The Best Airbnb Dynamic Pricing Tools in 2026 (Tested on Real Arbitrage Units)

The best airbnb dynamic pricing tools 2026 are PriceLabs ($19.99/listing/month), Beyond Pricing (1% of bookings), and Wheelhouse ($19.99/listing or free tier). After testing all five major options across 9 arbitrage units over two years, PriceLabs delivers the strongest revenue gains for operators managing multiple properties, thanks to its hyper local pulse algorithm and unmatched customization depth. Beyond works best for beginners who want zero configuration, and Wheelhouse is the smartest starting point if you’re not ready to pay.

I’m not hedging. I lost $4,200 in my first three months of rental arbitrage because I priced every night at $149 like it was a Holiday Inn Express. Static pricing is the single biggest revenue killer for vacation rental hosts. After switching to a dynamic pricing tool on my own portfolio, revenue jumped 31% in 60 days. Same listings. Same photos. Same amenities. The only variable that changed was price.

Here’s what this comparison covers: a head-to-head breakdown of PriceLabs vs Beyond Pricing vs Wheelhouse vs DPGO vs Airbnb Smart Pricing, with verified 2026 pricing, real revenue data from my portfolio, and a clear recommendation based on your specific situation. No affiliate rankings. No “it depends” cop-outs.

Why Dynamic Pricing Is Non-Negotiable for Vacation Rental Business Owners

The math should terrify any host still using flat rates. The average dynamic pricing software increases revenue between 20% and 40% compared to static pricing. On a portfolio of 5 units averaging $3,000/month each, that’s an extra $3,000 to $6,000 per month. The tools cost $100-$200/month total. The ROI is absurd.

The vacation rental market hit $97.85 billion in 2025 and is tracking toward $134 billion by 2034. Competition is intensifying in every market. Property managers running 10, 20, or 50 units can’t afford to leave 20-40% of their revenue on the table. Neither can a solo operator running 3 arbitrage units with a tight margin between lease payments and gross bookings.

Dynamic pricing isn’t about charging more. It’s about charging right. The right price on a Tuesday night in January looks nothing like the right price on a Saturday during a local music festival. A dynamic pricing tool reads real time market data, competitor pricing, local events, market demand, seasonal patterns, booking pace, and adjusts your rates automatically. You capture high demand periods at premium rates and fill slow nights at rates that still beat an empty calendar.

If you’re building a business plan for your Airbnb, dynamic pricing should be line item number one in your tech stack budget.

How Dynamic Pricing Actually Works (Quick Primer)

Every dynamic pricing tool does three things:

- Collects market data – comp set analysis, local event calendars, seasonal demand patterns, day-of-week trends, and competitor pricing from Airbnb, VRBO, Booking.com, and other channels

- Runs algorithms – machine learning models that predict optimal nightly rates based on booking probability, market trends, and revenue maximization targets

- Pushes prices automatically – syncs updated pricing updates to your channels and property management system every 24 hours (or more frequently)

The difference between tools comes down to data quality, algorithm sophistication, and customization depth. A tool with excellent market data but zero customization will outperform one with mediocre data and tons of knobs to turn. Data is king. The algorithm is queen. Customization is the court that keeps everything running efficiently.

For your full automation tech stack, dynamic pricing is the single highest-ROI tool you’ll add. Nothing else comes close.

PriceLabs: The Power User’s Choice (My Top Pick)

Overview and Core Features

PriceLabs is the dynamic pricing tool I keep coming back to. It’s not the prettiest, the dashboard looks like engineers designed it, because they did. But the depth of customization is unmatched in the space.

Founded in 2014, PriceLabs processes data from over 10 million listings across 200+ markets worldwide. Their hyper local pulse algorithm pulls from Airbnb, VRBO, Booking.com, and several private data sources to deliver accurate pricing recommendations. The result is market data that’s genuinely complete. Not just scraped Airbnb listings repackaged with a bow.

Key features that matter for vacation rental hosts:

- Hyper-local comp sets – You pick your exact competitors. Not a zip code average. YOUR comps

- Customization rules engine – Minimum stays by day-of-week, orphan day gap filling, last-minute discounts, far-out premiums, seasonal adjustments, weekend pricing overrides

- Portfolio analytics – Cross-listing performance dashboards showing which units are dragging your average down

- Neighborhood data – Drill into sub-market trends, not just city-level aggregates

- Multi-channel sync – Pushes to Airbnb, VRBO, Booking.com, and 160+ PMS/channel managers

- Market Dashboards – Free tool showing supply/demand trends, ADR, and occupancy by market

- Revenue Estimator Pro – Forward-looking revenue projections based on your specific property and market

PriceLabs Pricing (2026, Verified)

| Plan | Cost | Best For |

|---|---|---|

| Dynamic Pricing | From $19.99/listing/month | Core pricing tool with full customization |

| Percentage Billing | 1% of booking revenue | Alternative for hosts who prefer variable costs |

| Market Dashboard | From $9.99/month | Market intelligence without pricing automation |

| Revenue Estimator Pro | From $10/month (2 estimates) | Revenue projections for investment analysis |

| Listing Optimizer | $12.99/listing/month | Content and listing optimization suggestions |

Volume discounts kick in starting from the second listing. They offer a 30-day free trial with no credit card required, genuinely free, not the “free trial that charges you on day 2” nonsense. For property managers handling multiple listings, the sliding scale makes PriceLabs more cost-effective as you grow.

