An Airbnb business plan is a written document that maps your short-term rental strategy from first property to full portfolio. It covers your market, finances, operations, and growth timeline. Whether you’re pitching a landlord for your first rental arbitrage unit or applying for a DSCR loan to buy your tenth property, this is the document that separates operators from hobbyists.

I’ve reviewed dozens of airbnb business plan template options floating around online. Most are bloated MBA exercises stuffed with jargon nobody reads. The SBA’s business plan guide provides a solid general framework, but for Airbnb hosting you need something far more targeted. Your plan needs to do one thing: prove the math works. A landlord doesn’t care about your mission statement. They care that you’ll pay rent on time, keep the property in better shape than a long-term tenant, and carry proper insurance. A lender wants to see financial projections that survive scrutiny. A partner wants proof you’ve done the homework.

This guide walks through every section your own business plan needs, with specific examples built around rental arbitrage, the model where you lease properties and re-list them on Airbnb for profit without buying real estate. I’ve included a sample financial projection template you can adapt, a downloadable free PDF template, and the exact framework thousands of 10XBNB students use to secure landlord approval on their first (and fifteenth) airbnb property.

Why You Need an Airbnb Business Plan (Even If You Think You Don’t)

Here’s a number that should get your attention: landlords who receive a professional business plan approve arbitrage proposals at roughly 3x the rate of those who get a verbal pitch. That’s not a guess. It’s what we’ve seen across thousands of 10XBNB students pitching landlords nationwide.

But a business plan isn’t just a landlord persuasion tool. It forces you to confront the real numbers before you sign a lease. I’ve watched people skip this step, sign a 12-month lease on a property that looked “perfect,” and realize two months later that their cleaning costs eat 40% of their revenue because the unit has four bathrooms and white carpet everywhere.

A business plan protects you from yourself.

Think about it this way: a 12-month lease at $1,400/month is a $16,800 commitment. Add furniture at $4,000–$5,000 and you’re looking at over $20,000 on the line for a single unit. Would you write a $20,000 check without running the numbers first? That’s exactly what signing a lease without a business plan is.

Here’s who’s going to want to see it:

- Landlords and property managers – Your plan shows them you’re a professional operator, not someone who watched a YouTube video last Tuesday. It addresses their concerns before they voice them: insurance, guest screening, noise policies, property maintenance.

- Lenders and investors – If you need to secure funding for furniture packages or capital to scale, lenders want projections. Not vibes. Cash flow statements, break-even timelines, and realistic occupancy assumptions. Banks offering DSCR loans for Airbnb operators require documented revenue potential.

- Business partners – Splitting responsibilities? The plan defines who does what, how profits are divided, and what happens when things go sideways.

- Yourself – Seriously. Writing it down reveals gaps in your thinking. If you can’t explain your pricing strategy in two paragraphs, you don’t have one.

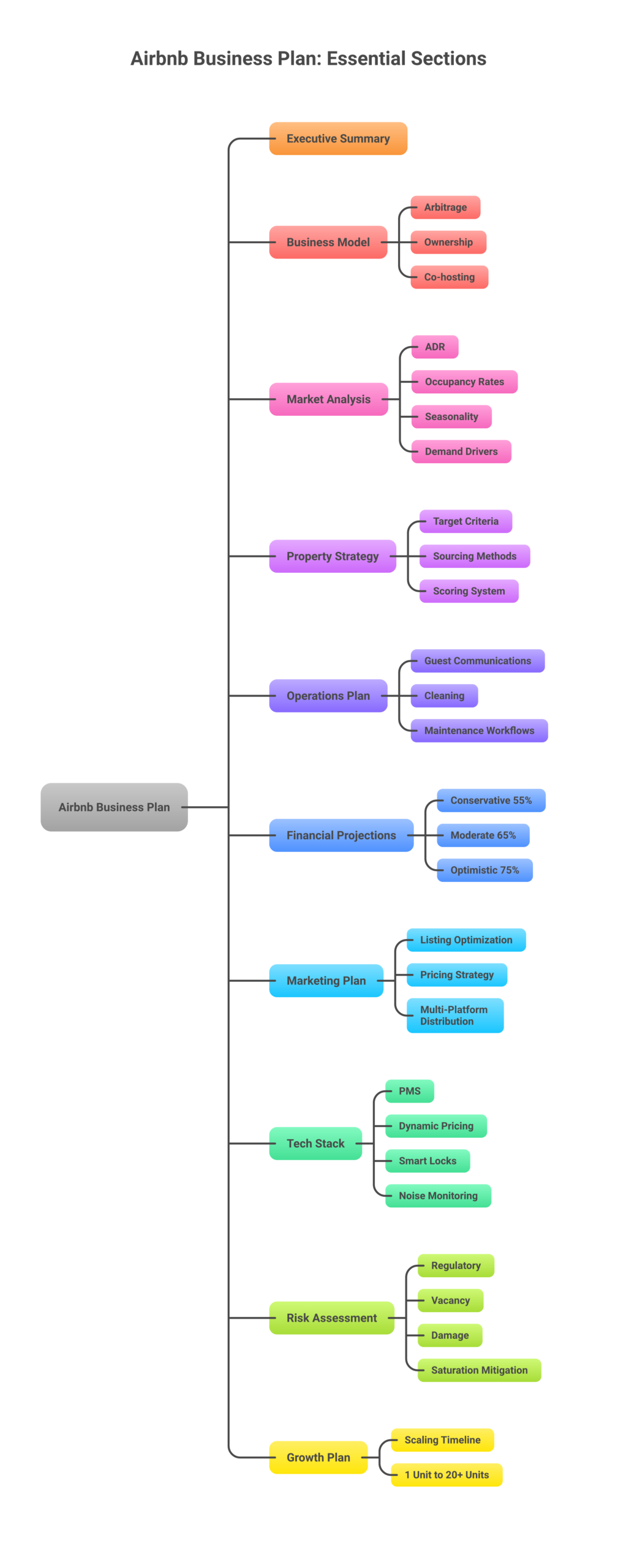

The 10 Essential Sections of a Successful Airbnb Business Plan

Every section below serves a specific purpose. Skip one and you’ll either lose credibility with whoever reads it or miss a critical blind spot in your own business strategy. I’ll walk through each with examples tailored to rental arbitrage operators, though the framework works for any vacation rental business model.

