Short-term rental regulations in the United States are a moving target. Every state handles Airbnb differently — some roll out the red carpet for hosts, others slam the door shut with permit caps, night limits, and outright bans in residential zones. As someone who’s tracked these laws across all 50 states, I can tell you: the difference between picking a host-friendly state and a restrictive one can mean tens of thousands of dollars in annual revenue.

This guide breaks down Airbnb regulations state by state so you know exactly where you stand — whether you’re an investor buying property, a host renting out a spare room, or someone building a rental arbitrage business without owning real estate at all.

Understanding STR Regulations: What Every Host Needs to Know

Before we get into individual states, you need to understand the regulatory layers that affect every short-term rental in America. It’s not just one law — it’s a stack of them.

The Three Layers of STR Regulation

State-level laws set the broad framework. Some states (like Florida and Arizona) have passed preemption laws that prevent cities from outright banning STRs. Others (like New York) give cities full authority to regulate — or crush — short-term rentals however they want.

City and county ordinances are where most of the action happens. This is the layer that determines permit types, night caps, zoning restrictions, occupancy limits, and whether non-owner-occupied rentals are even allowed. Two cities in the same state can have wildly different rules.

HOA and lease restrictions add a third layer that catches a lot of new hosts off guard. Even if your city allows Airbnb, your HOA rules or lease agreement might prohibit it entirely. If you’re doing rental arbitrage, landlord approval is step one.

Common Regulatory Elements

Across the country, most jurisdictions now require some combination of these:

- Business license and/or STR permit — annual registration, often $50–$500

- Lodging/occupancy taxes — typically 6–15% on top of state sales tax

- Safety inspections — smoke detectors, fire extinguishers, egress windows

- Liability insurance — $500K–$1M minimum in some cities

- Registration number on listings — required by most platforms now

- Local contact person — someone who can respond within 30–60 minutes

- Occupancy limits — usually 2 per bedroom plus 2–4 additional guests

- Night caps — some cities limit STR days to 90–180 per year

The trend in 2026 is clear: more cities are requiring registration, more states are mandating platform tax collection, and enforcement is getting sharper with software that scrapes listings to catch unlicensed operators.