PriceLabs Pros

- Most granular customization of any airbnb pricing tool on the market

- Excellent comp set selection. You handpick competitors for accurate pricing recommendations

- Minimum stay rules by day-of-week (critical for arbitrage profitability)

- Orphan day gap filling that actually works

- Portfolio-level analytics across all listings

- Transparent algorithm. You can see WHY a price was recommended

- 160+ PMS integrations (most in the industry)

- Responsive support team (usually replies within 4 hours)

- 30-day free trial, no credit card

PriceLabs Cons

- Dashboard UI is cluttered and dated, steep learning curve for first-timers

- Initial setup takes 2-3 hours to configure properly (compared to 20 minutes for Beyond)

- Can be overwhelming for vacation rental hosts with 1-2 listings who want “set and forget”

- Mobile app is functional but not great

- Some newer or smaller markets have thinner data than Beyond

Who Should Use PriceLabs

If you’re running 3+ arbitrage units and you care about squeezing every dollar out of your portfolio, PriceLabs is the answer. The customization depth lets you build a pricing strategy that matches YOUR market, YOUR property type, and YOUR target guest demographic. It rewards operators who spend time dialing in their settings.

I use PriceLabs on 7 of my 9 current listings. The two exceptions are in a market where Beyond has significantly better local data.

Beyond Pricing: The “Set It and Forget It” Option

Overview and Core Features

Beyond Pricing takes the opposite approach from PriceLabs. Where PriceLabs gives you 47 knobs to turn, Beyond gives you roughly 5. And honestly? For a lot of property managers, that’s exactly right.

Founded in 2013, Beyond was one of the first dynamic pricing software platforms for short-term rentals. They’ve processed over $35 billion in booking revenue, which gives them a massive data moat, especially in major US markets. Beyond also positions itself as more than just a pricing tool: their Pro package includes market analysis, reservation syncing, and even helps you build a direct booking website.

Key features:

- One-click setup – Connect your Airbnb account, set a base price, and you’re done

- Health Score – Dashboard metric showing how “healthy” your listing is across pricing, occupancy, and revenue

- Search-powered pricing – Pro plan uses actual guest search data to inform rates (exclusive feature)

- Signal Alerts – Notifications when market demand shifts significantly

- Owner Dashboards – Clean reporting for property managers who share data with property owners

- Multi-channel sync – Airbnb, VRBO, Booking.com, 20+ PMS integrations

- Revenue projections – Forward-looking revenue estimates for the next 12 months

Beyond Pricing Cost (2026, Verified)

| Plan | Cost | What’s Included |

|---|---|---|

| Growth | 1% of bookings | Dynamic pricing, daily price syncing, PMS integrations, demand sensitivity, occupancy adjustments, min stay automation, neighborhood data, pacing reports |

| Pro (Best Value per Beyond) | 1.25% of bookings | Everything in Growth + search-powered pricing (exclusive), owner dashboard with revenue insights, advanced market intelligence, comp sets, AI insights |

| Performance | 2% of bookings | Everything in Pro + dedicated revenue manager, full revenue strategy support |

The percentage pricing model sounds small, but run the numbers. A listing grossing $4,000/month costs $40/month with Beyond’s Growth tier, double what PriceLabs charges at their base rate. At $6,000/month gross, you’re paying $60/month per listing. For a 10-unit portfolio grossing $50,000/month, that’s $500/month. PriceLabs would cost roughly $180-$200/month for the same portfolio. The gap widens fast as revenue grows.

Beyond does offer a $50 credit when you connect your first listing, which softens the initial cost.

Beyond Pricing Pros

- Fastest setup of any dynamic pricing tool, literally 20 minutes to go live

- Clean, modern dashboard that makes sense immediately

- Excellent market data in major US markets (NYC, LA, Miami, Nashville, Austin)

- Ideal for property managers who need clean owner reporting

- Health Score catches underperforming listings quickly

- “Signal” alerts notify you of market demand shifts

- Direct booking site builder adds value beyond pricing

Beyond Pricing Cons

- Limited customization. No granular minimum stay rules by day-of-week

- Percentage pricing model gets expensive at scale with multiple properties

- Orphan day management is basic compared to PriceLabs

- Less transparent algorithm, “trust the black box” approach

- Weaker data in smaller and international markets

- No free trial. You start paying immediately

- Weekend pricing controls are limited versus competitors

Who Should Use Beyond Pricing

If you’re new to the vacation rental business, have 1-3 units, and want pricing handled without spending hours configuring rules, Beyond is solid. It’s also the better choice if you’re managing properties for owners who want clean reporting dashboards and you’re willing to pay the premium for simplicity.

I wouldn’t recommend it for arbitrage operators with 5+ units. The percentage pricing model eats into margins that are already tight in arbitrage, and the lack of customization means you’re leaving revenue on the table during shoulder seasons when strategic minimum stay rules and custom pricing make the biggest difference.

Wheelhouse: The Middle Ground (Best Free Option)

Overview and Core Features

Wheelhouse positions itself between PriceLabs’ complexity and Beyond’s simplicity. They offer a unique pricing model: use their recommended prices for free (you set them manually), or pay for automated price pushing. That free tier isn’t a crippled teaser. It’s a genuinely useful dynamic pricing tool.

Founded in 2014, Wheelhouse has solid market coverage in the US and is expanding internationally. Their emphasis on RevPAR optimization over vanity metrics like raw occupancy sets them apart. Wheelhouse’s blog content on revenue management strategy is some of the best in the industry. They clearly understand the economics of running a rental business.

Key features:

- Free pricing recommendations – See suggested prices without paying (you manually update)

- Comp Set Builder – Visual tool for selecting and comparing competitor pricing on a calendar view

- Pricing Profiles – Pre-built pricing strategies (conservative, balanced, aggressive) for different risk tolerances

- Demand calendar – Color-coded demand visualization by date

- Auto-pricing – Paid tier pushes pricing updates automatically to your channels

- 18-month forward pricing – Look ahead further than most competitors

- Multi-channel support – Airbnb, VRBO, and 15+ PMS integrations

Wheelhouse Pricing (2026, Verified)

| Plan | Cost | What You Get |

|---|---|---|

| Free (Suggested Pricing) | $0 | Price recommendations, comp sets, demand calendar. Manual updates only |

| Pro (Percentage) | 1% of revenue | Auto-push pricing + full customization + analytics |

| Pro (Flat Monthly Fee) | $19.99/listing/month (discounts at 10+ units) | Same as Pro percentage, predictable cost |

The dual pricing model is smart. If your listing generates over $2,000/month, the flat monthly fee at $19.99 is cheaper than the 1% option. For lower-revenue listings or new properties still ramping up, the percentage model reduces risk. And the free tier lets you validate that dynamic pricing works before spending a dollar.