1. Executive Summary

Write this last. The executive summary is a one-page snapshot of everything else in the plan. If someone reads only this page, they should understand your business model, target market, financial headline numbers, and competitive advantage.

What to include:

- Business name and legal structure (LLC is standard for STR operators, see our complete Airbnb LLC guide)

- Business model in one sentence: “We lease residential properties in [market] and operate them as professionally managed short-term rentals on Airbnb, Vrbo, and direct booking channels.”

- Target market and property type (e.g., “2-3 bedroom apartments in Nashville’s East Side, targeting weekend leisure travelers and business travelers“)

- Financial summary: projected revenue, expenses, and net profit per unit

- Growth timeline: “3 units by month 6, 10 units by month 18”

- Your competitive edge, what are your unique selling points? (professional operations, dynamic pricing, superior guest experience)

Keep it under 500 words. If your executive summary is three pages, you’re writing an essay, not a summary. A few tips: lead with the opportunity size, follow with your model, and close with the ask (if applicable). Landlords spend maybe 90 seconds on this page, so every sentence needs to earn its spot.

2. Business Model

This section explains how your airbnb business makes money. For most people reading this, that’s rental arbitrage. But your plan should specify which model you’re using and why.

The four primary Airbnb business models:

| Model | Capital Required | Risk Level | Scalability | Best For |

|---|---|---|---|---|

| Rental Arbitrage | $3,000–$7,000/unit | Medium | High | Scaling fast without buying property |

| Property Ownership | $50,000–$200,000+ | Lower (equity) | Lower | Long-term wealth building |

| Co-Hosting | $0–$500 | Low | High | Starting with zero capital |

| Hybrid | Varies | Medium | High | Diversified portfolio |

For rental arbitrage specifically, explain the mechanics: you sign a lease, furnish the unit, list it on short-term rental platforms, and capture the spread between your monthly lease payment and your nightly rental income. Your startup costs per unit typically run $3,000 to $7,000 depending on market and property size.

Include your revenue model:

- Primary income: Nightly rates × occupancy

- Secondary income: Cleaning fees, early check-in/late checkout fees, pet fees

- Platform mix: What percentage from Airbnb vs. Vrbo vs. Direct bookings

Be specific about why you chose your model. If you’re going with arbitrage, explain the advantages: lower capital barrier, faster scaling, ability to test key markets without long-term real estate commitments. Investors and landlords respect operators who can articulate why they’ve chosen their approach, not just what it is. That clarity is what turns a generic business plan template into a persuasive document.

3. Industry Analysis and Market Research

This is where amateur plans fall apart. Saying “Nashville is a great market for Airbnb” tells nobody anything. Your industry analysis needs data, specific, verifiable data about the short term rental market you’re entering.

What to research:

- Average Daily Rate (ADR) – What are comparable listings charging per night? Use AirDNA, Mashvisor, or manual Airbnb searches filtered to your target property type.

- Occupancy Rate – Market-wide occupancy for your property type. Be conservative. If AirDNA shows 72% average occupancy, use 60-65% in your projections.

- Revenue Per Available Night (RevPAN) – ADR × Occupancy Rate. This is the number that actually matters for your financial plan.

- Seasonality – Most markets have peaks and valleys. Map them. A beach town might hit 90% occupancy in summer and 30% in winter. Your cash reserves need to cover the valleys.

- Supply trends – Is the number of listings in your market growing 5% annually or 25%? Rapid supply growth compresses rates and occupancy.

- Regulatory environment – Is your city friendly to STRs or actively restricting them? Check local ordinances, licensing requirements, and pending legislation. Our Airbnb regulations by state guide covers this state by state.

- Demand drivers – What brings people to your market? Conventions, tourism, universities, hospitals, corporate offices? Diverse demand drivers equal more stable occupancy.

4. Competitor Analysis

Your competitor analysis deserves its own section. Not a throwaway paragraph buried in market research. Pull 10-15 comparable listings (same bedroom count, similar location, comparable quality) and analyze their pricing, guest reviews, and occupancy patterns. What are they doing well? Where are the gaps you can exploit?

Here’s a framework I use: screenshot the top 20 listings in your target area, sorted by relevance. Drop them into a spreadsheet. Track their nightly rate, review count, average rating, response time, and amenities offered. After 30 minutes of this exercise, you’ll know your market better than 95% of people entering it.

Competitor comparison template:

| Listing | Bedrooms | Nightly Rate | Reviews | Rating | Superhost? | Key Amenity Gap |

|---|---|---|---|---|---|---|

| Comp #1 | 2BR | $145 | 87 | 4.92 | Yes | No workspace |

| Comp #2 | 2BR | $128 | 42 | 4.85 | No | Poor photos |

| Comp #3 | 2BR | $155 | 134 | 4.96 | Yes | No EV charger |

| Comp #4 | 2BR | $119 | 23 | 4.71 | No | No smart lock |

| Comp #5 | 2BR | $138 | 68 | 4.89 | Yes | Dated furniture |

This analysis reveals where you can differentiate. If no competitor offers a dedicated workspace, that’s your angle for attracting business travelers. If everyone has generic IKEA furniture, invest in design that photographs well. The gaps in your competitor analysis become the unique selling points of your airbnb listing.

