Think you need $50,000 to start an Airbnb business? You don’t. Not even close. The real airbnb startup costs range from $1,200 for a bare-bones bootstrap to around $12,000 for a fully loaded premium setup—and most people land somewhere around $3,500 to $6,000 for their first property. I’ve watched hundreds of students launch profitable Airbnb listings, and the ones who obsess over exact numbers before they start are the ones who actually succeed. The ones who guess? They run out of cash halfway through furnishing a living room.

This guide breaks down every dollar you’ll spend—line item by line item—so you can plan with confidence and avoid the nasty surprises that sink first-time hosts. Whether you’re doing rental arbitrage (leasing a property and subletting on Airbnb) or buying a property outright, I’ll show you exactly what to budget for in 2026.

Rental Arbitrage vs. Buying: Two Very Different Cost Structures

Before we get into specific numbers, you need to understand the two main paths into the Airbnb business—because they require wildly different levels of capital.

Rental arbitrage is the model we teach at 10XBNB, and it’s how most people start with limited capital. You lease a property with the landlord’s permission, furnish it, and list it on Airbnb. Your biggest upfront cost is furniture and a security deposit. No mortgage. No down payment. No property taxes.

Buying a property means you’re looking at a down payment of $20,000 to $100,000+ depending on your market, plus closing costs, plus everything else on this list. It’s a fundamentally different business model with a much longer payback period.

Here’s how they compare side by side:

| Cost Category | Rental Arbitrage | Buying Property |

|---|---|---|

| Property Acquisition | $0 | $20,000–$100,000+ (down payment) |

| Security Deposit | $1,000–$4,500 | N/A |

| First Month’s Rent | $800–$3,000 | N/A (mortgage instead) |

| Furnishing | $1,500–$8,000 | $3,000–$15,000 |

| Photography | $150–$500 | $150–$500 |

| Supplies & Amenities | $200–$600 | $200–$600 |

| Insurance | $80–$175/month | $125–$250/month |

| Business Registration | $50–$500 | $50–$500 |

| Tech & Software | $0–$100/month | $0–$100/month |

| Total Upfront | $3,500–$15,000 | $25,000–$120,000+ |

| Time to Profit | 1–3 months | 12–36 months |

The difference is staggering. Rental arbitrage lets you test a market, prove the model works, and start generating income in weeks—not years. That’s exactly why it’s the entry point we recommend for anyone learning how to start an Airbnb business.

Essential Airbnb Startup Costs: The Complete Line-Item Breakdown

Here’s where we get granular. Every cost you’ll encounter, with real 2026 numbers. I’m using rental arbitrage as the base model since that’s what most new hosts use, but the furnishing and setup costs apply to property owners too.

Security Deposit

Your landlord will typically require one to two months’ rent as a security deposit. In most markets, this is your single largest upfront expense.

- Low-cost market (Midwest, smaller Southern cities): $800–$1,500

- Mid-range market (Nashville, Tampa, Charlotte): $1,200–$2,500

- High-cost market (Austin, Denver, LA suburbs): $2,000–$4,500

Pro tip: Some landlords will accept a smaller deposit if you offer two or three months’ rent upfront. That sounds counterintuitive, but it demonstrates financial stability and can actually reduce your total cash outlay compared to paying last month’s rent plus a full security deposit. You’ll learn negotiation strategies like this when getting landlord approval for your listing.

First Month’s Rent

You’ll pay rent before you earn a single dollar from Airbnb. Budget for at least one full month of rent before your first guest checks in, because you need time to furnish, photograph, list, and get your first booking.

- 1-bedroom apartment: $800–$1,800/month

- 2-bedroom apartment: $1,200–$2,800/month

- 3-bedroom house: $1,500–$3,500/month

Realistically, you should budget for 6 weeks of rent before income. Some students get their first booking within 48 hours of going live. Others take 2-3 weeks to build momentum. Plan for the slower scenario.

Furniture & Decor

This is where most people either overspend or underspend—both are mistakes. Overspend and you delay your breakeven point by months. Underspend and your listing photos look like a dorm room, which tanks your nightly rate and occupancy.

