If you’re running rental arbitrage on Airbnb, here’s the blunt truth: your rent payments are tax-deductible, and so are dozens of other expenses most hosts never claim. The IRS doesn’t care that you don’t own the property. They care that you’re operating a business and reporting income correctly. This guide covers every deduction, form, deadline, and strategy that applies to arbitrage operators filing their 2026 taxes. I’m not a CPA — consult a tax professional for your specific situation — but after years in this business, I’ve learned exactly what to track and what most hosts leave on the table.

Understanding Airbnb Tax Basics: What the IRS Expects From You

Before we talk deductions, you need to understand how Airbnb income gets reported and what forms you’ll receive. Mess this up and you’re inviting an audit.

The 1099-K Form: When Airbnb Reports Your Income

Airbnb issues a Form 1099-K to the IRS reporting your gross earnings. For the 2026 tax year, here’s what you need to know:

The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, reverted the 1099-K reporting threshold back to the pre-2022 standard: $20,000 in gross payments AND more than 200 transactions in a calendar year. That means Airbnb won’t send you (or the IRS) a 1099-K unless you cross both thresholds.

But here’s the part that trips people up: you owe taxes on every dollar of Airbnb income regardless of whether you receive a 1099-K. The form is just a reporting mechanism. The IRS expects you to report all income on your return. Period.

Other Tax Forms You May Receive

| Form | What It Reports | 2026 Threshold |

|---|---|---|

| 1099-K | Gross transaction payments from Airbnb | $20,000 + 200 transactions |

| 1099-MISC | Other income (co-host payments, referral bonuses) | $2,000 (increased from $600 by OBBBA) |

| 1099-NEC | Non-employee compensation | $2,000 (increased from $600 by OBBBA) |

If you have multiple Airbnb accounts using the same tax ID, Airbnb aggregates those transactions when determining thresholds. You should receive your tax documents by January 31 following the calendar year, either by mail or in your Airbnb account’s tax section.

The 14-Day Rule: A Trap for Part-Time Hosts

Here’s a rule that catches new hosts off guard. If you rent your primary residence on Airbnb for 14 days or fewer per year, you don’t have to report that income at all. Sounds great, right? The catch: you also can’t deduct any rental expenses for those days. It’s an all-or-nothing situation.

For rental arbitrage operators, this rule almost never applies — you’re renting a separate unit full-time, not your own bedroom. But if you’re also renting your primary residence on the side (maybe during a big local event), keep this threshold in mind. Once you hit day 15, ALL rental income becomes reportable, and you can start deducting expenses allocated to rental days.

Schedule C vs. Schedule E: Where Do You File?

This is where most arbitrage operators get confused. The answer depends on two factors: your average rental period and whether you provide “substantial services.”

| Scenario | File On | Self-Employment Tax? |

|---|---|---|

| Average stay < 7 days (most Airbnb hosts) | Schedule C | Yes — 15.3% |

| Average stay 7-30 days + substantial services | Schedule C | Yes — 15.3% |

| Average stay > 30 days, no substantial services | Schedule E | No |

For most rental arbitrage hosts, you’re filing on Schedule C. Your average guest stay is typically 2-5 nights. You’re providing check-in instructions, cleaning between guests, stocking supplies, managing communications. That’s a business, and the IRS treats it like one.

Yes, Schedule C means you pay self-employment tax (15.3% — covering Social Security at 12.4% and Medicare at 2.9%). That stings. But it also means you can deduct the employer-equivalent portion (7.65%) and potentially qualify for the Qualified Business Income deduction. More on that below.

Business Structure for Tax Optimization

Your business structure directly affects how much tax you pay. Here’s the realistic breakdown for arbitrage operators at different revenue levels.

Sole Proprietorship (Most Hosts Start Here)

If you haven’t formed an entity, you’re a sole proprietor by default. You report income on Schedule C attached to your personal 1040. Simple, cheap, no separate tax return required.

Best for: Operators making under $60,000/year in net profit from arbitrage.

Single-Member LLC

An LLC doesn’t change your tax situation by default — a single-member LLC is still taxed as a sole proprietor (Schedule C). The benefit is liability protection, which matters when you’re managing guest properties. If a guest gets injured, your personal assets have a layer of separation.

