Airbnb co-listing is how thousands of people earn $5K to $30K per month managing short-term rentals they don’t own. You partner with a property owner, handle the day-to-day hosting work, and split the rental income. No lease. No mortgage. No massive startup costs. If you’ve been searching for a way into the Airbnb business without buying property, co-listing is probably the fastest path.

I’ve watched our 10XBNB students go from zero listings to managing 10, 20, even 50+ properties as co hosts. The model works because property owners need help and most of them have no idea how to optimize their listings, manage guests, or handle operations. That’s where you come in.

This guide covers everything: what co-listing actually means, how to add a co host on Airbnb, what co hosts charge, the Co-Host Network, permission levels, and how to scale. Whether you want a side hustle or a full-time business, this is the playbook.

What Is Airbnb Co-Listing?

Airbnb co-listing means you manage someone else’s property on the Airbnb platform. The property owner adds you as a co host to their listing, and you take over some or all of the hosting tasks. Guest messaging, cleaning coordination, pricing adjustments, check-ins, calendar management, handling reviews. The owner keeps their property. You earn a percentage of each booking.

Think of it like being a property manager, but specifically for short-term rentals. You don’t need a real estate license in most areas (though local regulations vary). You don’t need to sign a lease or put down a security deposit. The barrier to entry is low, the earning potential is surprisingly high, and you’re making money from day one if you already have a booking on the calendar.