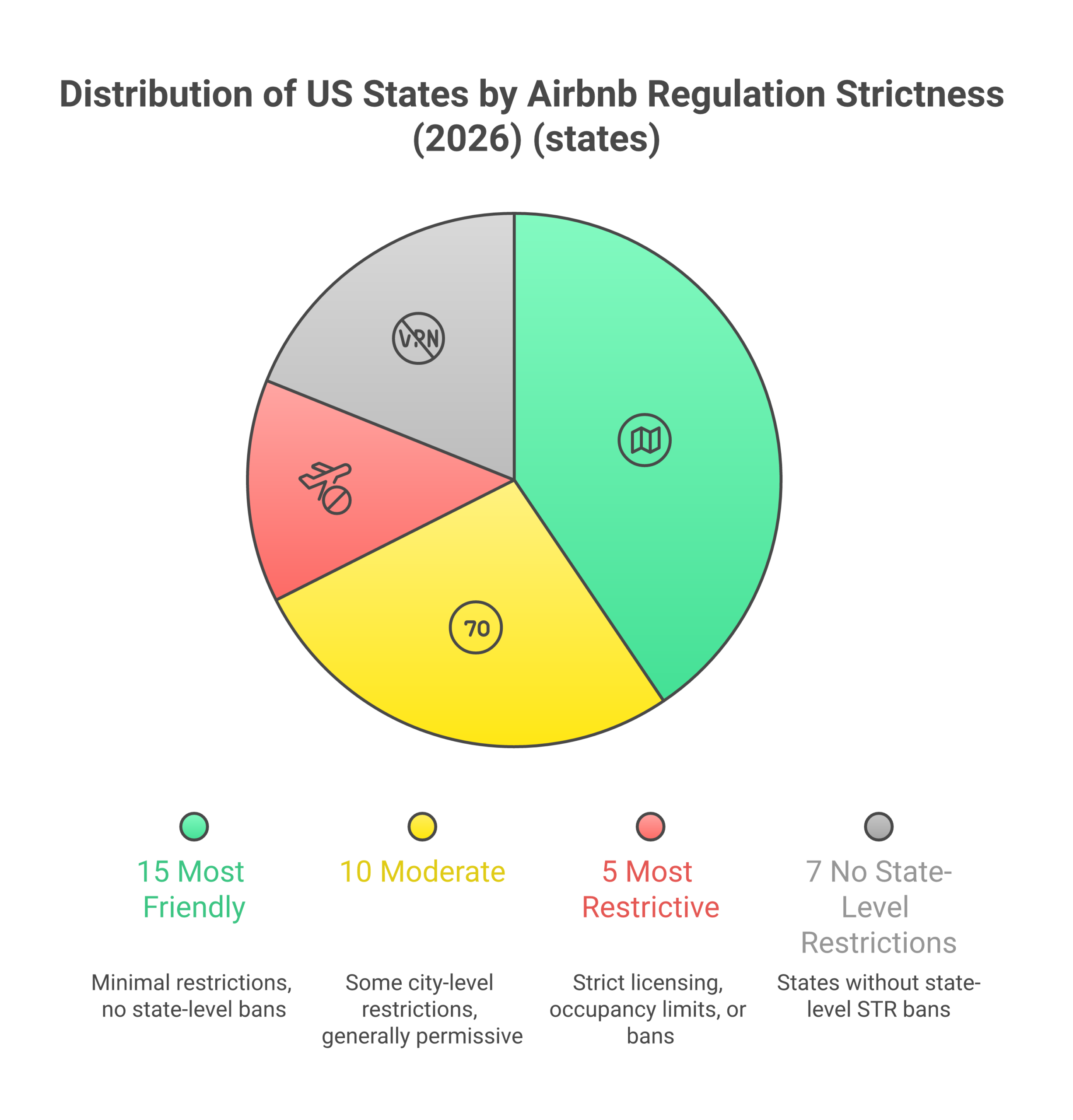

States Ranked by STR-Friendliness (2026)

I’ve ranked every state based on four factors: statewide preemption protecting hosts, typical permit costs and barriers, night caps or unit caps in major cities, and overall arbitrage viability. Here’s how they stack up.

| Tier | States | Why |

|---|---|---|

| Most Friendly | Florida, Texas, Arizona, Alabama, Tennessee, Georgia, South Carolina, Indiana | State preemption laws, low barriers, strong tourism demand, no state income tax (FL/TX/TN) |

| Host-Friendly | North Carolina, Ohio, Nevada, Missouri, Kentucky, Louisiana, Mississippi, Oklahoma, Arkansas, Idaho, Montana, Wyoming, Utah | Moderate regulations, reasonable permit costs, few night caps in major markets |

| Mixed | Colorado, Washington, Oregon, Virginia, Maryland, Michigan, Minnesota, Wisconsin, New Mexico, Connecticut, New Hampshire, Maine, Alaska, Hawaii, Rhode Island | Friendly at state level but restrictive in key cities; varies widely by jurisdiction |

| Restrictive | California, New York, Massachusetts, New Jersey, Illinois, Pennsylvania, Vermont, Delaware, Iowa, Nebraska, Kansas, West Virginia, North Dakota, South Dakota | Heavy local restrictions, night caps, primary residence requirements, high costs in major cities |

A word of caution: even “Most Friendly” states have individual cities with tough rules. Miami Beach, for example, bans most residential STRs despite Florida being the friendliest state overall. Always check city-level rules, not just state rankings.

State-by-State Guide: The Southeast

Florida

Florida is hands-down the most arbitrage-friendly state in 2026. And I don’t say that lightly.

The state’s preemption law (originally passed in 2011 and updated since) prevents local governments from outright banning vacation rentals that were operating before June 2011. Any property owner renting a full unit more than three times per calendar year for stays under 30 days must register with the Florida Department of Business and Professional Regulation (DBPR) and obtain a vacation rental license.

Permit costs: DBPR license runs $170 for initial application. Local permits vary — some counties charge nothing extra, others run $100–$300 annually.

Taxes: Florida charges state sales tax (6%) plus county-level tourist development taxes ranging from 2% to 6% depending on the county. No state income tax — that’s huge for profitability.

Key cities to watch:

- Miami Beach: The exception to Florida’s friendliness. Rentals under 30 days are illegal in most residential zones. Aggressive enforcement with fines starting at $20,000. Stick to commercially zoned properties or look elsewhere in Miami-Dade.

- Orlando/Kissimmee: Extremely STR-friendly. Osceola County has entire communities purpose-built for vacation rentals. Great for rental arbitrage.

- Tampa/St. Petersburg: Permits required, reasonable fees. Strong demand from both tourists and business travelers.

- Fort Lauderdale: Registration required but straightforward. Broward County’s tourist tax is 6%.

Arbitrage viability: Excellent. Florida’s combination of year-round tourism, state-level protections, no income tax, and massive demand makes it the top pick. Read our full breakdown of Florida rental arbitrage laws for city-by-city details.

Georgia

Georgia doesn’t have a statewide STR definition, which means regulations are entirely local. The good news? Most Georgia cities are reasonable about permits and don’t impose harsh restrictions.

Taxes: 4% state sales tax plus a $5 per-night state hotel-motel fee, plus local lodging taxes that vary by county (Savannah’s is higher than average).

Key cities:

- Atlanta: Hosts can operate a maximum of two properties total, including their primary residence. City business license required. The two-property cap limits arbitrage scaling but doesn’t kill it.

- Savannah: Registration required with caps on STR units in certain historic districts. Zoning rules are strict downtown but more flexible in surrounding areas.

- Augusta: Less regulated than Atlanta or Savannah. Growing market especially around Masters Tournament season.

Arbitrage viability: Good in Atlanta (within the 2-property cap) and surrounding suburbs. Savannah works for owner-operators more than arbitrage players. Check our Georgia state guide for more.

Alabama

Alabama flies under the radar, but that’s actually a good thing for hosts. The state has minimal regulation at the state level, and most cities haven’t imposed heavy restrictions yet. In 2024, Alabama passed a state preemption law preventing local governments from banning STRs outright, though cities can still regulate them.

