A DSCR loan for Airbnb lets you qualify to buy a short-term rental property based on what the property earns — not what you earn on a W-2. If you’ve been running rental arbitrage and you’re ready to stop making your landlord rich, this is the financing vehicle that bridges the gap between operating someone else’s property and owning yours. I’ve watched dozens of arbitrage operators make this transition, and DSCR lending is the single most important tool that makes it possible.

Below, I’m breaking down exactly how DSCR loans work for Airbnb properties in 2026, what the requirements actually look like (not the vague answers you’ll find elsewhere), current rates, how lenders calculate your Airbnb income, and the step-by-step playbook for going from arbitrage profits to property ownership.

What Is a DSCR Loan?

DSCR stands for Debt Service Coverage Ratio. It’s a number that tells a lender one thing: can this property’s income cover its own mortgage payment? That’s it. They don’t care about your W-2, your tax returns, your employer, or your debt-to-income ratio. The property has to pay for itself.

The DSCR Formula

DSCR = Gross Rental Income / Total Debt Service (PITIA)

PITIA stands for Principal, Interest, Taxes, Insurance, and Association dues (HOA if applicable). So if a property generates $4,000 per month in rental income and the total PITIA is $3,200, the DSCR is 1.25x. That means the property earns 25% more than it costs to carry — and that’s a comfortable number for most lenders.

Here’s a quick reference:

| DSCR Ratio | What It Means | Lender Appetite |

|---|---|---|

| Below 0.75x | Property loses money significantly | Most lenders decline |

| 0.75x – 0.99x | Property doesn’t fully cover debt | Some “no-ratio” programs accept this |

| 1.0x | Property breaks even on debt service | Minimum threshold for many lenders |

| 1.0x – 1.24x | Property covers debt with small margin | Approved, but rates may be higher |

| 1.25x+ | Property comfortably covers debt | Best rates and terms available |

| 1.5x+ | Strong cash flow above debt obligations | Premium terms, lower down payment options |

Why DSCR Works for Short-Term Rentals

Traditional lenders look at long-term rental comps (what a property would rent for on a 12-month lease) when underwriting investment properties. That’s a problem for Airbnb investors because a property that would rent for $2,000/month on a long-term lease might generate $4,500/month as a short-term rental. Conventional underwriting leaves that upside on the table.

DSCR lenders specializing in short-term rentals actually account for STR income. They use platforms like AirDNA, actual booking history from Airbnb and VRBO, or a 1007 Rent Schedule that factors in nightly rates and occupancy. This means the true income potential of a vacation rental gets counted — and that’s what makes DSCR loans the go-to financing for anyone buying an Airbnb property.

Why DSCR Loans Are Perfect for Arbitrage Operators Scaling Up

If you’re running rental arbitrage right now, you already have something 90% of first-time Airbnb buyers don’t: proof that you can operate a profitable short-term rental. That experience is worth more than you think when it comes time to buy.

The Natural Progression: Arbitrage to Ownership

Here’s the path I’ve seen work again and again. You start with arbitrage — you lease a property, furnish it, list it on Airbnb, and pocket the spread between your lease payment and your nightly revenue. You learn the market. You figure out pricing, guest management, cleaning operations, and local regulations. You build cash flow. And then you hit a ceiling.

The ceiling is this: you’re building someone else’s equity. Every month, your lease payment goes to your landlord’s mortgage. Every improvement you make to the property increases its value — for your landlord. Arbitrage is a business model, and a good one (we break down the full comparison in our arbitrage vs buying analysis), but it’s not a wealth-building strategy by itself.

DSCR lending is what turns your arbitrage operation into a real estate portfolio. And here’s why it’s specifically built for operators like you:

No Personal Income Verification Required

Most arbitrage operators are self-employed. Many write off significant expenses, which tanks their taxable income. Try walking into a bank and qualifying for a conventional mortgage when your tax return shows $38,000 after deductions even though you actually grossed $180,000. You’ll get denied.