Best for: Any arbitrage operator managing 2+ properties. The liability protection alone is worth the $50-$500 filing fee.

S-Corporation Election

Once your net arbitrage income exceeds roughly $50,000-$60,000/year, an S-Corp election can save you thousands in self-employment tax. Here’s how it works:

- You pay yourself a “reasonable salary” (subject to payroll taxes)

- Remaining profits pass through as distributions (NOT subject to self-employment tax)

- Example: $100,000 net profit. You pay yourself a $50,000 salary and take $50,000 in distributions. You save 15.3% on that $50,000 distribution = $7,650 saved

The catch: S-Corps require payroll processing, a separate tax return (Form 1120-S), and stricter record-keeping. Expect $1,500-$3,000/year in additional accounting costs. Do the math — it only makes sense when the tax savings exceed the overhead.

The QBI Deduction: 20% Off Your Taxable Income

The Qualified Business Income (QBI) deduction lets you deduct up to 20% of your qualified business income from pass-through entities (sole proprietorships, LLCs, S-Corps). The OBBBA permanently extended this deduction, so it’s not going away.

For a sole proprietor netting $80,000 from arbitrage, that’s a potential $16,000 deduction — reducing your taxable income before you even count business expenses. Income phase-outs apply above $191,950 for single filers and $383,900 for married filing jointly (2026 thresholds, adjusted for inflation).