Here’s a realistic furniture budget for a one-bedroom rental arbitrage unit:

| Item | Budget Option | Mid-Range | Premium |

|---|---|---|---|

| Queen bed frame + headboard | $120 | $280 | $550 |

| Queen mattress | $200 | $450 | $850 |

| Bedding set (sheets, duvet, pillows) | $75 | $160 | $350 |

| Nightstands (×2) | $50 | $120 | $280 |

| Sofa | $250 | $600 | $1,200 |

| Coffee table | $40 | $120 | $300 |

| TV + wall mount | $180 | $350 | $650 |

| Dining table + chairs | $100 | $280 | $600 |

| Dresser | $80 | $200 | $450 |

| Lamps (×3) | $45 | $100 | $240 |

| Curtains/blinds | $40 | $90 | $200 |

| Wall art & decor | $30 | $120 | $350 |

| Bath towel set | $35 | $75 | $150 |

| Total Furniture | $1,245 | $2,945 | $6,170 |

Two-bedroom units? Add roughly 60-70% on top of these numbers for the extra bedroom and living space furniture. Three-bedroom? Double the one-bedroom total and add 20%.

If you want to skip the headache of sourcing everything individually, check out pre-built furniture packages designed specifically for Airbnb hosts. They’re not always the cheapest option, but they save massive amounts of time and come designed to photograph well.

Kitchen Essentials & Guest Supplies

Guests expect a functional kitchen, clean towels, and basic toiletries. This isn’t a hotel—but it shouldn’t feel like camping, either.

- Cookware set (pots, pans, utensils): $60–$150

- Dishes, glasses, silverware (service for 6): $40–$100

- Small appliances (coffee maker, toaster, blender): $50–$120

- Cleaning supplies starter kit: $30–$60

- Toiletries (shampoo, conditioner, soap, toilet paper): $25–$50

- Extra linens (backup sheets, towels): $50–$100

- Welcome basket items (snacks, local guide): $15–$40

Total kitchen & supplies: $270–$620

Don’t overthink the welcome basket. A $12 assortment of granola bars, instant coffee packets, and a printed local restaurant guide gets you five-star reviews. I’ve seen it happen hundreds of times. Guests remember thoughtfulness, not expense.

Professional Photography

Your listing photos are the single most important factor in your click-through rate. Bad photos kill bookings before a guest ever reads your description. This isn’t optional.

- DIY with smartphone: $0 (but expect lower bookings)

- Budget photographer: $150–$250

- Professional Airbnb photographer: $300–$500

- Premium photographer + drone/twilight shots: $500–$800

The sweet spot for most new hosts is $200–$350. That gets you 15-25 professionally edited images that make your listing look like it belongs in an interior design magazine. Worth every penny. Airbnb also offers their own Pro Photography Program where the cost gets deducted from future payouts—so zero upfront cash.

Technology & Software

You need a smart lock. That’s non-negotiable. Everything else is optional but increasingly necessary as you scale.

- Smart lock (Schlage Encode, August, Yale): $150–$300

- Noise monitor (Minut, NoiseAware): $100–$150 + $10–$15/month

- WiFi router upgrade (if existing is weak): $60–$120

- Streaming service (Netflix, shared account): $8–$16/month

- Channel manager/PMS (Hospitable, Guesty): $0–$40/month (free tiers available)

- Dynamic pricing tool (PriceLabs, Beyond Pricing): $20–$40/month

Total tech upfront: $310–$570

Total tech monthly: $38–$111

If you’re running a single property, you can skip the channel manager and pricing tool in month one. Manual pricing works fine when you’re learning the ropes. Add automation after you’ve proven the unit is profitable.

Insurance

Airbnb’s AirCover program provides up to $3 million in host damage protection and $1 million in liability coverage—at no extra cost. But it has gaps. Plenty of them. A dedicated short-term rental insurance policy fills those gaps and protects your business properly.

