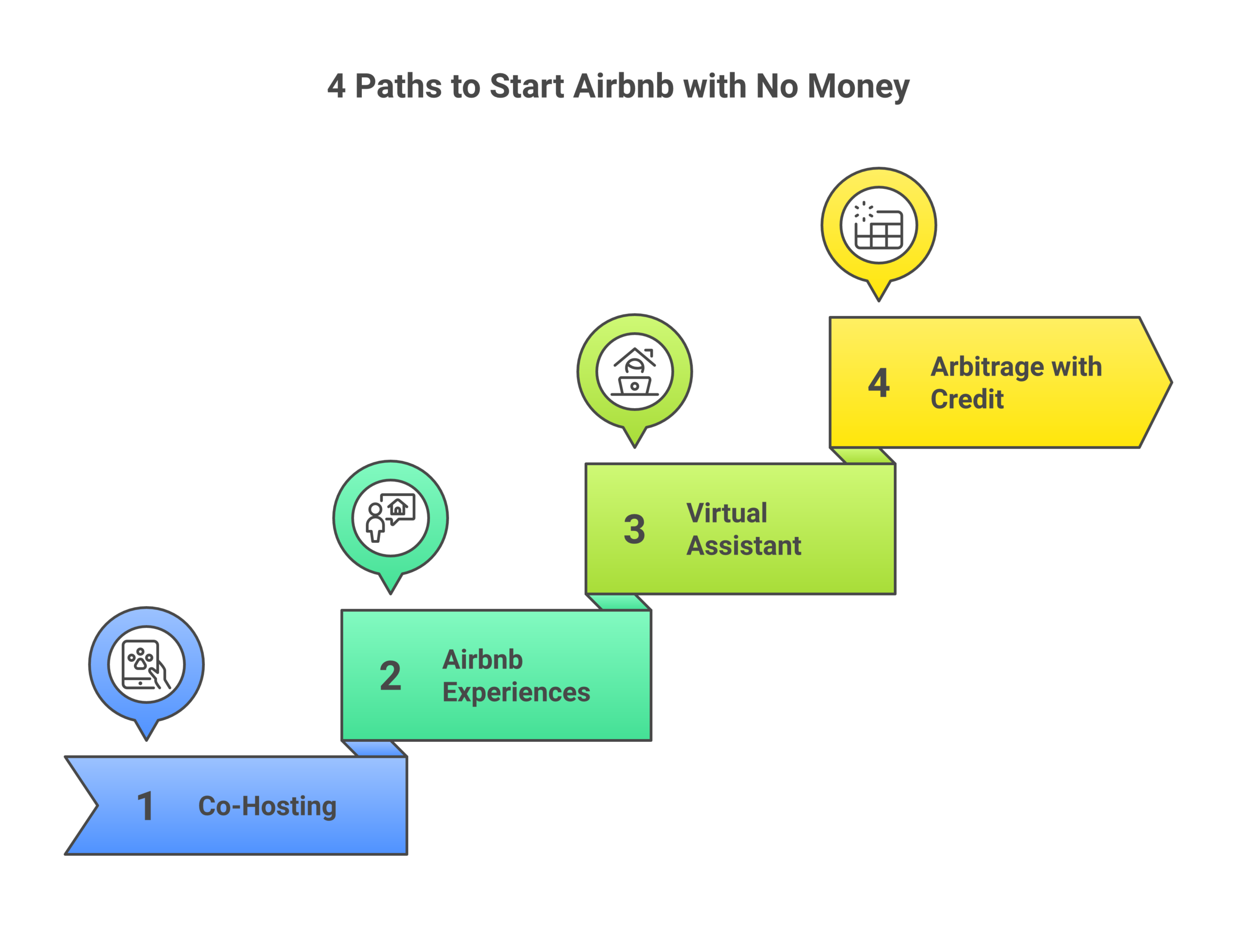

You can absolutely start an Airbnb business with no money—or close to it. I’ve watched hundreds of people do exactly that through rental arbitrage, co-hosting, and other creative strategies that don’t require buying property or draining a savings account. The truth is, most successful Airbnb entrepreneurs didn’t start with capital. They started with hustle, a plan, and one of the seven methods I’m about to break down for you.