I ran Wheelhouse’s free tier for 3 months on a test listing before committing to their paid plan. That kind of try-before-you-buy approach is rare in this space.

Wheelhouse Pros

- Free tier with real value. Not a stripped-down teaser

- Intuitive comp set builder with visual comparison

- Pricing profiles for different risk tolerances and market conditions

- Excellent demand calendar visualization

- Competitive flat monthly fee at $19.99/listing

- Clean, modern interface, better UX than PriceLabs

- RevPAR-focused approach matches arbitrage economics

Wheelhouse Cons

- Smaller data set than PriceLabs or Beyond in many markets

- Fewer PMS integrations than competitors (15+ vs 160+ for PriceLabs)

- Minimum stay rules are less sophisticated than PriceLabs

- Orphan day filling is basic

- Customer support can be slow (24-48 hour response times reported)

- International market data is noticeably thinner

- No portfolio-level analytics on the free tier

Who Should Use Wheelhouse

Wheelhouse is the right pick for vacation rental hosts who want more control than Beyond offers but don’t need PriceLabs’ full arsenal. The free tier makes it an excellent starting point for anyone testing dynamic pricing for the first time. If you’re not sure whether a pricing tool is worth the investment, start with Wheelhouse’s free recommendations for 30 days. You’ll have your answer.

DPGO: The AI-First Contender

Overview and Core Features

DPGO (Dynamic Pricing for Guest-centric Optimization) is a newer player focused on AI-driven pricing. Their algorithm claims to factor in over 200 data points per pricing decision, including weather forecasts, flight search volume, and social media event mentions. That’s more data inputs than any other tool I’ve tested.

Key features:

- AI-driven pricing with 200+ data inputs per decision, including market demand signals most tools miss

- Market pulse reports with weekly market trend summaries

- Booking pace tracking that adjusts prices based on how fast your calendar is filling

- Local events detection from multiple sources (not just major event sites)

- Seasonality controls with per-month adjustments from your base price

- Multi-platform sync with Airbnb, VRBO, and growing PMS integration list

DPGO Pricing (2026, Verified)

| Plan | Cost | Details |

|---|---|---|

| Flexible | 0.5% of booked price | Percentage-based, lower cost for budget-conscious hosts |

| Fixed | $1 per booked night | Predictable cost per actual booking |

| Free Trial | 30 days free | No credit card required |

DPGO’s pricing model is the cheapest in this comparison. A listing booked 25 nights per month at the Fixed rate costs just $25/month. That’s significantly less than PriceLabs or Wheelhouse. The question is whether the lower cost translates to lower results.

DPGO: My Honest Take After 4 Months of Testing

I tested DPGO for 4 months on two listings. The results were mixed. Their algorithm is aggressive, sometimes brilliantly so. It caught a local food festival I’d missed and spiked prices 35% for that weekend. Occupancy held. That was impressive event detection.

But it also dropped prices too aggressively during slower periods. My ADR fell 12% compared to PriceLabs on the same listing type in the same market during a parallel test month. The algorithm seems to prioritize occupancy over revenue, which isn’t always the right move for arbitrage hosts with fixed lease costs where every dollar of ADR matters.

DPGO is worth watching. Their AI approach and event detection show real promise. The pricing is hard to beat. But the data depth isn’t there yet to compete with PriceLabs or Beyond in most markets. If you want to experiment, their 30-day free trial and per-night pricing model make it low-risk to test alongside your primary tool.

Airbnb Smart Pricing: Why I Don’t Recommend It

Airbnb’s built-in smart pricing tool is free, which is its only real advantage. Here’s why I tell every vacation rental business owner to avoid it:

- It optimizes for Airbnb, not for you. Airbnb smart pricing prioritizes booking volume (which maximizes Airbnb’s commission revenue) over maximizing YOUR nightly rate. I’ve seen smart pricing suggest rates 25-35% below what PriceLabs recommends for identical dates

- Single-channel data only. Smart pricing uses only Airbnb’s own data. It ignores VRBO, Booking.com, and direct booking activity in your market. A pricing tool that sees one channel when your competitors are on four is working with incomplete market data

- No weekend pricing controls. You can’t set different minimums or premiums for weekends vs weekdays. For arbitrage hosts, weekend pricing is one of the biggest revenue levers available

- No minimum stay optimization. Smart pricing doesn’t help you manage minimum stays, orphan days, or far-out booking premiums, features that separate profitable arbitrage operators from ones who bleed money on empty Tuesday nights

- Discounts can override your floor. If you’ve enabled discounts, Airbnb smart pricing may push nightly rates below the minimum and maximum rates you’ve set, creating bookings that lose money

- No event awareness. Smart pricing doesn’t detect local events, concerts, conferences, or festivals that drive demand in your market. A tool that misses a 3-day music festival in your city is leaving hundreds on the table

The only scenario where Airbnb smart pricing makes sense: you have a single listing, it’s a side project, and you genuinely don’t care about maximizing revenue. For anyone running a vacation rental business, especially arbitrage, a third-party dynamic pricing tool pays for itself within the first week.

