If you’re doing rental arbitrage and relying solely on Airbnb’s AirCover to protect your business, you’re gambling with real money. AirCover is not insurance—it’s a reimbursement program with narrow eligibility rules, aggressive documentation requirements, and a track record of denied claims that would make any experienced host nervous. You need actual commercial coverage, and the specifics matter more than most guides will tell you.

I’ve watched arbitrage operators lose $8,000, $15,000, even $30,000+ because they assumed AirCover “had them covered.” It didn’t. This guide breaks down exactly what coverage you need, what you can skip, which providers are worth your money, and how to structure insurance across a growing arbitrage portfolio without overspending.

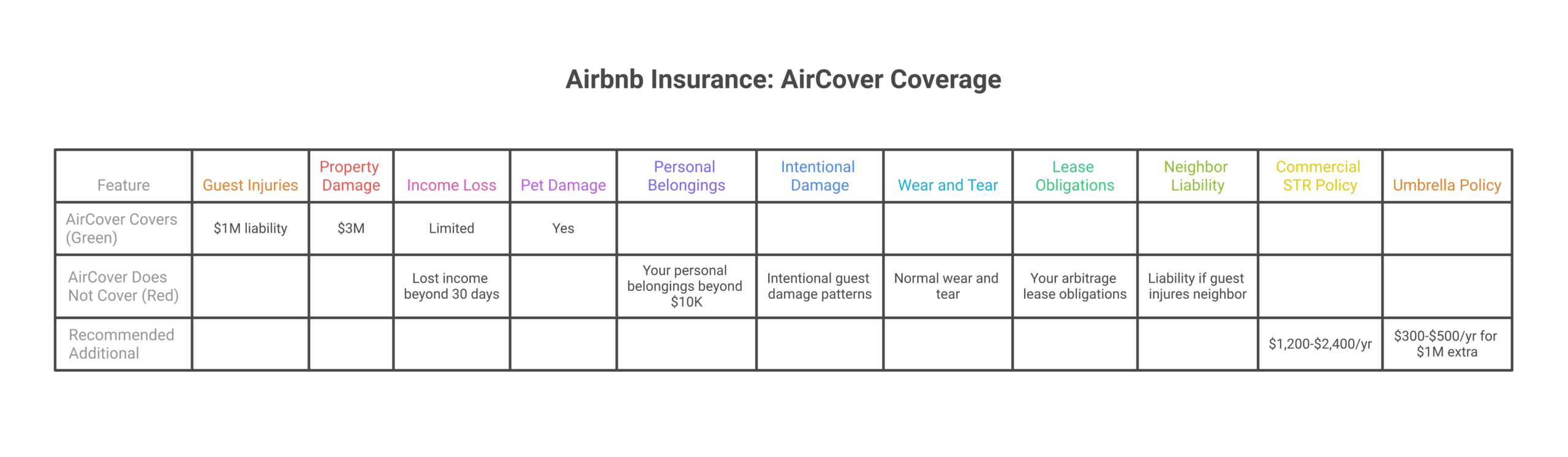

AirCover for Hosts: What It Actually Covers (and What It Doesn’t)

Airbnb launched AirCover in late 2022, rebranding their existing Host Guarantee and Host Protection Insurance into a shinier package. The headline numbers look impressive: $3 million in Host Damage Protection and $1 million in Host Liability Insurance. But those numbers are marketing, not a policy document.

What AirCover Does Cover

Host Damage Protection ($3M) reimburses you when a guest damages your property or belongings during a confirmed Airbnb stay. This includes broken furniture, stained carpets, damaged appliances, and similar guest-caused destruction. The $3 million cap applies per occurrence.

Host Liability Insurance ($1M) provides coverage if a guest or third party is injured at your property and you’re found legally responsible. Think: someone slips on a wet floor, trips on a loose step, or gets hurt using your amenities. This is underwritten by an actual insurance carrier and provides $1 million per occurrence.