DSCR loans skip all of that. The lender doesn’t look at your 1040. They look at the property. Can it service its own debt? Yes or no. This is why entrepreneurs, self-employed investors, and arbitrage operators gravitate toward DSCR — it matches how you actually earn money.

You Can Close as an LLC

Most conventional loans require you to buy in your personal name. DSCR loans allow you to close in an LLC, which gives you liability protection from day one. For anyone running multiple STR units, this isn’t optional — it’s essential. One guest slip-and-fall lawsuit shouldn’t put your personal assets at risk.

No Cap on Number of Properties

Fannie Mae caps conventional borrowers at 10 financed properties. Period. After that, you’re done. DSCR lenders have no such limit. I’ve seen operators close their 15th, 20th, even 30th DSCR loan because each property is evaluated independently. If the deal works, the deal gets funded. This is how you actually scale a portfolio without hitting a financing wall.

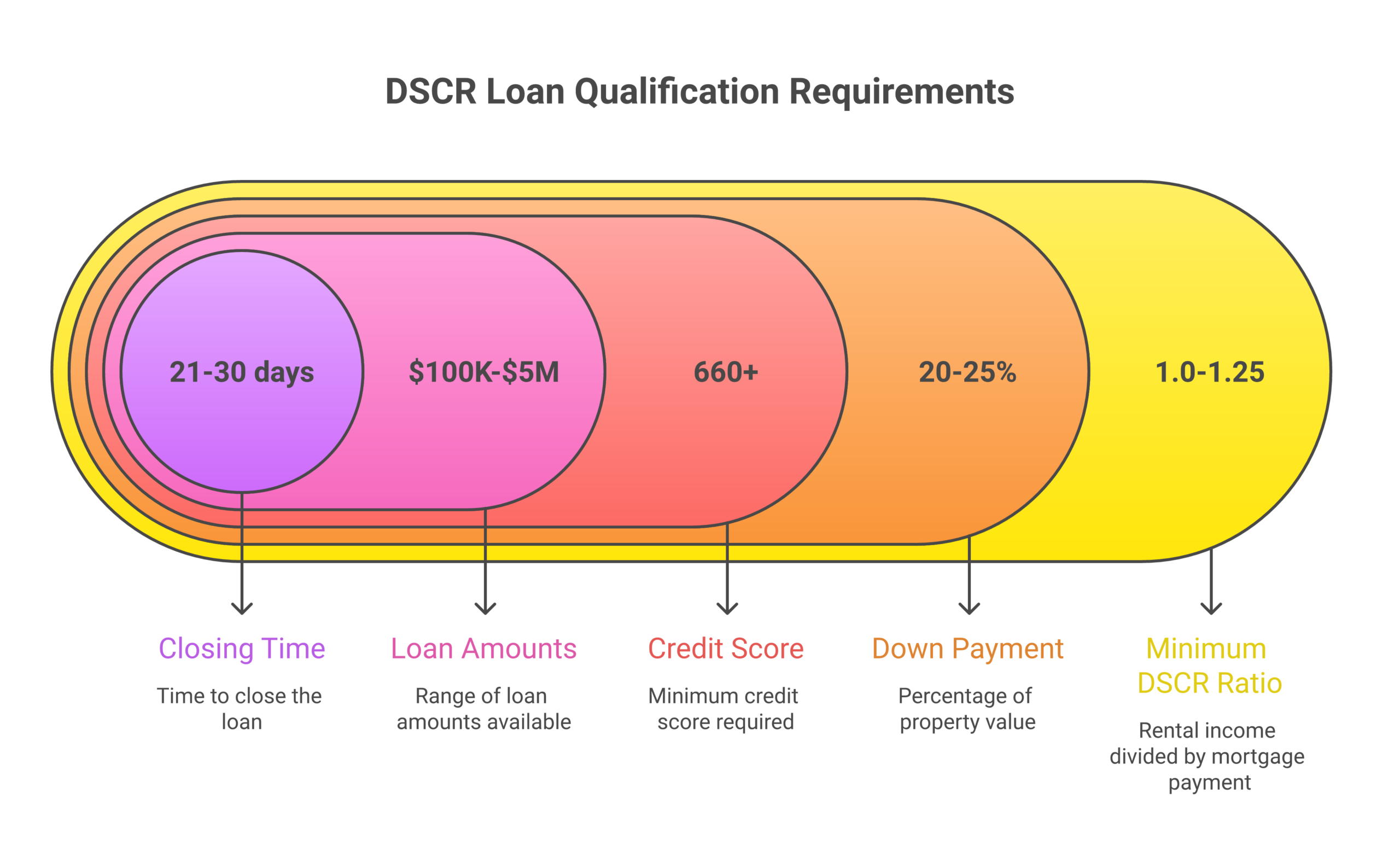

DSCR Loan Requirements for Airbnb Properties

Let’s get specific. Here are the actual requirements you’ll face when applying for a DSCR loan to buy a short-term rental in 2026:

Minimum DSCR Ratio

Most lenders require a minimum of 1.0x, meaning the property at least breaks even on debt service. The sweet spot for favorable terms is 1.25x or higher. Some specialty lenders offer “no-ratio” DSCR programs for properties below 1.0x, but expect to pay higher rates (typically 1-2% above standard DSCR pricing) and put more money down.

Down Payment

Standard DSCR down payments range from 20% to 25%. If your DSCR is above 1.4x and your credit score is 740+, some lenders will go as low as 15% down. For a $400,000 Airbnb property, you’re looking at $60,000 to $100,000 out of pocket before closing costs and furnishing. Factor this into your startup costs planning.

Credit Score

The minimum credit score for most DSCR lenders is 660, but you’ll want 700+ to get competitive rates. Here’s how credit score typically impacts your pricing:

| Credit Score Range | Rate Impact | Down Payment | DSCR Flexibility |

|---|---|---|---|

| 760+ | Best available rates | As low as 15-20% | No-ratio programs available |

| 720 – 759 | +0.25% above best rate | 20-25% | 1.0x minimum |

| 700 – 719 | +0.50% above best rate | 20-25% | 1.0x – 1.15x minimum |

| 680 – 699 | +0.75% above best rate | 25% | 1.15x – 1.25x minimum |

| 660 – 679 | +1.0-1.5% above best rate | 25-30% | 1.25x+ required |

Reserve Requirements

Lenders want to see 6 to 12 months of PITIA payments sitting in your bank account after closing. This protects them (and you) against seasonality dips, vacancy periods, and unexpected repairs. For a property with $3,500/month PITIA, that means $21,000 to $42,000 in liquid reserves. Short-term rentals inherently have more income variability than long-term rentals, so reserves are non-negotiable.

Property Types That Qualify

DSCR loans cover single-family homes, 2-4 unit multi-family, condos (warrantable and non-warrantable), townhomes, and in some cases, condotels. Properties must be investment-only — no primary residences or second homes. Most lenders require the property to be in habitable condition (no major structural issues) and located in a market where short-term rentals are legally permitted.

Airbnb Income Documentation

This is where it gets interesting for STR investors. Lenders accept several forms of income verification for short-term rental properties:

- 12-month Airbnb/VRBO booking history — The gold standard. If you have a full year of actual bookings on the property (or a comparable one in the same market), this is the strongest documentation you can provide.

- AirDNA or STR market reports — These third-party platforms estimate a property’s revenue potential based on comparable properties, local occupancy rates, and seasonal demand. Most DSCR lenders accept these for properties without existing booking history.

- 1007 Rent Schedule — An appraisal addendum that estimates market rent. Some lenders use this as a baseline, though for STR properties the AirDNA approach often yields a higher (and more accurate) income figure.

