership, S-Corp, or even C-Corp

- Business credibility – Landlords, lenders, insurance companies, and property managers take you more seriously

- Clean financial tracking – Dedicated EIN, business bank account, and credit lines keep everything separate

- Scalability – Add properties, bring in partners, or attract investors without restructuring from scratch

One thing I need to be direct about: an LLC is not a magic shield. If you personally guarantee a lease (which most landlords require for rental arbitrage), that guarantee passes through the LLC. And if you co-mingle personal and business funds or commit fraud, courts can “pierce the corporate veil” and hold you personally liable. But when maintained properly, separate accounts, proper records, an operating agreement on file, an LLC provides the strongest liability protection available to STR hosts short of a full corporation.

LLC vs Sole Proprietorship vs S-Corp: Which Business Structure Fits?

“Do I really need an LLC, or can I just operate under my own name?” I get this question weekly. The answer depends on where you are in your hosting journey, how many properties you manage, and how much you’re netting. Here’s an honest breakdown. No hedging.

Side-by-Side Comparison

| Factor | Sole Proprietorship | Single-Member LLC | Multi Member LLC | LLC + S-Corp Election |

|---|---|---|---|---|

| Liability Protection | None, personal assets fully exposed | Strong, personal assets shielded | Strong. Each member protected | Strong, same as standard LLC |

| Formation Cost | $0 | $35–$500 by state | $35–$500 by state | Same as LLC + $0 for S-Corp IRS filing |

| Annual Maintenance | $0 | $0–$800/year | $0–$800/year + partnership return | LLC fees + payroll costs ($500–$2,000/yr) |

| Tax Filing | Schedule C on personal return | Schedule C (disregarded entity) | Form 1065 + K-1s to members | Form 1120-S + salary/distributions split |

| Self-Employment Tax | 15.3% on all net income | 15.3% on all net income | 15.3% on each member’s share | 15.3% only on salary portion |

| Double Taxation Risk | No | No, pass-through | No, pass-through | No, pass-through |

| Flexible Management Structure | Owner-only | Owner-managed or manager-managed | Highly flexible per operating agreement | Same as LLC plus payroll requirements |

| Best For | Testing waters (<$10K/yr, 1 listing) | Most hosts (1-10+ listings) | Partnerships, spouse teams, investor deals | High earners ($70K+ net profit/year) |

When Each Structure Makes Sense

Sole Proprietorship. You’re renting a spare bedroom on weekends and clearing under $10,000 a year. Risk is minimal, income is modest, and the cost of forming an LLC might not justify itself yet. But here’s the catch: the moment you sign a dedicated lease for a rental arbitrage unit or start managing multiple properties, you’ve outgrown this structure. One slip-and-fall lawsuit could wipe out years of personal savings.

Single-Member LLC. This is the sweet spot for roughly 90% of Airbnb hosts. Whether you’re running your first arbitrage unit or managing 15 short term rentals, an LLC gives you the personal liability protection and credibility you need without corporate-level overhead. Formation takes 30 minutes and costs under $200 in most states. You file the same Schedule C you already know.

Multi Member LLC. Partnering with a spouse, friend, or investor? A multi member LLC lets you split ownership, define roles in an operating agreement, and protect each member’s personal assets independently. This is common for husband-wife teams running arbitrage portfolios and for deals where one person brings capital and another handles operations.

LLC with S-Corp Election. Once your net profit consistently exceeds $70,000–$100,000 per year, the S-Corp election starts saving you real money on self employment taxes. At $100K net profit, proper S-Corp structuring typically saves $5,000–$8,000 annually. You pay yourself a “reasonable salary” (subject to payroll taxes) and take the remainder as distributions (not subject to self-employment tax). But it comes with payroll obligations, quarterly filings, and the IRS scrutinizes that salary number. Talk to a tax professional before making this election.

6 Reasons You Need an LLC for Your Airbnb Business

If you’re doing rental arbitrage, leasing properties and subletting them on Airbnb, an LLC isn’t optional. It’s the foundation of a defensible rental business. Here’s exactly why.

1. Personal Asset Protection

Rental arbitrage means you’re managing properties you don’t own. That creates a different risk profile than renting out your own home. If a guest gets injured, if there’s a fire, if a pipe bursts and damages the unit below, the liability chain starts with you. Without an LLC, a plaintiff’s attorney can pursue your personal savings, your car, your home equity, your retirement accounts. Everything.

An LLC creates a separate legal entity. When maintained correctly, creditors and plaintiffs can only go after what’s inside the LLC, the business bank account, equipment, security deposits. Your personal life stays on the other side of the wall. That’s personal liability protection in action.

2. Pass-Through Taxation (No Double Taxation)

A single-member LLC is a “disregarded entity” for tax purposes. The IRS doesn’t tax the LLC itself. Instead, all income and expenses flow through to your personal income tax returns on Schedule C. No corporate tax return. No double taxation where the company pays taxes and then you pay again on dividends. It’s the simplest tax structure that still gives you full liability protection.