- Proper Insurance: $125–$170/month (comprehensive four-in-one policy)

- CBIZ: $100–$165/month (largest STR insurer in the US)

- Budget option (umbrella policy addition): $80–$120/month

For your first property, a budget umbrella policy plus AirCover is acceptable. But the moment you scale to two or three units, get a proper policy. One guest injury lawsuit without adequate coverage could wipe out everything you’ve built. Learn more about your options in our guide on Airbnb insurance coverage.

Business Registration & Licensing

This varies enormously by city and state. Some jurisdictions require nothing beyond a standard business license. Others demand short-term rental permits, fire inspections, and annual renewals.

- LLC formation: $50–$500 (state-dependent; Wyoming and New Mexico are cheapest)

- Business license: $0–$100/year

- Short-term rental permit: $0–$1,000/year (some cities don’t require one; others charge heavily)

- Fire safety inspection: $0–$200 (required in some jurisdictions)

- Hotel/occupancy tax registration: Usually free to register, but you’ll owe 6-15% of revenue

Total registration costs: $50–$1,800 (first year)

Always check your local regulations before signing a lease. Some cities have banned or heavily restricted short-term rentals. Nashville, for instance, stopped issuing new non-owner-occupied STR permits in certain zones. Don’t learn this the hard way.

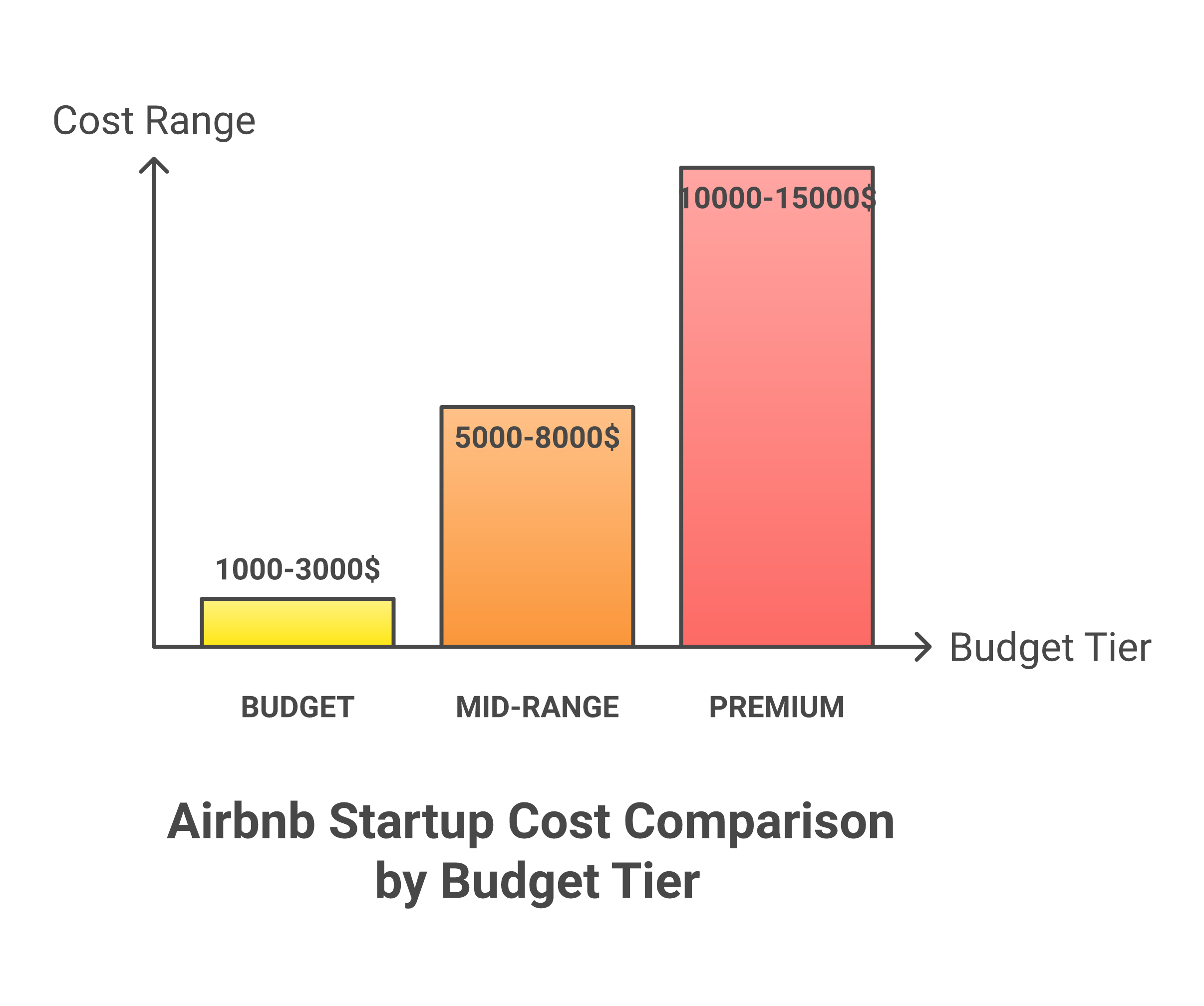

Three Budget Tiers: What Each Level Actually Gets You

Not everyone has $10,000 sitting in a savings account. And you don’t need it. Here’s what launching at three different budget levels actually looks like.

$1,500 Bootstrap (The “Scrappy Starter”)

This is the absolute minimum. You’re furnishing with Facebook Marketplace finds, doing your own photography, and skipping anything that isn’t essential.

| Expense | Cost |

|---|---|

| Security deposit (1 month, low-cost market) | $800 |

| Used furniture (Marketplace, estate sales) | $400 |

| Kitchen essentials & supplies | $100 |