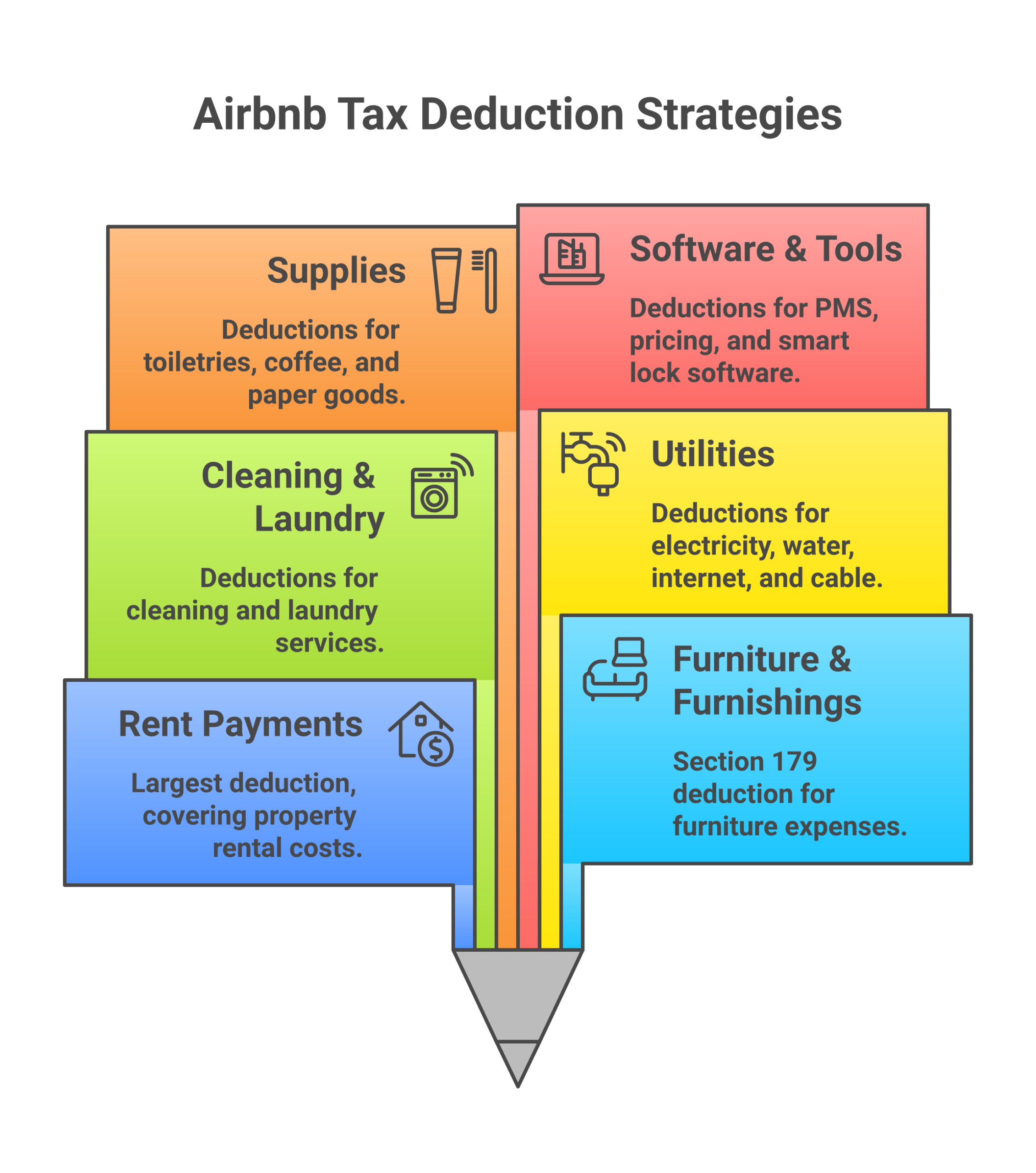

The Complete Deductions Checklist for Rental Arbitrage

This is where the money is. Every legitimate deduction you miss is a direct hit to your bottom line. Stop leaving money on the table — track every expense from day one.

Rent Payments (Your #1 Deduction)

Your monthly rent is your largest deductible expense. If you’re paying $2,000/month for a 2-bedroom that you list on Airbnb full-time, that’s $24,000/year in deductions. Even if you’re subletting and only arbitraging part of the space, you deduct the portion dedicated to short-term rental use.

Keep every lease agreement and rent receipt. If you’re paying by check or bank transfer, the paper trail is already there. Cash payments? Get receipts.

Furniture and Furnishing Depreciation

Everything you buy to furnish your arbitrage unit is deductible — beds, couches, dressers, dining tables, kitchen equipment, decor. You have three options for how to deduct these:

| Method | How It Works | Best For |

|---|---|---|

| Section 179 | Deduct the full cost in Year 1 | Most arbitrage furnishing |

| 100% Bonus Depreciation | Deduct full cost in Year 1 (OBBBA made permanent) | All qualifying assets placed in service after 1/19/2025 |

| MACRS Depreciation | Spread deduction over 5-7 years | When you want to smooth income across years |

The OBBBA made 100% bonus depreciation permanent for qualified property placed in service after January 19, 2025. This is massive for arbitrage operators. That $8,000 furniture package for your new unit? Write off the entire thing in year one. Qualifying assets include furniture, appliances, flooring, window treatments, electronics, and even smart locks.

Know your startup costs — many of those initial furnishing expenses are deductible in the first year.

Cleaning and Turnover Costs

Every dollar you pay your cleaner is deductible. For most arbitrage operators running 15-25 turnovers per month across multiple units, cleaning costs run $150-$400 per clean. That adds up fast — and every penny is a write-off.

- Professional cleaning service fees

- Cleaning supplies you purchase yourself

- Laundry service for linens

- Carpet cleaning and deep cleans

Utilities

If you’re paying the utilities on your arbitrage unit (and you usually are), they’re deductible:

- Electricity

- Gas/heating

- Water and sewer

- Internet (essential for smart locks, guest WiFi)

- Cable/streaming services provided to guests

- Trash removal

Software and Technology

The tech stack that runs your business is fully deductible. Don’t overlook these:

- Property management software (Hospitable, Guesty, OwnerRez) — $20-$100+/month per property

- Dynamic pricing tools (PriceLabs, Beyond, Wheelhouse) — $20-$40/month per listing

- Smart locks and access systems (August, Schlage, Yale) — hardware cost + monthly app fees

- Security cameras (Ring, Arlo) — exterior only for guest safety

- Noise monitoring devices (Minut, NoiseAware)

- Accounting software — track everything with the right accounting software

- Communication tools (phone plan, messaging apps used for guest communication)

Insurance Premiums

You need proper insurance coverage for your arbitrage units, and those premiums are deductible:

- Short-term rental insurance policies

- Liability insurance

- Contents insurance (covering your furnishings)

- Umbrella policies (if allocated to rental business)

Supplies and Consumables

Everything you stock for guests counts:

- Toiletries (shampoo, conditioner, soap, toilet paper)

- Kitchen basics (coffee, tea, cooking oil, spices, dish soap)

- Linens and towels (replacement sets)

- Welcome baskets or guest gifts

- Paper products (paper towels, napkins, tissues)

- Light bulbs, batteries, and household basics

Photography and Listing Optimization

- Professional photographer fees ($150-$500 per property)

- Virtual staging or 3D tour services

- Listing copywriting services

Vehicle Mileage and Transportation

Every trip to your property for check-ins, inspections, supply runs, or maintenance counts. You have two options:

| Method | 2026 Rate | Best For |

|---|---|---|

| Standard Mileage Rate | $0.70/mile (estimated — IRS announces annually) | Most hosts; simpler tracking |

| Actual Expense Method | Gas, insurance, repairs, depreciation | Hosts driving expensive or high-maintenance vehicles |

Track every mile. Use an app like Everlance, MileIQ, or even a simple spreadsheet. A host driving 8,000 business miles per year at $0.70/mile writes off $5,600. That’s real money most people forget.

Home Office Deduction

If you manage your arbitrage business from a dedicated space in your home — answering guest messages, managing bookings, doing accounting — you can claim the home office deduction. The simplified method gives you $5 per square foot, up to 300 square feet ($1,500 max). The regular method lets you deduct the actual percentage of home expenses (rent, utilities, insurance) proportional to your office space.

Professional Services

- CPA or tax accountant fees — deductible as a business expense

- Attorney fees (lease review, entity formation, legal disputes)

- Bookkeeper fees

- Business consulting or coaching

Marketing and Advertising

- Paid advertising on booking platforms

- Direct booking website costs (hosting, domain, design)

- Social media marketing expenses

- Business cards and print materials

Repairs and Maintenance

Anything you fix or maintain to keep the property guest-ready:

- Plumbing repairs

- Electrical work

- Appliance repair or replacement

- Painting and touch-ups

- Pest control

- HVAC maintenance

- Handyman visits

Airbnb Service Fees and Platform Costs

Don’t forget the platform itself takes a cut — typically 3% of each booking as a host service fee. That’s deductible. Also deductible: fees from any other platforms you list on (Vrbo, Booking.com, Furnished Finder).

Other Commonly Missed Deductions

- Bank fees on your business account

- Credit card processing fees for direct bookings

- Education and training — courses, books, and conferences related to your STR business

- Business licenses and permits

- Security deposits paid to landlords (if forfeited — otherwise they’re assets, not expenses)

- Travel expenses for scouting new markets

Quarterly Estimated Tax Payments: Don’t Get Hit With Penalties

If you expect to owe $1,000 or more in taxes for the year, the IRS requires quarterly estimated payments. Miss these and you’ll face underpayment penalties — not catastrophic, but annoying and avoidable.

2026 Quarterly Due Dates

| Quarter | Period Covered | Due Date |

|---|---|---|

| Q1 | January 1 – March 31 | April 15, 2026 |

| Q2 | April 1 – May 31 | June 15, 2026 |

| Q3 | June 1 – August 31 | September 15, 2026 |

| Q4 | September 1 – December 31 | January 15, 2027 |

How to Calculate Your Estimated Payments

The simplest approach: use the Safe Harbor Rule.

Pay at least 100% of last year’s total tax liability, divided into four equal quarterly payments, and you won’t owe penalties — even if your income jumps significantly. If your adjusted gross income exceeds $150,000 ($75,000 married filing separately), that threshold bumps to 110% of last year’s tax.

Alternatively, you can pay 90% of your current year’s expected tax. This works if your income is lower than last year, but it requires accurate forecasting — risky for arbitrage operators with fluctuating seasonal income.

Pro tip: Set aside 25-30% of every Airbnb payout in a separate savings account earmarked for taxes. When the quarterly deadline hits, you’ll have the cash ready. I’ve seen too many hosts spend everything and scramble when estimated payments come due.