What AirCover Does NOT Cover

Here’s where arbitrage hosts get burned. AirCover excludes:

- Normal wear and tear. That mattress sagging after 200 guests? Not covered. Carpet wearing thin? Also no

- Your personal property used for business. Furniture, linens, kitchenware—the stuff that actually costs you money to replace—has very limited coverage under AirCover’s definition of “belongings”

- Cash, securities, collectibles, pets, and vehicles. Explicitly excluded

- Intentional damage by guests who dispute the charges. If a guest trashes your place and claims they didn’t do it, you’re in a he-said-she-said with Airbnb acting as judge

- Loss of rental income. If a guest causes damage that takes your unit offline for two weeks of repairs, AirCover won’t reimburse your lost bookings. For an arbitrage host paying $2,500/month in rent, that’s $1,250 gone with zero recourse

- Damage discovered after the next guest checks in. You have 14 days to file, but if you don’t notice damage until a subsequent guest reports it, proving which guest caused it becomes nearly impossible

- Acts of nature, mold, mildew, insects, and vermin. All excluded

- Excessive utility usage. A guest who cranks your heat to 85°F for a month-long stay? That’s your problem

- Anything happening on a non-Airbnb booking. If you also list on Vrbo, Booking.com, or take direct bookings, AirCover provides zero coverage for those stays—even at the same property

The $3 Million Misconception

That $3 million figure is the maximum theoretical payout. In practice, getting reimbursed through AirCover requires jumping through hoops that would exhaust most people. You need timestamped before-and-after photos, professional repair estimates, proof you contacted the guest within 24 hours, and documentation that you filed within the 14-day window. Miss any step and your claim gets denied.

I’ve seen a $12,000 claim denied because the host filed on day 16 instead of day 14. The damage was real, the photos were clear, the guest admitted fault in messages. Didn’t matter—the window had closed. Airbnb community forums are filled with similar stories: hosts who followed every rule and still got partial payouts or outright rejections because of “insufficient documentation.”

Multiple industry reports note that a large number of AirCover claims are rejected due to alleged lack of proof. Airbnb’s own help documentation states that AirCover “is not a substitute for homeowners or renters insurance.” They’re telling you directly: this isn’t real insurance. Believe them.

Why Arbitrage Hosts Need Additional Insurance

Rental arbitrage creates a unique insurance gap that’s wider than what property owners face. Here’s why:

You Don’t Own the Property

This is the fundamental issue. Your landlord’s property insurance covers the building structure. It does not cover your business operations, your furnishings, or liability arising from your guests. If a guest starts a kitchen fire and damages the unit, your landlord’s insurance will cover the building repairs—and then their insurer will come after you for reimbursement through subrogation. Without your own policy, you’re personally on the hook.

Renters Insurance Won’t Save You

Standard renters insurance policies explicitly exclude commercial activity. The moment you start accepting paid guests through Airbnb, you’re running a business in that unit. If you file a claim and your renters insurance company discovers you’ve been operating a short-term rental, they’ll likely deny the claim and cancel your policy. Some hosts have learned this the hard way after a $5,000+ loss.

Landlords Increasingly Require It

If you’re following the right approach to getting landlord approval for rental arbitrage, you know that most sophisticated landlords now require proof of commercial liability insurance before they’ll sign off on subletting. A $1 million commercial general liability policy names them as an additional insured—which actually makes them more comfortable approving your arbitrage arrangement, not less. It’s a negotiation tool as much as a protection tool.

The Gap Between AirCover and Real Liability

Consider this scenario: A guest’s child falls down the stairs at your arbitrage unit and suffers a serious injury. The family sues for $500,000 in medical bills plus damages. AirCover’s liability coverage might respond—but only if Airbnb’s claims team agrees the incident qualifies under their terms. If they dispute any element (was the property maintained properly? was there a building code issue?), you could be personally liable for the entire amount. With a commercial policy, your insurer defends you from day one, regardless of Airbnb’s position.

Understanding Airbnb risk management means recognizing that AirCover is a supplement, not a foundation. Your insurance stack needs to stand on its own.