Taxes: 4% state lodging tax plus varying local taxes. Some counties charge additional bed taxes, typically 1–3%.

Key cities:

- Gulf Shores/Orange Beach: Tourist-heavy areas with established vacation rental markets. Registration required, but the process is straightforward.

- Birmingham: Growing STR market with relatively few restrictions. Business license required.

- Huntsville: Booming tech economy driving short-term demand. Minimal STR-specific regulation.

Arbitrage viability: Strong, especially in coastal areas and Birmingham. Low cost of living plus light regulation equals good margins.

South Carolina

South Carolina’s regulatory landscape is a patchwork — no single statewide STR law, but Senate Bill S.442 (passed in 2025) created new statewide standards while preserving local authority. The state’s 7% accommodations tax applies to all stays, collected by the South Carolina Department of Revenue.

Key cities:

- Charleston: One of the more complex regulatory environments in the Southeast. STRs split into Commercial and Residential categories. Non-owner-occupied STRs only allowed in the Short Term Rental Overlay Zone. Owner-occupied STRs require the owner to be on-site during guest stays. Maximum four unrelated adults per stay. Permit + business license required.

- Myrtle Beach: STRs not allowed in residential neighborhoods (R-zoned districts). Business license required, 3% local accommodations tax, and properties must fall within permitted use districts.

- Greenville: Less restrictive than Charleston. Growing market with reasonable permit requirements.

Arbitrage viability: Moderate. Charleston’s overlay zone requirement and on-site owner rules make arbitrage challenging there. Myrtle Beach works in commercial zones. Greenville and Columbia offer better arbitrage potential.

North Carolina

North Carolina’s Vacation Rental Act governs contractual relationships for stays under 90 days, but the real regulation happens at the city level. Most NC cities are relatively host-friendly, though the mountain and beach towns tend to have tighter rules than inland cities.

Key cities:

- Charlotte: Business license required but no specific STR ordinance — one of the easier major cities to operate in.

- Raleigh: Registration required with zoning verification. Events banned at STR properties. Operational standards for multifamily buildings.

- Asheville: More restrictive. Homestay permits for primary residences, whole-dwelling STRs limited to certain zones. Strong demand from tourism, but caps limit supply — which actually benefits permitted hosts.

- Outer Banks: Established vacation rental market with well-defined rules. Dare County and Currituck County both require registration.

Arbitrage viability: Good in Charlotte and the Triangle area. Asheville is tougher due to zoning limits but high ADR makes it worthwhile for those who qualify.

Tennessee

Tennessee passed the Short-Term Rental Unit Act, which created a statewide framework while giving cities authority to set their own rules. Nashville, the state’s biggest STR market, has some of the most well-known regulations in the country.

Key cities:

- Nashville: Two permit types — owner-occupied (allowed in all residential zones) and non-owner-occupied (restricted to non-residential zones only). All permits require annual renewal. Operating under an expired permit means a one-year ban from getting a new one. Occupancy limited to 2 per bedroom plus 4, max 12 total. The permit application through Metro Codes can take 4–8 weeks.

- Memphis: Less regulated than Nashville. Business license and registration required, but fewer zoning restrictions.

- Gatlinburg/Pigeon Forge: Tourist-focused economies where STRs are a core part of the local ecosystem. Smoky Mountain towns are generally very welcoming to vacation rentals.

Arbitrage viability: Nashville is tough for non-owner-occupied arbitrage due to zoning restrictions, but owner-occupied works everywhere. Memphis and Smoky Mountain towns offer better arbitrage potential with fewer barriers. Tennessee has no state income tax, which boosts profitability across the board.

State-by-State Guide: The South and Southwest

Texas

Texas is a powerhouse for Airbnb — strong demand, no state income tax, and a state government that’s historically sided with property rights over heavy regulation. But the city-level picture has gotten more complicated in 2025–2026.

Taxes: 6% state hotel occupancy tax plus local hotel taxes (typically 7–9% in major cities). No state income tax.

Key cities:

- Austin: Requires an STR operating license. As of September 2025, platforms must collect and remit Hotel Occupancy Taxes on behalf of operators. New regulations effective July 1, 2026 will tighten license requirements, taxes, and occupancy rules further. Type 1 (owner-occupied) STRs are allowed citywide; Type 2 (non-owner-occupied) are restricted to certain areas.

- Dallas: Relatively lenient. STR operators must collect and remit the 6% state tax plus 9% local occupancy tax. No owner-occupancy requirement.

- Houston: New STR ordinance effective January 1, 2026 requires a valid city registration, $1 million in liability insurance, display of STR number on listings, and an occupancy limit of 2 guests per bedroom plus 2. This is a significant tightening from Houston’s previously unregulated market.

- San Antonio: Registration required with a $200 annual permit fee. Must comply with noise, parking, and occupancy standards.

Arbitrage viability: Excellent in Dallas and San Antonio. Austin is viable but getting more complex. Houston’s new 2026 ordinance adds costs (that $1M insurance requirement is steep) but doesn’t kill the model. For a full state analysis, visit our Texas guide.