A multi member LLC files Form 1065 (informational only, the LLC pays no federal tax) and issues K-1s to each member. Each member reports their share on personal income tax returns. Same pass-through principle, just with an extra form.

3. Airbnb LLC Tax Benefits and Deductions

Running your rental property through an LLC doesn’t change what you can deduct, sole proprietors get the same deductions. But it does change how organized you are about claiming them, and that organization directly affects how much you save. When everything flows through a business bank account tied to your LLC’s EIN, you catch deductions you’d otherwise miss. The potential tax benefits of clean bookkeeping are substantial.

Here are the key tax deductions available to LLC owners running short term rentals:

- Mortgage interest – 100% of interest paid on rental property mortgages is deductible

- Property taxes – All local property taxes on your rental properties

- Depreciation – Residential rental property depreciates over 27.5 years. A $300,000 building (excluding land) yields a $10,909 annual deduction

- Repairs and maintenance – Plumbing, painting, HVAC fixes, appliance replacements

- Insurance premiums – Landlord, liability, and specialized STR coverage

- Utilities – Water, gas, electric, internet, trash, deductible even during vacancy periods

- Cleaning and supplies – Professional cleaning between guests, linens, toiletries, consumables

- Property management fees – Software subscriptions, co-host fees, management company charges

- Travel to properties – $0.70 per mile (2025 IRS rate) for driving to inspect, clean, or maintain units

- Professional services – CPA fees, attorney consultations, bookkeeping software

- LLC formation and maintenance costs – State filing fees, annual reports, registered agent services, all deductible

- Advertising – Listing fees, photography, social media marketing for your properties