- Property management income statements — If a property manager is already operating the unit as an STR, their income reports serve as documentation.

Pro tip: if you’re buying a property that’s currently a long-term rental but you plan to convert it to Airbnb, ask your lender if they accept projected STR income. Many DSCR lenders do — they’ll use AirDNA projections or comparable STR data rather than the current long-term lease rate.

DSCR Loan Rates and Terms in 2026

Rates have come down significantly from the 8-9% range we saw in 2023-2024. Here’s where things stand as of early 2026:

Current Rate Ranges

| Loan Scenario | Rate Range (Feb 2026) | Notes |

|---|---|---|

| Best-case (760+ credit, 1.5x+ DSCR, 25% down) | 6.00% – 6.50% | 30-year fixed |

| Strong profile (720+ credit, 1.25x+ DSCR, 20% down) | 6.50% – 7.00% | 30-year fixed |

| Average profile (680+ credit, 1.0x DSCR, 25% down) | 7.00% – 7.75% | 30-year fixed |

| Weaker profile (660 credit, sub-1.0x DSCR) | 7.75% – 8.50%+ | Higher LTV adjustments |

| Interest-only option | +0.25-0.50% above standard | IO period typically 5-10 years |

Rates change frequently. These are estimates based on February 2026 market conditions. Always get multiple quotes from different lenders — rates can vary by 0.5% or more between lenders on the same deal.

DSCR vs Conventional Rate Comparison

Conventional investment property loans are running about 6.10% for 30-year fixed (Freddie Mac average as of late January 2026). So yes, DSCR rates are typically 0.5% to 1.5% higher than conventional. But the rate difference is the price you pay for not needing income verification. For self-employed operators and arbitrage professionals who can’t easily qualify conventionally, that premium is worth every basis point.

ARM vs Fixed Options

Most DSCR lenders offer 30-year fixed, 5/6 ARM, and 7/6 ARM products. ARMs typically start 0.5-0.75% below fixed rates, which can make a meaningful difference on monthly cash flow. But if you’re planning to hold long-term (and you should be if you’re buying an Airbnb property), the 30-year fixed gives you certainty. I prefer fixed rates for STR acquisitions because Airbnb income already has enough variability without adding interest rate uncertainty.

Prepayment Penalties

Watch for this. Many DSCR loans include prepayment penalties, typically structured as 5-4-3-2-1 (5% of the balance in year one, declining by 1% each year) or 3-2-1. Some lenders offer no-prepayment-penalty options at slightly higher rates (+0.125-0.25%). If there’s any chance you’ll refinance or sell within 3-5 years, negotiate the prepayment penalty down or pay up for the no-penalty option.

How Airbnb Income Is Calculated for DSCR Qualification

This section matters more than most people realize. The way your lender calculates the property’s income directly determines your DSCR ratio — and a small difference in methodology can be the difference between approval and denial.

Method 1: Actual 12-Month Booking History

If the property (or one you own nearby) has been operating as a short-term rental, the lender uses actual gross rental income from the trailing 12 months. They’ll pull this from your Airbnb earnings dashboard or host statements. This is the most reliable method and gives lenders the most confidence. The income number should be gross revenue before platform fees, management costs, or cleaning fees.

Method 2: AirDNA or Third-Party STR Reports

For properties without existing STR history, lenders turn to market data platforms. AirDNA is the most commonly accepted. The report estimates annual revenue based on comparable properties within a defined radius — usually 1-3 miles — factoring in occupancy rates, average daily rate (ADR), and seasonal patterns. Some lenders apply a 10-25% haircut to AirDNA projections to account for ramp-up time and operator variability.

Method 3: 1007 Rent Schedule

The Fannie Mae Form 1007 is a single-family comparable rent schedule completed by the appraiser. It estimates fair market rent based on comparable long-term rental properties. For STR investors, this is usually the least favorable method because it reflects long-term rental rates, not short-term. However, some lenders use a blended approach — taking the higher of the 1007 estimate or the AirDNA projection.