How to Pay

File Form 1040-ES with each payment. You can pay via:

- IRS Direct Pay (directpay.irs.gov) — free, instant

- EFTPS (Electronic Federal Tax Payment System) — free, scheduled

- IRS2Go mobile app

- Credit/debit card (processing fees apply — usually 1.87-1.98%)

State and Local Tax Obligations

Federal taxes are only part of the picture. Depending on where you operate, state and local taxes can add 5-15% on top. Understanding regulations by state is critical before you start arbitraging in any market.

Occupancy and Transient Taxes

Most states and many cities charge a Transient Occupancy Tax (TOT), hotel tax, or lodging tax on short-term rentals. These range from 2% to 15%+ depending on jurisdiction.

The good news: Airbnb automatically collects and remits occupancy taxes in many (but not all) jurisdictions. Check Airbnb’s tax collection page for your specific area. In jurisdictions where Airbnb doesn’t collect automatically, you’re responsible for registering, collecting from guests, and remitting to the local tax authority.

State-Level Changes for 2026

Several states adjusted their transient accommodation taxes in 2026:

| Location | Change | New Rate |

|---|---|---|

| Hawaii | Increased Transient Accommodations Tax | 11% (up from 10.25%) |

| San Mateo County, CA | Increased TOT | 15.5% (up from 14.5%) |

| Saratoga County, NY | Increased local hotel tax | 3% (up from 1%) |

These are just a few examples. Tax rates vary wildly — always verify your specific city and county rates before launching in a new market.

State Income Tax

Don’t forget: most states tax business income too. If you’re operating in a state with income tax, your net Airbnb profit flows through to your state return. Nine states have no income tax (Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, Wyoming) — a genuine advantage if you’re choosing arbitrage markets.

Sales Tax on Short-Term Rentals

Beyond occupancy taxes, some states and localities charge sales tax on short-term rental income. Florida, for example, charges a 6% state sales tax plus county discretionary surtax (0.5-1.5%) on rentals of six months or less. Texas charges its 6.25% state sales tax on accommodation stays under 30 days, on top of the 6% state hotel tax.

This stacks. In some Florida markets, you’re looking at 6% sales tax + 6% tourist development tax + 1% county surtax = 13% in combined state and local taxes on every booking. Factor these into your pricing or your margins will evaporate.

Multi-State Considerations for Scaling Arbitrage Operators

If you operate units in multiple states, each state where you earn rental income may require you to file a state tax return, even if you don’t live there. Some states have reciprocity agreements that provide credits to avoid double taxation, but navigating multi-state filing is exactly when you need a CPA who understands short-term rental tax across jurisdictions.

Also watch for nexus rules. Having property (even rented property with your furnishings in it) in a state can create economic nexus, meaning that state can tax your income. This is especially relevant for operators scaling across state lines.

Business License and Registration Requirements

Many cities require a business license, short-term rental permit, or both. These typically cost $50-$500/year, though some major cities charge significantly more. The fees are deductible, but operating without them can result in fines that aren’t. Some jurisdictions — Nashville, New Orleans, Los Angeles — require annual inspections and renewals. Factor these into your operational calendar.

Record-Keeping Best Practices

The IRS can audit you for up to three years after filing (six years if they suspect significant underreporting). Keep every receipt, every statement, every record. Here’s the system that works.

What to Track (Everything)

| Category | What to Save | How Long to Keep |

|---|---|---|

| Income | Airbnb payout statements, 1099-K, booking confirmations | 7 years minimum |

| Rent | Lease agreements, rent receipts/bank transfers | 7 years minimum |

| Expenses | Receipts, invoices, credit card statements | 7 years minimum |

| Mileage | Mileage log (date, destination, purpose, miles) | 7 years minimum |

| Assets | Furniture receipts (for depreciation basis) | Life of asset + 7 years |

| Entity docs | LLC operating agreement, EIN letter, S-Corp election | Permanently |

Recommended Apps and Tools

- QuickBooks Self-Employed or QuickBooks Online — categorize expenses, generate Schedule C reports

- Wave — free accounting software, solid for smaller operations

- Stessa — built specifically for rental property accounting

- Everlance or MileIQ — automatic mileage tracking via GPS

- Google Drive or Dropbox — scan and store all receipts digitally

- Relay or Mercury — dedicated business bank account (separate personal from business transactions)

The golden rule: separate bank accounts. Never commingle personal and business money. Open a dedicated checking account for your arbitrage business. Run all income and expenses through it. Your CPA will thank you, and so will you during an audit.

