I’ll be straight with you, rental arbitrage isn’t for everyone. Anyone who tells you it’s all upside is either selling something or hasn’t actually done it.

But after watching hundreds of students build rental arbitrage portfolios through 10XBNB, I can tell you this: when done right, this business model is one of the fastest ways to generate real cash flow in real estate without purchasing properties. When done wrong, it’s a fast way to burn through your savings and stress yourself out.

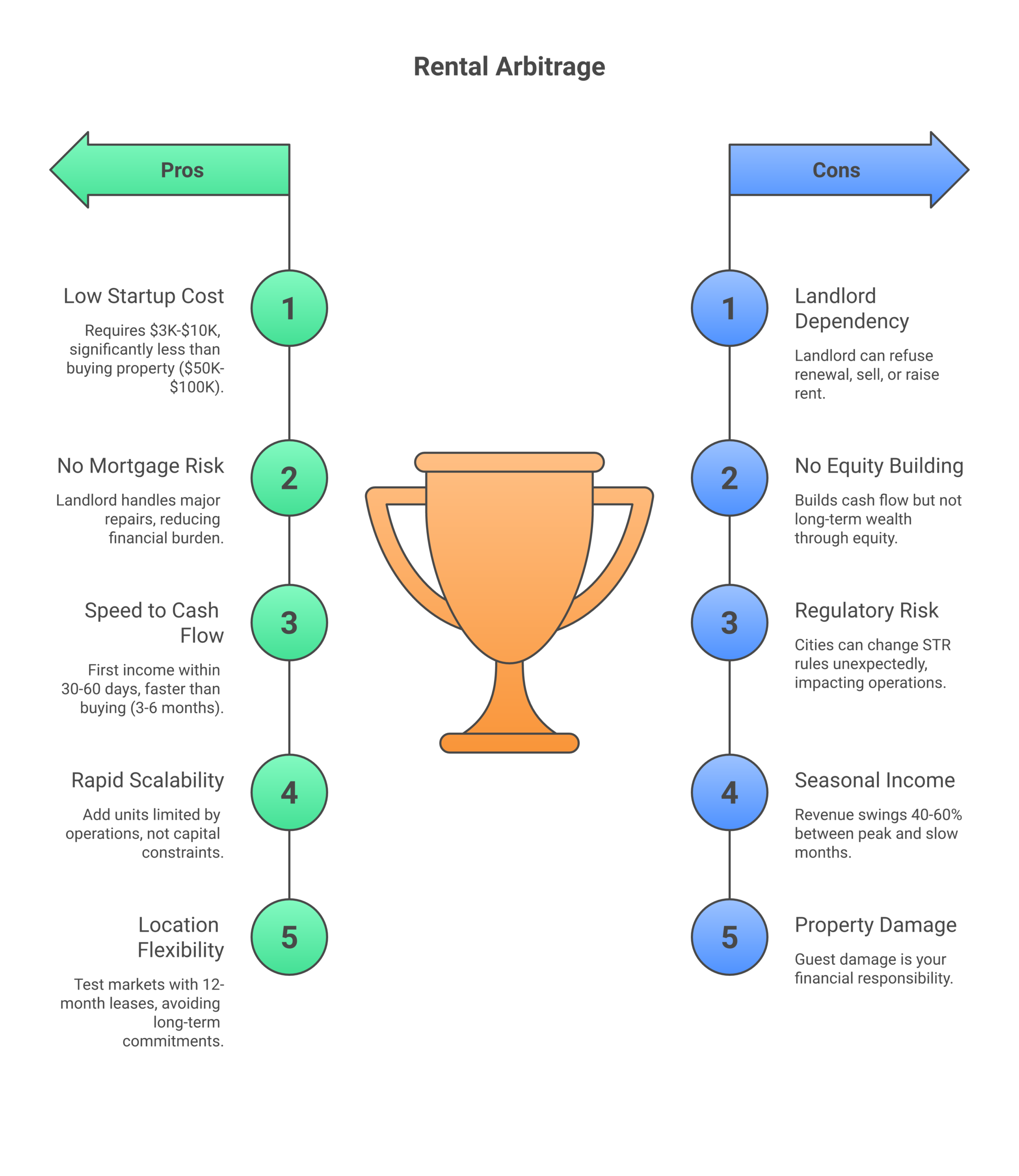

So what’s the honest breakdown of rental arbitrage pros and cons? You can start with as little as $3,000–$10,000 instead of the $50,000–$100,000+ needed to buy a rental property. You can have cash flow within 30-60 days. But you’re also building on someone else’s land, literally, and that comes with real risks.