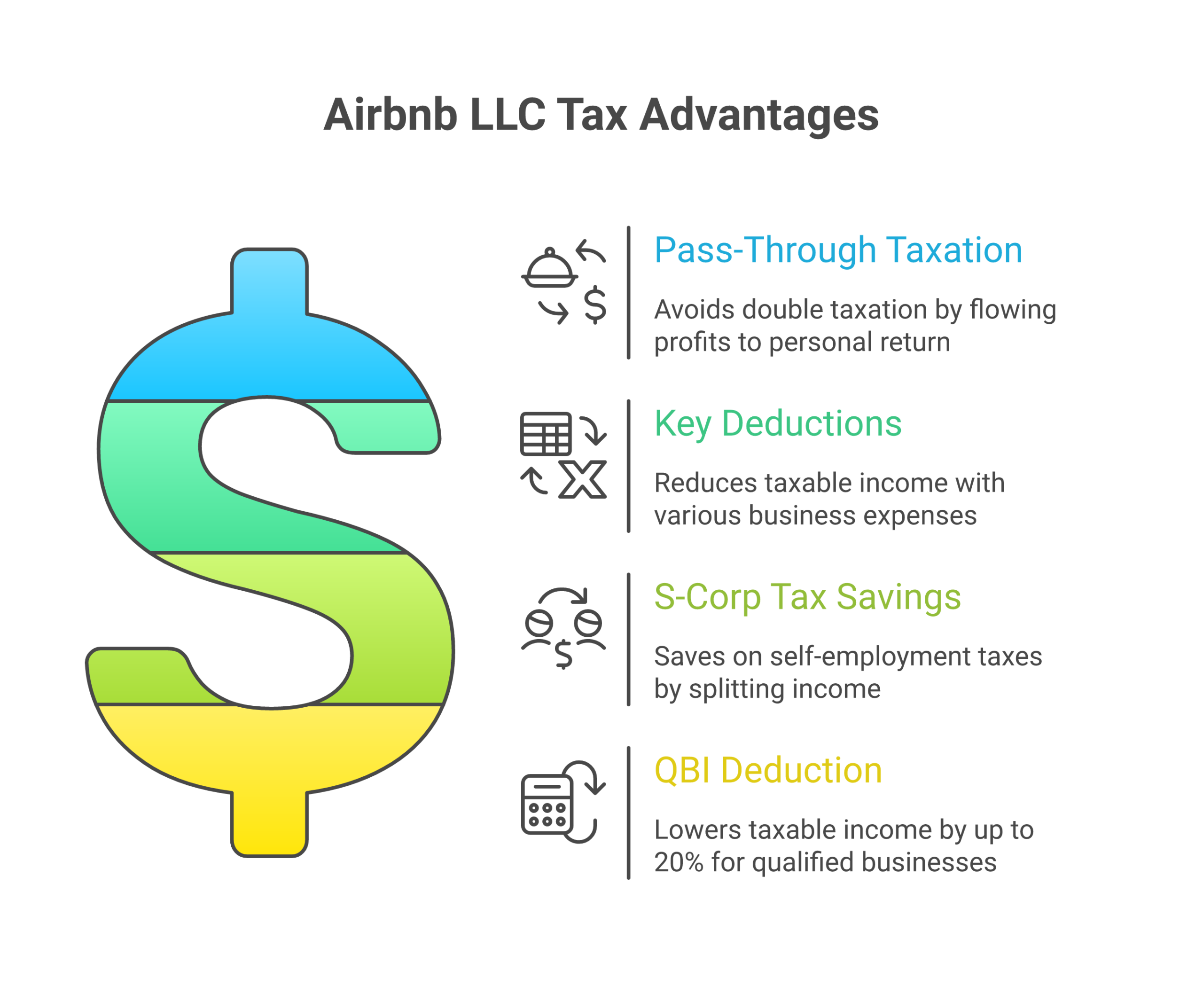

There’s also the Qualified Business Income (QBI) deduction under Section 199A, which can reduce your taxable income by up to 20%. Whether your STR qualifies depends on your involvement level and income, another reason to work with a tax professional who understands short-term rental tax strategy.

4. Credibility With Landlords and Lenders

Try signing an arbitrage lease as “John Smith, individual.” Now try as “Smith Hospitality LLC.” The second version signals to landlords that you’re running a legitimate business, not some side hustle that might disappear in three months. Many landlords won’t even consider subletting agreements with individuals. They want the formality and accountability that comes with a registered legal entity.

Same goes for DSCR loans and other financing. Lenders evaluate your business structure when determining loan terms. An LLC with a dedicated business bank account, clean financials, and a solid business plan gets better terms than a sole proprietor with personal and business transactions mixed together.

5. Scaling and Managing Multiple Properties

When you’re managing multiple properties, an LLC keeps each investment organized. Some hosts create a single LLC for all properties. Others create separate LLCs for each property (a “series LLC” in states that allow it, or individual LLCs held under a parent holding company). The right approach depends on your risk tolerance and portfolio size.

Here’s a quick framework for managing multiple properties across markets:

- 1-3 properties in one state: One LLC is usually sufficient

- 4-10 properties across states: Consider one LLC per state, or a holding company + operating LLCs

- 10+ properties: Series LLC (if your state offers it) or a holding company structure with your CPA’s guidance

6. Privacy Protection

In most states, your LLC’s registered agent address is public record. Not your home address. Some states like Wyoming, New Mexico, and Delaware offer enhanced privacy by not requiring member/manager names in public filings. If you’re doing arbitrage in competitive markets, keeping your identity and property portfolio private can be a strategic advantage.