Head-to-Head Comparison: The Complete Feature Matrix

Here’s the comparison table you actually need. I’ve rated each category based on hands-on experience, not marketing claims.

| Feature | PriceLabs | Beyond Pricing | Wheelhouse | DPGO | Airbnb Smart Pricing |

|---|---|---|---|---|---|

| Pricing Model | $19.99/listing/mo or 1% | 1%-2% of bookings | Free / $19.99/mo / 1% | $1/night or 0.5% | Free |

| Setup Time | 2-3 hours | 20 minutes | 45 minutes | 30 minutes | 5 minutes |

| Customization Depth | Excellent | Basic | Good | Good | None |

| Data Quality (Major US) | Excellent | Excellent | Good | Fair | Good (Airbnb only) |

| Data Quality (Small US) | Excellent | Good | Fair | Fair | Fair |

| International Coverage | Excellent (200+ markets) | Good (7,500+ cities) | Fair | Limited (US/Canada) | Airbnb markets only |

| Minimum Stay Rules | Best-in-class | Basic | Good | Good | None |

| Orphan Day Management | Best-in-class | Basic | Good | Fair | None |

| Ease of Use | Moderate | Excellent | Good | Good | Excellent |

| PMS Integrations | 160+ | 20+ | 15+ | 10+ | Airbnb only |

| Owner Reporting | Good | Excellent | Good | Basic | None |

| Free Trial | 30 days (no CC) | $50 credit | Free tier forever | 30 days (no CC) | Always free |

| Best For | Power users, 3+ units | Beginners, PM reporting | Budget-conscious, testing | AI early adopters | Side-project hosts |

Pricing Model Deep Dive: Flat Fee vs Percentage vs Per-Night

The pricing model matters more than most hosts realize. Here’s how each model plays out at different portfolio sizes:

| Scenario | PriceLabs (Flat) | Beyond (1%) | Wheelhouse (Flat) | DPGO ($1/night) |

|---|---|---|---|---|

| 1 listing, $3K/mo revenue | $19.99/mo | $30/mo | $19.99/mo | ~$25/mo |

| 5 listings, $15K/mo total | ~$90/mo | $150/mo | ~$90/mo | ~$125/mo |

| 10 listings, $40K/mo total | ~$170/mo | $400/mo | ~$170/mo | ~$250/mo |

| 20 listings, $80K/mo total | ~$320/mo | $800/mo | ~$320/mo | ~$500/mo |

| 50 listings, $200K/mo total | ~$750/mo | $2,000/mo | ~$750/mo | ~$1,250/mo |

The pattern is clear. Beyond’s percentage model costs 2-3x more than flat monthly fee alternatives at scale. For vacation rental business owners managing multiple properties, that difference compounds into thousands per year. A portfolio of 20 units saves $5,760 annually choosing PriceLabs over Beyond, and that’s money straight to your bottom line.

The counterargument: Beyond claims their data and algorithm generate enough additional revenue to justify the premium. In major US metros with dense data, that argument has some merit. In secondary markets? Not so much.

Market Data Quality: Where Each Tool Wins

Market data quality is the single most important factor in choosing a dynamic pricing tool. An algorithm is only as good as its inputs. Here’s what I’ve found after testing across multiple markets:

PriceLabs Data Strengths

PriceLabs dominates in mid-size US markets and internationally. Their data in places like Gatlinburg, Branson, Gulf Shores, Destin, Sedona, and the best cities for Airbnb arbitrage is noticeably better than Beyond or Wheelhouse. If you’re running arbitrage in a secondary or tertiary market, PriceLabs’ hyper local pulse algorithm will give you more accurate pricing signals.

Internationally, PriceLabs covers 200+ markets with genuine depth. European vacation rental hosts consistently rate PriceLabs as the top tool for data accuracy in EU markets.

Beyond Pricing Data Strengths

Beyond has the edge in top-tier US cities: New York, Los Angeles, Miami, Nashville, Austin, San Diego. Their data moat in these markets comes from years of processing billions in booking revenue. If your arbitrage portfolio is concentrated in one of these major metros, Beyond’s data advantage is real and measurable. Their search-powered pricing feature on the Pro plan pulls actual guest search data, which no other tool offers.

Wheelhouse and DPGO Data Strengths

Wheelhouse’s comp set builder compensates for a smaller raw data set. The visual comparison tool lets you validate competitor pricing against hand-selected comps in real time. For hosts who know their market intimately, this hands-on approach can outperform algorithmic black boxes. DPGO’s event detection is genuinely innovative. They pull from more sources than competitors for local events, catching demand spikes others miss.

Real Revenue Impact: My Static-to-Dynamic Pricing Case Study

In March 2024, I took one of my arbitrage units and ran a controlled experiment. For 90 days, I used static pricing at $159/night (the rate I’d been charging). Then for the next 90 days, I switched to PriceLabs with fully optimized settings. Same unit, same market, sequential time periods to control for seasonal differences.

The Results

| Metric | Static Pricing (90 days) | PriceLabs Dynamic (90 days) | Change |

|---|---|---|---|

| Total Revenue | $11,448 | $15,012 | +31.1% |

| Average Nightly Rate | $159.00 | $184.37 | +16.0% |

| Occupancy Rate | 80% | 90.5% | +10.5 pts |

| Average Booking Length | 3.4 nights | 2.9 nights | -0.5 nights |

| Orphan Days | 11 | 3 | -72.7% |

| RevPAR | $127.20 | $166.80 | +31.1% |

The $3,564 revenue increase over 90 days cost me $59.97 in PriceLabs fees ($19.99/month x 3 months). That’s a 5,843% ROI. I don’t know any other $20/month tool in the rental business that delivers those numbers.

The biggest surprise wasn’t the higher nightly rate. It was the occupancy improvement. PriceLabs’ algorithm priced my slower weeknights competitively enough to fill them, while pushing weekend pricing and high demand periods significantly higher. The blended result was more revenue AND more booked nights. Fewer orphan days meant fewer nights where my lease payment came out of pocket instead of guest revenue.