Whether you have $0, $500, or $5,000 to work with, there’s a path into the short-term rental industry that fits your situation. Some methods generate $2,000-$8,000 per month. Others start smaller but scale fast. Here’s what actually works in 2026—no fluff, just the real playbook people are using right now to build Airbnb income from scratch.

Method 1: Rental Arbitrage ($0-$5K to Start)

Rental arbitrage is the single most popular way to start an Airbnb business without owning property—and for good reason. The concept is straightforward: you sign a long-term lease on an apartment or house, then list that property on Airbnb at a nightly rate that exceeds your monthly rent. The difference between what guests pay and what you owe in rent is your profit.

Here’s what the numbers actually look like. Say you lease a two-bedroom apartment for $1,500 per month in a mid-size city. You furnish it for around $3,000 (that’s your only real startup cost, and you can cut it further with Facebook Marketplace furniture). If you charge $120 per night and maintain 70% occupancy, your monthly gross revenue hits roughly $2,520. After rent, utilities, cleaning fees, and supplies, you’re clearing $500-$800 in profit from that single unit. Scale to three or four units and you’re looking at $2,000-$4,000 per month in net income.

But the real money in rental arbitrage comes when you pick the right markets. I’ve seen operators in cities like Nashville, Scottsdale, and San Antonio clear $3,000-$8,000 per month per unit on well-located properties near tourist attractions or event venues. The key variables are:

- Location selection — Target cities where arbitrage works best, meaning nightly rates are 2-3x higher than monthly rent

- Landlord negotiation — You need the landlord’s written permission to sublet. Many landlords actually love this arrangement because you guarantee occupancy and maintain the property at a higher standard than typical tenants

- Furnishing strategy — Start lean. A clean, well-photographed space with solid basics (comfortable bed, good towels, coffee maker, fast WiFi) outperforms an expensive but poorly staged one

- Pricing optimization — Use dynamic pricing tools like PriceLabs or Wheelhouse to adjust rates based on demand, events, and seasonality

The biggest misconception about rental arbitrage is that you need a lot of cash. You don’t. Some landlords let you move in with first month’s rent and a security deposit totaling $3,000-$4,500. If you’re strategic about furnishing (buy used, negotiate deals, start with essentials only), your total out-of-pocket can be under $5,000. Some people have started with even less by negotiating move-in specials or partnering with someone who has furniture.

One more thing about arbitrage: the landlord pitch matters more than people realize. Property owners worry about damage, noise complaints, and turnover. Your pitch needs to address all three head-on. Offer a higher security deposit than asked. Explain that Airbnb guests are vetted through ID verification and reviews. Mention that you’ll maintain the property at a higher standard because your income depends on guest satisfaction. Some hosts even offer to show landlords their cleaning checklist and guest screening process. The hosts who land the best arbitrage deals are the ones who treat the landlord conversation like a business presentation, not a favor request.

Want to understand the full picture? Read our rental arbitrage pros and cons breakdown and our startup costs breakdown for exact dollar figures.

Method 2: Airbnb Co-Hosting (Manage Others’ Properties for 10-25% of Revenue)

Co-hosting is the true $0 startup method. You don’t lease anything. You don’t buy furniture. You simply manage someone else’s Airbnb listing in exchange for a percentage of each booking—typically 10-25% of gross revenue depending on how much work you handle.

Here’s what co-hosting actually involves on a daily basis. You handle guest communications (answering messages, managing check-in/check-out), coordinate cleaning crews between guests, optimize the listing (photos, description, pricing), and deal with any issues that come up during a stay. The property owner keeps their listing and their property. You bring the operational expertise.

The income potential is real. If you manage a property that generates $3,000 per month in bookings at a 20% commission, you’re earning $600 per month from that single listing. Manage five properties and you’re at $3,000 per month. I’ve seen co-hosts managing 15-20 properties who earn $8,000-$12,000 monthly—all without owning or leasing a single property.