Monthly Reconciliation Habit

Don’t wait until April to organize your taxes. Build a monthly habit:

- First of the month: Download last month’s Airbnb payout summary and import into your accounting software

- Categorize all expenses from your business bank account and credit card

- Scan and file any paper receipts (use your phone camera — apps like Dext or HubDoc auto-extract amounts)

- Reconcile your mileage log against your calendar (did you miss any property visits?)

- Check your estimated tax running total — are you on track for the next quarterly payment?

Thirty minutes per month saves you 15+ hours of panic at tax time. And if you ever get audited, you’ll hand your CPA a clean, organized file instead of a shoebox of receipts.

8 Common Tax Mistakes Arbitrage Hosts Make

I’ve seen these over and over. Don’t be the host who learns the hard way.

1. Not Reporting Income Because They Didn’t Get a 1099

The $20,000/200-transaction threshold determines when Airbnb sends you a form. It does NOT determine when you owe taxes. A host making $15,000 who doesn’t report it because “Airbnb didn’t send a 1099” is committing tax fraud. Full stop.

2. Missing the Quarterly Payment Deadlines

Underpayment penalties are typically 7-8% annualized. Not the end of the world, but easily avoided with the Safe Harbor Rule. Set calendar reminders for each deadline.

3. Forgetting to Track Mileage

You drove to your property 200+ times this year for turnovers, supply runs, and inspections. At $0.70/mile and an average 12-mile round trip, that’s $1,680 you’ll never get back if you didn’t log it.

4. Not Separating Personal and Business Expenses

That furniture you bought for the Airbnb unit but also use in your living room? The IRS will challenge a 100% business deduction. Keep business assets in business properties. Personal use = reduced deduction.

5. Ignoring State and Local Obligations

Operating without a required business license or failing to remit occupancy tax isn’t just a tax mistake — it can get your listing shut down. Research your local regulations before you launch.

6. Over-Deducting or Making Up Expenses

Aggressive deductions without receipts is a red flag. The IRS uses algorithms to compare your deduction ratios against industry benchmarks. If your cleaning expenses are 60% of revenue when the average is 15-20%, expect questions.

7. Failing to Account for Security Deposits

Security deposits paid to your landlord are NOT expenses — they’re assets that should be returned when you vacate. Only deduct a deposit if it’s been applied to damages or forfeited. This is a common initial investment cost that gets mishandled.

8. Not Considering Entity Structure Until It’s Too Late

You can’t retroactively form an S-Corp and apply it to last year’s taxes. By the time you realize you’re paying $5,000+ in unnecessary self-employment tax, you’ve already missed the election deadline (March 15 for the current tax year, or within 75 days of formation). Plan ahead.

When to Hire a CPA vs. DIY

Can you file your own arbitrage taxes with TurboTax or FreeTaxUSA? Sure — if you have a single unit and straightforward income. But here’s my honest take.

DIY Makes Sense When:

- You operate 1-2 units

- You’re a sole proprietor (no entity)

- You understand Schedule C and self-employment tax

- Your income is under $50,000/year

- You keep clean records with accounting software

Hire a CPA When:

- You operate 3+ units

- You’re earning $50,000+ and considering S-Corp election

- You have multi-state tax obligations

- You made significant asset purchases (furniture, vehicles) and need depreciation strategy

- You’ve been flagged or audited before

- You want to maximize the QBI deduction

A good CPA who specializes in short-term rentals typically costs $500-$2,000 per year for tax preparation and planning. That fee is deductible, and the tax savings they find almost always exceed their cost. Look for a CPA with Airbnb and short-term rental experience specifically — a generalist won’t catch the nuances.

Questions to Ask a Prospective CPA

Before you hire anyone, ask these:

- “How many short-term rental clients do you work with?” — You want at least 10-15. STR tax is specialized enough that generic CPAs miss deductions constantly.