Here’s the full picture, including the cons of rental arbitrage that most guides gloss over.

What Rental Arbitrage Actually Is (Quick Refresher)

If you’re brand new, here’s the 30-second version. Rental arbitrage means you sign a long-term lease on a rented property (just like a regular tenant), get written permission from the property owner for allowing rental arbitrage, and then list it on vacation rental platforms like Airbnb and VRBO as a short term rental. The difference between what you pay in monthly rent and what you earn from nightly bookings is your profit.

Say you lease a 2-bedroom apartment for $1,800/month. You furnish it, list it on Airbnb, and average $4,500/month in booking revenue. After cleaning fees, supplies, platform fees, and your rent, you’re left with roughly $1,500–$2,000 in monthly profit. Multiply that across 3, 5, or 10 units, and the numbers get interesting fast.

That’s the business model. Simple in concept, detailed in execution. If you want the deep dive on the full strategy, check out our complete rental arbitrage guide.

The Pros: Why Rental Arbitrage Works in 2026

Let’s start with why people are drawn to this rental business in the first place, because the advantages are genuinely compelling for anyone looking to break into the vacation rental industry.

1. Dramatically Lower Start Up Costs

This is the single biggest advantage, and it’s not even close. Buying an investment property typically requires $50,000–$100,000+ between down payment, closing costs, inspections, and initial repairs. Even with creative financing, you’re looking at $25,000–$40,000 minimum. That’s a wall most people can’t climb.

Rental arbitrage? Your start up costs typically run $3,000–$10,000 per unit. That covers first month’s rent, security deposit, furnishing, and initial supplies. One of our students in Phoenix launched her first unit for $4,200 total and was cash-flow positive by month two.

Compare that to purchasing properties outright. With Airbnb arbitrage, you’re investing a fraction of the capital and seeing returns faster. For a complete line-by-line breakdown, see our full startup costs analysis.

2. Zero Mortgage Risk and No Property Ownership Liability

When you own a rental property, you own everything that comes with it. The roof that needs replacing. The foundation crack. The $12,000 HVAC system that dies in July. The property taxes. The insurance. The liability if someone gets hurt on your property.

With arbitrage, the property owner handles major maintenance and structural issues. Your lease payment is fixed and predictable. You’re not underwater if the property value drops 20%. And if the market turns or a recession hits, you can wind down a lease far more cleanly than you can sell an underwater property long term.

That’s not to say you have zero risk, we’ll get to the cons, but the financial exposure per unit is a fraction of what landlords face.

3. Speed to Cash Flow

Buying a property takes 30-90 days minimum from offer to close. Then add renovation time, furnishing, listing optimization, and ramp-up. You’re looking at 3-6 months before you see real rental income.

Airbnb arbitrage moves faster. Sign a lease, furnish the place (most students get this done in 5-10 days), list it, and you can have your first booking within the week. Most 10XBNB students see their first cash flow within 30-60 days of starting, and some hit profitability in their first month. That speed matters when you’re paying rent from day one.

4. Rapid Scalability of Your Rental Portfolio

Want to go from 1 unit to 5 units? With ownership, you need 5x the down payments, 5x the mortgage qualifications, 5x the closing costs. Your capital is the hard constraint.

With a rental arbitrage business, scaling your rental portfolio is primarily limited by your operational capacity and deal flow, not your bank account. I’ve seen students go from 0 to 5 units in 90 days. Some run 10-20 units within their first year. The capital requirement per unit stays manageable, so each new lease is an incremental addition rather than a massive financial commitment.

That’s what makes this short term rental business so attractive to ambitious operators. You can grow your vacation rental business at a pace that purchasing properties simply doesn’t allow.

5. Location Flexibility and Market Testing

Here’s something ownership can’t give you: the ability to test a market without a 15-30 year commitment.

Think a mountain town is going to blow up as a vacation rental market? Sign a 12-month lease and test it. If the numbers work, great, sign another lease or add units. If they don’t, you’re out at the end of your term with minimal losses. Compare that to buying a property in a market that underperforms, where you’re stuck with a mortgage and a property that might take months to sell at a loss.

This flexibility is underrated. Markets shift. Regulations change. Tourism patterns evolve. Rental arbitrage lets you follow the opportunity instead of being anchored to one location. You can chase local demand wherever it’s hottest.

6. Legitimate Tax Advantages

When you operate rental arbitrage as a business (and you absolutely should set up an LLC), you unlock legitimate tax deductions. Furnishing costs, cleaning supplies, platform fees, property management software subscriptions, mileage, a portion of your home office, professional photography, insurance – all deductible business expenses.