Which Lenders Accept Airbnb Income?

Not all DSCR lenders are STR-friendly. Some only underwrite using long-term rental comps, which defeats the purpose for Airbnb investors. When shopping for a lender, ask this exact question: “Do you calculate DSCR using projected short-term rental income, or only long-term rental comps?” If they say long-term only, move on. You want a lender that works with AirDNA data or actual STR booking history.

Top DSCR Lenders for Short-Term Rentals in 2026

I’m not going to name-drop specific lenders and pretend I’m unbiased — loan products, rates, and terms change constantly, and the “best” lender depends on your specific deal. Instead, here’s the framework for finding the right DSCR lender for your Airbnb purchase.

Types of DSCR Lenders

- Portfolio lenders — Banks and credit unions that keep loans on their own books. They have more underwriting flexibility but may have geographic limitations. Good for unique properties or unusual deal structures.

- Debt fund lenders — Private capital firms that originate and hold DSCR loans. Often the most aggressive on terms for experienced investors. Companies like Easy Street Capital, Griffin Funding, and Defy Mortgage fall into this category.

- Correspondent lenders — They originate the loan but sell it to a larger investor. Their rates and guidelines are often dictated by their secondary market buyers. Less flexible but can offer competitive rates for clean deals.

- DSCR-specialized brokers/platforms — Marketplaces like Rabbu or aggregators that connect you with multiple DSCR lenders in one application. Useful for comparison shopping.

What to Look for in a DSCR Lender

- STR income acceptance — Confirm they use AirDNA/actual bookings, not just long-term comps.

- LLC vesting — Make sure they allow closing in your LLC entity.

- Prepayment flexibility — Ask about penalty structures upfront.

- Closing timeline — Most DSCR loans close in 21-30 days. If a lender quotes 45+, shop elsewhere.

- Rate lock options — Can you lock your rate at application or only at approval? This matters in volatile rate environments.

- Geographic expertise — Lenders comfortable with your target market understand local STR regulations and appraisal nuances. Markets like Florida, Tennessee, Arizona, and Colorado mountain towns tend to see the most favorable underwriting treatment.

Questions to Ask Before Applying

- What’s your minimum DSCR for a short-term rental property?

- Do you accept AirDNA reports for income calculation?

- Can I close in an LLC?

- What are the reserve requirements after closing?

- What’s the prepayment penalty structure?

- Do you offer interest-only payment options?

- What’s the maximum loan-to-value you’ll go?

- How many DSCR loans can I have simultaneously with your firm?

The Arbitrage-to-Ownership Playbook

This is the section that ties everything together. If you’re currently running rental arbitrage and want to start owning the properties instead of just operating them, here’s the exact playbook.

Step 1: Build Your Arbitrage Portfolio First

Don’t rush to buy. Arbitrage is your proving ground. Run 2-5 units for at least 6-12 months. Learn your market. Understand seasonality. Figure out your operating costs. Calculate your actual profit margins using our profit calculator. This operational experience becomes your greatest asset when you transition to ownership — you’ll know exactly what a property should earn because you’ve already done it.

Step 2: Stack Your Down Payment From Arbitrage Profits

A single arbitrage unit netting $1,500/month in profit generates $18,000 in a year. Three units producing similar returns give you $54,000. That’s enough for a 20% down payment on a $270,000 property, plus reserves. The math works. The discipline of actually saving it — that’s on you.