| Smart lock (basic model) | $150 |

| Bedding & towels | $50 |

| Total | $1,500 |

Reality check: This works, but it’s tight. You’re living on the edge with no cushion for first month’s rent (you’d need a rare landlord who waives the security deposit or allows you to pay in installments). More realistic minimum is $2,500–$3,000 when you include first month’s rent in a low-cost market. But I’ve personally watched a student in Memphis launch a profitable listing with $1,847 total invested. It happens.

$5,000 Standard (The “Smart Start”)

This is where most successful new hosts land. Enough budget to do things right without being extravagant.

| Expense | Cost |

|---|---|

| Security deposit (1 month) | $1,400 |

| First month’s rent | $1,400 |

| Furniture (mix of new & used) | $1,200 |

| Kitchen & supplies | $250 |

| Professional photography | $250 |

| Smart lock + basic tech | $250 |

| Bedding, towels, decor | $200 |

| LLC + permits | $150 |

| Total | $5,100 |

Why this tier wins: Professional photos make a measurable difference—listings with pro photography earn 40% more revenue in their first 90 days compared to smartphone shots. At $5K, you’ve got a real business, not a side hustle held together with duct tape.

$10,000 Premium (The “Launch Like a Pro”)

This budget lets you furnish a 2-bedroom unit in a competitive market with everything a Superhost would want.

| Expense | Cost |

|---|---|

| Security deposit (1.5 months) | $2,700 |

| First month’s rent | $1,800 |

| New furniture (mid-range, 2BR) | $3,200 |

| Kitchen, linens, supplies | $500 |

| Professional photography | $400 |

| Smart lock + noise monitor + tech | $450 |

| Insurance (first 2 months) | $300 |

| LLC + permits + legal | $350 |

| Cash reserve (vacancy buffer) | $500 |

| Total | $10,200 |

The advantage: You’re launching with a cash reserve, which means one slow week won’t send you into panic mode. You can afford to hold out for higher nightly rates rather than slashing prices to fill the calendar.