Arizona

Arizona passed a landmark STR preemption law in 2016 (SB 1350) that prevented cities from banning vacation rentals. While the state has since amended that law to allow some local regulations (SB 1168 in 2022), it still protects the fundamental right to operate an STR. That said, 2026 legislative sessions are seeing new reform bills aimed at giving cities more enforcement tools.

Key cities:

- Phoenix: Very host-friendly. No limits on the number of properties a host can operate and no yearly caps on rental nights. Registration with the city required, sales tax and Transient Lodging Tax must be collected, and $500,000 minimum liability insurance is mandatory. Landlords must respond to police calls within one hour.

- Scottsdale: Among Arizona’s strictest. Requires a specific STR license ($250/year), detailed operational requirements for noise control, neighborhood notification, and responsible management.

- Sedona: Annual STR permit required. Nearly 1,000 of Sedona’s 6,600 housing units are STRs — the city launched a $10,000 incentive program to get owners to convert back to long-term rentals. Late fees for permit renewal as of January 2026.

- Tucson: Registration required, relatively straightforward process. Lower barrier than Scottsdale or Sedona.

Arbitrage viability: Phoenix is one of the best arbitrage cities in America — no property limits, no night caps, strong year-round demand. Scottsdale and Sedona work but with higher compliance costs. See our Arizona guide.

Nevada

Nevada’s STR landscape is complicated, largely because of one county: Clark County (Las Vegas). The state doesn’t set a single statewide definition of short-term rentals. AB 363 created a framework that includes jurisdiction-specific licensing, lodging tax obligations of 13–13.8%, and safety compliance standards.

Key cities:

- Las Vegas (Clark County): This is where it gets messy. Clark County’s STR ordinance faced legal challenges, and a U.S. District Court judge granted a preliminary injunction preventing the county from enforcing some of its provisions as of early 2026. Applications for new STR licenses in Clark County remain closed. The market exists in a legal gray area right now.

- Henderson: Has its own STR permit system separate from Clark County. More structured and predictable.

- Reno (Washoe County): STR permits available with zoning restrictions. Vacation rental permits required, with caps in certain neighborhoods.

Arbitrage viability: Proceed with caution. Clark County’s regulatory uncertainty makes Las Vegas risky for new entrants. Henderson and Reno are safer bets with clearer rules.

New Mexico

New Mexico saw multiple STR bills in 2025 (HB 109, HB 139, HB 1445) aimed at creating more structure around short-term rentals. The state’s regulatory landscape is evolving fast, with the New Mexico Association of Realtors and New Mexico Short-Term Rental Association both active in shaping policy.

Key cities:

- Santa Fe: Registration required with annual renewal. Zoning restrictions in historic districts. Strong tourism demand year-round.

- Albuquerque: Business registration required. Less restrictive than Santa Fe. Growing market with expanding demand.

Arbitrage viability: Moderate. Tourism-driven markets like Santa Fe have strong ADR but regulatory uncertainty from pending legislation. Watch the 2026 legislative session closely.

State-by-State Guide: The West

California

California is the poster child for fragmented STR regulation. There’s no statewide Airbnb law — each city sets its own rules. And California cities don’t hold back. Senate Bill 346, effective January 1, 2026, gives cities new power to compel platforms like Airbnb and VRBO to share information about STRs operating within their jurisdictions.

Key cities:

- Los Angeles: Only primary residences with an active City Planning Home-Sharing registration can operate as STRs. Limited to 120 rental days per year unless approved for Extended Home-Sharing. 14% Transient Occupancy Tax. This is one of the toughest major-city STR environments in the country.

- San Francisco: Must be a permanent resident. STR limited to your primary residence. Quarterly reports required. 14% TOT. Hosts must register with the Office of Short-Term Rentals.

- San Diego: Since July 2022, all STR properties need a license with four tiers based on usage level. Zone-based TOT rates range from 11.75% to 13.75% depending on proximity to the Convention Center. Updated fee structures took effect March 2025.

- Palm Springs/Desert Cities: More STR-friendly than coastal cities. Registration required but fewer restrictions. Strong seasonal demand.

Arbitrage viability: Poor in LA and SF due to primary residence requirements. San Diego is possible in the right zones. Desert cities and smaller beach towns outside LA/SF offer the best California opportunities for rental arbitrage. Visit our California guide for the full picture.

Colorado

Colorado’s STR market is split between its mountain resort towns (which are getting restrictive) and its cities (which vary widely). No statewide preemption — cities have full authority. HB 25-1247 was considered in 2025 to create additional statewide standards.

Key cities:

- Denver: Primary residence only. License required with $100 annual renewal. 4.81% city sales tax plus 10.75% lodger’s tax on stays. Denver has filed lawsuits against property managers operating illegal non-primary rentals. Zero tolerance for non-compliant operators.

- Breckenridge: Some of the most restrictive STR regulations in Colorado. Cap of 2,200 licenses (down from 3,945). Town divided into four STR zones with different caps. Annual fees scale by bedroom — a one-bedroom condo costs $856/year. Breckenridge successfully defended its restrictions in federal court in 2024.