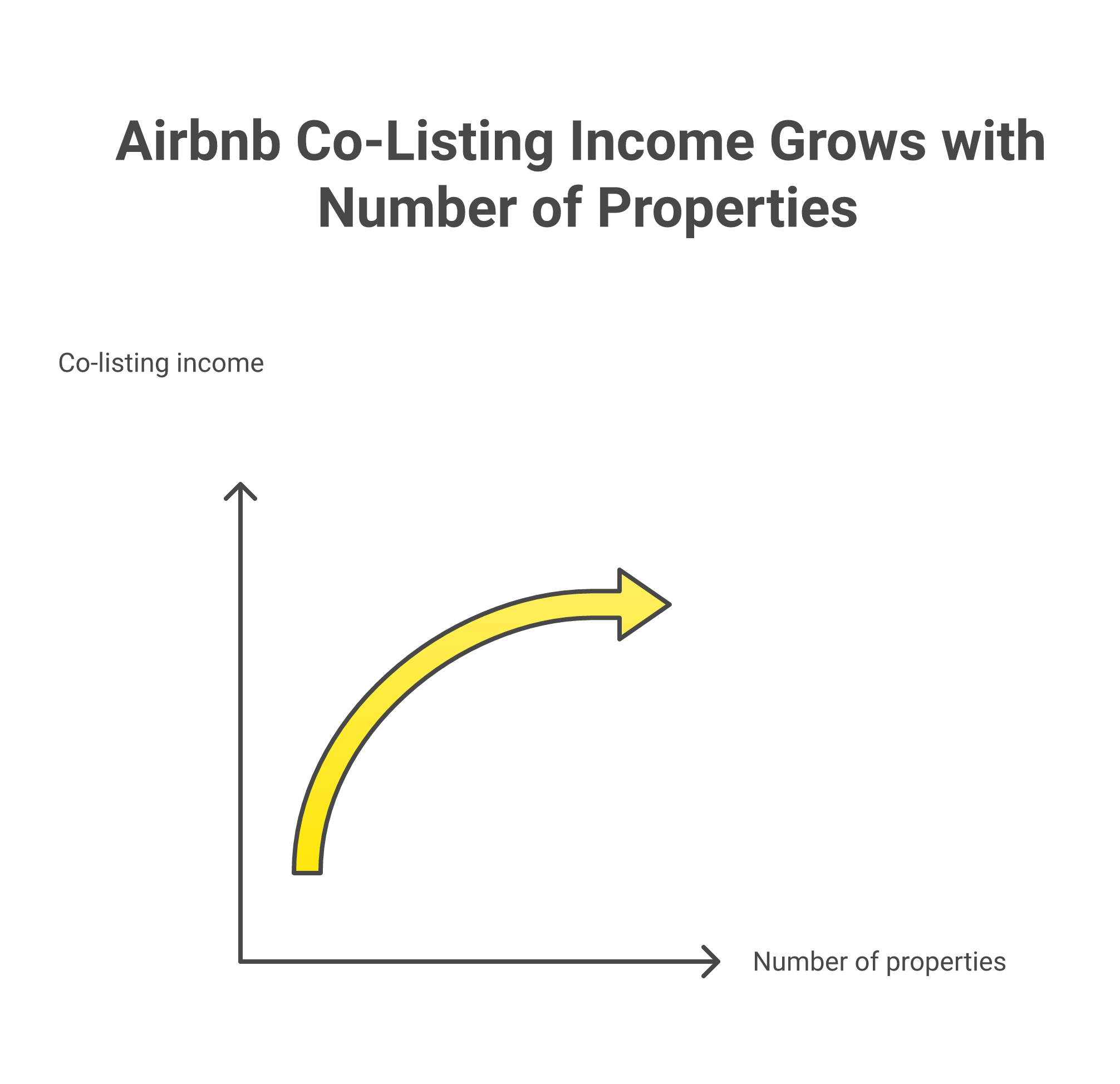

Most co hosts earn between 15% and 25% of the nightly rate per booking. On a property that grosses $3,000 per month, that’s $450 to $750 in your pocket. Manage five properties and you’re looking at $2,250 to $3,750 monthly. Manage ten and the math gets very interesting.

How Co-Listing Works Step by Step

The process is straightforward once you understand the moving parts:

- Find a property owner who needs help managing their Airbnb listing (or wants to list their home but doesn’t know how)

- Agree on terms including your percentage, responsibilities, and who handles what. Get this in a written co-hosting agreement

- The primary host adds you as a co host through Airbnb’s platform with the appropriate permission level

- You manage the listing by handling guest messaging, coordinating cleaning, adjusting pricing, managing the calendar, and handling check-ins and checkout

- Airbnb splits payouts automatically through the earnings dashboard based on the percentage you’ve agreed on

The property owner stays listed as the primary host. You show up as the co host on the listing. Guests can see your profile, and you can message guests directly through the inbox depending on your access level.

Co-Listing vs Co-Hosting: What’s the Real Difference?

People use these terms interchangeably, and honestly, the distinction is blurry. But here’s how I think about it:

| Feature | Co-Listing | Co-Hosting |

|---|---|---|

| Definition | You’re added to the listing as a co host with shared management duties | Broader term: any arrangement where you help manage someone’s Airbnb |

| Platform integration | Formal Airbnb co host role with permissions | Can be formal or informal (even off-platform) |

| Payout handling | Airbnb can share payouts directly via earnings dashboard | May require manual payment from owner |

| Guest visibility | Co host profile visible on listing | May or may not be visible to guests |

| Best for | Serious co hosts building a business | Casual help (a family member or trusted friend) |

For this guide, I’m using “co-listing” and “co-hosting” to mean the same thing: you’re formally added as a co host on Airbnb and you manage the property for a cut of the revenue.

How to Add a Co-Host to Your Airbnb Listing

Whether you’re the property owner adding someone, or you’re the co host being added, here’s exactly how it works on the platform. The process takes about two minutes.

Step-by-Step: Inviting a Co-Host

- Log into Airbnb and go to your listing

- Click Manage Listing, then select Co-Hosts from the menu

- Click Invite a Co-Host

- Search by name, email, or phone number. The person needs an existing Airbnb profile

- Choose the permission level (see below)

- Set the payout percentage if you want Airbnb to handle the split automatically

- Send the invitation. The co host accepts through their Airbnb account

Once accepted, the co host can immediately start taking on tasks depending on their access level. For detailed instructions, see Airbnb’s guide on adding co-hosts.