In many cases, the depreciation on furnishings alone can offset a significant chunk of your taxable income. One of our students who runs 7 units deducted over $38,000 in legitimate business expenses in her first year. That’s real money back in your pocket.

Consult a CPA who understands short-term rental taxation. It’s one of the highest-ROI investments you’ll make in this rental business.

7. Portfolio Diversification Without Concentration Risk

Owning one property means all your eggs are in one basket. One bad market, one terrible tenant, one natural disaster, and your entire investment is at risk.

Arbitrage naturally diversifies because the capital per unit is so low. You can run units in different neighborhoods, different property types (apartments, houses, townhomes), and even different cities. If one unit underperforms, your other units absorb the impact. That kind of built-in diversification is genuinely hard to achieve with property ownership unless you have deep pockets.

The Cons: The Real Risks You Need to Know

Alright, here’s where I earn the “honest truth” part of this article. These cons of rental arbitrage aren’t hypothetical. They’re real challenges that real operators face. Ignoring them doesn’t make them go away.

1. Landlord Dependency and Lease Risk

This is, without question, the single biggest risk in the rental arbitrage business. You are building a tenant’s business on someone else’s property, and they have the ultimate say.

A property owner can refuse to renew your lease, even if you’ve been a model tenant and your short term rental has been flawless. They might decide to sell the property. They might raise rent beyond what makes the numbers work. They might change their mind about allowing rental arbitrage on their property.

I’ve seen this happen to strong operators. One student had a 4-unit portfolio, and two landlords decided not to renew in the same quarter. That’s half your rental income gone in 60 days through no fault of your own.

The mitigation? Build strong landlord relationships. Over-communicate. Keep the rented property in better shape than you found it. And always have a pipeline of new deals so losing one unit doesn’t break your business. For detailed strategies, read our guide on getting landlord approval.

2. No Equity Building

This is the trade-off that makes real estate purists cringe. Every month, your rent check goes to the landlord’s mortgage, building their equity, not yours. After 5 years of a successful rental arbitrage business, you don’t own anything. No property. No appreciation. No asset to sell.

You’ve (hopefully) built cash flow, savings, and business systems. But you haven’t built the kind of wealth that compound appreciation creates. A property bought for $300,000 that appreciates to $400,000 over 5 years has created $100,000 in equity, on top of whatever cash flow it generated.

This doesn’t make arbitrage bad. It makes it different. Think of it as a cash flow engine, not a wealth-building vehicle. Many smart operators use arbitrage cash flow to eventually fund property purchases, getting the best of both worlds. For a head-to-head comparison, see our breakdown of arbitrage vs buying property.

3. Regulatory Risk and Local Laws

Short term rental regulations are a moving target in 2026. Cities that were STR-friendly two years ago might now require permits, limit operating days, or ban non-owner-occupied short term rentals entirely. New York, San Francisco, and parts of LA have already made Airbnb arbitrage extremely difficult or impossible.

And here’s the kicker: you often can’t predict regulatory changes. A new city council, a well-organized neighborhood association, or a single viral news story about “party houses” can shift the political landscape overnight.

If your city passes a ban on non-owner-occupied vacation rentals, your arbitrage business in that market is done. And you’re still on the hook for whatever lease obligations remain. Local permit fees add up too. Some cities charge $500–$2,000+ annually just for the right to operate.

Risk mitigation: always research local regulations and local laws before entering a market. Check our state-by-state legal guide to understand where rental arbitrage legal requirements stand. Diversify across multiple municipalities so one city’s policy change doesn’t wipe you out. And stay engaged with local STR advocacy groups. You want to know about regulatory threats before they become laws.

4. Lease Violation Risk

Operating a short term rental without proper landlord permission and a correctly structured rental agreement is a recipe for disaster. You could face eviction, lease termination, forfeiture of your security deposit, and in some cases, legal action.

“I’ll just do it and hope the landlord doesn’t find out” is one of the most dangerous approaches I see beginners take. Landlords find out. Neighbors complain. Airbnb reviews with your address show up on Google. It’s not a matter of if. It’s when.

Every unit you operate needs explicit, written permission from the property owner documented in your lease agreement. Period. This is non-negotiable and protects both of you.

5. Seasonal Income Volatility vs. Steady Rental Income

Short term rental income is not consistent. Depending on your market, you might earn $8,300 in July and $3,200 in January. That’s a 60% swing, and you’re paying rent, utilities, and insurance the same amount every month regardless.