How to find your first co-hosting client:

- Search for poorly performing listings in your area — Look for properties with few reviews, bad photos, or inconsistent pricing. These owners need help and often don’t know it

- Reach out directly — Message through Airbnb or find them on Facebook groups for local hosts. Your pitch is simple: “I’ll increase your bookings and handle everything day-to-day. You just collect the checks”

- Start with one property to build a track record — Once you’ve improved one listing’s performance (better photos, optimized pricing, faster response times), you have proof of value to pitch the next owner

- Get a solid co-host contract — Protect yourself with a written agreement covering commission rate, responsibilities, and termination terms

The beauty of co-hosting is scalability. Your costs stay near zero no matter how many properties you manage. The only investment is your time and a smartphone.

One strategy that works incredibly well for new co-hosts: offer a free 30-day trial to your first client. Tell them you’ll manage their property for one month at no cost. If they see more bookings, better reviews, or less stress during that month, you start charging your commission. This eliminates risk for the property owner and gives you a track record you can leverage when approaching your next clients. I’ve never seen a host say no to a free trial—and I’ve rarely seen a co-host who did good work during that trial period get dropped afterward.

Method 3: Co-Listing on Airbnb (Earn Per Booking)

Co-listing is similar to co-hosting but with a key difference: instead of managing all operations, you primarily focus on creating and optimizing the listing itself. Property owners add you as a co-host on their Airbnb account, giving you the ability to manage the listing, adjust pricing, and communicate with guests.

Co-listing works especially well if you have marketing or photography skills. Many property owners are terrible at writing descriptions, taking photos, and setting competitive prices. If you can walk in, reshoot their property with a smartphone and natural lighting, rewrite their title and description with SEO-friendly copy, and implement dynamic pricing—you’ve just potentially doubled their bookings.

Commission structures for co-listing usually fall between 10-20% of each booking. Some co-listers charge a flat monthly fee ($200-$500 per property) instead of a percentage. Either model works. The flat fee gives you more predictable income. The percentage model gives you more upside when properties perform well.

Your startup cost? Literally $0. You’re using the property owner’s space, their Airbnb account, and their existing furnishings. All you bring is the knowledge of how to optimize a short-term rental listing.

Method 4: Become an Airbnb Virtual Assistant ($15-$30/Hour)

This one flies under the radar, but Airbnb virtual assistants are in massive demand. As the short-term rental industry has grown, hosts managing multiple properties need help with guest communication, booking management, calendar synchronization, and review responses—tasks that can be done entirely from a laptop.

Airbnb VAs typically earn $15-$30 per hour depending on experience and the complexity of tasks. Some charge per property ($150-$400/month per listing) rather than hourly. Either way, the startup cost is functionally zero—you need a computer, internet access, and the ability to respond to messages quickly.

Core tasks of an Airbnb VA:

- Responding to guest inquiries within 15 minutes (this directly impacts Superhost status)

- Managing check-in/check-out instructions and coordinating key exchanges

- Syncing calendars across Airbnb, VRBO, and Booking.com to avoid double bookings

- Writing and posting guest reviews

- Handling refund requests and guest complaints

- Updating pricing based on seasonal demand

Where to find VA work? Start on Upwork, Fiverr, and specialized Facebook groups like “Airbnb Virtual Assistant Jobs” and “STR Virtual Assistants.” You can also approach busy hosts directly—anyone managing 5+ properties almost certainly needs help. If you manage 10 listings at $250/month each, that’s $2,500 monthly income with zero overhead.

Method 5: Airbnb Experiences ($0 Startup)

Airbnb Experiences let you earn money on the platform without a property at all. You offer an activity—a walking tour, cooking class, photography session, hiking excursion, wine tasting, or any skill-based experience—and guests book directly through Airbnb.

The startup cost is genuinely $0. Airbnb doesn’t charge to list an Experience. You can apply to host an Experience directly through the platform. You set your own price (most range from $25-$150 per person per session), and Airbnb takes a 20% service fee. If you run a walking tour for 8 people at $40 each, that’s $320 gross per session. Run three sessions a week and you’re generating $3,840 per month before Airbnb’s cut.

The key to profitable Experiences is picking something you already know how to do. Are you a solid cook? Offer a local cuisine class. Know your city’s history? Run a neighborhood tour. Have photography skills? Teach tourists how to capture Instagram-worthy shots of local landmarks.