- Colorado Springs: Less restrictive than Denver. Requires business license and STR registration but no primary residence requirement.

Arbitrage viability: Denver is a no-go for traditional arbitrage (primary residence only). Mountain towns are increasingly capped. Colorado Springs and other mid-size cities offer better arbitrage potential.

Washington

Washington requires a state Unified Business Identifier (UBI) for all STR operators, but the real rules are local. The state’s major cities have been tightening regulations steadily.

Key cities:

- Seattle: STR operators need a city business license, STR permit, and platform registration. Primary residence requirement for most hosts. Limited to two units. Short-term rental operators tax applies in addition to lodging tax.

- Vancouver: STR permit program paired with city business license. Local contact required, nuisance standards enforced.

- Tacoma: Less restrictive than Seattle. Registration required, but fewer unit caps.

Arbitrage viability: Limited in Seattle due to primary residence requirement and unit caps. Better opportunities in mid-size cities and tourist-heavy areas like the San Juan Islands or Leavenworth.

Oregon

Oregon’s regulatory picture is mixed. Portland has some of the strictest STR rules in the West, while coastal towns and smaller cities are more welcoming.

Key cities:

- Portland: Strict. Must be your primary residence. Permit required, safety inspections mandated. Recently approved stricter safety standards for STRs. 6% Multnomah County transient lodging tax plus state and city taxes.

- Bend: More STR-friendly than Portland. Permit required but fewer restrictions. Tourism-driven economy supports strong demand.

- Coastal towns (Cannon Beach, Lincoln City, Newport): Varies by jurisdiction. Some have caps on STR permits, others are more open. Lincoln County has its own regulatory framework.

Arbitrage viability: Not viable in Portland (primary residence only). Bend and coastal markets offer opportunities, though caps in some beach towns limit scaling.

Hawaii

Hawaii is one of the most restrictive states for STRs in the country. Each county (Honolulu, Maui, Kauai, Hawaii County) sets its own rules, and they’re getting tighter every year.

Key areas:

- Honolulu (Oahu): Requires a Non-Conforming Use Certificate (NUC) for most STRs. Aggressive enforcement with fines up to $10,000/day. Very limited legal STR inventory.

- Maui: Cracking down hard. Many previously permitted STRs are being phased out. Permits required and increasingly difficult to obtain.

- Big Island: Slightly more relaxed than Oahu or Maui, but still requires registration and compliance with zoning.

Arbitrage viability: Extremely difficult. High barriers to entry, limited permits, aggressive enforcement. Not recommended for rental arbitrage beginners.

Alaska

Alaska has no statewide STR definition — cities and boroughs set their own criteria. State business license required for all operators, plus state sales tax and local bed taxes.

Key cities:

- Anchorage: Local license per unit, 24-hour contact required, liability insurance mandatory. Registration number must display on listings.

- Juneau: Defines STRs as stays under 30 days. Annual renewal with safety verification.

- Fairbanks: State and borough business licenses required. No dedicated STR registration — one of the simpler setups.

Arbitrage viability: Niche. Strong seasonal demand (summer tourism) but limited market size. Best for operators who understand Alaska’s unique tourism patterns.

Utah, Idaho, Montana, Wyoming

These Mountain West states share a common thread: relatively light state-level STR regulation with most rules set locally.

- Utah: No statewide STR ban. Salt Lake City requires STR licenses. Park City has strict regulations with permit caps (critical during ski season). State transient room tax applies.

- Idaho: Minimal statewide regulation. Boise requires business licenses for STR operators. McCall and Sun Valley have their own local rules geared toward vacation rental markets.

- Montana: State lodging facility use tax applies. Most regulation is at the city/county level. Whitefish and Big Sky have specific STR ordinances due to tourism pressure.

- Wyoming: Among the least regulated states. State lodging tax applies. Jackson Hole has its own regulations due to the Teton tourism economy, but most of Wyoming is wide open.

State-by-State Guide: The Midwest

Ohio

Ohio has been slower to regulate STRs than coastal states, making it increasingly attractive for arbitrage operators looking for affordable markets with manageable rules.

Key cities:

- Columbus: STR license required. Notable privacy rules per Ohio Revised Code — must disclose monitoring devices, cannot record in sleeping or bathroom areas. Reasonable permit process.

- Cleveland: STR permit required. Must post permit numbers. Residential districts often impose occupancy limits and event prohibitions.

- Cincinnati: Business license required. The Over-the-Rhine and downtown areas are popular STR zones with strong demand from business travelers and tourists.

Arbitrage viability: Good. Ohio’s major cities have reasonable regulations, affordable rents, and solid demand. Columbus and Cincinnati are particularly strong for Airbnb arbitrage.

Michigan

Michigan’s STR regulation varies dramatically between its tourism-heavy areas (northern Lower Peninsula, Upper Peninsula) and its major cities.

- Detroit: Relatively few STR-specific regulations. Business license required. Emerging market with low entry costs.

- Traverse City: More restrictive. STR permits, zoning restrictions, and growing pushback from residents concerned about housing availability.