Ongoing Monthly Costs: What You’ll Spend Every Single Month

Startup costs are one thing. But what about the recurring expenses that eat into your margins month after month? Here’s the honest picture.

| Monthly Expense | 1-Bedroom | 2-Bedroom | 3-Bedroom |

|---|---|---|---|

| Rent | $800–$1,800 | $1,200–$2,800 | $1,500–$3,500 |

| Utilities (electric, gas, water, internet) | $150–$300 | $200–$400 | $250–$500 |

| Cleaning (per turnover, ~8-12/month) | $420–$630 | $575–$865 | $800–$1,200 |

| Supplies restocking | $40–$80 | $60–$120 | $80–$160 |

| Insurance | $80–$175 | $100–$200 | $125–$250 |

| Software & subscriptions | $0–$80 | $0–$80 | $0–$80 |

| Minor maintenance & repairs | $50–$150 | $75–$200 | $100–$250 |

| Airbnb host service fee (3%) | Varies | Varies | Varies |

| Total Monthly Expenses | $1,540–$3,215 | $2,210–$4,665 | $2,855–$5,940 |

These numbers assume you’re charging a cleaning fee to guests that covers (or nearly covers) your actual cleaning costs. Most hosts pass the full cleaning expense to guests—it’s standard practice and expected on Airbnb.

The numbers that actually matter? Rent + utilities. That’s your fixed cost floor. Everything else scales with occupancy. Higher occupancy means more cleaning turns but also more revenue. It’s a good problem to have.

The Hidden Costs Most Startup Guides Won’t Tell You About

This is the section that separates people who launch successfully from people who run out of money in month three. Every other guide gives you the obvious costs. Here are the ones that blindside new hosts.

Vacancy During Ramp-Up

Your listing won’t be fully booked from day one. New listings on Airbnb typically take 2-4 weeks to gain traction in the algorithm, build reviews, and achieve steady booking rates. During this ramp-up period, you’re paying rent and utilities with little or no income.

Budget for: 1-2 months of rent as a vacancy cushion ($800–$3,500)

Some hosts mitigate this by launching with aggressive introductory pricing—25-35% below your target nightly rate—to build reviews fast. Five-star reviews are rocket fuel for the Airbnb algorithm. Get 5-10 of them quickly and occupancy climbs dramatically.

Damage & Wear Replacement

Guests break things. Not maliciously (usually). But wine glasses chip, towels stain, remote controls vanish into parallel dimensions. Budget for replacing small items continuously.

Budget for: $75–$200/month in ongoing replacement costs

Bigger damage happens too. A guest locks themselves out and kicks in the door—that’s $400. Someone drags furniture across hardwood floors—that’s a $200 repair. AirCover handles some of this, but the claims process is slow and doesn’t cover everything. Keep a cash reserve.

Seasonal Revenue Swings

Unless you’re in a market with year-round demand (Miami, Hawaii, parts of Arizona), you’ll experience seasonal dips. Some markets see occupancy drop from 85% in summer to 40% in winter. That’s not a crisis—it’s normal. But you need to survive the slow months.

Budget for: 2-3 months of reduced revenue (save 20% of peak-season profits)

Savvy hosts use the slow season to negotiate better rates with landlords, refresh decor, update listing photos, and run promotions targeting long-term stays. Monthly discounts of 40-50% during off-peak months can keep units occupied and cash flowing.

Tax Obligations

This catches people off guard every April. Short-term rental income is taxable, and depending on your location, you may owe:

- Federal income tax: 10-37% (depends on your bracket)

- Self-employment tax: 15.3% (if you provide substantial services)

- State income tax: 0-13.3% (varies by state)

- Occupancy/hotel tax: 6-15% (Airbnb collects this in many, but not all, jurisdictions)

- Local tourism taxes: Varies widely

Budget for: Set aside 25-30% of net profit for taxes

Get a CPA who understands short-term rentals. The deductions available to Airbnb hosts are substantial—furniture depreciation, home office deduction, mileage, cleaning supplies, insurance premiums, software subscriptions, and more. A good accountant pays for themselves many times over.

Landlord Relationship Costs

If you’re doing rental arbitrage, maintaining a good relationship with your landlord has a real cost. Some landlords want a cut of your Airbnb revenue (typically 10-20% above market rent). Others want proof of insurance annually. A few require you to handle all guest noise complaints within 30 minutes or face lease termination.