- “Do you understand the Schedule C vs. Schedule E distinction for Airbnb hosts?” — If they hesitate, move on.

- “Can you advise on entity structure and S-Corp election timing?” — Tax planning matters more than tax prep. You want a strategist, not just someone who fills in boxes.

- “What’s your approach to bonus depreciation and cost segregation for STR furnishings?” — The OBBBA changes are new. Your CPA should know them cold.

- “Do you handle multi-state filings?” — Critical if you’re scaling across markets.

The right CPA pays for themselves ten times over. The wrong one costs you money you didn’t even know you were losing.

Real Tax Scenario: Sample Schedule C for an Arbitrage Host

Let’s walk through a realistic example. Meet Sarah — she runs two arbitrage units in Nashville, Tennessee (no state income tax, but local hotel/tourism taxes apply). Here’s her year:

Income

| Source | Amount |

|---|---|

| Airbnb gross payouts (Unit 1 — 2BR apartment) | $52,000 |

| Airbnb gross payouts (Unit 2 — 1BR condo) | $36,000 |

| Total Gross Income | $88,000 |

Deductible Expenses

| Expense Category | Annual Amount |

|---|---|

| Rent payments (2 units) | $36,000 |

| Cleaning costs (480 turnovers × $100 avg) | $9,600 |

| Utilities (electric, gas, water, internet × 2) | $7,200 |

| Furniture depreciation (100% bonus — Year 1) | $12,000 |

| Supplies and consumables | $2,400 |

| Software (PMS, pricing tool, locks) | $3,600 |

| Insurance premiums (2 units) | $2,400 |

| Airbnb service fees (3% of gross) | $2,640 |

| Vehicle mileage (6,500 miles × $0.70) | $4,550 |

| Photography (2 properties) | $600 |

| Repairs and maintenance | $1,800 |

| Professional services (CPA) | $1,200 |

| Home office (simplified — 200 sq ft) | $1,000 |

| Marketing and business cards | $400 |

| Business licenses and permits | $350 |

| Total Deductions | $85,740 |

Tax Calculation

| Line Item | Amount |

|---|---|

| Net Profit (Schedule C, Line 31) | $2,260 |

| QBI Deduction (20% of $2,260) | -$452 |

| Self-Employment Tax (15.3% of $2,260 × 92.35%) | $319 |

| Deductible half of SE tax | -$160 |

| Taxable Business Income | $1,648 |

| Federal Income Tax (at 10% bracket) | ~$165 |

The takeaway: Sarah grossed $88,000 and owes roughly $484 in federal taxes on her arbitrage business (income tax + SE tax) — in year one when she can write off all her furniture through bonus depreciation. Year two, without the $12,000 furniture deduction, her net profit and tax liability increase significantly. That’s why understanding the pros and cons of arbitrage includes understanding the tax timeline.

Notice how the first-year numbers look artificially low. The $12,000 furniture deduction is a one-time accelerator. In year two, Sarah’s net profit jumps to roughly $14,260, her self-employment tax climbs to about $2,023, and her federal income tax liability increases accordingly. Year one is the tax honeymoon — plan for year two’s reality from the start.

Also worth noting: Sarah’s gross-to-net ratio (gross $88K, net $2.3K in year one) shows how tight arbitrage margins can be. That’s exactly why tracking every deduction matters. Missing $3,000 in write-offs could mean the difference between profitable and break-even.

Disclaimer: This example is simplified for illustration. Your actual tax situation will differ based on filing status, other income sources, state taxes, and individual circumstances. Work with a qualified tax professional.

Tax Planning Calendar for Arbitrage Hosts

Stay ahead of every deadline. Print this out and pin it to your wall.

| Date | Action |

|---|---|

| January 15 | Q4 estimated tax payment due |

| January 31 | Airbnb sends 1099-K (if applicable) |

| March 15 | S-Corp tax return due (Form 1120-S) if applicable |

| April 15 | Q1 estimated tax payment due + personal return due (Form 1040) |

| June 15 | Q2 estimated tax payment due |

| September 15 | Q3 estimated tax payment due + extension deadline for personal returns |

| October 15 | Extension deadline for personal returns (if filed extension) |

| Year-round | Track all income and expenses; reconcile monthly |

Frequently Asked Questions

Do I have to pay taxes on Airbnb income if I made less than $20,000?