Here’s a realistic savings timeline:

| Arbitrage Units | Monthly Net Profit (Each) | Annual Savings | Down Payment (20%) + Reserves | Property You Can Buy |

|---|---|---|---|---|

| 2 | $1,500 | $36,000 | ~$30,000 down + $6,000 reserves | $150,000 property |

| 3 | $1,500 | $54,000 | ~$45,000 down + $9,000 reserves | $225,000 property |

| 4 | $1,500 | $72,000 | ~$60,000 down + $12,000 reserves | $300,000 property |

| 5 | $2,000 | $120,000 | ~$80,000 down + $40,000 reserves | $400,000 property |

Step 3: Identify Your Purchase Target in a Proven Market

Buy where you already have arbitrage data. You know the occupancy rates. You know the seasonal patterns. You know what guests will pay. This isn’t speculation — it’s an informed investment backed by your own operating history. Pull AirDNA reports for the specific neighborhood. Compare projected income to the purchase price and estimated PITIA. If the DSCR comes in at 1.25x or better, you have a deal worth pursuing.

Step 4: Apply for DSCR Using Projected or Actual STR Income

Gather your documentation:

- AirDNA report for the target property’s market area

- Your Airbnb hosting history (proves you’re an experienced operator)

- 6-12 months of bank statements (for reserves verification)

- LLC operating agreement (if closing in an entity)

- Property listing and purchase contract

Apply to 2-3 DSCR lenders simultaneously. Compare rates, fees, and closing timelines. Don’t accept the first offer. The difference between 6.5% and 7.0% on a $300,000 loan is roughly $100/month — that adds up to $36,000 over 30 years.

Step 5: Run Arbitrage and Owned Properties Simultaneously

This is where real wealth gets built. You keep your arbitrage units generating cash flow while your owned property builds equity and appreciates. Your arbitrage income funds your lifestyle and future down payments. Your owned properties build long-term wealth. The combination is more powerful than either strategy alone.

Shaun Ghavami teaches this exact progression inside the 10XBNB program — start with arbitrage to learn the business and generate capital, then graduate to ownership using DSCR and other investor-friendly financing. It’s not about choosing one or the other. It’s about using arbitrage as the launchpad.

A Real-World Example With Numbers

Let’s walk through a concrete scenario:

- Property: 3BR/2BA single-family home in a mid-tier STR market (e.g., Gatlinburg, TN; Gulf Shores, AL; Scottsdale, AZ)

- Purchase price: $350,000

- Down payment (20%): $70,000

- Loan amount: $280,000

- DSCR loan rate: 6.75% (30-year fixed)

- Monthly PITIA: ~$2,650 (P&I $1,816 + taxes $350 + insurance $350 + HOA $134)

- Projected monthly STR income: $4,200 (based on AirDNA for comparable properties)

- DSCR ratio: $4,200 / $2,650 = 1.58x (excellent — qualifies for best terms)

- Monthly cash flow before operating expenses: $1,550

- After operating expenses (~35%): $1,550 – $1,470 (35% of $4,200) = approximately $80/month net cash flow

That $80/month in net cash flow looks modest, but here’s what else is happening: you’re paying down the mortgage by ~$630/month in principal, the property is (historically) appreciating at 3-5% annually, and you’re getting significant tax deductions through depreciation, mortgage interest, and operating expenses. The total return picture is far richer than the cash flow number alone.

DSCR Loans vs Other Loan Types for Airbnb Properties

How does DSCR stack up against other financing options? Here’s the honest comparison:

| Feature | DSCR Loan | Conventional | FHA | Hard Money | Bank Statement |

|---|---|---|---|---|---|

| Income verification | Property income only | Full W-2/tax docs | Full W-2/tax docs | Minimal | 12-24 months bank statements |

| Min credit score | 660 | 620-680 | 580 | 600+ | 660 |

| Down payment | 15-25% | 15-25% | 3.5% (owner-occ only) | 20-30% | 10-20% |

| Interest rates (2026) | 6.0-8.5% | 6.1-7.0% | 5.5-6.5% | 10-15% | 6.5-8.0% |

| LLC closing | Yes | No (personal only) | No | Yes | Varies |

| Property limit | Unlimited | 10 financed max | 1 (primary residence) | Unlimited | Varies |

| Closing time | 21-30 days | 30-45 days | 45-60 days | 7-14 days | 30-45 days |

| Best for | STR investors scaling | First 1-2 properties | House hack only | Fix-and-flip/BRRRR | Self-employed investors |

| STR income accepted | Yes (most lenders) | Rarely | No | Yes | Varies |

For context on the fix-to-rent strategy (which pairs well with DSCR for the refinance stage), check out our fix to rent loans guide.