Types of Insurance Every Arbitrage Host Should Know About

Not every arbitrage operator needs every type of coverage. But you need to understand what’s available so you can make informed decisions based on your portfolio size, risk tolerance, and startup cost budget.

Commercial General Liability (CGL)

This is the baseline. A CGL policy covers third-party bodily injury and property damage claims arising from your business operations. If a guest slips in the shower, trips over a rug, or gets food poisoning from a contaminated fridge, CGL responds. Standard coverage starts at $1 million per occurrence / $2 million aggregate.

Cost: $400–$900/year for a single-unit arbitrage operation. Multi-unit policies scale but don’t multiply linearly—a 5-unit portfolio might run $1,500–$2,500/year.

Who needs it: Every arbitrage host. No exceptions. This is your minimum viable insurance.

Short-Term Rental (STR) Insurance

STR-specific policies are purpose-built for hosts. They combine elements of landlord insurance, commercial liability, and business personal property coverage into a single policy designed for the unique risks of short-term rental operations. Providers like Proper Insurance, Safely, and CBIZ specialize in this space.

Cost: According to the National Association of Short-Term Rental Management, the average STR insurance premium runs between $2,000 and $3,000 per year per property. High-value properties, units with pools or hot tubs, or properties in high-liability states can push this to $4,000+.

Who needs it: Hosts managing 3+ units or anyone who wants comprehensive coverage without assembling multiple separate policies.

Umbrella Insurance

An umbrella policy sits on top of your other coverage and kicks in when underlying policy limits are exhausted. If your CGL covers $1 million and you face a $1.5 million lawsuit, the umbrella covers the remaining $500,000 (up to its own limit).

Cost: $200–$400/year for the first $1 million block. Additional million-dollar blocks cost roughly $100 each. Remarkably affordable for the protection level.

Who needs it: Any host with more than 3 units or anyone operating in a litigious market. If you’re scaling an arbitrage portfolio, this is cheap peace of mind.

Business Personal Property (BPP) Coverage

This covers the furniture, electronics, appliances, linens, and kitchenware you’ve invested in to furnish your arbitrage units. Standard AirCover has vague and limited protection for your belongings. A BPP policy provides explicit, defined coverage for everything you’ve purchased to operate the business.

Cost: Usually bundled into STR policies. Standalone BPP riders run $300–$800/year depending on the total value of your furnishings.

Who needs it: Anyone who’s invested more than $5,000 furnishing a unit. For most arbitrage operators, that’s every single unit you manage.

Business Interruption Insurance

If your unit goes offline due to covered damage—fire, water leak, storm damage—business interruption coverage reimburses your lost rental income during the repair period. For arbitrage hosts paying rent regardless of whether the unit is generating revenue, this coverage can be the difference between surviving a setback and going bankrupt.

Cost: Typically included in comprehensive STR policies. Standalone coverage adds $200–$600/year.

Who needs it: Every arbitrage host. You’re paying rent whether or not you have guests. If your unit is offline for 30 days of repairs, you need income replacement.

Insurance Provider Comparison for Arbitrage Hosts

Three providers dominate the STR insurance space. Each has a different model, and the right choice depends on your portfolio size and operating style.

Proper Insurance

Proper is the gold standard for dedicated STR insurance. Backed by Lloyd’s of London, their policies are specifically designed to replace your standard homeowners or landlord policy with commercial-grade coverage purpose-built for short-term rentals. They’re pre-approved by Airbnb and Vrbo, which simplifies the claims process.

Coverage highlights:

- $1M+ liability per occurrence (configurable up to $2M on base contract)

- Building and contents coverage at replacement cost

- Loss of rental income / business interruption

- Amenity coverage (pools, hot tubs, fire pits)

- Theft by guests

Pricing: $2,000–$4,000/year per property depending on location, value, and amenities. A typical 2-bedroom arbitrage unit in a mid-tier market runs around $2,200–$2,800/year.