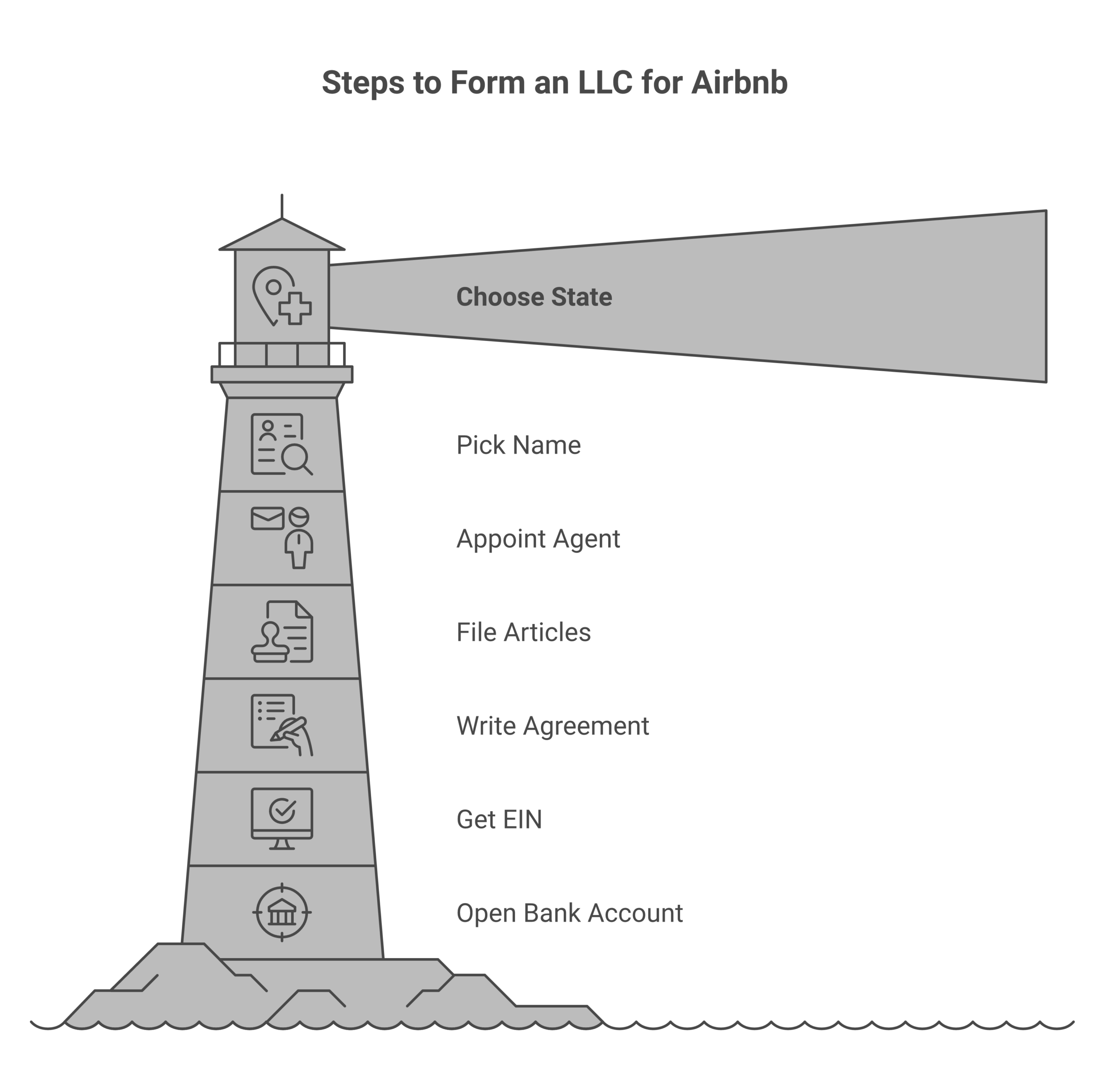

How to Form an LLC for Your Airbnb Business (Step by Step)

Forming an LLC is one of those tasks that sounds intimidating but actually takes less than an hour in most states. Here’s the exact process I walk new hosts through.

Step 1: Choose Your State

File your LLC in the state where your rental property is located. If you live in Texas but your arbitrage units are in Florida, you form the LLC in Florida. “But what about Wyoming or Delaware?” Those states offer privacy and tax advantages, but if you’re operating properties in another state, you’ll still need to register as a “foreign LLC” in that state, which means paying fees in both states. For most Airbnb hosts, filing in the state where you operate is the simplest and cheapest approach.

Exception: if you’re managing multiple properties across several states and want a centralized holding company, Wyoming or Delaware can make sense as the parent entity. Talk to an attorney before going this route.

Step 2: Choose Your LLC Name

Your name must be unique in your state’s business registry. Search your state’s Secretary of State database to check availability. Rules vary, but most states require:

- The name must include “LLC,” “L.L.C.,” or “Limited Liability Company”

- It can’t be too similar to an existing registered business in that state

- It can’t include restricted words (Bank, Insurance, University) without special approval

Keep it professional but don’t overthink it. “Smith Hospitality LLC” or “Sunshine Stays LLC” both work fine. You can always register a DBA (Doing Business As) for branding purposes later.

Step 3: Appoint a Registered Agent

Every LLC needs a registered agent, a person or service with a physical address in your state who receives legal documents, tax notices, and official correspondence on behalf of your LLC. You can be your own registered agent (free), but that means your home address goes on public record and you need to be available during business hours.

Most hosts use a registered agent service ($50–$300/year). Northwest Registered Agent, Incfile, and your state bar association’s referral service are common options. The cost is deductible as a business expense.

Step 4: File Articles of Organization

This is the official formation document. You file it with your state’s Secretary of State (or equivalent agency). The form is typically one or two pages and asks for:

- LLC name

- Registered agent name and address

- Principal office address

- Management structure (member-managed or manager-managed)

- Organizer’s name and signature

Filing costs range from $35 (Montana) to $500 (Massachusetts). Most states fall between $50 and $200. Processing takes 1-10 business days, though many states offer expedited processing for an extra $50–$200.

Step 5: Draft an Operating Agreement

An operating agreement is the internal rulebook for your LLC. Some states require it (California, New York, Missouri, Maine, Delaware). Even where it’s not legally required, you should have one. Why? Because without it, your state’s default LLC rules govern, and those defaults might not match your intentions.

For a single-member LLC, the operating agreement is simple: it confirms you as the sole owner, defines how profits are distributed, and establishes rules for adding members or dissolving the LLC. For a multi member LLC, the operating agreement becomes critical. It defines ownership percentages, voting rights, profit splits, and what happens if a member wants out.

Templates are available online for $0–$50, or an attorney can draft a custom one for $500–$1,500.

Step 6: Get an EIN (Employer Identification Number)

An EIN is your LLC’s tax ID number, the business equivalent of a Social Security Number. You need it to open a business bank account, file taxes, and hire employees or contractors. Getting one is free and takes about five minutes on the IRS website (irs.gov/ein). Multi member LLCs are required to have an EIN. Single-member LLCs technically can use the owner’s SSN, but I strongly recommend getting an EIN anyway. It keeps your SSN off business documents and makes financial separation cleaner.