5. Target Customer Profiles

Who are your target customers? “Anyone who wants to stay” is not an answer. Different guest segments have different needs, booking patterns, and willingness to pay. Your business plan should identify 2-3 primary guest personas and explain how you’ll attract customers in each segment.

Common guest segments for short-term rentals:

- Leisure travelers and families – Book weekends and holidays. Want full kitchens, parking, and kid-friendly amenities. Price-sensitive but book longer stays.

- Business travelers – Book midweek. Need fast WiFi (50+ Mbps), a workspace, and proximity to commercial districts. Less price-sensitive, shorter average stays.

- Remote workers and digital nomads – Book 7-30+ days. Want reliable internet, ergonomic workspace, and a walkable neighborhood. High-value guests because they reduce turnover costs.

- Event attendees – Concerts, conferences, sports events. Book months in advance. Willing to pay premium rates during peak events. Predictable demand if your market has a strong event calendar.

- Insurance and relocation stays – People displaced by fire, flood, or renovations. Often 30-90 day bookings paid by insurance companies at consistent rates. Low maintenance, high occupancy.

Your property’s amenities, pricing, and marketing should align with your ideal customers. If you’re targeting business travelers, invest in a standing desk and a Nespresso machine. Not a hot tub. If families are your bread and butter, get a Pack ‘n Play, highchair, and baby-proofing supplies. The mismatch between property amenities and guest segment is one of the most common (and most expensive) mistakes new operators make.

6. Property Strategy

This section answers: what kind of properties will you target, where, and how will you find them?

Define your property criteria:

- Bedroom count (2-3 bedrooms typically offers the best revenue-to-rent ratio for arbitrage)

- Maximum monthly rent (your rent should be no more than 30-35% of projected monthly revenue at conservative occupancy)

- Target neighborhoods (proximity to demand drivers, walkability, safety scores)

- Property features that boost bookings (parking, washer/dryer in-unit, outdoor space, dedicated workspace)

- Deal-breakers (HOAs that prohibit STRs, no-pet buildings in pet-friendly markets, units above the 3rd floor without an elevator)

Sourcing strategy:

- Direct outreach to property management companies

- Zillow, Apartments.com, Facebook Marketplace for listings

- Networking with real estate agents who specialize in investor-friendly properties

- Driving target neighborhoods and contacting “For Rent” signs directly

Your property strategy should also address your lease structure, specifically the addendum that grants permission for short-term subletting. This is non-negotiable. Never operate without written permission from your landlord.

One detail many plans miss: a property scoring system. Create a simple checklist that scores each potential property on a 1-10 scale across categories like rent-to-revenue ratio, location quality, amenity mix, parking availability, and landlord flexibility. This turns subjective decisions into objective comparisons. When you’re evaluating three potential units at once, the scoring system tells you which one to pursue first. Our guide on the best cities for Airbnb arbitrage can help you narrow down which key markets to target.

7. Operations Plan

Operations is where most airbnb business ventures quietly fail. Not because the market was wrong or the pricing was off, but because the owner couldn’t handle running things on a day to day basis – 24/7 guest communications, turnover logistics, and maintenance calls at 3 AM.

Guest communication workflow:

- Booking confirmation (automated within 5 minutes)

- Pre-arrival message with check-in instructions (sent 48 hours before)

- Day-of check-in confirmation (automated at 2 PM)

- Mid-stay check-in for stays of 3+ nights

- Checkout instructions (sent morning of departure)

- Post-checkout review request

Cleaning and turnover:

- Primary cleaning team and backup team (always have a backup)

- Turnover checklist (standardized across all units)

- Restocking protocol for consumables

- Quality inspection process

- Same-day turnover capability (checkout at 11 AM, check-in at 3 PM)

Maintenance:

- Preventive maintenance schedule (HVAC filters, deep cleaning, mattress rotation)

- Emergency repair contacts (plumber, electrician, locksmith, appliance repair)

- Response time standards (urgent issues: 1 hour; non-urgent: 24 hours)

The operations plan is also where you address your role versus your team’s role. An experienced airbnb host running one unit handles everything solo. By five units, you need to delegate cleaning coordination and guest messaging. By ten, you shouldn’t be handling any day-to-day operations personally. Map out at which unit count you’ll hire for each role: cleaning coordinator, virtual assistant for guest communications, local property inspector, and eventually an operations manager. Documenting your ongoing expenses for each team member keeps your financial plan honest.

8. Marketing Plan and Promotional Strategies

Your marketing plan isn’t about running Facebook ads (at least not initially). For Airbnb arbitrage, marketing is primarily about listing optimization, making your airbnb listing appear higher in search results and convert browsers into bookers. The best promotional strategies for a vacation rental operator cost almost nothing beyond time.