Beach markets get crushed in winter. Mountain towns struggle in shoulder seasons. Even urban markets see dips during certain months. If you’re not financially prepared for lean months, one bad quarter can drain your reserves and put you behind on rent.

Traditional landlords enjoy steady rental income from long-term tenants. As a vacation rental host, you don’t get that luxury. Your income fluctuates with seasonality, local demand, and competition.

The smart move: bank 2-3 months of operating costs as a reserve before you even list your first property. Know your market’s seasonal patterns. Adjust pricing dynamically. And never count your peak-season income as your baseline.

6. Property Damage Liability

Here’s a con that catches people off guard. Property damage from guests is your responsibility. Not Airbnb’s, not the landlord’s. Yours.

A guest spills red wine on the carpet? That’s a $400 replacement out of your pocket. Someone breaks the dishwasher? $300–$600 to fix. A group throws a party and puts a hole in the wall, burns the countertop, and trashes the bathroom? I’ve seen repair bills hit $3,000+ from a single weekend.

Airbnb’s host damage protection covers some incidents, but the claims process is slow, contentious, and doesn’t always pay out. You need your own short-term rental insurance policy AND a cash reserve specifically for property damage. Budget $50–$100/month per unit into your operating costs for maintenance and damage.

7. Management Intensity and Operating Costs

I hear this one a lot from beginners: “I want passive income.” Let me be direct, rental arbitrage is not passive income. Not at the start, and honestly, not ever (unless you hire a management team or use a co-host).

You’re handling guest communications, check-ins, turnovers, cleaning coordination, maintenance issues, pricing adjustments, listing optimization, restocking supplies, dealing with noise complaints, managing reviews, and handling emergencies. At 2 AM. On holidays. When you’re on vacation.

Operating costs add up fast too. Cleaning fees ($75–$150 per turnover), supplies ($100–$200/month), property management software ($20–$50/month per listing), utilities ($150–$300/month), insurance ($50–$100/month). These eat into your margins and many new operators underestimate them.

This is a real business with real operational demands. Some people thrive on it. Others burn out within 6 months. Be honest with yourself about your tolerance for this kind of work before you sign your first lease.

8. Furnishing Costs Are Sunk If You Lose a Lease

You just spent $5,000–$8,000 furnishing a 2-bedroom apartment. Everything’s dialed in, the decor, the kitchen setup, the linens. Then your landlord decides to sell the property and gives you 60 days’ notice.

Now what? You can move the furniture to a new unit, but that costs money (movers, potential damage, items that don’t fit the new space). You can sell it, usually at a fraction of what you paid. Or you eat the loss.

These start up costs are effectively sunk. Unlike property equity, furniture depreciates the moment you buy it. After 2-3 years, most furnishings have minimal resale value regardless.

9. Market Saturation in Some Areas

The vacation rental industry has exploded since 2020. In popular markets, the number of Airbnb listings has grown 30-50% while traveler demand hasn’t kept pace. That means more hosts competing for the same guests, which drives down nightly rates and occupancy.

Markets like Nashville, Austin, Phoenix, and parts of Florida have seen significant saturation. Average daily rates have compressed, and new operators entering these markets face much thinner margins than operators who established themselves in 2019 or 2020.

This doesn’t mean rental arbitrage opportunities don’t exist. They absolutely do. But you need to be smarter about market selection. Secondary and tertiary markets often offer better margins than oversaturated primary markets. Research local demand carefully before committing.

Rental Arbitrage Pros and Cons: Side-by-Side Comparison

| Factor | Rental Arbitrage | Buying Property |

|---|---|---|

| Start Up Costs | $3,000–$10,000 per unit | $50,000–$100,000+ |

| Time to First Cash Flow | 30-60 days | 3-6 months |

| Equity Building | None | Yes (mortgage paydown + appreciation) |

| Scalability | Fast, limited by operations, not capital | Slow. Each purchase requires major capital |

| Major Maintenance | Property owner’s responsibility | Your responsibility ($$) |

| Control Over Property | Limited (landlord can end lease) | Full ownership control |

| Regulatory Risk | High (double exposure: lease + local laws) | Medium (local laws only) |

| Exit Strategy | Walk away at lease end (low cost) | Sell property (months + transaction costs) |

| Monthly Cash Flow | $1,000–$3,000+ per unit | $500–$2,000+ per unit (after mortgage) |

| Income Stability | Variable (seasonal) | Steady rental income (long-term tenants) |

| Property Damage Risk | Your liability (guest damage) | Your liability (tenant/structural) |

| Market Flexibility | High, test and pivot quickly | Low, anchored to property location |

| Best For | Cash flow seekers, beginners, fast scalers | Long-term wealth builders, high capital |