- Grand Rapids: Registration required. Moderate regulations. Strong event-driven demand.

Arbitrage viability: Good in Detroit and Grand Rapids. Northern Michigan resort towns are getting tighter but high seasonal ADR compensates.

Indiana

Indiana passed a state preemption law that significantly limits local governments’ ability to restrict STRs. Cities can require registration and impose safety standards but can’t ban them outright.

- Indianapolis: Registration required, safety standards enforced, but no permit caps or primary residence requirements. Strong event demand (Indy 500, conventions).

- Bloomington: Registration with some zoning restrictions near the university.

Arbitrage viability: Excellent. Indiana’s preemption law creates one of the most predictable regulatory environments in the Midwest. Indianapolis is a strong arbitrage market.

Illinois, Minnesota, Wisconsin, Iowa, Missouri

These Midwest states represent a spectrum from restrictive to moderate:

- Illinois: Chicago is the story here. Requires a Shared Housing License, $125 annual fee, 4.5% surcharge on STR bookings. Must register with the city. Two-unit cap for non-primary residences.

- Minnesota: Minneapolis requires STR licenses with annual renewal. St. Paul has its own ordinance. Both cities have been tightening rules. State lodging tax applies statewide.

- Wisconsin: State requires a Tourist Rooming House license for any STR operator. Annual license fee plus inspection. Milwaukee and Madison have additional local rules.

- Iowa: Minimal statewide regulation. Des Moines requires business licenses. Generally host-friendly outside of any specific local ordinances.

- Missouri: No statewide STR law. Kansas City introduced special event permits at reduced fees ($50 vs $200) for the 2026 FIFA World Cup. St. Louis requires registration. Generally moderate regulations.

Kansas, Nebraska, North Dakota, South Dakota

The Great Plains states have minimal STR-specific regulation at the state level:

- Kansas: Local control. Kansas City area (both KS and MO sides) seeing increased regulation ahead of the 2026 FIFA World Cup.

- Nebraska: Omaha requires business licenses for STR operators. Lincoln has minimal specific STR rules. State lodging tax applies.

- North Dakota: Minimal specific STR regulation. State lodging tax. Williston saw STR activity during oil boom periods.

- South Dakota: Minimal regulation. Rapid City (near Mount Rushmore) and Sioux Falls are primary markets. State tourism tax applies.

State-by-State Guide: The Northeast

New York

New York is the cautionary tale for STR operators. The state gives cities full authority to regulate, and New York City used that authority to create one of the toughest STR environments in the world.

Key cities:

- New York City: Local Law 18 (effective September 2023) requires all STR hosts to register with the Mayor’s Office of Special Enforcement. Hosts must be present during all stays. Only one or two guests allowed. No entire-apartment rentals unless the host is present. This essentially killed the traditional Airbnb model in NYC. Registration numbers must appear on all listings, and platforms face penalties for listing unregistered properties.

- Upstate New York: Much more relaxed. In January 2025, the state legislature approved a law allowing counties to develop their own STR registries, with platforms required to submit quarterly reports. The Catskills, Adirondacks, and Finger Lakes regions remain viable STR markets.

Arbitrage viability: Essentially impossible in NYC. Upstate markets offer much better opportunities. The Hudson Valley, Catskills, and Finger Lakes are popular STR destinations with more manageable regulations.

Massachusetts

Massachusetts enacted a statewide STR law in 2019 that requires registration with the state, imposes a 5.7% state excise tax on STRs, and allows cities to add a local community impact fee up to 3%.

- Boston: Only owner-occupied or owner-adjacent units can be STRs. Must register with the city. Limited to one listing per host. Annual registration fee plus state taxes.

- Cape Cod/Martha’s Vineyard: Registration required. Seasonal markets with very high ADR but limited off-season demand.

Arbitrage viability: Very limited in Boston (owner-occupancy requirement). Cape Cod and seasonal markets work for owners, not arbitrage operators.

New Jersey, Connecticut, Pennsylvania

- New Jersey: No statewide STR law, but Jersey Shore towns have heavy local regulation. State sales tax applies to all rentals. Atlantic City and Jersey City have specific STR ordinances with registration requirements.

- Connecticut: State requires STR operators to collect a 15% room occupancy tax. Registration varies by town. Generally moderate regulation outside of specific tourist areas.

- Pennsylvania: No statewide STR law. Philadelphia requires a rental license and collects 8.5% hotel tax. Pittsburgh has its own registration requirements. State hotel occupancy tax of 6% applies statewide.

Vermont, New Hampshire, Maine, Rhode Island, Delaware

- Vermont: State requires STR registration and collects a 9% rooms tax plus 1% local options tax. Burlington has additional restrictions including permits and zoning compliance.

- New Hampshire: Operators must register with the state as a tourist accommodation. State meals and rooms tax of 8.5% applies. Local regulations vary.

- Maine: No statewide STR license, but cities like Portland have annual registration, primary-residence rules, and caps in certain districts. Kennebunkport requires STR licenses with inspections and caps in certain zones.

- Rhode Island: State collects a 5% rooms tax plus 1% local hotel tax. Providence has STR registration requirements. Generally moderate regulation.