Listing optimization:

- Professional photography (non-negotiable; $150–$300 per shoot)

- Title optimization with location-specific keywords

- Description writing that sells the experience, not just the features

- Strategic pricing for the first 30 days to build reviews and ranking

- Instant Book enabled (Airbnb’s algorithm rewards this)

Pricing strategy:

- Dynamic pricing tool (PriceLabs, Beyond, Wheelhouse)

- Seasonal adjustments mapped to your market analysis

- Event-based pricing for conferences, festivals, sports events

- Minimum stay requirements (varies by market and season)

Multi-platform distribution:

- Airbnb (primary, typically 60-70% of bookings)

- Vrbo (secondary, 15-25%, especially for families)

- Booking.com (growing for STR, 5-15%)

- Direct booking website (long-term play for reducing platform fees)

Review generation strategy:

Positive guest reviews are the single most valuable marketing asset in airbnb hosting. Your first 10 stays should be strategically priced below market to generate a burst of positive reviews quickly. After that:

- Automated review requests post-checkout

- Respond to every review (positive and negative)

- Address complaints publicly and resolve them privately

- Maintain Superhost status (4.8+ rating, 90%+ response rate, fewer than 1% cancellations)

9. Tech Stack

Technology is what separates a person managing 3 units from their phone at 2 AM from an operator running 15 units who sleeps through the night. Your business plan should outline the tools you’ll use and what they cost.

| Category | Tool Examples | Monthly Cost | Why It Matters |

|---|---|---|---|

| Property Management System | Hospitable, Guesty, Hostaway | $20–$100/unit | Calendar sync, automated messaging, multi-platform management |

| Dynamic Pricing | PriceLabs, Beyond, Wheelhouse | $20–$30/listing | Automated rate optimization based on demand |

| Smart Locks | Schlage Encode, Yale Assure, August | $0 (one-time $150–$250) | Remote access, unique codes per guest, no key handoff |

| Noise Monitoring | Minut, NoiseAware | $10–$15/device | Party prevention, neighbor protection, landlord peace of mind |

| Guest Communication | Hospitable, Hostfully, TouchStay | $5–$15/listing | Digital guidebooks, automated messages |

| Accounting | QuickBooks, Xero, Stessa | $0–$30/month | Expense tracking, tax preparation, financial reporting |

Budget $50–$150 per unit per month for your full tech stack. That’s a rounding error compared to the operational headaches these tools eliminate. Include these ongoing expenses in your financial projections so there are no surprises.

10. Risk Assessment

Every investor, lender, and sharp landlord will look for this section. If it’s missing, they’ll assume you haven’t thought about what can go wrong. And in short-term rentals, plenty can go wrong.

Key risks and mitigation strategies:

Regulatory risk:

- Risk: City passes new STR restrictions or bans

- Mitigation: Monitor local legislation, diversify across multiple markets, maintain relationships with local STR advocacy groups, structure leases with early termination clauses tied to regulatory changes

Vacancy risk:

- Risk: Occupancy drops below break-even during slow seasons

- Mitigation: 3-month cash reserve per unit, mid-term rental pivot strategy (30+ day stays at reduced rates), diversified platform distribution

Property damage risk:

- Risk: Guest damages property beyond security deposit

- Mitigation: Airbnb Host Protection ($1M), supplemental STR insurance (Proper, CBIZ), security deposit or damage waiver, guest screening

Landlord risk:

- Risk: Landlord terminates lease or sells property

- Mitigation: 12-24 month lease terms, right of first refusal clause, diversified portfolio (no single landlord controls more than 30% of units)

Market saturation risk:

- Risk: Too many competing listings drive down rates

- Mitigation: Superior guest experience (4.9+ rating), professional photos, dynamic pricing, unique property amenities, multi-platform presence

Economic downturn risk:

- Risk: Recession reduces travel demand

- Mitigation: STR historically outperforms hotels in downturns (budget-conscious travelers prefer home-like accommodations). Mid-term rental pivot for corporate housing, traveling nurses, and insurance displacement stays. Maintain cash reserves equal to 3 months of all lease obligations.

Arbitrage-Specific Business Plan Considerations

If you’re building a plan specifically for rental arbitrage, there are nuances that generic business plan template options completely miss. A successful airbnb business plan for arbitrage looks different from one written for property owners.

Lease structure matters more than location. A fantastic property with a terrible lease is a terrible deal. Your plan should address:

- Required lease addendum for STR permission (non-negotiable, never operate on a verbal agreement)

- Lease term alignment with your growth strategy (12 months minimum, 24 months preferred)

- Early termination provisions in case of regulatory changes

- Rent escalation caps for renewal periods

- Maintenance responsibility split between you and the landlord

Startup capital per unit is your constraint. Unlike property ownership, arbitrage requires relatively low capital per unit ($3,000–$7,000 for furniture, supplies, and first/last month rent), but you need that capital liquid and available. Your plan should show the initial investment breakdown:

- Exact upfront costs per unit type (studio, 1BR, 2BR, 3BR)

- Capital source (savings, credit, investor, revenue from existing units)

- Payback period per unit (typically 2-4 months at moderate occupancy)

- Reinvestment strategy (what percentage of profits funds the next unit)

The landlord is your most important stakeholder. Your business plan should have a specific section, or at minimum, a supplementary document, designed for landlord presentations. More on this below.

Furniture is a depreciating asset. This catches new operators off guard. That $5,000 furniture package won’t last forever. Mattresses need replacing every 2-3 years in high-turnover STR environments. Sofas get worn. Dishes break. Your financial projections should include a monthly furniture replacement reserve, typically $50–$100 per unit per month depending on quality and turnover frequency.