Want to calculate your own potential increase revenue numbers? Use our Airbnb profit calculator to model dynamic vs static pricing for your specific portfolio.

Integration Capabilities: PMS and Channel Manager Compatibility

Your dynamic pricing tool needs to connect with your property management system and push rates to every channel where you list. Here’s the integration landscape for the best dynamic pricing tools:

| Platform / PMS | PriceLabs | Beyond | Wheelhouse | DPGO |

|---|---|---|---|---|

| Airbnb (direct) | ✓ | ✓ | ✓ | ✓ |

| VRBO (direct) | ✓ | ✓ | ✓ | ✓ |

| Booking.com | ✓ | ✓ | ✓ | ✓ |

| Guesty | ✓ | ✓ | ✓ | ✓ |

| Hostaway | ✓ | ✓ | ✓ | ✓ |

| Hospitable (Smartbnb) | ✓ | ✓ | ✓ | ✗ |

| OwnerRez | ✓ | ✓ | ✗ | ✗ |

| Lodgify | ✓ | ✓ | ✗ | ✗ |

| iGMS | ✓ | ✓ | ✓ | ✗ |

| Streamline | ✓ | ✓ | ✗ | ✗ |

| Turno (TurnoverBnB) | ✓ | ✗ | ✗ | ✗ |

PriceLabs wins the integration game decisively with 160+ PMS connections. If you’re using a less common property management software or channel manager, check PriceLabs first. They probably support it. For vacation rental hosts listing on direct booking sites alongside Airbnb and VRBO, PriceLabs’ multi-channel coverage ensures your pricing stays synchronized everywhere.

Minimum Stay Optimization: The Hidden Revenue Lever

Most hosts fixate on nightly rate. But minimum stay rules are where the real money hides. A poorly configured minimum stay kills your calendar with gaps that can’t be filled, and every empty night in an arbitrage property costs you real money. Your lease payment doesn’t pause.

A 2-night minimum on a Wednesday check-in might block a Thursday-through-Sunday guest who would’ve booked 4 nights. That’s the kind of invisible revenue leak that compounds into thousands per year across multiple listings.

PriceLabs Minimum Stay Features (Best in Class)

PriceLabs offers the most granular minimum stay controls I’ve seen:

- Day-of-week minimums – Set different minimums for Monday check-ins vs Friday check-ins

- Seasonal overrides – 3-night minimum in peak season, 1-night in slow season

- Last-minute reductions – Drop to 1-night minimum for dates within 3 days

- Far-out premiums – Require 3+ nights for bookings 90+ days out

- Orphan day exceptions – Automatically drop minimums to fill gap nights

After implementing day-of-week minimum stays through PriceLabs, my average booking length dropped from 3.2 nights to 2.8 nights. But my total revenue increased 11% because I was filling more calendar gaps. Shorter stays at slightly higher nightly rates beat longer stays with empty nights in between.

Beyond and Wheelhouse Minimum Stay Features

Beyond offers basic minimum stay settings but nothing close to PriceLabs’ granularity. You can set a global minimum and seasonal adjustments, but no day-of-week customization or last-minute automatic reductions.

Wheelhouse is slightly better, offering seasonal minimum stay adjustments and basic gap-filling logic. But it can’t match PriceLabs’ per-day-of-week controls.

For arbitrage hosts specifically, this is a major differentiator. When your operating model depends on maximizing every single night, PriceLabs’ minimum stay engine is worth the learning curve.

Orphan Day Gap Filling: Stop Bleeding Money

Orphan days are the silent killer of arbitrage profitability. Those single empty nights sandwiched between bookings that nobody will ever book at your normal rate? They cost more than you think.

Say you have 4 orphan days per month across a 5-unit portfolio. At an average nightly rate of $150, that’s $3,000/month walking out the door. $36,000 per year. For context, that might be your entire profit margin on one or two of those units.

How Each Tool Handles Orphan Days

PriceLabs (Best): Automatically detects orphan days and drops prices (you set the discount percentage) AND reduces minimum stays to 1 night. You configure orphan day detection to trigger when a gap is 1 night, 2 nights, or 3 nights. The granularity is excellent.

Beyond (Basic): Basic orphan day detection. It drops prices slightly for gap nights but doesn’t automatically adjust minimum stays. You’ll still lose some orphan days that a more aggressive system would catch.

Wheelhouse (Mid-tier): Detects gaps and suggests discounts. The automated response is less sophisticated than PriceLabs but better than Beyond.

DPGO (Aggressive): Decent gap detection with aggressive discounting. Their algorithm tends to drop prices steeply on orphan days, filling them reliably but at lower ADR.

I’ve tracked a 7% increase revenue just from PriceLabs’ orphan day filling vs Beyond’s on a parallel test across two similar listings. For arbitrage operators, that 7% often represents the difference between profitable and break-even.

How to Set Up Dynamic Pricing for Arbitrage (Step-by-Step)