Step 7: Open a Business Bank Account

This is where most hosts slip up. They form the LLC, get the EIN, and then keep running everything through their personal checking account. Don’t do this. Co-mingling funds is the fastest way to lose your liability protection. Courts will “pierce the corporate veil” if they determine you’re treating the LLC as an alter ego rather than a genuine separate legal entity.

Open a dedicated business bank account. Run all rental income through it. Pay all business expenses from it. Transfer profits to your personal account through documented owner distributions. This one habit protects your LLC’s legal standing more than any other single action.

State-by-State LLC Filing Costs for Airbnb Hosts

LLC formation costs vary dramatically by state. Here’s a comparison of the most popular states for STR hosts, so you can estimate your upfront investment. Every dollar spent on forming an LLC is a tax-deductible business expense.

| State | Filing Fee | Annual Fee | Notes |

|---|---|---|---|

| Arizona | $50 | $0 | No annual report required. One of the cheapest states to maintain |

| California | $70 | $20 (biennial) | Note: CA also charges an $800 annual franchise tax regardless of income |

| Colorado | $50 | $25 | Fast online filing, popular for mountain STR markets |

| Delaware | $90 | $300 | Business-friendly laws but expensive annual fee |

| Florida | $125 | $139 | No state income tax, major advantage for STR hosts |

| Georgia | $100 | $50 | Reasonable costs, growing STR market in Atlanta |

| Kentucky | $40 | $15 | Lowest filing fee in the country |

| Montana | $35 | $20 | Cheapest state to file, low annual cost |

| Nevada | $75 | $350 | No state income tax but high annual fee |

| New York | $200 | $9 (biennial) | Requires publication in 2 newspapers (adds $300–$1,500+) |

| North Carolina | $125 | $200 | Growing STR market, moderate costs |

| Ohio | $99 | $0 | No annual filing, set-and-forget state |

| Tennessee | $300 | $300 | No state income tax on wages, but high LLC fees |

| Texas | $300 | $0 | No annual fee, no state income tax, popular for STR operators |

| Wyoming | $100 | $60 | Strong privacy, no state income tax, popular for holding companies |

Pro tip: States with no income tax (Florida, Nevada, Tennessee, Texas, Wyoming) give LLC owners an extra advantage. Your rental income isn’t taxed at the state level regardless of structure. But remember: you pay taxes where the property is located, not where the LLC is formed. If your LLC is in Wyoming but your rental property is in California, you still owe California income tax on that property’s income. Always check local laws and state regulations before filing.

Tax Implications of an LLC for Airbnb Hosts

The tax side of running an airbnb LLC is where most hosts either save money or leave it on the table. Let me break down the major areas.

Pass-Through Taxation: How It Works

By default, a single-member LLC doesn’t file its own tax return. The IRS treats it as a “disregarded entity.” All revenue, expenses, and profit flow through to your personal return on Schedule C (or Schedule E if your STR qualifies as rental activity rather than active business). You report it alongside your W-2 income, investment income, and everything else on your personal income tax returns.

This eliminates double taxation, the scenario where a C-Corporation pays corporate income tax and then shareholders pay again on dividends. With an LLC, the money is taxed once, at your individual rate. That’s a significant advantage, especially for hosts in the early growth phase who are reinvesting profits.

Self-Employment Tax: The 15.3% Bite

Here’s the part nobody warns you about: if your STR is classified as an active trade or business (not passive rental income), you’ll owe self employment taxes of 15.3% on net profit. That’s 12.4% for Social Security (up to the wage base of $176,100 in 2025) plus 2.9% for Medicare. On $80,000 in net profit, that’s $12,240, on top of your regular income tax.

This is why the S-Corp election becomes attractive at higher income levels. More on that below.

The S-Corp Tax Savings Threshold

Once your net profit from short term rentals consistently exceeds $70,000–$100,000, you can elect S-Corp status by filing IRS Form 2553. This doesn’t change your LLC’s legal structure. It only changes how the IRS taxes it.

With an S-Corp election, you split your income into two buckets:

- Reasonable salary – Subject to self employment taxes (15.3%)

- Distributions – NOT subject to self-employment taxes

Example: Your LLC nets $120,000. Without S-Corp election, you’d owe approximately $18,360 in self-employment taxes. With S-Corp election, you pay yourself a $55,000 salary (subject to payroll taxes: ~$8,415) and take $65,000 as distributions (no SE tax). That’s roughly $9,945 in annual savings. Over five years? Nearly $50,000.

But there are costs: payroll processing ($500–$2,000/year), a separate 1120-S tax return ($500–$1,500 if CPA-prepared), and IRS scrutiny of your “reasonable salary.” Set the salary too low and you’re inviting an audit. A good CPA or tax professional can help you find the right balance. The typical S-Corp breakeven point, where the tax savings exceed the extra compliance costs, is around $50,000–$70,000 in net profit.