The Real Numbers: What a Successful Rental Arbitrage Business Looks Like

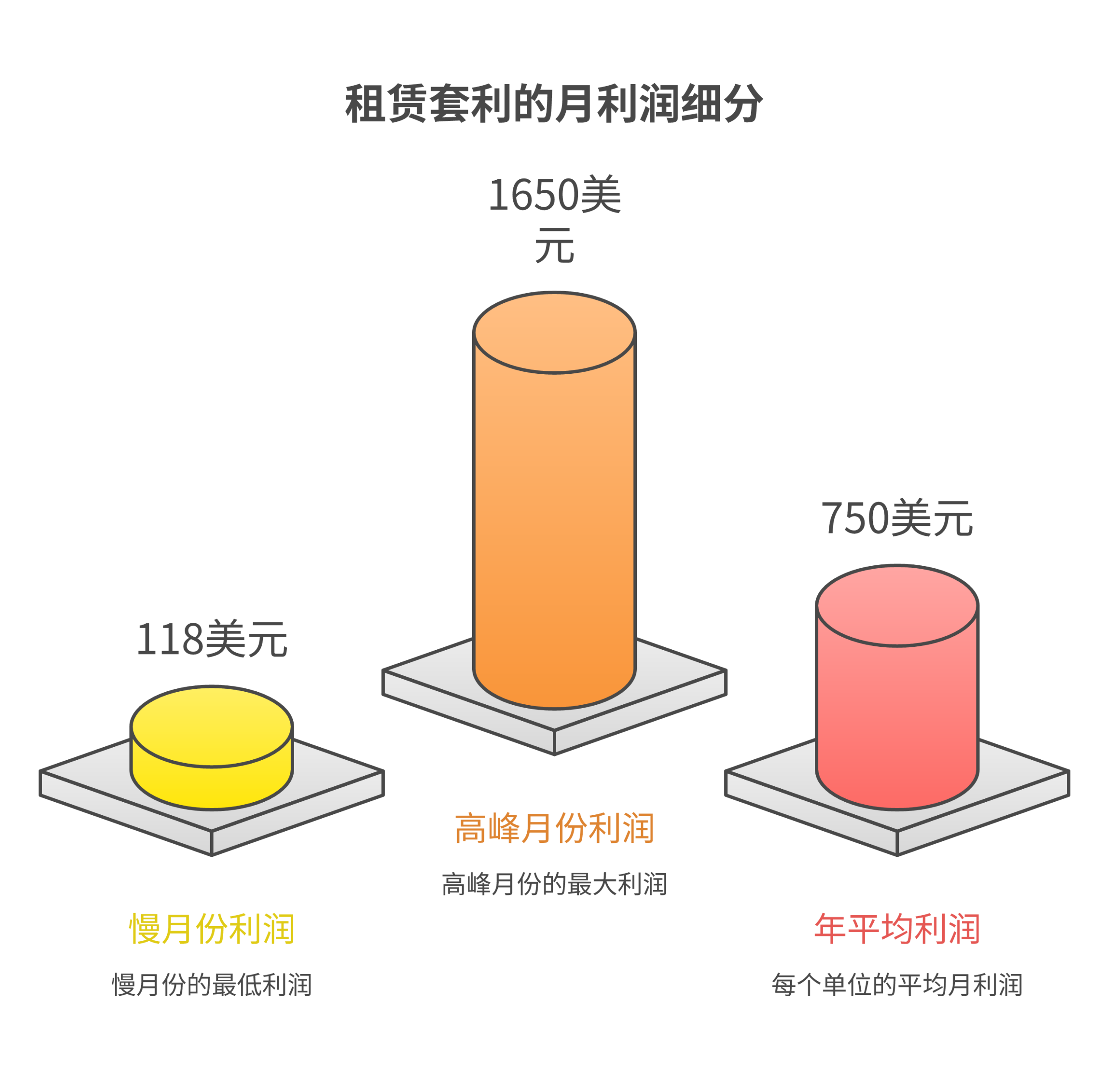

Forget the Instagram screenshots. Here’s what the actual math looks like for a single unit in a mid-tier market, broken down month by month.