Some of the highest-earning Experience hosts I’ve seen make $4,000-$7,000 per month running 4-5 sessions per week in high-tourism cities. The margins are enormous because your only real costs are supplies (if any) and your time.

Tips for a high-performing Airbnb Experience listing:

- Keep groups small (4-8 people). Intimate experiences get better reviews and command higher per-person prices

- Invest in one great cover photo. This is what makes people click. A dynamic action shot of participants enjoying the experience beats a generic landscape photo every time

- Write your description in second person (“You’ll discover…” not “Guests will discover…”). This makes the reader imagine themselves in the experience

- Offer a unique angle that tourists can’t get elsewhere. “Downtown Walking Tour” is generic. “Hidden Speakeasies and Prohibition History Tour” is specific and bookable

- Follow up with every guest for a review. Your star rating and review count directly determine your ranking in Airbnb’s Experience search results

Method 6: Airbnb Cleaning Business ($500-$2K Startup)

Every single Airbnb property needs cleaning between guests. Every. Single. One. An Airbnb cleaning business is one of the most reliable income streams you can build in the short-term rental space because demand is constant and growing.

Here’s the math. Most Airbnb hosts pay $75-$200 per turnover cleaning depending on property size. A one-bedroom apartment might be $75-$100. A three-bedroom house runs $125-$175. A luxury property could be $200+. If you clean 3 properties per day, 5 days per week at an average of $100 per clean, that’s $6,000 per month in gross revenue.

Startup costs are minimal:

- Cleaning supplies — $150-$300 (vacuum, mop, cleaning solutions, microfiber cloths, laundry detergent)

- Transportation — You need a reliable car (which you likely already have)

- Insurance — General liability insurance runs $30-$50/month

- Marketing — Business cards and a basic Google Business profile (free)

Total startup: $500-$2,000 depending on what you already own. You can land your first client within a week by joining local Airbnb host Facebook groups and posting your services. Hosts are always looking for reliable cleaners because bad turnovers lead to bad reviews, which kills their business.

The real advantage of an Airbnb cleaning business is that it gives you an inside look at what successful hosts do. You’ll see which properties perform well, how they’re staged, what amenities they provide, and how they price. That knowledge is gold when you’re ready to launch your own listing through arbitrage or co-hosting.

Pro tip for growing your cleaning business fast: create a simple checklist system with before-and-after photos for every turnover. Send the photo set to the host after each clean. This builds trust faster than anything else and gets you referrals. Hosts talk to each other constantly in local Facebook groups—one great referral can land you 3-4 new clients within a month. Within 6 months, many Airbnb cleaners transition from doing the cleans themselves to hiring a small team and managing the business, turning a labor-intensive job into a semi-passive income stream earning $4,000-$6,000 per month.

Method 7: Rent Out a Spare Room (House Hacking)

The simplest entry point into Airbnb is renting out a room you already have. A spare bedroom, a finished basement, a detached guest suite—any private space in your home can generate income on Airbnb with virtually zero startup cost.

Spare room listings earn less per night than full-property listings, but the profit margin is nearly 100% because you’re not paying extra rent. If you charge $50-$80 per night for a private room and maintain 50-60% occupancy, you’re adding $750-$1,440 per month to your income. That’s mortgage payment money for many people.

A few things make spare room hosting work well:

- Separate entrance — If the room has its own entrance, you can charge 20-30% more and attract more bookings

- Private bathroom — Shared bathroom listings get 40% fewer bookings than private bathroom listings in most markets

- Clean, minimal staging — You don’t need to spend thousands on decor. A clean room with fresh linens, a bedside lamp, a power strip with USB charging, and a luggage rack covers 90% of what guests want

- Strong WiFi — Business travelers are a huge market for private rooms. Fast, reliable internet is non-negotiable

House hacking through Airbnb is particularly powerful if you’re already paying rent or a mortgage. You’re turning a cost center (your housing) into a revenue stream. Some hosts in expensive cities cover their entire mortgage payment by renting out one or two spare rooms on Airbnb.