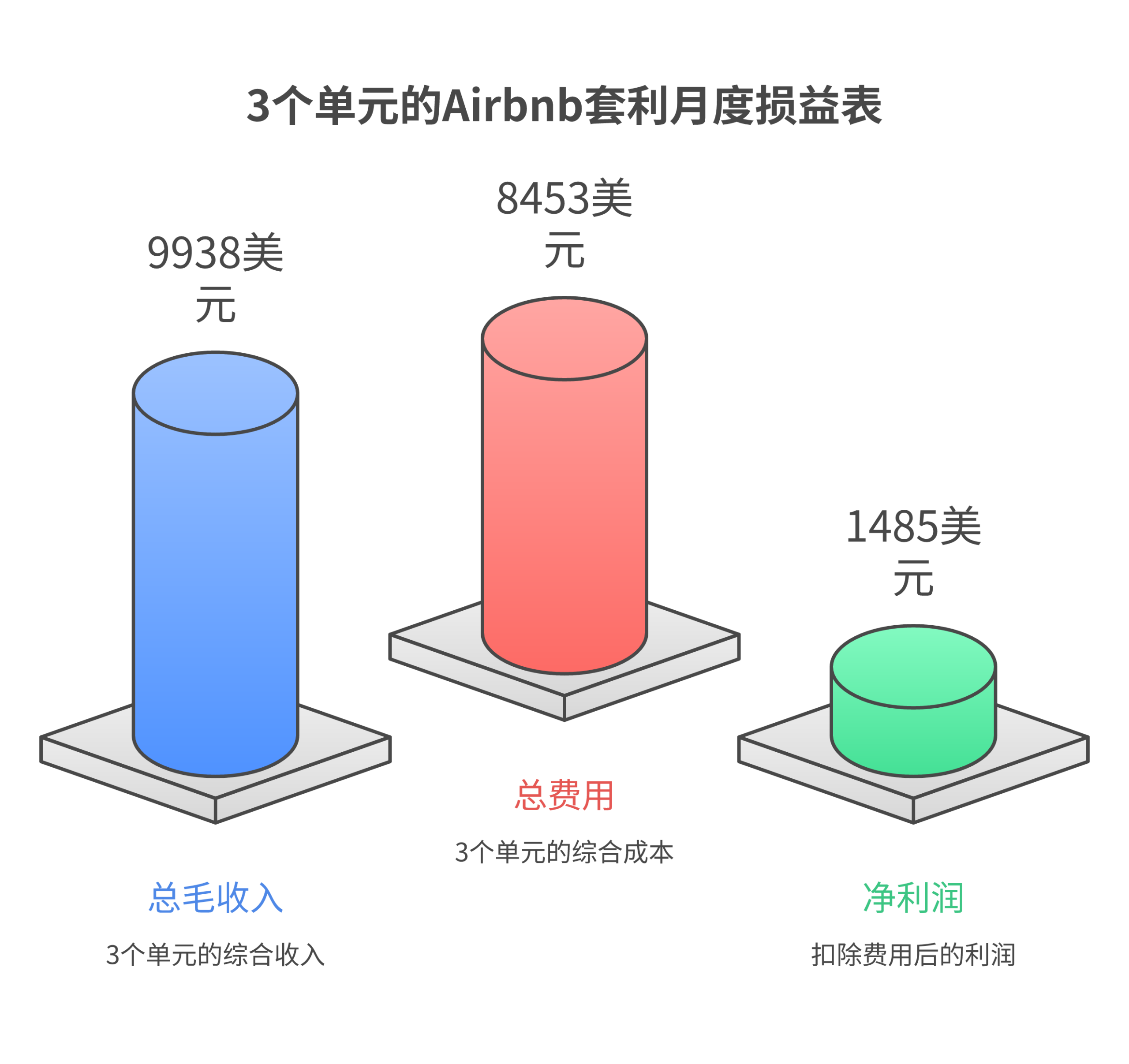

Financial Projections Template: Sample P&L for 3 Arbitrage Units

Here’s a realistic monthly projection for a 3-unit arbitrage portfolio in a mid-size US market. These numbers use conservative assumptions, adjust them for your specific market. Your financial plan is only as good as your assumptions, so I’ve intentionally built this as a stress test rather than a best-case fantasy.

Assumptions:

- Market: Mid-size US city (population 200K–500K)

- Property type: 2-bedroom apartments

- Average monthly rent: $1,400/unit

- Average nightly rate: $135

- Occupancy: 65% (conservative-moderate)

- Average turnovers per month: 8 per unit

Monthly Revenue (3 Units)

| Revenue Line | Per Unit | 3 Units |

|---|---|---|

| Nightly revenue (65% × 30 days × $135) | $2,633 | $7,898 |

| Cleaning fees collected ($85 × 8 turnovers) | $680 | $2,040 |

| Gross Revenue | $3,313 | $9,938 |

Monthly Expenses (3 Units)

| Expense Line | Per Unit | 3 Units |

|---|---|---|

| Rent | $1,400 | $4,200 |

| Platform fees (Airbnb 3% host-only) | $99 | $298 |

| Cleaning costs ($70 × 8 turnovers) | $560 | $1,680 |

| Utilities (electric, gas, water, internet) | $200 | $600 |

| Supplies and consumables | $75 | $225 |

| Software/tech stack | $85 | $255 |

| Insurance (STR policy) | $125 | $375 |

| Furniture replacement reserve | $75 | $225 |

| Total Expenses | $2,619 | $7,858 |

Monthly Profit Summary

| Metric | Per Unit | 3 Units |

|---|---|---|

| Net Operating Income | $694 | $2,080 |

| Annual Net Profit | $8,328 | $24,960 |

| Break-even Occupancy | ~52% | |

| Cash-on-Cash Return (Year 1, $5,500 startup/unit) | ~151% | |

The break-even occupancy of 52% means you have a 13-percentage-point cushion below your projected 65% occupancy. That’s your margin of safety. If your break-even occupancy is above 60%, the deal is too tight. One bad month and you’re underwater.

For an interactive version of this analysis, plug your actual numbers into our Airbnb profit calculator.

One more thing: include a month-by-month cash flow projection for Year 1. Annual averages hide seasonal pain. A landlord or investor needs to see that you’ve budgeted for the slow months. Not just the peaks. Show Month 1 (negative due to startup costs and ramp-up), the break-even month, and the steady-state months. This level of detail separates your plan from every cookie-cutter plan template online. For a thorough tax strategy, see our Airbnb tax guide.