Depreciation: The Tax Deduction You’re Probably Missing

Residential rental property depreciates over 27.5 years. If your rental property (excluding land value) is worth $275,000, that’s a $10,000 annual tax deduction, even though you haven’t spent a dime. This is a paper loss that reduces your taxable income. Combine it with your actual expenses (mortgage interest, repairs, insurance, utilities), and many STR owners show a tax loss on paper while actually cash-flowing nicely.

Personal property inside the rental, furniture, appliances, electronics, depreciates over 5-7 years. A $15,000 furnishing package on a new arbitrage unit can yield $3,000/year in tax deductions for five years. Track these purchases carefully. Your profit calculations should account for depreciation as a real benefit.

Multi-State LLC Considerations for STR Hosts

If you’re running short term rentals in multiple states, which is increasingly common as hosts scale through rental arbitrage – you need to understand how multi-state LLC rules work.

Domestic vs Foreign LLC Registration

Your LLC is “domestic” in the state where it was formed. To operate legally in any other state, you must register as a “foreign LLC” in that state. This typically means:

- Filing a Certificate of Authority or Application for Registration

- Paying that state’s foreign LLC filing fee ($50–$300 in most states)

- Appointing a registered agent in that state

- Filing annual reports (and paying annual fees) in that state

So if your LLC is formed in Florida and you have arbitrage units in Georgia and Tennessee, you’re paying fees and filing reports in three states. This is why some hosts create a separate LLC in each state rather than registering one LLC everywhere, sometimes the math works out better, especially if the “home” state has high annual fees.

Tax Nexus

You owe state income tax where the rental property is located, regardless of where your LLC is domiciled. A Wyoming LLC with a property in California pays California state income tax on that property’s income. There’s no way around this. Factor state income tax into your market analysis when deciding where to invest.

When to Upgrade From an LLC to an S-Corp

I see two camps in the STR world: hosts who jump to S-Corp status way too early, and hosts who wait way too long. Here’s how to make this decision rationally.

You Should Stay as a Standard LLC If:

- Your net profit is under $50,000/year

- You’re still scaling and reinvesting most profits

- You don’t want to deal with payroll compliance

- Your STR income is classified as passive (you use a property manager)

You Should Seriously Consider S-Corp Election If:

- Your net profit is consistently above $70,000/year

- You’re materially participating in the business (managing listings, handling guests, overseeing cleaners)

- You’re paying more than $10,000/year in self-employment taxes

- You have a CPA who can run the numbers and handle the extra filings

The key phrase is “consistently above.” One good year doesn’t justify the overhead. You want two or three consecutive years of strong profit before committing. And remember. You can make the election effective for the current tax year if you file Form 2553 by March 15. You can always go back to standard LLC taxation later by revoking the election.

10 Common LLC Mistakes Airbnb Hosts Make

I’ve helped hundreds of hosts set up their business structures. These are the mistakes I see over and over.

1. Co-Mingling Personal and Business Funds

This is mistake number one. If you deposit Airbnb payouts into your personal checking account or pay for groceries with your business debit card, you’re weakening the legal wall between you and the LLC. Open a business bank account. Use it exclusively for business transactions. Period.

2. Skipping the Operating Agreement

Even for single-member LLCs. Without an operating agreement, your state’s default LLC statute governs how the business operates. In some states, that means equal voting rights for all members (even if ownership is unequal) or automatic dissolution if a member leaves. A five-page operating agreement prevents all of this.

3. Forming the LLC in the Wrong State

Wyoming and Delaware get all the hype, but if your properties are in Illinois and you live in Illinois, form your LLC in Illinois. Going out-of-state adds complexity, cost, and a foreign LLC registration in your home state anyway. The only exception: multi-state portfolios where a Wyoming holding company genuinely simplifies things.

4. Not Maintaining the LLC Properly

Filing your Articles of Organization is step one, not the finish line. You need to file annual reports (in most states), keep your registered agent current, maintain your operating agreement, hold annual meetings or document resolutions, and keep financials separate. Let any of these slide and you risk the LLC being dissolved by the state or losing your liability shield in court.

5. Putting the Property Title in the LLC (Without Understanding the Consequences)

Transferring a property deed into your LLC can trigger a “due-on-sale” clause in your mortgage. Most lenders have this clause, which technically allows them to demand full repayment if ownership changes. In practice, many lenders don’t enforce it for single-member LLCs. But some do. Talk to your lender first. For arbitrage operators who don’t own the properties, this isn’t an issue.

6. Ignoring Local Laws and Permits

Forming an LLC doesn’t exempt you from local short-term rental regulations, licensing requirements, or zoning laws. Many cities require separate STR permits, business licenses, and tax registrations in addition to your LLC. Check your local laws before listing.

7. Choosing the Wrong Registered Agent

Your registered agent is the person or service that receives legal paperwork, including lawsuits. If they’re unreliable, you might miss a court filing deadline and get a default judgment against you. Pay for a reputable service or use your attorney’s office.

