Managing finances for vacation rentals is a complex task that requires precision and efficiency. Vacation rental accounting software, including specialized bookkeeping software, streamlines business finances, automates repetitive tasks, and ensures compliance with trust accounting requirements. For property managers and vacation rental owners, selecting the right accounting software can make or break operational success. This Airbnb Tips article examines top accounting software solutions, their key features, and how they integrate with property management software to support vacation rentals. We’ll also highlight how 10XBNB’s strategies align with these tools to optimize your vacation rental business.

Introduction to Accounting Software

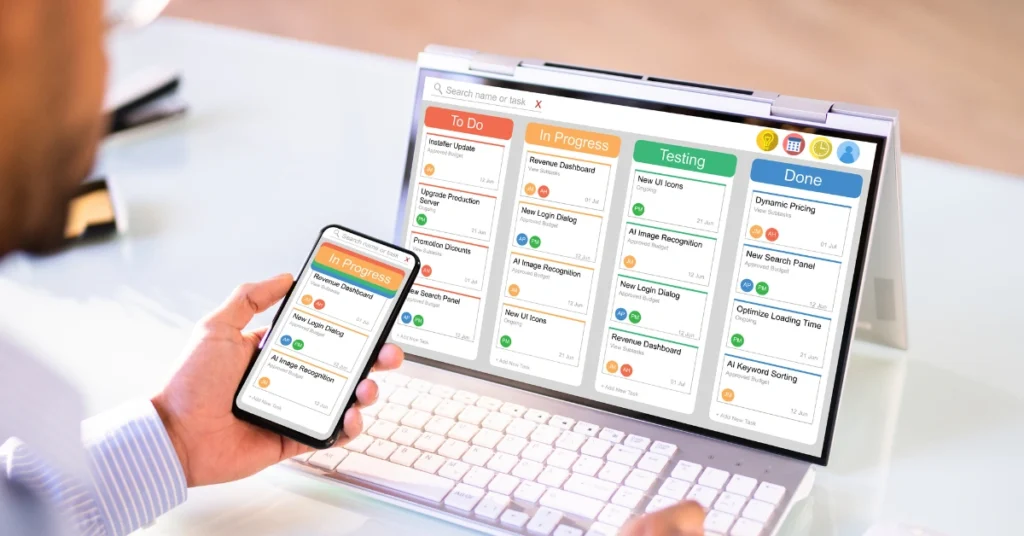

Accounting software is a crucial tool for vacation rental managers to streamline their financial operations. With the right accounting software, property managers can automate tasks, reduce errors, and gain valuable insights into their business finances. In the vacation rental industry, accounting software helps property management companies to manage multiple properties, track expenses, and generate owner statements. By using accounting software, vacation rental owners can simplify their bookkeeping, reduce manual data entry, and focus on growing their business.

The right accounting software can transform the way you manage your vacation rental business. It automates repetitive tasks, such as invoicing and bank reconciliation, freeing up your time to focus on more strategic activities. Additionally, it provides a clear picture of your business finances, helping you make informed decisions and stay ahead in the competitive vacation rental industry. Whether you are managing a few properties or a large portfolio, accounting software is an indispensable tool for ensuring financial accuracy and efficiency.

Why Vacation Rental Accounting Software Matters

Vacation rentals demand meticulous financial oversight due to multiple revenue streams, owner statements, and tax obligations. As the vacation rental business grows, the need for more efficient financial management becomes critical. Unlike traditional businesses, vacation rental accounting involves tracking booking fees, billable expenses, and property owner funds across platforms like Airbnb, Vrbo, and Booking.com. Manual data entry is time-consuming and error-prone, making accounting software essential for scalability and accuracy.

The right accounting software simplifies bank reconciliation, generates detailed reports, and ensures trust accounting compliance, which is critical for segregating property owner funds. For instance, 10XBNB emphasizes automation to reduce manual work, allowing property managers to focus on business growth. Their approach, detailed in their short-term rentals investment strategies, underscores the importance of integrating accounting software with property management tools.

Key Features of Vacation Rental Accounting Software

When selecting accounting software for vacation rentals, prioritize features that align with your property management business needs. Below are the must-have capabilities:

Trust Accounting and Owner Statements

Trust accounting is non-negotiable for property management companies handling multiple properties. It ensures property owner funds are kept separate from operational accounts, reducing legal risks. Software like Clearing and OwnerRez excels in trust accounting by segregating funds and generating owner statements with a few clicks. These statements provide a clear picture of revenue, expenses, and payouts, fostering transparency with property owners.

Pro Tip: Always use software that automates owner statements to save time during tax season. Ensure it supports double-entry accounting for accurate financial tracking.

Integration with Online Travel Agencies

Top accounting software integrates seamlessly with online travel agencies (OTAs) like Airbnb, Vrbo, and Booking.com. This eliminates manual data entry by syncing booking fees, payments, and availability in real time. Hostfully and QuickBooks Online, when paired with Bnbtally, offer robust OTA integrations, making them ideal for short-term rental businesses.