How to Write Your Mission Statement and Executive Summary

Your mission statement doesn’t need to sound like it was pulled from a Fortune 500 annual report. For a vacation rental business, keep it grounded and specific. A good mission statement answers three questions in 1-2 sentences: What do you do? Who do you serve? What makes you different?

Examples that work:

“We provide professionally managed short-term rentals in Nashville’s East Side, offering business travelers and weekend visitors a home-like experience with hotel-level reliability.”

“Our mission is to lease, furnish, and operate Airbnb properties in mid-size Southern markets, generating consistent cash flow through superior guest experience and dynamic pricing.”

Examples that don’t work:

“We aim to be the premier provider of innovative hospitality solutions in the sharing economy space.” (This says nothing. What market? What model? What guest segment?)

Pair your mission statement with the executive summary to give any reader, landlord, lender, or partner, a 60-second understanding of your own business. If they need more detail, that’s what the other nine sections are for.

Presenting Your Business Plan to Landlords

Everything I’ve covered above is for you – your strategy, your numbers, your roadmap. But when you’re presenting to a landlord, you need a streamlined version that addresses their specific concerns. A landlord doesn’t care about your 5-year growth plan. They care about three things: Will rent get paid? Will the property be maintained? Will there be problems with neighbors?

The landlord presentation should include:

- Professional introduction – Who you are, your experience (even if you’re new, frame it: “I’ve completed 80 hours of training through 10XBNB’s professional STR operator program and carry $1M in liability insurance”)

- Business model overview – One paragraph explaining rental arbitrage simply: you furnish the unit, manage it professionally, and your rent is guaranteed because your revenue supports it

- Insurance documentation – Show proof of liability coverage. This is the #1 concern landlords have

- Guest screening policy – Explain your screening criteria (no same-city bookings, verified ID, minimum account age, positive review history)

- Noise and party prevention – Explain noise monitoring devices, house rules, and your responsive approach to complaints

- Property maintenance commitment – Quarterly professional cleaning, preventive maintenance schedule, dedicated maintenance budget

- Financial snapshot – Simplified P&L showing your revenue comfortably covers rent (show the conservative scenario)

- References – If you have existing landlords, include their testimonials. If you’re brand new, offer a higher security deposit or a trial period

Keep the landlord version to 3-5 pages. Your full business plan might be 15-20 pages. The landlord version is the highlight reel. Think of it like an executive summary tailored to a specific audience.

How to Secure Funding with Your Business Plan

Whether you need to secure funding from a bank, private investor, or business credit line, your plan is the centerpiece of that conversation. Here are a few tips on using your plan to access capital for your profitable venture:

For traditional bank loans and SBA loans:

- Banks want to see conservative financial projections with realistic assumptions

- Include personal financial statements alongside business projections

- Show 3 years of projected income statements, balance sheets, and cash flow

- Demonstrate industry knowledge through your industry analysis section

- SBA 7(a) loans can fund STR furniture and working capital at favorable rates

For DSCR loans (property purchases):

- DSCR lenders focus on property cash flow, not your personal income

- Your business plan’s financial projections prove the property can service its debt

- Include comparable rental income data from AirDNA or local comps

- Our DSCR loans for Airbnb guide covers qualification requirements in detail

For private investors:

- Investors care about return on investment and risk mitigation

- Your plan’s financial plan section is the centerpiece, especially cash-on-cash return projections

- Show the initial investment required, projected returns, and payback period

- Address upfront costs transparently, nothing kills investor trust faster than hidden expenses

Business Plan Mistakes That Kill Deals

After reviewing hundreds of student business plans, I see the same mistakes tank otherwise promising proposals. Here are the most common, and most fatal:

- Using market-wide averages as your projections. AirDNA says the average ADR in your market is $180. Great. But if you’re leasing a studio apartment and the average is skewed by luxury homes, your actual ADR might be $95. Use comps that match your property type, not market averages.

- Ignoring seasonality. Projecting 70% occupancy year-round in a market that drops to 35% in winter is fantasy math. Build month-by-month projections that reflect seasonal demand curves.

- Forgetting the ramp-up period. New listings don’t hit full stride on Day 1. Expect 30-50% occupancy for the first 60 days while you build reviews and ranking. Your cash flow model needs to account for this.

- No contingency budget. Something will go wrong. A guest will break a TV. A pipe will burst. Your cleaning team will cancel on a Friday night. Budget 5-10% of revenue for unexpected expenses.

- Overly complex financial models. If your spreadsheet has 47 tabs and requires a finance degree to follow, you’ve missed the point. Clarity beats complexity. A landlord should understand your numbers in 5 minutes.

- Copying a generic template without customizing it. Every business plan template available online is a starting framework, not a finished product. Landlords and lenders have seen them all. Customize every section with your specific market data, property details, and operational approach. That’s what transforms a template into a successful airbnb business plan.

- No risk section. If your plan doesn’t address what happens when things go sideways, readers assume you haven’t thought about it. The risk assessment is actually a credibility builder. It shows you’ve anticipated problems and have mitigation plans ready.