None of this is unreasonable. But it’s a cost of doing business that you need to factor into your projections. For everything you need to know about structuring this relationship properly, see our guide on the rental arbitrage contract.

How to Slash Your Startup Costs (Without Slashing Quality)

I’ve seen students cut their startup costs by 40-60% using these strategies. None of them require compromising on guest experience.

Source Furniture Strategically

Facebook Marketplace is the single best tool for furnishing an Airbnb on a budget. Wealthy homeowners replacing perfectly good furniture sell it for 10-20 cents on the dollar. I’ve seen students furnish entire one-bedroom units for under $600 by checking Marketplace daily for two weeks.

Other sources worth checking:

- Estate sales: Often 50-80% below retail, and you get quality older furniture

- IKEA: The MALM dresser ($180) and HEMNES bed frame ($250) photograph beautifully and hold up to guest use

- Amazon Warehouse deals: Open-box items at 20-40% off

- Wayfair clearance: End-of-season pieces at steep discounts

- Habitat for Humanity ReStore: Donated furniture and home goods at rock-bottom prices

The key: buy a good mattress new. Everything else can be used. Guests will forgive a scratched coffee table. They won’t forgive a lumpy mattress. A quality queen mattress ($300–$500 range) is the single best investment in your listing’s review scores.

DIY Photography (That Actually Works)

Can’t afford a photographer? You can take decent listing photos with a smartphone if you follow these rules:

- Shoot during “golden hour” (the hour after sunrise or before sunset) for warm, natural light

- Clean every surface. Then clean again. Clutter murders your photos

- Shoot from corners, not the center of the room—it makes spaces look 30% larger

- Use HDR mode on your phone for balanced exposure

- Edit with free tools (Snapseed, Lightroom Mobile) to brighten and straighten

- Take at least 50 photos per room and pick the best 3-5

Will this beat a professional? No. But it’s good enough to launch, get your first bookings, and use that revenue to pay for a pro shoot within 30-60 days.

Negotiate With Landlords

Most new hosts accept whatever lease terms the landlord offers. That’s leaving money on the table. Here’s what you can negotiate:

- Reduced security deposit in exchange for higher rent (spreads the cost)

- Free first month if you sign a longer lease (18-24 months)

- Landlord-provided furnishings (some include basic furniture, especially in college towns)

- Gradual rent increases tied to your Airbnb performance

- Permission baked into the lease (crucial for rental arbitrage—see our landlord approval guide)

The best negotiating leverage? Data. Show the landlord comparable long-term rental rates, your projected occupancy, and proof of insurance. Landlords say yes when they feel protected.

Phase Your Spending

You don’t need everything on day one. Here’s a phased approach that keeps cash flow positive:

Week 1 (Must-haves to go live): Bed, sofa, basic kitchen items, smart lock, towels, bedding. Budget: $1,200–$2,000.

Week 3 (After first payouts): Coffee table, dining set, wall art, extra linens, welcome basket. Budget: $300–$600 (funded by first bookings).

Month 2 (Reinvest profits): Professional photography, noise monitor, upgraded decor, premium toiletries. Budget: $400–$700 (funded by revenue).

This approach means you might launch with a slightly less “Instagram-perfect” listing, but you stay solvent. And you can upgrade continuously as revenue flows in.

Real Numbers From Actual Hosts

Theory is great. Real numbers are better. Here are startup cost breakdowns from students who’ve gone through the 10XBNB program and launched real properties.

Sarah — Nashville, TN (1-Bedroom Apartment)

| Expense | Amount |

|---|---|

| Security deposit | $1,650 |

| First month’s rent | $1,650 |

| Furniture (75% Facebook Marketplace) | $1,340 |

| Kitchen & supplies | $285 |

| Professional photos | $275 |

| Smart lock + tech | $210 |

| LLC formation (Tennessee) | $100 |

| Insurance (first month) | $130 |

| Total invested | $5,640 |

Result: First booking within 5 days of going live. Averaged $3,800/month gross revenue in the first 90 days. Broke even on her startup investment in 47 days. Now operates three units.