Bank Reconciliation and Separate Bank Accounts

Maintaining separate bank accounts for each property or owner is a best practice for vacation rental accounting. Software like Xero and QuickBooks Online automates bank reconciliation, matching deposits from OTAs with your bank account. This ensures a clear picture of cash flow and simplifies tracking billable expenses.

Payment Processing and Vendor Payments

The ability to pay vendors and collect payments directly through accounting software is a game-changer. Secure handling of payment information is crucial to foster guest trust and ensure smooth financial transactions. Clearing integrates with Stripe and Chase, allowing property managers to pay bills and distribute owner payouts efficiently. FreshBooks makes invoicing and payment tracking intuitive, especially for smaller vacation rental businesses.

Detailed Financial Reporting

Detailed reports, such as balance sheets and loss statements, are crucial for making informed decisions. Software like QuickBooks Online and Xero generates customizable reports that track revenue, expenses, and profitability across multiple properties. These insights help property managers stay ahead in the competitive vacation rental industry.

Double Entry Accounting for Accuracy

Double-entry accounting is a fundamental concept in accounting that ensures accuracy and reliability in financial reporting. In double-entry accounting, each transaction is recorded twice, once as a debit and once as a credit. This method helps to prevent errors, ensures that accounts are balanced, and provides a clear picture of a company’s financial position. For vacation rental businesses, double-entry accounting is essential for managing property owner funds, tracking expenses, and generating accurate financial statements. By using accounting software that supports double-entry accounting, property managers can ensure that their financial records are accurate, reliable, and compliant with accounting standards.

Implementing double-entry accounting in your vacation rental business can significantly enhance your financial management. It allows you to track every financial transaction with precision, ensuring that your accounts are always balanced. This level of accuracy is crucial for generating reliable financial reports, such as balance sheets and income statements, which are essential for making informed business decisions. Moreover, double-entry accounting helps in maintaining transparency with property owners by providing detailed and accurate owner statements.

Expense Tracking and Invoicing

Expense tracking and invoicing are critical components of accounting software for vacation rental businesses. With expense tracking, property managers can record and categorize expenses, such as utility bills, maintenance costs, and booking fees. Invoicing features allow property managers to generate professional invoices, track payment status, and collect payments from clients. By using accounting software with expense tracking and invoicing features, vacation rental managers can streamline their financial operations, reduce administrative tasks, and improve cash flow. Additionally, accounting software can help property managers to manage billable expenses, track vendor payments, and generate detailed reports on business transactions.

Effective expense tracking and invoicing are vital for maintaining healthy cash flow in your vacation rental business. Accounting software simplifies these processes by automating the recording and categorization of expenses, ensuring that nothing is overlooked. It also enables you to create and send professional invoices with ease, track payment status, and follow up on overdue payments. This not only saves time but also ensures that you get paid promptly, enhancing your cash flow. Furthermore, detailed financial reports generated by the software provide valuable insights into your business transactions, helping you manage your finances more effectively and make informed decisions.

Top Vacation Rental Accounting Software Solutions

Here’s a breakdown of the best accounting software for vacation rentals, tailored to property managers and owners:

1. OwnerRez: Best for Multi-Platform Integration

OwnerRez is a standout for its elite channel management and trust accounting capabilities. It integrates directly with Airbnb, Vrbo, and Booking.com, syncing bookings and payments in real time. Its accounting features include tax tracking, owner statements, and payment processing, making it an all-in-one solution for property management companies.

Pros:

- Robust trust accounting for property owner funds

- Seamless OTA integrations

- Built-in CRM and website builder

Cons:

- Additional fees for managing multiple properties

- Steeper learning curve for new users

10XBNB Insight: Pair OwnerRez with 10XBNB’s Airbnb appraisal strategies to optimize property performance and maximize revenue.

2. QuickBooks Online with Bnbtally: Best for Scalability

QuickBooks Online, when integrated with Bnbtally, is a powerhouse for vacation rental accounting. It offers double-entry accounting, class tracking, and customizable owner statements, ideal for property managers handling 10+ properties. Its cloud-based platform ensures access from any device, and the support team is responsive.

Pros:

- Comprehensive accounting features

- Affordable pricing starting at $17/month

- Strong OTA integrations via Bnbtally

Cons:

- Bnbtally’s $32/month fee adds to costs

- Limited to Airbnb and Vrbo integrations

Pro Tip: Use QuickBooks’ class tracking to monitor each property’s performance, as recommended in 10XBNB’s average Airbnb income guide.

3. Clearing: Best for Financial Automation

Clearing is an all-in-one financial operating system designed for short-term rental businesses. It automates bookkeeping, trust accounting, and vendor payments, integrating with Hostfully and OTAs. Clearing also automates bookkeeping software tasks, making it easier for property managers. Its dashboard provides a clear picture of business finances, making it a favorite among property managers.

Pros:

- Automated bank reconciliation

- Seamless payment processing

- Detailed financial reports

Cons:

- Higher cost compared to standalone software

- Limited advanced features for large portfolios

4. Xero: Best for International Properties

Xero is a cloud-based accounting software ideal for vacation rental owners with properties in multiple countries. It is also versatile for managing short term rental properties, especially those in multiple countries. It supports multi-currency transactions, bank reconciliation, and detailed reports. Its integrations with Airbnb and Vrbo make it a versatile choice for global property management.