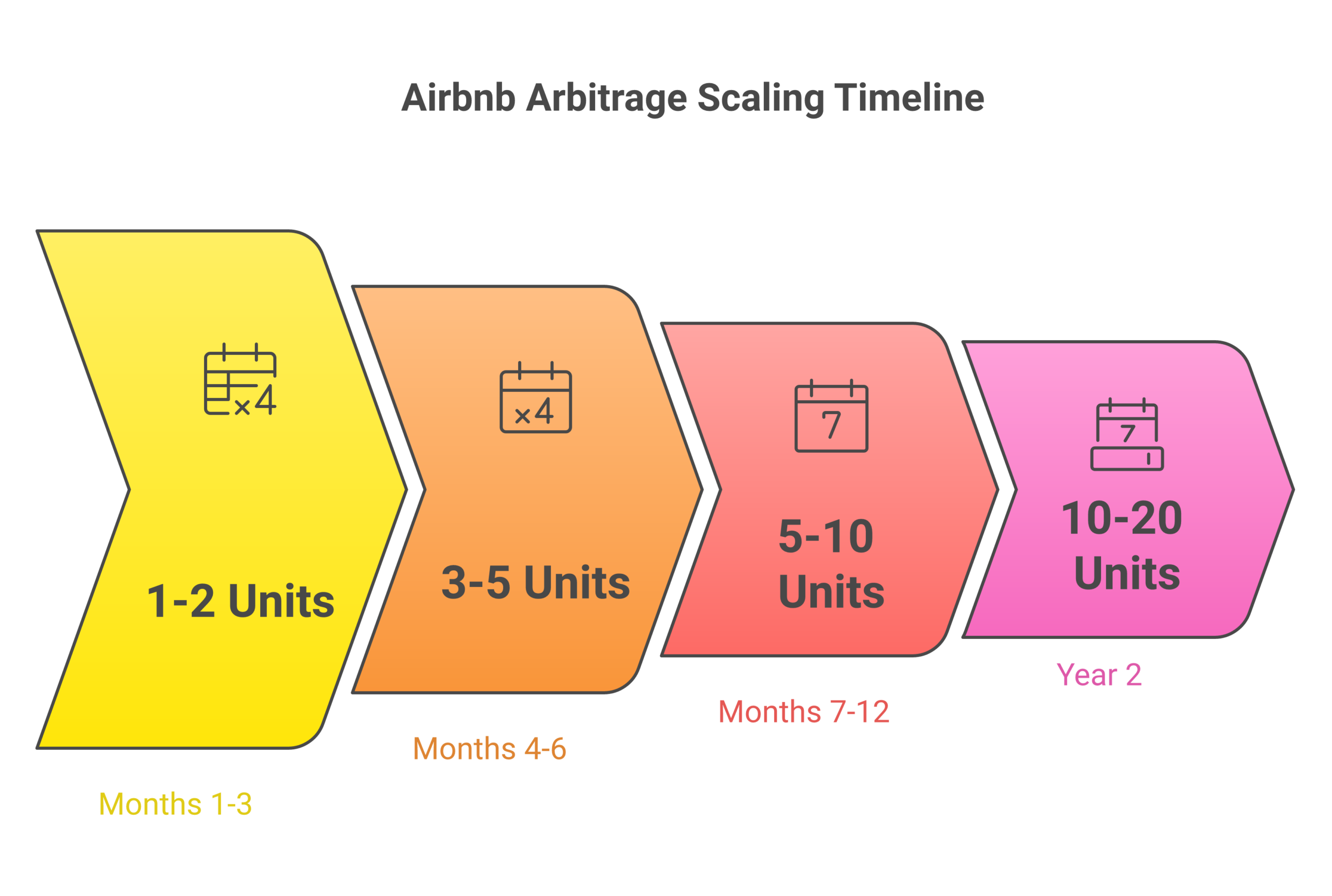

Growth Plan: Scaling From 1 Unit to a Full Portfolio

Your growth plan shows that you’re building a real business, not managing a side hustle. Map out a realistic timeline with specific milestones. Every successful airbnb business plan includes a clear path from first unit to a profitable venture that runs without you handling operations on a day to day basis.

Sample scaling timeline for rental arbitrage:

| Timeline | Units | Focus | Monthly Net Profit |

|---|---|---|---|

| Months 1-3 | 1-2 | Learn operations, build systems, establish cleaning team | $1,000–$2,500 |

| Months 4-6 | 3-5 | Systemize, hire VA for guest communication | $3,000–$6,000 |

| Months 7-12 | 5-10 | Add second market, build management team | $6,000–$15,000 |

| Year 2 | 10-20 | Multiple markets, full team, explore ownership | $15,000–$35,000 |

Growth prerequisites at each stage:

- 1 to 3 units: You can manage everything yourself. Focus on perfecting your systems and earning those first guest reviews.

- 3 to 5 units: You need a virtual assistant and a reliable cleaning team. Operations can’t depend entirely on you.

- 5 to 10 units: You need a property management system, standard operating procedures documented for every task, and at least one local team member.

- 10 to 20 units: You’re running a real business. Dedicated operations manager, multiple cleaning teams, and you should be spending 80% of your time on acquisition. Not operations.

Your growth plan should also address capital allocation. The most common scaling mistake is reinvesting 100% of profits into new units immediately. Instead, build a reserve first. A good rule: reinvest 60% of net profits into new unit acquisition, allocate 20% to cash reserves, and take 20% as owner distributions. Adjust the ratio as your portfolio stabilizes, but never scale into a position where one bad month threatens the entire portfolio.

An experienced airbnb host will tell you: the jump from 5 to 10 units is harder than the jump from 0 to 5. Not because the math changes, but because you’re transitioning from doing the work to managing people who do the work. That management layer needs to be in your plan.

Free Airbnb Business Plan Template (PDF Download)

I’ve compiled the framework from this guide into a downloadable free PDF template you can customize for your own business plan. It includes all 10 sections with fill-in prompts, a sample P&L spreadsheet, a landlord presentation template, and the property scoring checklist described above.