Marcus — Atlanta, GA (2-Bedroom House)

| Expense | Amount |

|---|---|

| Security deposit | $2,200 |

| First month’s rent | $2,200 |

| Furniture (new, mid-range) | $3,450 |

| Kitchen, linens, supplies | $420 |

| Professional photos + drone | $475 |

| Smart lock + noise monitor | $380 |

| LLC + STR permit | $350 |

| Insurance (first month) | $155 |

| Total invested | $9,630 |

Result: Slower start (first booking took 11 days) but the 2-bedroom premium pricing made up for it. Averaged $5,200/month gross in the first 90 days. Breakeven at 62 days. Now runs five properties and quit his 9-to-5.

Jaylen — Memphis, TN (1-Bedroom Apartment)

| Expense | Amount |

|---|---|

| Security deposit | $850 |

| First month’s rent | $850 |

| Furniture (100% used—Marketplace & estate sales) | $547 |

| Kitchen & supplies | $135 |

| DIY photos (smartphone) | $0 |

| Smart lock | $165 |

| Towels, bedding, decor | $95 |

| Total invested | $2,642 |

Result: Launched with a scrappy listing and aggressive introductory pricing ($59/night). Got 8 bookings in the first month. Invested in professional photos after week 3 using Airbnb revenue. Raised his nightly rate to $89 and currently averages $2,900/month gross. Breakeven at 35 days.

Notice a pattern? The ones who launched fastest—even with less-than-perfect setups—reached profitability sooner. Perfectionism is the enemy of Airbnb profitability.

ROI Timeline: When You’ll Actually Break Even

The question everyone wants answered: when does this investment start paying for itself? Here’s a realistic timeline based on what we’ve seen across thousands of listings.

Breaking Down the Math

Let’s use a concrete example. You invest $5,000 in a one-bedroom rental arbitrage unit with $1,400/month rent.

- Monthly revenue (75% occupancy at $120/night): $2,700

- Monthly expenses (rent + utilities + cleaning + supplies + insurance): $2,050

- Monthly profit: $650

- Months to recoup $5,000 investment: 7.7 months

That’s the conservative case. Plenty of hosts in strong markets see:

- Monthly revenue (80% occupancy at $140/night): $3,360

- Monthly expenses: $2,050

- Monthly profit: $1,310

- Months to recoup $5,000: 3.8 months

Want to run the numbers for your specific market? Use our rental arbitrage profit calculator to model different scenarios with your actual rent, expected nightly rate, and occupancy projections.

Typical Breakeven Timeline by Budget Tier

| Budget Tier | Total Invested | Breakeven (Conservative) | Breakeven (Optimistic) |

|---|---|---|---|

| Bootstrap ($1,500–$3,000) | ~$2,500 | 4-6 months | 1-3 months |

| Standard ($5,000) | ~$5,000 | 6-9 months | 3-5 months |

| Premium ($10,000) | ~$10,000 | 8-14 months | 5-8 months |

Here’s what makes rental arbitrage special: your ROI accelerates as you scale. Your second unit is cheaper to launch because you already own the smart lock setup knowledge, have photographer contacts, have bulk supplier relationships, and know exactly which furniture items to buy. Students commonly report their second unit costing 25-35% less to launch than their first.

And once you’ve got 3-5 units running, you’re looking at $2,000–$8,000/month in combined profit. That’s when this shifts from a side hustle to a real business.

The Biggest Mistake New Hosts Make With Money

After watching hundreds of students launch, one financial mistake stands above the rest: underestimating the gap between going live and generating consistent income.

They calculate startup costs perfectly. They budget for furniture, photography, and the security deposit down to the penny. Then they forget that it takes 2-4 weeks to get their first booking, another week to get paid (Airbnb’s payout schedule), and another 2-3 weeks to build enough reviews for the algorithm to favor their listing.

That’s potentially 6-8 weeks of expenses with minimal revenue. If your monthly nut is $2,000 in rent plus utilities, that’s $3,000–$4,000 in operating costs before meaningful income kicks in.