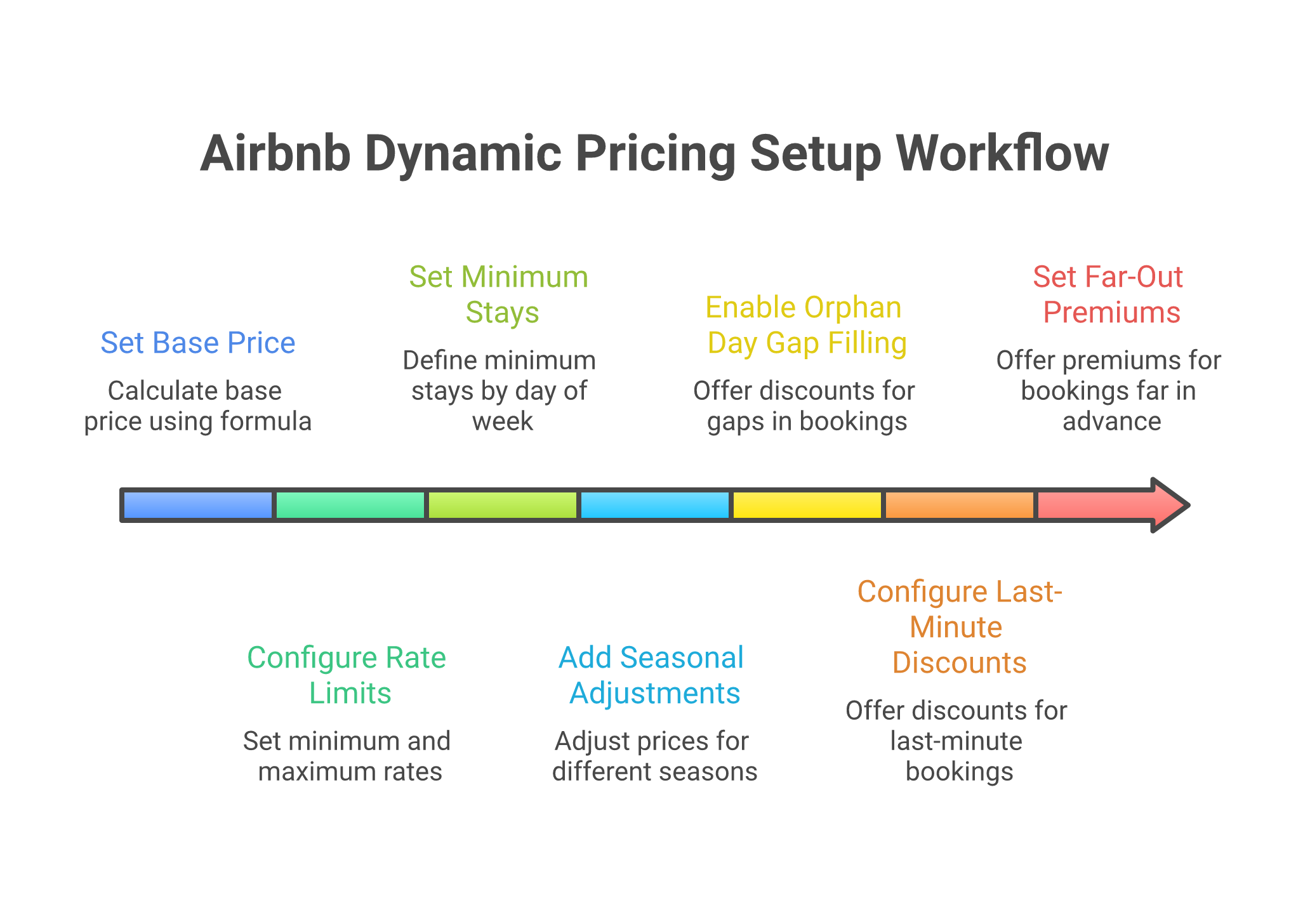

Whether you pick PriceLabs, Beyond, or Wheelhouse, the setup philosophy is the same. Here’s how I configure a dynamic pricing tool for every new arbitrage unit:

Step 1: Establish Your Base Price

Your base price is the anchor point the algorithm adjusts from. Set it at your target average nightly rate. NOT your minimum acceptable rate. For arbitrage, I calculate base price using this formula:

Base Price = (Monthly Lease + Utilities + Supplies + Target Profit) / 25 billable nights

I use 25 billable nights (not 30) because even with great pricing, you’ll have 3-5 transition and cleaning days per month. Being realistic here prevents you from setting a base price too low. If you’re not sure what realistic numbers look like for your market, our guide on Airbnb host earnings breaks down the math.

Step 2: Set Your Minimum and Maximum Rates

- Minimum price (floor): Your break-even nightly rate. Below this, you’re losing money. For arbitrage, this is (Monthly Lease + Fixed Costs) / 30

- Maximum price (ceiling): I set this at 2.5x my base price. During high demand periods, the algorithm can push rates high. But 3x or 4x your normal rate attracts angry reviews and cancellations

Setting proper minimum and maximum rates is the most important configuration step. Too tight a range and the algorithm can’t work. Too loose and you risk underselling slow nights or overpricing peak dates into zero bookings.

Step 3: Configure Minimum Stays

- Friday/Saturday check-in: 2-night minimum (capture the weekend)

- Sunday-Thursday check-in: 1-night minimum (fill those midweek gaps)

- Peak season: 3-night minimum (maximize high demand periods)

- Last minute (within 3 days): 1-night minimum regardless (anything is better than empty)

Step 4: Set Seasonal Adjustments

Even with dynamic pricing, I add seasonal overlays:

- Peak season: +15-25% base price increase

- Shoulder season: No adjustment (let the algorithm work)

- Off season: -10-15% base price decrease

- Major local events: +30-50% manual override (the algorithm catches these, but I like insurance)

Seasonal adjustments work alongside the algorithm, not against it. Think of them as guardrails that ensure the tool doesn’t miss macro-level seasonal demand shifts in your market.

Step 5: Enable Orphan Day Filling

Set orphan day detection to trigger on 1-night and 2-night gaps. Discount 15-25% off the standard rate for orphan nights. Drop minimum stay to 1 night for orphan periods. This alone is worth hundreds per month on multiple properties.

Step 6: Configure Last-Minute Discounts

- 7+ days out: Standard pricing

- 3-6 days out: -10% discount

- 1-2 days out: -20% discount

- Same day: -25% discount (still above your minimum)

In arbitrage, an empty night costs you your full lease rate. A discounted booking at 75% of your normal rate is infinitely better than a $0 night that still costs you $50-$100 in fixed costs.