- Delaware: No specific statewide STR law. Beach towns (Rehoboth Beach, Dewey Beach) have their own rental permit requirements. State accommodations tax applies.

State-by-State Guide: The Mid-Atlantic and South Central

Virginia, Maryland, West Virginia

- Virginia: No statewide STR law, but Virginia Beach, Richmond, and Arlington have specific ordinances. State transient occupancy tax of 2% plus local taxes. Arlington requires registration, limits to primary residences.

- Maryland: State requires platforms to collect lodging taxes. Montgomery County and Baltimore have specific STR regulations. Ocean City has established vacation rental rules. Generally moderate.

- West Virginia: Minimal statewide STR regulation. State hotel occupancy tax applies. Ski resort areas (Snowshoe, Canaan Valley) have some local rules. Generally welcoming to STR operators.

Kentucky, Louisiana, Mississippi

- Kentucky: State tax collection registration required. Louisville requires STR registration with zoning limits in some areas, local contacts, and parking plans. Lexington requires registration with noise, trash, and parking compliance. Generally host-friendly.

- Louisiana: State now requires platforms to collect lodging taxes (new as of 2025). New Orleans has a robust STR regulatory system with permits, caps in certain neighborhoods, and a whole-home STR license requirement. Baton Rouge and other cities have lighter regulation.

- Mississippi: Minimal statewide STR regulation. State sales tax applies to lodging. Most cities have basic business license requirements. Low barriers to entry across the state.

Oklahoma, Arkansas

- Oklahoma: State preemption limits local restrictions on STRs. Oklahoma City and Tulsa require business licenses. State hotel tax applies. One of the more host-friendly regulatory environments.

- Arkansas: No statewide STR ban. Hot Springs and Eureka Springs have specific regulations tied to their tourism economies. State tourism tax applies. Fayetteville/Bentonville growing as STR markets.

Key Regulatory Trends in 2026

After tracking regulations across all 50 states, here are the five biggest trends I’m watching in 2026:

1. Platform Accountability Is the New Normal

More states are requiring Airbnb, VRBO, and other platforms to collect and remit lodging taxes automatically. California’s SB 346 (effective January 2026) lets cities compel platforms to share STR operator data. This trend eliminates the “honor system” for tax collection and makes it harder for unlicensed operators to hide.

2. Event-Driven Temporary Regulations

The 2026 FIFA World Cup (hosted across multiple US cities) is creating a new category of regulation: temporary event permits. Kansas City introduced special event permits at $50 (versus the normal $200). Expect more cities to create fast-track licensing for major events.

3. Housing Affordability Backlash

Sedona offering $10,000 to convert STRs back to long-term housing is the tip of the iceberg. Cities across the country are tightening STR rules specifically to address housing availability. Primary-residence requirements, unit caps, and night limits are all tools cities use to push housing back to long-term residents. This trend is accelerating.

4. Enforcement Technology Getting Sharper

Cities are investing in software that scrapes Airbnb, VRBO, and other platforms to identify unlicensed operators. Denver has filed lawsuits. Miami Beach issues $20,000 fines. The days of operating under the radar are numbered. If your city requires a permit, get one.

5. Junk Fee Transparency

Federal and state rules requiring full upfront pricing disclosure are affecting how hosts present cleaning fees, service fees, and other charges. This doesn’t change whether you can operate, but it changes how you price — and guests can now comparison-shop on total cost more easily.

How Regulations Affect Rental Arbitrage Specifically

If you’re building a rental arbitrage business — leasing properties long-term and subletting them as short-term rentals — regulations hit you differently than property owners. Here’s what matters most:

Primary Residence Requirements Kill Arbitrage

Cities like Denver, Los Angeles, San Francisco, Portland, Seattle, and Boston require STR operators to live in the property. You can’t do arbitrage if you have to physically live in the unit. These cities are off-limits for the arbitrage model (though you could still do arbitrage with a room in your primary residence).

Non-Owner-Occupied Permit Restrictions

Nashville, Austin, and several other cities distinguish between owner-occupied and non-owner-occupied STRs, with the non-owner category facing tighter zoning restrictions. As an arbitrage operator, you’re in the non-owner category even if you have a lease — you don’t own the property.

Lease Compliance Is Your Responsibility

No city regulation exempts you from your lease terms. You need explicit written permission from your landlord to sublet as an STR. A solid rental arbitrage contract is non-negotiable. Some states (like California) have laws that require landlord consent for any subletting.

Best Arbitrage Markets in 2026

The best markets for rental arbitrage in 2026 share common traits: no primary-residence requirement, reasonable permit costs, strong tourist or business traveler demand, and affordable long-term rents relative to STR income. Cities like Phoenix, Indianapolis, Columbus, Dallas, Memphis, and Orlando top the list.

Whether you’re starting an Airbnb business or expanding into a new market, here’s the exact process I follow before committing to any location:

Step 1: Identify Your Target City and Check State Law

Start at the state level. Does the state have a preemption law (like Florida or Arizona) that protects your right to operate? Or does it give cities full authority (like New York or California)? This tells you whether you’re starting from a position of strength or caution.