Before listing, check your local short-term rental regulations and, if you’re renting, your lease agreement. Some cities require permits for short-term rentals, and some leases prohibit subletting. Get this sorted before your first guest arrives.

Realistic Income Comparison: All 7 Methods

Here’s a side-by-side comparison to help you decide which method fits your situation. These numbers reflect realistic ranges based on what operators are actually earning—not best-case-scenario hype.

| Method | Startup Cost | Monthly Income Range | Time Commitment | Scalability |

|---|---|---|---|---|

| Rental Arbitrage | $0-$5,000 | $1,000-$8,000 per unit | 10-20 hrs/week per unit | High (add more units) |

| Co-Hosting | $0 | $600-$3,000 per property managed | 5-10 hrs/week per property | Very High |

| Co-Listing | $0 | $300-$1,500 per listing | 3-8 hrs/week per listing | High |

| Virtual Assistant | $0 | $1,500-$4,000 | 15-30 hrs/week | Moderate |

| Experiences | $0 | $1,000-$7,000 | 10-25 hrs/week | Moderate |

| Cleaning Business | $500-$2,000 | $2,000-$6,000 | 20-40 hrs/week | High (hire a team) |

| Spare Room | $0-$500 | $750-$1,500 | 3-5 hrs/week | Low |

Key takeaway: Co-hosting and co-listing have the highest return relative to investment because you invest nothing upfront. Rental arbitrage has the highest absolute income potential per unit but requires some startup capital. Cleaning businesses generate the most predictable, recession-resistant income.

Which Method Is Right for You?

Choosing the right method depends on your current financial situation, available time, and long-term goals. Here’s a simple decision framework:

If you have $0 and want income fast: Start with co-hosting or becoming a VA. Both require zero capital and can generate your first income within 2-4 weeks. Use that income to fund your first rental arbitrage unit.

If you have $0 but have a skill or passion: Launch an Airbnb Experience. It costs nothing, leverages what you already know, and can be running within a week of Airbnb approving your listing.

If you have $500-$2,000: Consider starting an Airbnb cleaning business. The demand is guaranteed, the startup is minimal, and you’ll build relationships with hosts who may later become your co-hosting clients or your source for arbitrage-friendly landlords.

If you have $3,000-$5,000: Go straight into rental arbitrage. This is the method with the highest income ceiling, and $3,000-$5,000 is enough to cover a lease deposit and basic furnishing for your first unit.

If you already have a spare room: List it today. Seriously. There’s almost no reason not to. You can have a listing live within 24 hours and start earning within a week.

Many successful Airbnb entrepreneurs stack multiple methods. They start with co-hosting or cleaning to learn the business, then use that income and knowledge to move into rental arbitrage. The methods aren’t mutually exclusive—they’re stepping stones.

How 10XBNB Students Started with Zero Capital

The “no money” path isn’t theoretical. Here are real examples from people who’ve done it through the 10XBNB program:

Marcus, Atlanta: Marcus had $800 in savings and no property. He started by co-hosting for a neighbor who owned a condo near the airport but was burned out on managing guests. Within 3 months, Marcus was managing 4 properties at 20% commission, earning roughly $2,800 per month. He used that income to sign a lease on his first arbitrage unit, which now generates $2,200 per month in profit. Total time from $0 to $5,000/month: 6 months.

Rachel, Denver: Rachel started by renting out her finished basement as a private suite on Airbnb. First month she earned $1,100. She used that money to buy cleaning supplies and started an Airbnb cleaning business on the side, picking up 6 regular clients within 2 months. Combined income from the spare room and cleaning: $4,200/month. She’s now saving for her first arbitrage unit.

David, Nashville: David was working full-time and wanted side income. He became an Airbnb VA, managing guest communications for 8 properties remotely. He charged $200/month per property, earning $1,600/month working about 12 hours per week from his couch. The host knowledge he gained led him to launch two arbitrage units that now net $5,400/month combined.

The pattern is the same every time: start with a $0 method, build income and knowledge, then reinvest into higher-return methods like rental arbitrage. What all three have in common is they treated their first “no money” method not as the destination, but as the launchpad. They didn’t wait until they had enough savings. They created the savings through the business itself.