Pros:

- Multi-currency support for international rentals

- Intuitive interface

- Affordable pricing starting at $20/month

Cons:

- Limited OTA integrations compared to OwnerRez

- Payroll features require additional fees

10XBNB Insight: Xero complements 10XBNB’s mid-term rental calculator for tracking profitability across diverse markets.

5. Wave: Best Free Option

Wave is a free accounting software solution perfect for small vacation rental businesses. It offers unlimited income and expense tracking, invoicing, and bank reconciliation. While it lacks advanced trust accounting, it’s a cost-effective choice for new property managers.

Pros:

- Completely free with no subscription fees

- Easy-to-use interface

- Real-time bank connectivity

Cons:

- Limited integrations with OTAs

- No built-in trust accounting

How Property Management Software Enhances Accounting

Property management software like Hostfully, Guesty, and Hostaway often includes accounting features or integrates with dedicated accounting software. A property manager plays a critical role in maintaining financial transparency and compliance through effective accounting practices. These platforms streamline lead management, automate guest communications, and sync bookings across OTAs, reducing manual data entry. For example, Hostfully’s integration with Clearing enhances trust accounting, while Guesty’s marketplace connects to payment processors like Stripe.

Pro Tip: Choose property management software with an open API to ensure compatibility with your favorite apps, as outlined in 10XBNB’s Airbnb no-money strategies.

Trust Accounting: A Cornerstone of Vacation Rental Accounting

Trust accounting is critical for property management companies to maintain compliance and build trust with property owners. It involves segregating property owner funds in separate bank accounts, ensuring funds are only used for their intended purpose. Most accounting software, like OwnerRez and Clearing, automates this process, generating monthly statements and tracking payment status.

Failure to implement trust accounting can lead to legal issues and financial mismanagement. 10XBNB’s insurance coverage guide highlights the importance of financial transparency to protect your vacation rental business.

Automating Business Finances for Growth

Automation is the key to scaling a vacation rental business. Accounting software reduces time-consuming tasks like manual data entry, invoice creation, and bank reconciliation. For instance, FreshBooks makes it easy to pay vendors and track expenses, while Clearing automates owner payouts and financial reporting.

By automating business transactions, property managers can focus on lead management and guest experience, driving business growth. 10XBNB’s hands-free automation strategies, detailed in their fix-rent loans guide, emphasize the role of software in achieving a competitive edge.

Choosing the Right Accounting Software for Your Needs

Selecting the best accounting software depends on your vacation rental business size, budget, and operational complexity. Here’s a quick guide:

- Small Businesses (1-3 Properties): Wave or FreshBooks for cost-effective, user-friendly solutions.

- Mid-Sized Businesses (4-10 Properties): Xero or QuickBooks Online with Bnbtally for scalability and OTA integrations.

- Large Portfolios (10+ Properties): OwnerRez or Clearing for advanced trust accounting and multi-platform management.

Pro Tip: Request a personalized quote from vendors to ensure the software meets your specific needs, especially for trust accounting and owner statements.

The Role of 10XBNB in Optimizing Vacation Rental Accounting

10XBNB’s expertise in rental arbitrage and property management aligns seamlessly with top accounting software. Their strategies focus on maximizing revenue and minimizing manual work, making tools like OwnerRez and Clearing ideal companions. For example, 10XBNB’s selling Airbnb property guide emphasizes accurate financial reporting to boost property value, which accounting software facilitates.

By integrating 10XBNB’s automation techniques with vacation rental software, property managers can streamline check-in and check-out processes, track payments, and generate owner statements effortlessly. This synergy creates a competitive edge in the vacation rental industry.

Common Mistakes to Avoid in Vacation Rental Accounting

Avoid these pitfalls to ensure your short-term rental business thrives:

- Relying Solely on OTA Reports: Airbnb and Vrbo reports don’t account for all expenses. Use accounting software to track billable expenses and revenue comprehensively.

- Mixing Personal and Business Finances: Maintain separate bank accounts to simplify bank Reconciliation and tax season.

- Neglecting Trust Accounting: Failing to segregate property owner funds can lead to legal issues. Choose software with robust trust accounting features.

- Ignoring Automation: Manual data entry wastes time. Invest in software that automates owner statements and payment status tracking.

Future Trends in Vacation Rental Accounting Software

The vacation rental industry is evolving, and accounting software is keeping pace. Expect advancements in AI-driven analytics, enhanced OTA integrations, and mobile-first platforms. Cloud-based solutions will dominate, offering real-time access to business finances. Property managers should stay ahead by adopting software with advanced features and reliable support teams.

Conclusion

Vacation rental accounting software is the backbone of a successful short-term rental business. Tools like OwnerRez, QuickBooks Online, Clearing, Xero, and Wave offer tailored solutions for property managers and owners. By prioritizing trust accounting, OTA integrations, and automation, these platforms streamline business finances and drive growth. Pairing these tools with 10XBNB’s expert strategies ensures your vacation rental business thrives in a competitive market. Choose the right accounting software, implement best practices, and watch your revenue soar.