Best for: Hosts with 1–10 units who want comprehensive, hassle-free coverage. Their claims process is consistently rated as fast and straightforward.

Safely

Safely takes a different approach: per-booking insurance combined with guest screening. Instead of an annual premium, you pay per reservation. Their model is attractive for hosts who want to pass the cost through to guests (though Airbnb requires you to bake it into nightly rates or cleaning fees rather than listing it as a separate charge).

Coverage highlights:

- Up to $1M in property damage coverage

- Up to $1M in liability coverage

- Guest screening included

- Claims typically resolved within 3–9 days

- 60-day window to report damage (vs. AirCover’s 14 days)

Pricing: Per-booking model. The standard protection fee is around $33 per booking, though this varies by property value and location. For a unit doing 20 bookings/month, that’s roughly $660/month or $7,920/year—significantly more expensive than annual policies for high-turnover properties.

Best for: Hosts with 1–3 units and lower booking frequency (10–15 bookings/month or fewer), or hosts who want guest screening bundled with insurance. The math works better for longer stays with fewer turnovers.

CBIZ

CBIZ has been in the vacation rental insurance space since 2002—longer than most competitors. They offer customizable commercial policies backed by carriers with AA+ financial strength ratings (A.M. Best). Their approach is more traditional insurance: you work with an agent to build a policy tailored to your specific portfolio.

Coverage highlights:

- Replacement cost coverage for building and contents

- Guest-caused damage

- Loss of use and extra expenses

- Loss of rental income

- Extensive liability coverage including pool, hot tub, and amenity coverage

- Bed bug remediation (unique to CBIZ)

Pricing: Highly variable based on custom policy design. Hosts report plans ranging from approximately $3/day (~$1,095/year) to $100/month (~$1,200/year) for standard coverage. Complex portfolios with high-value properties will pay more.

Best for: Hosts with 5+ units or complex portfolios who need customized commercial coverage. CBIZ’s agent-based model works better when you have specific needs that off-the-shelf policies don’t address.

Provider Comparison Table

| Feature | Proper Insurance | Safely | CBIZ |

|---|---|---|---|

| Pricing Model | Annual premium | Per-booking fee | Annual premium (custom) |

| Typical Annual Cost | $2,000–$4,000/unit | $33/booking (varies) | $1,100–$3,000/unit |

| Liability Coverage | $1M–$2M per occurrence | Up to $1M | Custom (typically $1M+) |

| Property Damage | Replacement cost | Up to $1M | Replacement cost |

| Business Interruption | Included | Not included | Included |

| Guest Screening | Not included | Included | Not included |

| Claim Filing Window | Per policy terms | 60 days | Per policy terms |

| Backed By | Lloyd’s of London | Commercial carriers | AA+ rated carriers (A.M. Best) |

| Best For | 1–10 units, simplicity | Low-volume, screening | 5+ units, custom needs |

How Much Insurance Do You Actually Need?

Coverage requirements scale with your portfolio. Here’s a framework based on what I’ve seen work across hundreds of arbitrage operations:

1–2 Units (Starting Out)

- Minimum: CGL policy ($1M/$2M) + renters insurance that permits STR activity (rare, but they exist)

- Recommended: STR-specific policy from Proper or CBIZ ($2,000–$3,000/year)

- Monthly insurance budget: $170–$250/month across all units

3–5 Units (Growing Portfolio)

- Minimum: STR policy covering all units + $1M umbrella

- Recommended: Comprehensive STR policy + $2M umbrella + BPP rider if furnishings exceed $10,000/unit

- Monthly insurance budget: $400–$700/month across all units

6–15 Units (Established Operation)

- Minimum: Commercial package policy + $2M umbrella

- Recommended: Custom commercial policy through CBIZ or similar + $3M–$5M umbrella + business interruption + workers’ comp if you have cleaners on payroll

- Monthly insurance budget: $800–$1,500/month across all units

15+ Units (Scaled Business)

- At this stage, you need a commercial insurance broker who specializes in hospitality. Off-the-shelf STR policies don’t scale efficiently past 15 units

- Consider forming an LLC for liability isolation (separate from your insurance strategy)

- Monthly insurance budget: $1,500–$3,000+ depending on markets and property values

Factor insurance into your unit economics from the start. When you’re calculating rental arbitrage pros and cons, insurance is a fixed operating cost—not an optional line item. Budget $150–$300/month per unit as a baseline, and adjust based on your market and risk profile.