Yes. The $20,000 threshold only determines whether Airbnb sends you a 1099-K. The IRS requires you to report all income regardless of amount. Even if you earned $500, it goes on your tax return.

Can I deduct rent payments even though I don’t own the property?

Absolutely. Rent is a legitimate business expense for rental arbitrage. It doesn’t matter that you’re a tenant, not an owner. If you’re paying rent on a property you use for business, it’s deductible.

Is Airbnb income subject to self-employment tax?

For most short-term rental hosts providing substantial services (cleaning, guest communication, supplies), yes — you’ll pay 15.3% self-employment tax on net profit. If your average rental period exceeds 30 days and you don’t provide substantial services, it may be classified as passive rental income on Schedule E, which is not subject to SE tax.

What happens if I don’t make quarterly estimated tax payments?

The IRS charges an underpayment penalty, currently around 7-8% annualized on the underpaid amount. It’s not devastating, but it’s avoidable. Use the Safe Harbor Rule: pay 100% of last year’s tax liability (110% if AGI > $150,000) in four equal installments.

Can I write off furniture purchases all at once?

Yes. Thanks to the OBBBA making 100% bonus depreciation permanent, you can deduct the full cost of qualifying furniture and equipment in the year you purchase and place it in service. This includes beds, couches, appliances, smart locks, electronics — everything you buy to furnish your unit.

Does Airbnb collect occupancy tax for me?

In many jurisdictions, yes — Airbnb automatically collects and remits transient occupancy tax, hotel tax, or sales tax on your behalf. But not everywhere. Check Airbnb’s “Areas where tax collection and remittance by Airbnb is available” page for your specific location. If Airbnb doesn’t handle it, you’re responsible for registering and remitting directly.

How long should I keep my tax records?

Keep everything for at least seven years. The IRS has three years to audit a standard return, six years if they suspect substantial underreporting (25%+ of income), and no time limit for fraud. Seven years covers you in almost every scenario. Asset records (furniture, vehicles) should be kept for the life of the asset plus seven years.

When should I switch from sole proprietor to S-Corp?

Run the numbers when your net arbitrage income consistently exceeds $50,000-$60,000/year. The self-employment tax savings from an S-Corp typically outpace the additional accounting costs ($1,500-$3,000/year) once you hit that income level. File Form 2553 by March 15 to elect S-Corp status for the current tax year.

What’s the difference between a repair and an improvement for tax purposes?

A repair restores something to its original condition — fixing a leaky faucet, patching drywall, replacing a broken window. Repairs are fully deductible in the year you pay for them. An improvement adds value, extends useful life, or adapts property to a new use — replacing all flooring, adding a bathroom, upgrading the entire HVAC system. Improvements must be capitalized and depreciated over time. For arbitrage operators who don’t own the property, most spending falls into the repair category, which is favorable since you get the full deduction immediately.

Can I deduct the cost of this course or coaching program?

Yes. Education expenses directly related to your current business are deductible. Courses on short-term rental management, arbitrage strategy, real estate investing, and tax planning all qualify as business education expenses. Keep your receipt and a record of the course content.

What if I operate at a loss for the year? Can I still deduct expenses?

Yes, but be careful. If your arbitrage expenses exceed your income, you report a business loss on Schedule C. That loss can offset other income on your personal return (like a W-2 job), reducing your total tax liability. However, if you report losses for multiple consecutive years, the IRS may challenge your “profit motive” and reclassify your activity as a hobby — which eliminates most deductions. Keep records showing you’re actively trying to be profitable (pricing strategy, marketing efforts, scaling plans).

Do I need to charge guests sales tax separately?

It depends on your jurisdiction. In states where Airbnb collects and remits occupancy and sales taxes automatically, no — it’s handled for you. In jurisdictions where Airbnb doesn’t collect, you may need to register for a sales tax permit, add tax to your nightly rate, and remit it yourself. Failing to collect required sales tax puts you personally on the hook for the uncollected amount plus penalties.