The takeaway: if you’re buying your first investment property and have a strong W-2 income, conventional might save you money on rate. But the moment you’re scaling beyond 2-3 properties, self-employed, or buying specifically for Airbnb income, DSCR becomes the obvious choice. And if you’re coming from arbitrage, where your “income” is self-employment from STR operations, DSCR is almost certainly your best path.

Common Mistakes With DSCR Loans for Airbnb

I’ve seen every one of these mistakes cost investors money, time, or both. Don’t repeat them.

1. Not Shopping Multiple Lenders

DSCR is a non-QM (non-qualified mortgage) product, which means rates and terms vary wildly between lenders. I’ve seen rate quotes differ by 1.0%+ on the exact same deal. Get at least 3 quotes. NerdWallet’s rate comparison tool can help you start shopping. It takes an afternoon and can save you tens of thousands over the loan’s life.

2. Overestimating STR Income

When you’re excited about a property, it’s easy to use the “best case” AirDNA projection. Don’t. Use the conservative estimate. Assume 65-70% occupancy, not 85%. Account for seasonality. The property still needs to cash flow during the slow months, not just July and August.

3. Forgetting About Reserves Post-Closing

You meet the reserve requirement at closing, great. But then you spend your last dollar on furniture and launch. Now you have zero cushion for HVAC repairs, guest damage, or a slow booking month. Keep 6 months of PITIA in reserve at all times — not just at closing.

4. Ignoring Prepayment Penalties

The DSCR loan with the lowest rate might also have a 5-year prepayment penalty. If you refinance in year two because rates drop, you could owe 4% of the loan balance — $11,200 on a $280,000 loan. Read the prepayment terms before signing. Always.

5. Buying in an STR-Restricted Market

Some investors fall in love with a property and figure they’ll “deal with” local regulations later. Bad plan. DSCR lenders are increasingly checking local STR ordinances during underwriting. If the city bans or heavily restricts short-term rentals, the lender may decline the loan — or worse, you’ll close and then find out you can’t legally operate. Verify STR legality before you make an offer. Consider mid-term rentals as a backup strategy for markets with stricter rules.

6. Not Getting a Proper STR Appraisal

Standard appraisals use long-term rental comps, which undervalue STR properties. Ask your lender if they use appraisers experienced with short-term rental valuations. A proper Airbnb property appraisal factors in nightly rates, occupancy, and STR-specific comparable sales. This matters for both your DSCR calculation and your loan-to-value ratio.

7. Treating the DSCR Ratio as the Only Number That Matters

A 1.5x DSCR looks great on paper. But DSCR doesn’t account for furniture replacement, property management fees, platform commissions, or capital expenditures. Always run your own full cash flow analysis separate from the DSCR calculation. The lender’s math tells them if the loan is safe. Your math tells you if the investment is worth it.

Frequently Asked Questions About DSCR Loans for Airbnb

What credit score do I need for a DSCR loan?

Most DSCR lenders require a minimum 660 credit score, though you’ll need 700+ for the best rates. A score of 740 or above opens up the most favorable terms, including lower down payment options and access to no-ratio DSCR programs. If your score is below 660, focus on improving it before applying — the rate difference between a 660 and a 740 score can be 1.0-1.5%, which translates to hundreds of dollars per month.

Can I use a DSCR loan for my first investment property?

Yes. DSCR loans don’t require prior property ownership experience. However, first-time investors may face slightly stricter requirements — some lenders require a higher DSCR minimum (1.25x instead of 1.0x) or larger down payment for borrowers without a track record. Your arbitrage experience can help here, even though you didn’t own the properties.