What’s included in the airbnb business plan template:

- 10-section plan outline with guided prompts for each section

- Financial projection spreadsheet (conservative/moderate/optimistic scenarios)

- Landlord presentation template (3-page version)

- Property scoring checklist

- Competitor analysis spreadsheet template

- Operations checklist covering guest communications, cleaning, and maintenance

- Startup cost calculator for your initial investment

To get the template, join the 10XBNB community where you’ll also gain access to our full library of resources, including the profit calculator, market research tools, and the exact scripts our students use to pitch landlords successfully.

How Much Does It Cost to Start? Understanding Your Initial Investment

Before you can write convincing financial projections, you need a clear picture of your upfront costs. The initial investment for an Airbnb arbitrage unit varies by market and property size, but here’s what to budget:

| Cost Category | Studio/1BR | 2BR | 3BR |

|---|---|---|---|

| First month’s rent | $800–$1,200 | $1,200–$1,800 | $1,500–$2,500 |

| Security deposit | $800–$1,200 | $1,200–$1,800 | $1,500–$2,500 |

| Furniture package | $1,500–$2,500 | $2,500–$4,000 | $3,500–$5,500 |

| Kitchen and linens | $300–$500 | $400–$700 | $500–$900 |

| Smart lock and tech | $200–$350 | $200–$350 | $250–$400 |

| Professional photography | $150–$250 | $150–$300 | $200–$350 |

| Consumables and decor | $200–$400 | $300–$500 | $400–$700 |

| Total Upfront Costs | $3,950–$6,400 | $5,950–$9,450 | $7,850–$12,850 |

These numbers assume you’re buying new, mid-range furniture. Many operators cut costs 30-40% by sourcing from Facebook Marketplace, estate sales, and outlet stores. But don’t skimp on the mattress, linens, or photography. Those three items directly impact guest reviews, which directly impact your revenue.

For a more in-depth look at startup expenses, check out how much Airbnb hosts actually make and work backward from there.

Frequently Asked Questions

Do I need a business plan to start an Airbnb?

Technically, no. You can sign a lease and list a property without one. But operating without a plan is like driving cross-country without GPS. You might get there eventually, but you’ll waste time, money, and fuel. A business plan forces you to validate your market, stress-test your numbers, and identify risks before they become expensive surprises. If you’re doing rental arbitrage, you almost certainly need one to pitch landlords successfully.

How long should an Airbnb business plan be?

Your full own business plan should be 10-20 pages. The landlord-facing version should be 3-5 pages. More than 20 pages and you’re writing a thesis. Less than 5 pages and you’re writing a brochure. Focus on substance over length. Every page should contain information that matters to whoever’s reading it.

Can I use a free template or do I need a professional plan?

A free pdf template is a perfectly fine starting framework. The value isn’t in the template itself. It’s in the research and analysis you put into it. A professionally written plan from a consultant ($500–$2,000) might be worth it if you’re seeking six-figure funding, but for most arbitrage operators starting out, a well-researched DIY plan is more than sufficient.

What financial projections do landlords want to see?

Landlords care about one thing in your financial plan: can you pay rent reliably? Show your conservative-scenario financial projections (55% occupancy) and demonstrate that you still have positive cash flow after all expenses. Include the break-even occupancy rate and the size of your cash reserves. Landlords sleep better knowing you have a 3-month rent cushion.

How do I write a business plan with no Airbnb experience?

Focus on data, not anecdotes. You might not have personal hosting stories yet, but you can do thorough industry analysis, pull market data from AirDNA, analyze your competition, and present conservative financial projections. Frame your lack of experience as preparedness: “I’ve completed 80 hours of professional STR training and my projections are based on verifiable market data, not assumptions.” That’s more persuasive than an experienced airbnb host who wings their pitch without numbers.

Should I form an LLC before creating my business plan?

It depends on your timeline. If you’re still in the research phase, you can draft the plan first and form the LLC before you sign your first lease. Most operators form an LLC before their first booking for liability protection and tax benefits. Your business plan should specify your planned legal structure regardless of whether the entity already exists.

What’s the difference between a business plan and a pitch deck?

A business plan is a complete written document (10-20 pages). A pitch deck is a visual presentation (10-15 slides) designed for live presentations to investors or landlords. Many operators create both: the business plan for due diligence, and the pitch deck for meetings. The landlord presentation template I described above is essentially a simplified pitch deck.

How often should I update my business plan?

Review and update quarterly at minimum. Update immediately when: you enter a new market, add a significant number of units, your local regulations change, or market conditions shift materially. Your plan is a living document, not a one-time exercise. As you collect real data from your operations, replace assumptions with actuals. A plan built on 6 months of real performance data is 10x more convincing to a lender than one built on projections alone.

Build the Plan, Then Build the Business

Your airbnb business plan isn’t a homework assignment. It’s the foundation of a profitable venture. Every hour you spend writing it saves you from mistakes that cost 10x more in time and money. The plan forces clarity on your market, your numbers, your operations, and your growth path. It turns “I think this could work” into “here’s exactly why this works.”

Whether you’re using our airbnb business plan template or building one from scratch, the principles are the same: know your market, validate the math, plan for things to go wrong, and show anyone reading it that you’ve done the work. Landlords approve operators who come prepared. Lenders fund businesses with clear financial projections. Partners commit to people with a real plan.

Ready to build your own business? Start with the template, fill in your market data, run the numbers, and take the first step toward your first (or next) airbnb property. The business plan is step one. Everything else, finding properties, pitching landlords, furnishing units, welcoming your first guest, flows from this document.

For the full system on how to find, pitch, furnish, and scale rental arbitrage properties, start with our complete guide to launching your first Airbnb.