Sample Unit: 2-Bedroom Apartment in a College Town

| Line Item | Monthly Amount |

|---|---|

| Monthly Rent (paying rent to landlord) | $1,600 |

| Airbnb Revenue (avg 72% occupancy, $145/night) | $3,132 |

| Cleaning Fees (10 turnovers × $85) | -$850 |

| Airbnb Host Fee (~3%) | -$94 |

| Utilities | -$185 |

| Supplies & Restocking | -$110 |

| Property Management Software | -$35 |

| Insurance | -$65 |

| Maintenance/Damage Reserve | -$75 |

| Net Monthly Profit | $118 (slow month) to $1,650 (peak) |

| Annual Average | ~$750/month ($9,000/year) |

Those numbers aren’t sexy. They’re real. A single unit won’t change your life. But stack 4 of those and you’re looking at $36,000/year on roughly $20,000–$30,000 in total start up costs. That’s a 120-180% cash-on-cash return, far better than what purchasing properties typically delivers.

Now here’s why the top performers earn more: they pick better markets, negotiate lower rent, optimize pricing aggressively, and run tighter operations. The difference between a $750/month operator and a $2,000/month operator usually isn’t the market. It’s the execution.

Who Rental Arbitrage Is Perfect For

Based on everything above, arbitrage isn’t universally good or bad. It’s about fit. Here’s who tends to crush it in this vacation rental business, and who should look elsewhere.

Rental Arbitrage Is Ideal If You:

- Have limited capital – You don’t have $50K+ for a down payment but you can scrape together $5K–$10K to get started in the short term rental business.

- Want fast results – You need cash flow in the next 60-90 days, not 6-12 months from now.

- Are operationally-minded – You enjoy (or at least tolerate) the hospitality side: guest communication, property presentation, problem-solving on the fly. Being a vacation rental host takes real effort.

- Live in or near an STR-friendly market – You have access to cities or towns where short term rentals are legal, permitted, and in demand.

- Want to learn the STR business before buying – Arbitrage is a phenomenal training ground. You learn pricing, guest management, market dynamics, and operations, all with far less financial risk than ownership.

- Plan to scale quickly – If your goal is 5-10+ units within a year, arbitrage removes the capital constraint that makes rapid scaling through ownership nearly impossible.

You Should Probably Skip Arbitrage If You:

- Want truly passive income – This isn’t it. Even with automation and co-hosts, rental arbitrage requires active involvement, especially in the first year.

- Are focused purely on long-term wealth building – If your primary goal is equity and appreciation over 10-20 years, purchasing properties (even with higher upfront cost) is the better vehicle.

- Have low risk tolerance – The landlord dependency and regulatory risk factors mean you need to be comfortable with uncertainty. If losing a lease would financially devastate you, you’re over-use.

- Live in a heavily regulated market with no alternatives – If your only option is a city that’s banned or severely restricted short term rentals, arbitrage isn’t viable regardless of how much you want it to work.

- Hate dealing with people – Guest issues, landlord relationships, cleaning teams, neighbors. This is a people-intensive business. If that drains you, the money won’t compensate for the misery.

How to Build a Successful Rental Arbitrage Business (Despite the Risks)

Every con on this list has a mitigation strategy. You can’t eliminate these risks, but you can manage them down to acceptable levels. Here’s how operators running a successful rental arbitrage business handle each one.

Landlord Risk Mitigation

- Get everything in writing. A proper arbitrage lease agreement protects both you and the property owner. No handshake deals. The rental agreement should explicitly address subletting, guest limits, and insurance requirements.

- Offer above-market incentives. Higher security deposits, quarterly property inspections, professional cleaning between guests, and sharing a portion of positive reviews can make landlords enthusiastic partners rather than reluctant ones.

- Maintain a deal pipeline. Always be prospecting for new rental arbitrage opportunities. If you have 5 units, maintain conversations with landlords for 2-3 backup properties. When (not if) you lose a lease, you can pivot quickly.

- Diversify landlords. Don’t put 4 units with the same property owner. If they decide to exit the arrangement, you don’t lose everything at once.

Regulatory Risk Mitigation

- Research before you commit. Check city STR ordinances, HOA rules, and building restrictions before signing any lease. Call the city’s permit office directly. Don’t rely on blog posts or forums for legal accuracy. Factor in local permit fees when running your numbers.

- Operate across multiple municipalities. If you have 5 units in one city and that city passes an STR ban, your entire arbitrage business is gone. Spread your units across 2-3 different jurisdictions when possible.

- Stay politically engaged. Join your local STR alliance or host association. Attend city council meetings when STR legislation is on the agenda. The operators who get blindsided by regulation are the ones who weren’t paying attention.