What to Look for in an STR Insurance Policy: 10-Point Checklist

Not all policies are created equal. Before you sign anything, verify these 10 items:

- Short-term rental activity is explicitly covered. Read the policy language. “Vacation rental” and “short-term rental” are not the same thing in insurance terminology. Confirm your specific use case (subleased unit, 1–30 night stays, commercial operation) is covered

- Liability coverage of at least $1M per occurrence. This is the floor, not the ceiling. In litigious states like California, Florida, or New York, $2M is safer

- Property damage includes guest-caused damage. Some commercial policies cover fire and natural disasters but exclude guest negligence. That’s the opposite of what you need

- Business personal property is included or available as a rider. Your $8,000 worth of furniture per unit needs explicit coverage

- Business interruption / loss of rental income is included. Non-negotiable for arbitrage hosts who pay rent regardless of occupancy

- The policy covers multi-platform bookings. If you list on Airbnb, Vrbo, and Booking.com, make sure your policy covers stays from all platforms—not just Airbnb

- Additional insured endorsement is available. Your landlord will likely require being named as additional insured. Confirm the policy supports this

- Bed bug and biohazard coverage. One bed bug incident can cost $3,000–$8,000 to remediate and take your unit offline for days. CBIZ includes this; others may not

- Reasonable deductibles. Watch for policies with low premiums but $5,000+ deductibles. For arbitrage hosts, a $1,000–$2,500 deductible is the sweet spot

- Claims process reputation. Read reviews from actual hosts. The cheapest policy is worthless if the claims process is adversarial. Proper Insurance consistently ranks highest for claims satisfaction among STR hosts

Insurance and Your Lease Agreement

Your rental arbitrage contract and your insurance policy need to work together. Here’s what landlords typically require and how to structure it:

Common Landlord Insurance Requirements

- Certificate of Insurance (COI). A one-page document from your insurer confirming active coverage, limits, and effective dates. Most landlords require this before signing the lease or subletting addendum

- Additional Insured endorsement. This adds your landlord (and sometimes their property management company) to your policy. It means they’re covered under your liability protection if a guest sues them because of your operations. Most STR policies offer this for $50–$100/year per additional insured

- Minimum coverage limits. Expect landlords to require at least $1M in general liability. Some require $2M aggregate. Properties with amenities (pools, fire pits) may trigger higher requirements

- Annual proof of renewal. Your landlord will want updated COIs each year. Set a calendar reminder 30 days before renewal to avoid lapses that could violate your lease

Pro Tip: Use Insurance as a Negotiation Tool

When you’re approaching landlords about rental arbitrage approval, leading with “I carry $1 million in commercial liability insurance and will name you as additional insured” immediately separates you from every other tenant. Most tenants don’t carry any commercial coverage. You’re showing the landlord that you’re a professional operator who takes risk seriously. I’ve seen this single line in a proposal letter convert hesitant landlords into enthusiastic partners.