How long does it take to close a DSCR loan?

Most DSCR loans close in 21-30 days, significantly faster than the 45-60 days typical of conventional financing. The streamlined timeline comes from minimal income documentation requirements and lenders who specialize in investment property underwriting. Some lenders advertise 14-day closes, but that usually requires perfect documentation and a cooperative title company.

Do I need a property manager to qualify for a DSCR loan?

No. You can self-manage. However, some lenders factor in a management fee (typically 20-25% for STR) when calculating the property’s net operating income, even if you plan to manage yourself. This is a conservative underwriting assumption — ask your lender whether they deduct management fees from their DSCR calculation, because it directly affects your ratio.

Can I use DSCR loan proceeds to buy a property and then rent it on Airbnb?

Absolutely — that’s the entire premise. DSCR loans are specifically designed for investment properties, and many lenders specialize in short-term rental underwriting. Just make sure the property is in a market that legally permits short-term rentals and that the lender accepts STR income projections (not just long-term rental comps) for DSCR calculation.

What happens if my Airbnb income drops below the DSCR threshold after closing?

Nothing immediate. DSCR is evaluated at origination, not on an ongoing basis. Once the loan closes, your payment is fixed (assuming you chose a fixed-rate product). If revenue dips during a slow season, you still owe the same payment — but the lender won’t call the loan or adjust your terms. This is why reserves are so critical: they’re your buffer for income variability.

Can I refinance a DSCR loan later?

Yes. Many investors use the BRRRR (Buy, Rehab, Rent, Refinance, Repeat) strategy with DSCR loans. After the property appreciates or you’ve improved it, you can refinance into a new DSCR loan at a higher appraised value and pull out equity for your next purchase. Watch for prepayment penalties on the original loan — factor those into your refinance timeline.

Are DSCR loan interest rates tax deductible?

Yes. Mortgage interest on investment properties is deductible as a business expense, just like conventional mortgage interest. Depreciation, property taxes, insurance, maintenance, and other operating expenses are also deductible. Consult our Airbnb tax guide and a qualified CPA for specifics — STR tax strategy can save you thousands annually.

How many DSCR loans can I have at the same time?

There’s no Fannie Mae-style cap. Each DSCR loan is underwritten independently based on the individual property’s income. I’ve seen investors hold 20+ DSCR loans simultaneously across different lenders. The practical limit is your ability to find qualifying deals and maintain reserves across the portfolio. Some individual lenders cap their exposure to a single borrower (e.g., 10 loans with one lender), but you can use multiple lenders.

The Bottom Line: DSCR Is How Arbitrage Operators Become Property Owners

If you’re running rental arbitrage right now, you already have the hardest part figured out — you know how to operate a profitable short-term rental. DSCR lending removes the traditional financing barriers that keep operators from becoming owners. No W-2 requirement. No DTI ceiling. No cap on properties. Close in an LLC. Qualify on what the property earns, not what your tax return shows.

The path is straightforward: build your arbitrage operation, stack cash, prove your market, and then use DSCR to buy properties in the markets you’ve already mastered. Arbitrage builds your skills and your capital. DSCR converts that capital into equity. Together, they’re the fastest path from zero to a real short-term rental portfolio.

Rates in early 2026 are sitting in the 6.0-7.5% range for qualified borrowers — significantly better than where they were 18 months ago. If you’ve been waiting for the right moment to make the jump from arbitrage to ownership, the financing environment has rarely been more favorable.

Get your credit score above 700. Save 20-25% for a down payment. Document your arbitrage income. Shop 3+ DSCR lenders. Buy in a market you know. Run the numbers conservatively. And make the move.

Disclaimer: Interest rates, loan terms, and lender requirements referenced in this article are estimates based on February 2026 market conditions and are subject to change. DSCR loan availability varies by lender and state. This article is for educational purposes and does not constitute financial or lending advice. Always consult with a licensed mortgage professional and financial advisor before making financing decisions.