- Get properly permitted. In cities that require STR permits, get them. Operating without permits gives regulators an easy reason to shut you down and makes the entire vacation rental industry look bad.

Income Volatility Mitigation

- Build a cash reserve. Before you launch, save 2-3 months of rent per unit as a safety net. This isn’t optional. It’s survival money for slow months when you’re still paying rent but bookings are thin.

- Use dynamic pricing tools. Platforms like PriceLabs and Beyond Pricing adjust your nightly rates based on demand, local events, and market conditions. They won’t eliminate seasonality, but they’ll help you capture every available dollar during slow periods.

- Diversify booking channels. Don’t rely solely on Airbnb. List on VRBO, Booking.com, and Furnished Finder (for mid-term rentals). Some operators fill slow months with 30-day+ stays at lower nightly rates but higher occupancy.

- Choose markets with year-round demand. Urban markets near hospitals, universities, and business centers tend to have more stable local demand than purely tourism-dependent markets. That means more consistent rental income throughout the year.

No-Equity Mitigation

- Use arbitrage as a stepping stone. The best play? Run arbitrage to generate cash flow, then funnel that cash flow into property down payments. You get the fast cash flow now AND the equity building later. Many of our most successful students used this exact path.

- Build transferable business assets. Your systems, SOPs, team, and reputation have value even if your individual leases don’t. Some operators eventually sell their entire portfolio (leases, furnishings, systems, and guest pipeline) to incoming operators. A well-run arbitrage business with documented systems has real market value.

Real Talk: What 10XBNB Students Say After Year One

Forget the theory for a minute. Here’s what actual operators report after 12 months in the Airbnb arbitrage game.

The students who succeed, and I mean consistently profit $3,000–$10,000+/month, share a few traits. They treated it like a business from day one. They got landlord approval in writing before signing anything. They understood their market’s numbers cold. And they didn’t panic during their first slow month.

The ones who struggled or quit? Almost always one of three patterns:

- They skipped the landlord conversation. Operated without permission, got caught, lost everything including their deposit. Every time. Don’t be that person.

- They didn’t run the numbers honestly. They used peak-season projections as their baseline, ignored cleaning costs, underestimated operating costs, and found themselves upside down by month three.

- They treated it like a side hustle instead of a business. Half-effort gets half-results (at best). Guests notice when the place isn’t dialed in. Reviews suffer. Bookings dry up. It’s a downward spiral.

The honest truth? About 70-80% of students who follow the 10XBNB system, not just watch the content but actually execute the steps, report profitability within their first 90 days. The top performers reinvest that cash flow into additional units and hit $5,000–$15,000/month in net profit within their first year.

But it took work. Real, consistent, sometimes-unglamorous work. The ones who expected passive income were universally disappointed. The ones who expected a real business that requires real effort? They’re the ones still operating (and scaling) today. Read their success stories for yourself.

Rental Arbitrage vs. Other Real Estate Models

Rental arbitrage isn’t the only way to make money in real estate without a massive down payment. Here’s how it stacks up against other common approaches.

Arbitrage vs. Property Management

Property managers run someone else’s property for a percentage (typically 15-25% of revenue). You never sign a lease or pay rent, the property owner covers all costs, and you take a management fee. Lower risk, lower reward. If you want zero financial exposure, managing beats arbitrage. But your upside is capped at that management percentage, and you’re dependent on property owners keeping you on.

Arbitrage vs. Co-Hosting

Co-hosting means you handle operations for an existing vacation rental host and split the revenue (usually 20-30% to you). Similar to property management but more common in the STR world. No lease, no furnishing costs, no rent. Good entry point, but you don’t control pricing, listing quality, or the property itself.

Arbitrage vs. House Hacking

House hacking means buying a property (usually with an FHA loan at 3.5% down), living in one unit, and renting out the others as short term rentals. You build equity, get owner-occupied financing rates, and generate cash flow. The downside? You need to qualify for a mortgage, live in the property, and your capital is locked up. Best for people who want the long game and can tolerate living in their investment.

The Sweet Spot: Hybrid Approach

Most seasoned operators end up combining models. They run 3-5 arbitrage units for cash flow, manage 2-3 properties for other owners, and eventually buy 1-2 properties of their own. This hybrid approach gives you cash flow (arbitrage), steady management income, and long-term equity, all while keeping each individual risk manageable.

How to Get Started With Rental Arbitrage (If You Decide It’s Right)

If you’ve read this far and the pros outweigh the cons for your situation, here’s the path forward. Don’t overthink it. But don’t rush blindly either.