The Claims Process: How to File Effectively

When damage happens—and it will eventually happen—your response in the first 24 hours determines whether your claim gets paid or denied. Here’s the system I recommend:

Immediate Response (First 2 Hours)

- Document everything with photos and video. Wide shots of the room, close-ups of damage, include timestamps. Use your phone’s timestamp feature or hold a newspaper with the date visible if you want to be extra careful

- Message the guest through the Airbnb platform. Describe the damage calmly and ask if they’re aware of it. This creates a written record within Airbnb’s system

- Contact your insurance provider. Most STR insurers have 24/7 claim hotlines. File a preliminary report even before you have repair estimates

Within 48 Hours

- Get professional repair estimates. Two or three written estimates from licensed contractors. Include photos of the damage in the estimate requests

- File your Airbnb AirCover claim (if the booking was on Airbnb). Even if you have commercial insurance, file with AirCover first. Your commercial policy is a backup, and your insurer will want to see that you’ve pursued all available reimbursement channels

- Compile your “before” documentation. This is why maintaining a photo inventory of every unit after each turnover is critical. If you don’t have before photos, your claim—with both AirCover and your insurer—becomes much harder to prove

Within 14 Days

- Follow up on the AirCover claim. Airbnb moves slowly. Push for updates and provide any additional documentation requested

- Submit the full claim package to your insurer. Include: photos/video, guest communication records, repair estimates, your AirCover claim number, and your property inventory

- Track everything in writing. Email confirmations, claim numbers, adjuster names, phone call dates. If a claim goes sideways, your paper trail is your best weapon

Common Claim Mistakes to Avoid

- Don’t repair damage before documenting it. I know it’s tempting to fix things fast so you can get back to hosting, but pre-repair photos and estimates are essential for claim approval

- Don’t skip the AirCover filing. Even if you expect AirCover to deny you, your commercial insurer may require proof that you attempted to recover through the platform first

- Don’t admit fault in guest communications. Stick to facts: “I noticed damage to the kitchen counter” not “I should have secured the counter better”

- Don’t accept the first AirCover offer without review. If Airbnb offers partial reimbursement, you can negotiate or escalate. Their initial offer is rarely the maximum available

Cost-Benefit Analysis: Is Extra Insurance Worth It?

Let’s do the math on a real arbitrage scenario.

The Numbers

Typical arbitrage unit:

- Monthly rent: $2,000

- Monthly gross revenue: $4,500

- Monthly net profit (before insurance): $1,200

- Annual furnishing investment: $8,000 (initial) + $2,000 (replacement)

Insurance cost (Proper Insurance): $2,400/year = $200/month

Net profit after insurance: $1,000/month = $12,000/year

That $200/month represents 4.4% of gross revenue and 16.7% of net profit. Painful? Slightly. But here’s what you’re protecting against:

Scenario 1: Guest Causes $15,000 in Damage

Without insurance: AirCover claim filed. If approved (big if), you might get $8,000–$12,000 after deductions and disputes. If denied, you’re out $15,000 plus 2–3 weeks of lost bookings ($2,000+). Total potential loss: $17,000.

With insurance: You file with your insurer, pay your $1,500 deductible, and receive a check for $13,500 within 2–4 weeks. Your business interruption coverage also reimburses lost rental income during repairs. Total out-of-pocket: $1,500.

Scenario 2: Guest Injury Lawsuit ($250,000)

Without insurance: AirCover liability might respond, but if Airbnb disputes coverage, you’re personally defending a six-figure lawsuit. Legal fees alone can run $30,000–$50,000 even if you win.

With insurance: Your CGL policy assigns a defense attorney immediately. They handle everything. Your out-of-pocket is zero (after deductible) for claims within your policy limits.

Scenario 3: Water Pipe Bursts, Unit Offline for 30 Days

Without insurance: You pay $2,000 rent for a unit generating zero revenue. AirCover doesn’t cover infrastructure failures or lost income. Loss: $2,000 rent + $4,500 lost revenue = $6,500.

With insurance: Business interruption coverage reimburses your lost rental income. Property coverage handles the water damage repair. Your loss is limited to your deductible.

The math is clear. $200/month in insurance protects against five- and six-figure losses that would wipe out months or years of arbitrage profits. This isn’t optional—it’s a core operating expense. Factor it in when you’re evaluating your full Airbnb startup costs.