Step 2: Research City-Level Ordinances

Go to the city’s official website and search for “short-term rental” or “vacation rental.” Look for:

- Permit/license requirements and costs

- Zoning restrictions (which zones allow STRs)

- Primary residence requirements

- Night caps or unit caps

- Occupancy limits

- Insurance requirements

- Tax obligations

Step 3: Check HOA and Lease Restrictions

If you’re buying, check the HOA CC&Rs before closing. If you’re doing arbitrage, get landlord approval in writing before signing a lease. This step trips up more new hosts than any city regulation.

Step 4: Calculate Total Compliance Costs

Add up every cost: permit fees, annual renewals, required insurance, tax obligations, safety equipment, and any required inspections. These costs reduce your margins and need to be in your financial projections from day one.

Step 5: Apply for Permits Before Listing

Many cities require permits before you can legally list on any platform. Nashville’s one-year ban for operating under an expired permit shows how seriously cities take this. Get your permits first, then list.

Step 6: Set Up Tax Collection

Most platforms now collect and remit taxes automatically in most jurisdictions. But verify this for your specific city — some local taxes still need to be collected and remitted manually. Register with your state and local tax authorities.

Step 7: Consult a Local Attorney if Needed

For complex markets or high-value investments, a 30-minute consultation with an Airbnb lawyer can save you thousands in fines and headaches. This is especially important in states like California, New York, and Colorado where regulations are dense and penalties are steep.

Frequently Asked Questions

Which state is the most Airbnb-friendly in 2026?

Florida takes the top spot. State preemption protects your right to operate a vacation rental, there’s no state income tax, tourism demand is year-round, and most Florida cities (with the notable exception of Miami Beach) have reasonable permit processes. Texas and Arizona are close seconds.

Can I run an Airbnb in any state legally?

Short-term rentals are legal in all 50 states at the state level. However, individual cities and counties can restrict or ban them within their jurisdictions. The question isn’t whether your state allows Airbnb — it’s whether your specific city and zoning district does.

What states have banned Airbnb?

No state has banned Airbnb outright. However, specific cities within certain states have effectively banned most short-term rentals. New York City’s Local Law 18 makes traditional whole-apartment Airbnb hosting nearly impossible. Miami Beach bans STRs in most residential zones. Honolulu severely restricts permits. But these are city-level bans, not state bans.

Do I need a license to Airbnb my house?

In most US cities with populations over 100,000, yes. The specific license type varies — some call it a Short-Term Rental Permit, others a Shared Housing License, Vacation Rental License, or Home-Sharing Registration. Costs range from $0 in some jurisdictions to over $800 per year in places like Breckenridge. Check your local government’s website for exact requirements.

What taxes do Airbnb hosts pay?

Most hosts pay three layers of tax: state sales/lodging tax (typically 4–9%), local transient occupancy tax (typically 2–15%), and income tax on rental profits (federal plus state, where applicable). In high-tax jurisdictions like San Francisco, total tax on a booking can exceed 14%. States with no income tax — Florida, Texas, Tennessee, Nevada, Washington, Wyoming, Alaska — give hosts a significant profitability advantage.

Is rental arbitrage legal in every state?

Rental arbitrage is legal as a business model in every state. But your ability to execute it depends on three things: local STR regulations (especially primary-residence requirements), your lease terms (you need landlord permission), and zoning (some cities only allow STRs in certain zones). Cities with primary-residence requirements effectively block arbitrage since you can’t live in every unit you lease.

What happens if I operate an Airbnb without a permit?

Penalties vary wildly. Miami Beach starts at $20,000 for a first offense. Denver has filed lawsuits against illegal operators. Nashville bans you from getting a permit for one year if caught. Other cities issue warnings first, then escalating fines. Airbnb and VRBO are increasingly requiring registration numbers on listings and delisting properties that can’t provide them. The risk isn’t worth it — get your permits.

How are STR regulations changing in 2026?

Five major trends: platform accountability (states requiring Airbnb/VRBO to collect taxes and share data), event-driven temporary permits (FIFA World Cup cities), housing affordability measures (converting STRs back to housing), enforcement technology (AI-powered listing scrapers), and price transparency rules (junk fee disclosure). The overall direction is toward more regulation, not less. But for permitted, compliant operators, tighter enforcement actually reduces competition from illegal listings.

Which states require Airbnb to collect taxes automatically?

As of 2026, the majority of states have tax collection agreements with Airbnb, including Florida, Texas, California, New York, Colorado, Tennessee, and many others. Louisiana and Maryland joined the list in 2025. However, automatic platform tax collection doesn’t always cover all local taxes — you may still need to register separately for city or county taxes in some jurisdictions.

What’s the best state for Airbnb rental arbitrage?

For rental arbitrage specifically, my top picks are Florida (state protections, no income tax, massive demand), Texas (lenient in most cities, no income tax), Arizona (especially Phoenix — no property limits or night caps), Indiana (state preemption, affordable rents), and Ohio (reasonable regulations, low cost of living). The key factor is avoiding states and cities with primary-residence STR requirements, which fundamentally block the arbitrage model. See our full list of best states for Airbnb.