8. Not Getting Adequate Insurance

An LLC limits your personal exposure, but it doesn’t prevent lawsuits. You still need commercial general liability insurance ($1M minimum), property damage coverage, and ideally an umbrella policy. The LLC and insurance work together, the LLC caps personal exposure, and insurance pays claims within its limits.

9. Waiting Too Long to Form the LLC

I’ve talked to hosts who have been operating 10+ units as sole proprietors for years. Every day without an LLC is a day your personal assets are fully exposed. The cost to save money by avoiding LLC formation is far smaller than the cost of a single lawsuit.

10. Not Consulting Professionals

An LLC costs $35–$500 to form. A CPA charges $200–$500 for an initial consultation. An attorney charges $250–$750 for a formation review. Compare that to a $50,000 lawsuit settlement or $15,000 in unnecessary taxes because you chose the wrong structure. The return on professional advice is enormous.

Managing Multiple Properties Under LLCs

As your portfolio grows, the question shifts from “Should I form an LLC?” to “How many LLCs do I need?” There’s no single right answer. It depends on your risk tolerance, state laws, and the size of your operation.

Strategy 1: One LLC for Everything

Pros: Simple, cheap, one set of books, one tax return.

Cons: If one property generates a massive liability, all properties are exposed.

Best for: Hosts with 1-5 properties in one state, moderate risk tolerance.

Strategy 2: One LLC Per Property

Pros: Maximum isolation. A lawsuit on Property A can’t touch Property B’s assets.

Cons: Expensive, complex. Each LLC needs its own bank account, annual filings, and potentially its own tax return.

Best for: High-value properties, litigious markets, hosts with 10+ units.

Strategy 3: Holding Company + Operating LLCs

Pros: Clean hierarchy. Holding company owns the operating LLCs. Centralized management with compartmentalized risk.

Cons: Higher setup and maintenance costs. Requires CPA guidance.

Best for: Portfolios spanning multiple states, investor partnerships, hosts scaling aggressively.

Strategy 4: Series LLC (Where Available)

A few states (Delaware, Illinois, Iowa, Nevada, Oklahoma, Tennessee, Texas, Utah) offer “series LLCs”, a single LLC with separate “series” or cells, each of which can hold distinct assets with independent liability. You file one set of paperwork and pay one set of fees, but each series functions like a separate entity.

Pros: Cost-effective asset separation.

Cons: Not recognized in all states, limited case law, some courts in non-series states might not honor the liability separation.

Best for: Multi-property operators in states that offer it, who want isolation without the cost of separate LLCs.

LLC Formation Timeline: What to Expect

Here’s a realistic timeline for getting your LLC operational from start to finish:

| Task | Time | Cost |

|---|---|---|

| Research state requirements | 30 min | $0 |

| Choose and verify LLC name | 15 min | $0 |

| Prepare Articles of Organization | 20 min | $0 |

| File with Secretary of State | 10 min online | $35–$500 |

| Wait for state processing | 1-10 business days | Expedited: $50–$200 extra |

| Appoint registered agent | 10 min | $50–$300/year (or free if self) |

| Apply for EIN on IRS.gov | 5 min | $0 |

| Draft operating agreement | 30-60 min (template) or 1 week (attorney) | $0–$1,500 |

| Open business bank account | 30 min at bank branch | $0 |

| Update Airbnb host profile | 10 min | $0 |

| Total | ~3 hours active work + processing wait | $85–$2,500 depending on state and choices |

How to Link Your LLC to Airbnb

Once your LLC is formed, you need to connect it to your Airbnb account so payouts go to the right place and your tax documents are correct.

- Update your payout method: Go to Account, Payments, Payout methods. Add your LLC’s business bank account as the payout destination. Remove (or deprioritize) your personal account

- Update your taxpayer information: Go to Account, Taxes, Taxpayer information. Switch from your SSN to your LLC’s EIN. Enter the LLC’s legal name exactly as it appears on your Articles of Organization

- Update your listing details: If your listing mentions you by personal name, consider updating the host profile to reflect the business brand while keeping things personal and warm (guests still want to feel like they’re dealing with a person, not a corporation)

Airbnb will issue your 1099-K using whatever taxpayer information is on file. Make sure it’s the LLC’s EIN so the income matches your business tax records.

LLC Insurance Requirements for Airbnb Hosts

An LLC limits your personal liability. Insurance pays claims. You need both. Here’s the minimum insurance stack I recommend for every STR operator:

- Commercial General Liability (CGL): $1M per occurrence minimum. Covers guest injuries, property damage claims, and legal defense costs. Airbnb’s Host Liability Insurance provides some coverage, but it has significant exclusions and you don’t control the claims process

- Property/Dwelling Coverage: Covers physical damage to the rental unit, fire, storms, vandalism, burst pipes. Make sure the policy covers “short-term rental use” explicitly; standard homeowner’s policies usually exclude it

- Loss of Income/Business Interruption: If a covered event forces your property offline, this replaces lost rental income during repairs

- Umbrella Policy: $1M–$5M extra liability coverage that kicks in when your CGL limits are exhausted. At $200–$500/year for $1M, this is the cheapest protection per dollar of coverage available

Insurance premiums are fully deductible as a business expense of your LLC. Most policies run $1,200–$3,000/year per property depending on location, coverage limits, and claims history.