This is exactly what 10XBNB teaches—the progression from no-capital methods into full-scale rental arbitrage operations. The students who succeed fastest are the ones who take action on day one instead of spending months “researching” and waiting for the perfect moment.

Step-by-Step: Going from $0 to Your First Airbnb Booking

Regardless of which method you choose, here’s the exact sequence to go from nothing to your first booking:

Week 1: Research and Preparation

- Pick one method from the list above based on your current situation

- Research your local short-term rental regulations (city website, county clerk, or call your city’s planning department)

- Study 10-15 top-performing Airbnb listings in your target area. Note their photos, descriptions, pricing, and amenities

- If doing arbitrage: start searching for landlord-friendly apartments on Zillow, Apartments.com, and Craigslist. Filter for properties that allow subletting

- If co-hosting: identify 10 underperforming listings in your area and draft your pitch

Week 2: Setup and Launch

- Create your Airbnb account (or optimize your existing one with a professional photo and complete bio)

- If arbitrage: sign your lease and begin furnishing. Focus on bedroom, bathroom, and kitchen first

- If co-hosting: reach out to your target hosts. Aim to pitch 10 owners to land your first 1-2 clients

- Set up your listing with professional-quality photos (smartphone is fine—use natural light, clean every surface, shoot from corners)

- Write a compelling title and description using proven listing optimization strategies

Week 3: Optimize and Fill Your Calendar

- Set an introductory price 15-20% below comparable listings to attract your first 3-5 bookings and reviews

- Enable Instant Book (listings with Instant Book get 30-40% more visibility in Airbnb search)

- Respond to every inquiry within 15 minutes. Response time is a ranking factor on Airbnb

- Ask every guest for a review after checkout. Your first 5-10 reviews are critical for building trust and search ranking

Week 4 and Beyond: Scale

- Raise prices gradually as reviews come in (5-10% increase after every 5 positive reviews)

- Implement dynamic pricing to capture peak demand (weekends, holidays, local events)

- Cross-list on VRBO and Booking.com for additional bookings

- Start planning your second unit or next client

Creative Financing: How to Fund Your First Airbnb Unit

Even when you don’t have cash upfront, creative financing strategies can bridge the gap between zero capital and your first arbitrage unit. Here are approaches that real operators use:

Partner with someone who has money but no time. This is more common than you’d think. Find someone—a friend, family member, or colleague—who has savings but zero interest in managing an Airbnb business. They put up the deposit and furnishing costs. You do all the work. You split profits 50/50 (or whatever you negotiate). After a few months, you can buy them out with your share of the profits.

Use credit card sign-up bonuses strategically. New business credit cards often offer 0% APR for 12-18 months. A card with a $5,000 limit and 0% intro APR gives you enough to furnish an entire arbitrage unit with zero interest. Pay it off from your Airbnb revenue over the first year. This isn’t financial advice—run your own numbers—but I’ve seen dozens of hosts use this approach successfully.

Negotiate free months with landlords. Many apartments offer 1-2 months free rent on a 12-month lease. That free month is essentially your startup capital—you can use the rent savings to buy furniture instead. Combine this with a move-in special (waived deposit or reduced first month) and your out-of-pocket drops dramatically.

Start with an unfurnished listing. Some Airbnb markets—particularly those serving traveling nurses, corporate relocators, and long-term stays (30+ nights)—don’t require magazine-quality staging. A clean, functional space with basic furniture from Facebook Marketplace can get you started for $500-$1,000 instead of $3,000.

Understanding Airbnb Startup Costs (Even on a Budget)

Even “no money” methods have some costs you should anticipate. Being realistic about expenses prevents surprises and helps you plan properly. Here’s what to expect for the lowest-cost methods:

Co-hosting and VA work: Your costs are essentially a smartphone, internet, and possibly a $10/month scheduling tool. Total: under $50/month.

Spare room hosting: Fresh linens ($50-$100), basic amenities like toiletries and a coffee setup ($30-$50), and possibly a lock for the room door ($20). Total: $100-$200 one-time.