Step 7: Set Far-Out Premiums

Bookings made 90+ days in advance should pay a premium. These early bookers are typically less price-sensitive. They’re planning ahead for events or trips. I add a 10-15% premium for bookings made more than 90 days out. If market demand catches up, the algorithm adjusts. If it doesn’t, you locked in above-average rates early.

For more on building your complete pricing strategy beyond just tool configuration, read our dedicated pricing guide.

Multi-Channel Pricing Strategy: Beyond Just Airbnb

Running multiple listings across multiple platforms creates a pricing complexity that static pricing simply can’t handle. Here’s how dynamic pricing tools handle multi-channel distribution:

The smartest vacation rental hosts don’t just list on Airbnb. They list on VRBO, Booking.com, and their own direct booking sites. Each channel has different guest demographics, booking windows, and commission structures. Your pricing tool needs to account for all of it.

- Airbnb: 3% host fee (or 14-16% split fee). Price accordingly

- VRBO: 5% host fee OR guest-pays model. Adjust base price to maintain margins

- Booking.com: 15% commission. Price 10-12% higher to maintain net revenue parity

- Direct bookings: 0% commission. Can price 5-10% below OTA rates and still earn more per night

PriceLabs and Beyond both handle channel-specific pricing rules. You set different base prices or markups by channel, and the dynamic pricing engine applies its adjustments on top. Wheelhouse handles this through their PMS integrations but with less native support. DPGO’s multi-channel capabilities are still developing.

If you’re building a direct booking site to capture commission-free revenue, our guide on creating a direct booking website covers the tech stack and pricing strategy.

Common Dynamic Pricing Mistakes (and How to Avoid Them)

Even the best dynamic pricing tools can’t save you from configuration errors. These are the mistakes I see most often among vacation rental hosts:

Mistake 1: Setting Your Base Price Too Low

The algorithm adjusts from your base price. Start too low and even peak-season rates won’t reach their potential. Use the formula from Step 1 above. Be honest about your costs. Round up, not down.

Mistake 2: Overriding the Algorithm Constantly

If you override the tool’s pricing recommendations more than 10% of the time, you’re paying for dynamic pricing software you’re not using. Trust the market data for at least 60 days before making manual adjustments. The algorithm needs time to calibrate to your market trends and booking patterns.

Mistake 3: Not Setting a True Minimum Price

Without a price floor, aggressive algorithms can drop your rates to unprofitable levels during slow periods. Your minimum price should ALWAYS cover your break-even costs, lease, utilities, cleaning fee share, and consumables. For arbitrage operators, this isn’t optional. It’s survival.

Mistake 4: Skipping Comp Set Configuration

The default comp set is usually wrong. Spend time selecting 5-10 actual competitors that match your property type, size, location, and amenity level. A 1BR apartment shouldn’t be compared to 4BR houses just because they’re in the same zip code. Bad comps lead to bad competitor pricing data, which leads to bad rates.

Mistake 5: Ignoring Weekend Pricing Differentiation

Weekends and weekdays are fundamentally different markets. A dynamic pricing tool that doesn’t differentiate weekend pricing from weekday pricing is leaving money on the table. In most markets, Friday-Saturday rates should be 20-40% higher than Tuesday-Wednesday rates. Ensure your tool is configured to capture this spread.

Mistake 6: Never Reviewing Performance

Set a monthly reminder to review your pricing performance. Check: Are occupancy rates where you want them? Is ADR trending up or down? Are there calendar gaps the tool isn’t catching? Are your seasonal adjustments still accurate? Even the best algorithm benefits from human oversight. Property management isn’t fully automated yet.

Which Dynamic Pricing Tool Is Best for Your Situation?

After two years of testing every major dynamic pricing tool on actual arbitrage units, here’s my definitive ranking for different types of vacation rental hosts:

Best Overall for Arbitrage: PriceLabs

PriceLabs wins for arbitrage operators. Period. The customization depth, especially minimum stay rules, orphan day management, and comp set selection, is purpose-built for hosts who need to maximize every night. The flat monthly fee pricing model is predictable and scales efficiently. Yes, the UI is ugly and setup takes time. I don’t care. It makes me more money.

Choose PriceLabs if: You manage 3+ units, you’re willing to invest 2-3 hours in setup, and you want the most accurate pricing recommendations backed by the hyper local pulse algorithm.

Best for Simplicity: Beyond Pricing

If you genuinely don’t have time to configure PriceLabs and you’re in a major US market, Beyond will outperform static pricing by 25-40% with almost zero effort. The percentage pricing model hurts at scale, but for a small portfolio in a data-rich market, the ease of use is hard to beat.

Choose Beyond if: You have 1-3 units in a major US metro, you want zero configuration, and you need clean owner reporting dashboards.

Best for Testing Dynamic Pricing: Wheelhouse

Start with Wheelhouse’s free tier to prove dynamic pricing works for your market. Then graduate to PriceLabs once you’re convinced. Zero risk. Zero cost.

Choose Wheelhouse if: You’re skeptical about dynamic pricing, you want to test before paying, or you need a flexible pricing model.

Best Budget Option: DPGO

DPGO’s per-night pricing model is the cheapest in the space. Their event detection is strong. The algorithm is improving rapidly. Worth testing as a secondary tool alongside your primary platform.

Choose DPGO if: You want the lowest possible cost, you’re in the US or Canada, and you value AI-driven event detection.

Skip: Airbnb Smart Pricing

Unless you have a single listing as a side project and truly don’t care about revenue optimization, skip Airbnb smart pricing. It underprices listings by 25-35% and offers zero customization. Every serious vacation rental business owner needs a third-party tool.