- Research your market. Check local regulations, STR permit requirements, local demand patterns, and average nightly rates on AirDNA or similar platforms. Is the vacation rental market viable in your area?

- Build your budget. Calculate realistic start up costs including first month’s rent, deposit, furnishing, and 2-3 months of reserves. Don’t start if you can’t cover operating costs through a slow season.

- Find landlord-friendly properties. Focus on individual property owners (not corporate management companies). Look for properties that would perform well as vacation rentals, good location, adequate parking, in-unit laundry, updated interior.

- Pitch the landlord professionally. Present your business plan, insurance proof, and references. Explain how your tenant’s business actually benefits them: guaranteed rent, professional maintenance, and a well-kept rented property.

- Set up your business entity. Get your LLC formed, insurance in place, and bank accounts separated. Protect yourself legally from day one.

- Furnish and launch. Budget $2,000–$5,000 for furnishing. Professional photos are non-negotiable. Optimize your listing with competitive pricing to get those first reviews.

- Build your exit strategy from the start. Know what happens if a lease doesn’t renew. Have a plan for furniture. Maintain relationships with other landlords. The operators who survive long-term are the ones who planned for the downside.

Frequently Asked Questions About Rental Arbitrage

Is rental arbitrage legal?

Yes, rental arbitrage is legal in most places. But rental arbitrage legal requirements depend on your specific city, county, and even building/HOA rules. Some cities require STR permits or licenses and charge local permit fees. Others limit the number of nights you can rent per year. A handful have banned non-owner-occupied short term rentals entirely. Always check local regulations AND get written landlord permission before starting. Operating without both is how people get shut down.

How much money can you realistically make with rental arbitrage?

Profit varies significantly by market, property type, and operational skill. As a general range, most operators running a successful rental arbitrage business net $1,000–$3,000 per unit per month after all expenses. A student running 5 units averaging $2,000/month profit is earning $10,000/month, or $120,000/year, on a total initial investment of roughly $25,000–$40,000. Peak months can be significantly higher; slow months can dip to break-even.

What happens if my landlord says no to renewal?

This is a real risk, and it happens. If your property owner doesn’t renew, you typically have 30-90 days (depending on your rental agreement and local laws) to wind down operations. You’ll need to honor existing guest bookings, remove furnishings, and return the property. The financial impact depends on your reserves and whether you have backup rental arbitrage opportunities ready. This is exactly why diversifying landlords and maintaining a deal pipeline matters.

Can I do rental arbitrage with no real estate experience?

Absolutely, and this is one of arbitrage’s biggest strengths as a business model. You don’t need real estate licenses, property management experience, or investment expertise to start. What you do need is willingness to learn (market analysis, pricing strategy, guest communication), a few thousand dollars for start up costs, and the discipline to run it like a rental business. Many of our most successful students had zero background before starting.

Is rental arbitrage better than buying property?

Neither is universally “better.” They serve different goals. Arbitrage is better for fast cash flow, low capital entry, and rapid scaling. Purchasing properties is better for long-term wealth building, equity accumulation, and asset appreciation. Many experienced operators do both, using arbitrage cash flow to eventually fund property purchases. Your best choice depends on your current financial situation, risk tolerance, and timeline. We break this down fully in our arbitrage vs buying property comparison.

How much does it cost to start rental arbitrage?

For a typical unit, expect $3,000–$10,000 total in start up costs. That breaks down roughly as: first month’s rent ($1,200–$2,500), security deposit ($1,200–$2,500), furnishing ($2,000–$5,000), initial supplies ($300–$500), and professional photography ($150–$300). You can start on the lower end by finding deals on furniture through Facebook Marketplace and estate sales. Check our detailed startup costs breakdown for a complete line-by-line budget.

What’s the biggest mistake new operators make?

Operating without written landlord permission. Full stop. It’s the fastest way to lose everything. Your deposit, your furnishings, your bookings, and potentially face legal action. The second most common mistake is using peak-season projections as their baseline income assumption, then being shocked when January revenue is 40-60% lower than July. Both are entirely avoidable with proper preparation.

Do I need property management software?

Not for your first unit, but yes once you scale beyond 2-3 listings. Property management software like Hospitable, Guesty, or OwnerRez automates guest messaging, syncs calendars across vacation rental platforms, and handles pricing adjustments. At $20–$50/month per listing, it’s one of the most worthwhile operating costs in the business. Without it, managing multiple listings across Airbnb, VRBO, and Booking.com becomes a full-time job.