Insurance for Airbnb Arbitrage vs. Property Owners: Key Differences

If you’ve read generic Airbnb insurance guides, you’ve noticed most are written for property owners. Arbitrage hosts face different challenges:

| Factor | Property Owner | Arbitrage Host |

|---|---|---|

| Building Coverage | Needed (you own the structure) | Not needed (landlord covers this) |

| Contents Coverage | Included in homeowners | Need separate BPP coverage |

| Liability | Homeowners + STR supplement | Need standalone CGL or STR policy |

| Business Interruption | Nice to have | Critical (you still pay rent) |

| Additional Insured | Rarely needed | Almost always required by landlord |

| Multi-platform Coverage | Important | Equally important |

| Lease Compliance | N/A | Insurance may be a lease requirement |

The biggest arbitrage-specific need is business interruption coverage. A property owner with a mortgage can potentially defer payments or tap home equity during a repair period. An arbitrage host pays rent every single month regardless. Thirty days without revenue doesn’t just hurt—it can force you to break your lease and abandon the unit entirely.

For more on the specific insurance considerations in arbitrage arrangements, see our guide to arbitrage insurance for Airbnb.

FAQ: Airbnb Insurance for Rental Arbitrage

Is Airbnb’s AirCover enough for rental arbitrage hosts?

No. AirCover is a reimbursement program, not a comprehensive insurance policy. It doesn’t cover business interruption, loss of rental income, damage to your furnishings beyond narrow definitions, or liability arising from non-Airbnb bookings. Arbitrage hosts need commercial general liability insurance at minimum, and a dedicated STR policy is strongly recommended. AirCover should be treated as a supplementary backup, not your primary protection.

How much does Airbnb host insurance cost per year?

The average short-term rental insurance premium runs between $2,000 and $3,000 per year per property, according to the National Association of Short-Term Rental Management. Actual costs depend on property location, coverage limits, amenities, and booking volume. For arbitrage hosts, expect to budget $150–$300/month per unit for adequate coverage. Per-booking models (like Safely) can cost more or less depending on your turnover rate.

Can I use my regular renters insurance for Airbnb hosting?

Almost certainly not. Standard renters insurance policies exclude commercial activity, which includes accepting paid short-term rental guests. If you file a claim and your insurer discovers you’ve been operating an Airbnb business, they’ll likely deny the claim and may cancel your policy entirely. You need either a commercial policy or a renters policy with a specific short-term rental endorsement (which very few carriers offer).

Do landlords require insurance for rental arbitrage?

Increasingly, yes. Sophisticated landlords and property management companies require proof of commercial liability insurance (typically $1M minimum) before approving subletting arrangements for short-term rental use. Many also require being named as additional insured on your policy. Even if your landlord doesn’t explicitly require it, carrying insurance and presenting a Certificate of Insurance during negotiations significantly improves your chances of approval.

What’s the difference between Proper Insurance and Safely?

Proper Insurance offers annual commercial policies specifically designed for STR hosts, backed by Lloyd’s of London, with comprehensive coverage including business interruption and replacement-cost property protection. Safely uses a per-booking model that combines guest screening with insurance coverage. Proper is generally better value for high-volume hosts (more than 15–20 bookings/month), while Safely can be more cost-effective for low-volume operations or hosts who want integrated guest screening.

Does insurance cover damage from Airbnb guests specifically?

Yes—but you need the right policy. Standard commercial property policies often exclude “tenant-caused damage” because they’re designed for traditional rental operations. STR-specific policies from providers like Proper, Safely, and CBIZ explicitly include guest-caused damage as a covered peril. When shopping for coverage, confirm that guest negligence and guest-caused property damage are listed as covered causes of loss, not just fire and natural disasters.

Should I file claims with AirCover or my insurance first?

File with AirCover first for any Airbnb booking-related damage. Your commercial insurer typically expects you to pursue all available first-party reimbursement before they step in. However, don’t wait for AirCover’s resolution before notifying your insurer—file preliminary notice with both simultaneously, then let AirCover process first. If AirCover denies or underpays, your commercial policy picks up the remainder (minus your deductible). This dual-filing approach maximizes your recovery while satisfying both parties’ requirements.