The Property Management Software Connection

Dynamic pricing doesn’t exist in a vacuum. Your pricing tool connects to your property management software, which connects to your listing channels. Here’s how to think about the full stack:

- PMS handles: Guest communication, cleaning schedules, channel management, booking coordination

- Dynamic pricing handles: Nightly rate optimization, minimum stays, seasonal adjustments

- Channel manager handles: Calendar sync, availability distribution across direct booking sites and OTAs

The ideal stack for most arbitrage operators: PriceLabs for pricing + a PMS like Guesty, Hostaway, or Hospitable for operations. PriceLabs integrates natively with all three, so pricing updates flow automatically without manual intervention. Your property management system pushes the rates PriceLabs sets to every channel simultaneously.

If you’re just getting started, our guide to starting an Airbnb walks through the full tech stack from day one, including when to add each tool layer.

2026 Market Trends Affecting Dynamic Pricing

Several market trends are reshaping how the best dynamic pricing tools operate in 2026:

- AI-powered demand forecasting: Tools are moving beyond historical data to predictive modeling. DPGO leads here, but PriceLabs and Beyond are closing the gap with their own machine learning improvements

- Event data integration: Local events remain one of the biggest revenue opportunities. Tools that detect conferences, concerts, festivals, and sporting events earlier give hosts more time to capture high demand periods at premium rates

- Direct booking growth: More hosts are building direct booking sites to avoid OTA commissions. Dynamic pricing tools that support direct channel pricing (not just Airbnb) are increasingly valuable

- Market saturation pressure: Supply growth in popular markets means competitor pricing analysis is more important than ever. The tools with the best comp set data help hosts avoid the race to the bottom

- Regulatory changes: New short-term rental regulations in many cities are reducing supply, creating pricing opportunities for compliant hosts. Dynamic pricing tools that adjust for regulatory-driven supply changes will outperform those that don’t

Frequently Asked Questions

Is PriceLabs or Beyond Pricing better for Airbnb arbitrage?

PriceLabs is better for most arbitrage operators. The flat monthly fee pricing model is more cost-effective at scale, and the granular minimum stay and orphan day controls are critical for arbitrage profitability. Beyond Pricing is simpler to set up, but the 1% revenue fee adds up quickly and you sacrifice customization. If you have 3+ units, go with PriceLabs.

Can I use dynamic pricing tools with VRBO and Booking.com, not just Airbnb?

Yes. PriceLabs, Beyond Pricing, Wheelhouse, and DPGO all sync with Airbnb, VRBO, and Booking.com directly. PriceLabs and Beyond also integrate with 20-160+ property management systems that handle multi-channel distribution. Your pricing updates flow automatically across all connected platforms, including direct booking sites.

How much does dynamic pricing increase Airbnb revenue?

Independent studies and tool-provider data consistently show a 20-40% revenue increase when switching from static pricing to a dynamic pricing tool. My own controlled test showed a 31.1% revenue increase over 90 days. The exact lift depends on your market, property type, and how well you configure the tool. Even poorly configured dynamic pricing software typically outperforms static pricing by 10-15%.

Is Airbnb Smart Pricing good enough, or do I need a third-party tool?

Airbnb smart pricing consistently underprices listings, by 25-35% compared to third-party tools in my testing. Airbnb’s algorithm optimizes for booking volume (which benefits Airbnb’s commission revenue), not for maximizing YOUR nightly rate. It uses only single-channel market data, offers no custom pricing controls, and doesn’t handle minimum stays or orphan days. For any host serious about revenue, a third-party dynamic pricing tool is essential.

What’s the best free dynamic pricing tool for Airbnb?

Wheelhouse’s free tier is the best free option for vacation rental hosts. You get real pricing recommendations based on market data, comp set analysis, and demand calendars. The catch is you need to update prices manually (no auto-sync on the free plan). For hosts testing dynamic pricing or running 1-2 listings on a tight budget, it’s genuinely valuable and not a stripped-down teaser.

How long does it take for dynamic pricing to show results?

You’ll see initial pricing changes within 24 hours of setup. Meaningful revenue impact typically shows within 30-45 days as the algorithm calibrates to your market and booking patterns. Give any tool at least 60 days before judging its performance. The first 2 weeks are the algorithm’s learning period. Don’t panic if results look uneven early on.

Do dynamic pricing tools work for properties listed only on Airbnb?

Absolutely. All major tools connect directly to Airbnb without requiring a PMS or channel manager. If Airbnb is your only platform, you can connect PriceLabs, Beyond, or Wheelhouse directly to your Airbnb account and start getting optimized pricing immediately. That said, listing on multiple platforms (Airbnb + VRBO at minimum) typically increases occupancy by 8-15%, and dynamic pricing tools make multi-platform management much easier for vacation rental business owners.

What is the hyper local pulse algorithm in PriceLabs?

The hyper local pulse algorithm is PriceLabs’ proprietary pricing engine that analyzes real time market data at the neighborhood level. Not just city-wide averages. It pulls competitor pricing, booking pace, seasonal patterns, local events, and demand signals from multiple channels to generate accurate pricing recommendations for your specific micro-market. This granularity is what separates PriceLabs from tools that rely on broader, less precise market data.

Can I use multiple dynamic pricing tools at the same time?

Yes, but don’t connect two tools to the same listing, they’ll fight each other. The smart approach: use one tool as your primary pricing engine and a second tool’s free tier or market dashboard for competitive intelligence. I run PriceLabs as my primary tool and occasionally check Wheelhouse’s free comp set data to validate PriceLabs’ recommendations against a different data source.

How do I choose between a flat monthly fee and percentage-based pricing?

Simple math. If your listing generates over $2,000/month in revenue, a $19.99 flat monthly fee is cheaper than a 1% percentage fee ($20). As revenue grows, the gap widens dramatically. A $5,000/month listing costs $50/month at 1% but still only $19.99 on a flat fee. For vacation rental business owners scaling to multiple properties, flat fee pricing models save thousands annually.