FAQ: Airbnb LLC Formation

Do I need an LLC to host on Airbnb?

Legally, no. You can host as a sole proprietor using your personal name and SSN. But practically? If you’re earning more than a few thousand dollars a year or managing dedicated rental units, operating without personal liability protection is a gamble with your personal assets. An LLC costs as little as $35 to form and provides legal separation that could save you everything you own if a lawsuit hits.

How much does an LLC for Airbnb cost?

Initial formation runs $35–$500 depending on your state (Montana and Kentucky are cheapest; Massachusetts and California are most expensive). Annual maintenance adds $0–$800 in state fees, plus $50–$300 for a registered agent service, and $500–$1,500 for annual CPA services. Total first-year cost for most hosts: $200–$1,500. Total annual maintenance after that: $500–$2,500. Every dollar is tax-deductible.

Can I use one LLC for multiple Airbnb properties?

Yes. Most hosts with 1-5 properties use a single LLC and it works fine. The tradeoff is that all properties share liability risk, a lawsuit on one property could theoretically impact the others within the same LLC. For hosts with 5+ properties or high-value assets, separate LLCs or a series LLC structure adds isolation. Your CPA and attorney can help you decide.

What’s the difference between an LLC and an S-Corp?

An LLC is a legal entity (state level). An S-Corp is a tax election (federal level). They’re not mutually exclusive, the most common setup for profitable Airbnb hosts is an LLC that has elected S-Corp tax treatment. You get the liability protection of an LLC with the self-employment tax savings of an S-Corp. The S-Corp election makes sense when net profit consistently exceeds $70,000/year.

Should I form my LLC before or after getting my first property?

Before, if possible. Having the LLC in place before you sign leases or purchase property means everything starts clean, the lease is in the LLC’s name, the bank account is established, and the operating agreement is filed. If you already have a property, form the LLC now and transition your operations going forward. For owned properties, consult your lender about transferring the title to avoid triggering the due-on-sale clause.

How much does it cost to maintain an LLC annually?

Annual costs depend on your state. Arizona and Ohio charge nothing. California charges $800 per year in franchise tax regardless of revenue. Most states fall in the $25–$300 range for annual reports. Add $50–$300 for a registered agent service and $500–$1,500 for CPA services. Total annual maintenance for most hosts: $500–$2,500.

Should I use an LLC formation service or file myself?

For a single-state, single-member LLC, filing yourself through the Secretary of State website is straightforward and saves $100–$500 in service fees. Formation services like Northwest Registered Agent, ZenBusiness, or LegalZoom are worth it if you want a registered agent, compliance reminders, and operating agreement templates bundled, especially for multi-state setups.

What happens if I don’t form an LLC and get sued?

Without an LLC, you’re operating as a sole proprietor by default. The plaintiff can pursue your personal bank accounts, investments, home equity (in states without strong homestead exemptions), vehicles, and other personal property. A $50,000 lawsuit settlement comes directly out of your pocket. An LLC for your airbnb rental business is the line between losing business assets and losing everything.

Can my LLC own real estate?

Yes. An LLC can hold title to a rental property. But be aware that transferring an existing mortgage into an LLC can trigger the due-on-sale clause. For properties with mortgages, many hosts keep the title in their personal name and operate the rental business through the LLC using a management agreement. For properties purchased with DSCR loans, the lender often allows (or requires) LLC ownership from the start.

Do I need a separate LLC for each state I operate in?

Not necessarily. You can register your home-state LLC as a “foreign LLC” in any other state where you have properties. However, if you have significant assets in multiple states, separate LLCs can simplify administration and provide cleaner liability isolation. Run the cost comparison with your CPA, sometimes the fees for foreign registration exceed the cost of a new LLC in that state.

The Bottom Line: Protect Yourself Before You Need To

Forming an LLC for your airbnb business isn’t about paperwork. It’s about protecting the life you’re building. The hosts who skip this step are gambling that nothing will ever go wrong. And in a business where strangers sleep in your properties every night, that’s a bet with terrible odds.

The process takes about three hours of actual work. The cost ranges from $50 to $500 depending on your state. And the personal liability protection? That pays for itself the first time a guest threatens legal action.

Whether you’re just starting with rental arbitrage or scaling to a multi-property portfolio, an LLC should be among your first moves. Pair it with a dedicated business bank account, proper insurance, and a tax professional who understands short-term rentals, and you’ve built the kind of business structure that supports real growth.

Ready to build your STR rental business the right way? Start with our complete rental arbitrage guide, run the numbers with our Airbnb profit calculator, and check out how much Airbnb hosts actually make to set realistic income targets for your first (or next) property.