Rental arbitrage: First month’s rent plus deposit ($2,000-$4,500), basic furnishing ($1,000-$3,000 if buying used), and initial cleaning supplies ($100). Total: $3,000-$7,500 for your first unit. You can reduce this by negotiating move-in specials, buying secondhand furniture, and starting with a studio or one-bedroom.

For a complete dollar-by-dollar breakdown, check our detailed startup costs breakdown guide.

Common Mistakes When Starting an Airbnb Business with No Money

I’ve seen people fail at every single one of these methods—not because the methods don’t work, but because they made avoidable mistakes. Here are the ones that kill new Airbnb businesses the fastest:

Skipping landlord permission for arbitrage. This is the number one career-ending mistake. If your lease prohibits subletting and your landlord finds out you’re running an Airbnb, you’ll get evicted and potentially sued. Always get written permission before listing a rental property. Period.

Ignoring local regulations. Many cities require short-term rental permits, business licenses, or occupancy taxes. Operating without them can result in fines from $500 to $10,000+ depending on your city. Check your city’s rules before your first guest arrives.

Underpricing to fill the calendar. New hosts panic when they don’t get bookings in the first week and slash prices. Don’t. Airbnb’s algorithm actually penalizes extremely low prices in some cases. Price competitively, not desperately.

Neglecting the guest experience. A $100/night listing with 4.9 stars will always outperform a $100/night listing with 4.5 stars. Invest in cleanliness, communication, and small touches (a welcome note, local restaurant recommendations, a phone charger by the bed).

Trying to do everything alone. Once you have 3+ properties or clients, you need systems. Automate messaging, hire cleaners, use pricing tools. The hosts who burn out are the ones who try to handle everything manually at scale.

Not building an emergency fund. Even with the best planning, unexpected costs come up—a broken appliance, a guest who damages something, a slow month due to seasonality. Keep at least one month’s rent in reserve for each arbitrage unit. If you’re co-hosting, save enough to cover 2-3 months of reduced bookings. Businesses fail when they can’t survive a bad month.

Frequently Asked Questions

Can you really start Airbnb with no money?

Yes. Co-hosting, co-listing, becoming a virtual assistant, and offering Airbnb Experiences all require $0 in startup capital. You’re leveraging your time, skills, and hustle instead of money. Thousands of people have built five-figure monthly income streams starting with nothing more than a smartphone and determination.

What is the cheapest way to start an Airbnb business?

Renting out a spare room in your existing home is the cheapest method if you already have the space—your only cost is $100-$200 in linens and basic amenities. If you don’t have a spare room, co-hosting is completely free to start since you’re managing someone else’s property.

How much money can you make on Airbnb without owning property?

Rental arbitrage operators commonly earn $1,000-$8,000 per unit per month in profit. Co-hosts earn $600-$3,000 per property managed. Airbnb VAs earn $1,500-$4,000 per month. The ceiling depends on the method, your market, and how many properties or clients you manage.

Is rental arbitrage legal?

Rental arbitrage is legal in most areas as long as you have your landlord’s written permission to sublet and comply with local short-term rental regulations. Some cities have banned or heavily restricted short-term rentals, so always research your local laws before signing a lease for arbitrage purposes.

How long does it take to get your first Airbnb booking?

Most new listings get their first booking within 1-2 weeks if they’re properly optimized with good photos, competitive pricing, and Instant Book enabled. In high-demand markets, first bookings can come within 24-48 hours of listing. In slower markets, it might take 2-3 weeks. Lowering your price slightly for the first 3-5 bookings to build reviews accelerates this process.

Do you need a business license to be an Airbnb host?

Requirements vary by city and state. Many municipalities require a short-term rental permit or business license, and some require you to collect and remit occupancy taxes. Check with your city’s business licensing department and your local zoning office. The SBA provides a free guide to licenses and permits by state. Operating without required permits can result in significant fines.

What’s the best Airbnb business model for beginners?

For absolute beginners, co-hosting is the best starting point. It costs nothing, teaches you the full operation of running an Airbnb business, and lets you make mistakes on someone else’s dime (not literally—but you’re not on the hook for rent). Once you understand guest management, pricing, and listing optimization through co-hosting, you’re prepared to launch your own arbitrage unit with much lower risk of failure.