The fix? Add a cash reserve equal to 2 months of fixed expenses to your startup budget. If your rent and utilities total $2,200/month, add $4,400 to your launch capital. Yes, it increases your upfront investment. But it also means you can survive the ramp-up period without panicking, slashing prices, or—worst case—abandoning the business before it has a chance to work.

Frequently Asked Questions

How much does it cost to start an Airbnb in 2026?

The total cost to start an Airbnb in 2026 ranges from $1,500 to $12,000 for rental arbitrage (leasing a property), or $25,000 to $120,000+ if you’re buying a property. Most first-time hosts using the rental arbitrage model invest between $3,500 and $6,000, which covers a security deposit, first month’s rent, furniture, photography, supplies, a smart lock, and basic insurance. Your exact costs depend on your market, property size, and whether you buy furniture new or used.

Can I start an Airbnb with $1,000?

Starting a fully independent Airbnb listing for under $1,000 is extremely difficult because security deposits alone typically cost $800–$2,500. However, if you already have a spare room in a property you own, your costs could be as low as $300–$800 for furnishing, supplies, and a smart lock. For rental arbitrage, plan for a minimum of $2,500–$3,000 to cover the deposit, first month’s rent, and basic furnishing in a low-cost market.

What is the single biggest Airbnb startup expense?

For rental arbitrage hosts, the single biggest upfront expense is the combination of security deposit plus first month’s rent, which typically totals $1,600–$6,000 depending on your market. For property buyers, the down payment on the property dwarfs every other cost combined, often ranging from $20,000 to $100,000+. After securing the property, furniture is the next largest expense at $1,200–$8,000.

How much should I budget for Airbnb furniture?

Budget $1,200–$3,000 for a one-bedroom unit and $2,500–$5,500 for a two-bedroom unit. You can furnish for less by sourcing from Facebook Marketplace, estate sales, and discount retailers—some hosts furnish entire one-bedroom units for under $600 using 100% secondhand furniture. The one item you should always buy new is the mattress ($300–$500 for a quality queen), because guest comfort directly impacts your review scores and future bookings.

What ongoing monthly costs should I expect?

For a one-bedroom rental arbitrage unit, expect $1,500–$3,200/month in total expenses, including rent ($800–$1,800), utilities ($150–$300), cleaning ($420–$630 based on 8-12 turnovers), supplies restocking ($40–$80), insurance ($80–$175), and minor maintenance ($50–$150). Most of the cleaning cost is passed to guests through Airbnb’s cleaning fee feature, so your actual out-of-pocket is lower than the gross number suggests.

How long until an Airbnb business becomes profitable?

Most rental arbitrage hosts start generating positive monthly cash flow within 1-3 months of going live. Breaking even on the total startup investment typically takes 3-9 months depending on your market, nightly rate, occupancy, and initial investment amount. A $5,000 investment in a market generating $650/month in profit breaks even in about 8 months. Stronger markets with higher nightly rates can cut that to 4 months or less. Use our profit calculator to model your specific scenario.

Do I need an LLC to start an Airbnb?

An LLC isn’t legally required to list on Airbnb, but it’s strongly recommended for liability protection, especially if you’re operating as a business rather than occasionally renting a spare room. LLC formation costs range from $50 to $500 depending on your state (Wyoming and New Mexico are the cheapest). The liability protection alone—separating your personal assets from your Airbnb business—is worth the small investment. Most CPAs and legal advisors recommend forming an LLC before your first guest checks in.

Your Next Step

You’ve got the numbers. You know exactly what every line item costs, which expenses you can cut, and how long it’ll take to get your money back. Now it’s time to actually do it.

Start by picking your market and running the numbers through our profit calculator. If the math works—and in most markets, it does—your next move is finding a property and getting landlord approval.

The students who succeed aren’t the ones with the biggest budgets. They’re the ones who stop researching and start executing. You’ve done the research. Go execute.

Want a step-by-step system for launching your first (or next) Airbnb property with minimal risk? Learn exactly how to start an Airbnb business with our complete guide, or explore rental arbitrage to see why it’s the fastest path from zero to profitable host.