Permission Levels Explained

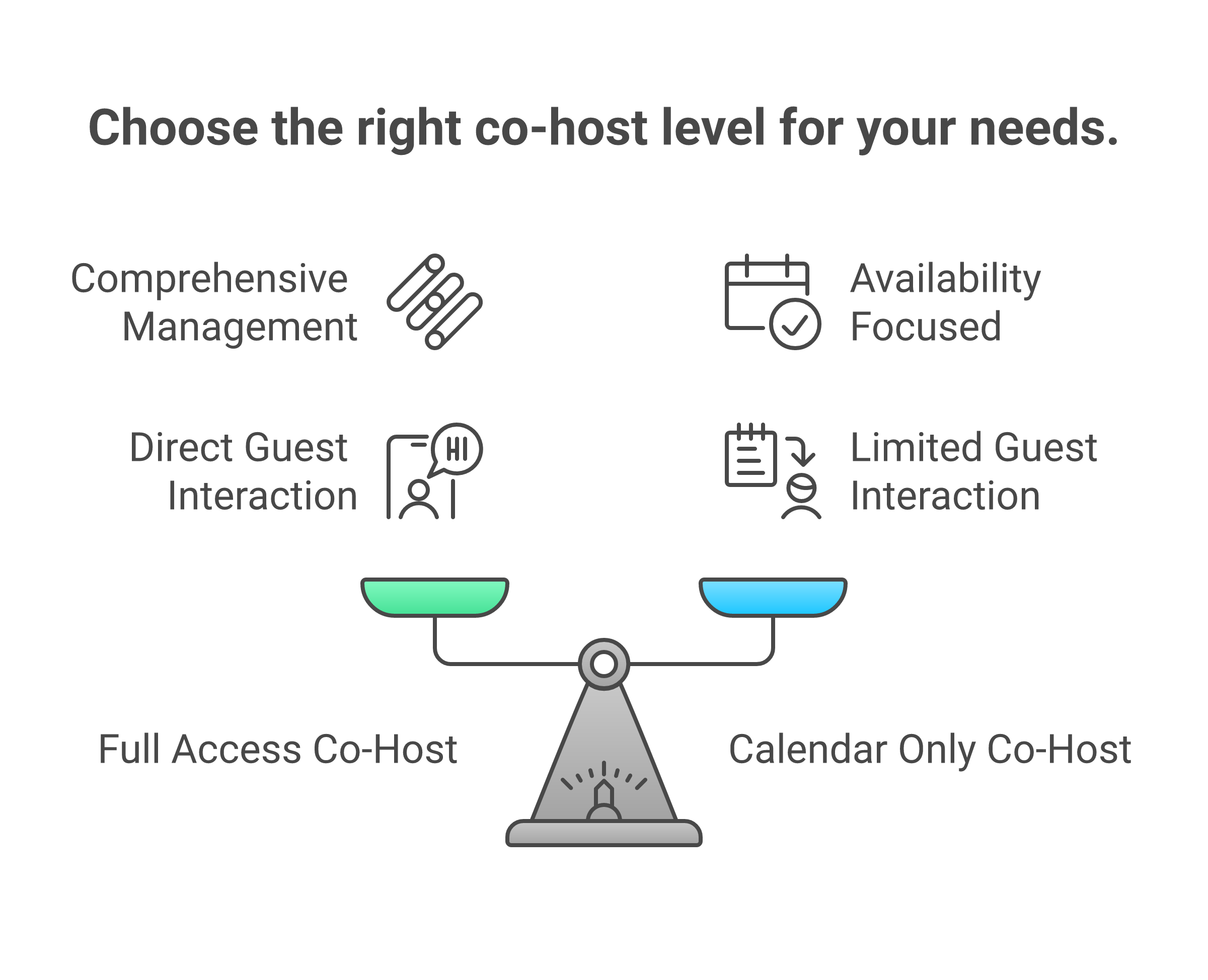

Airbnb offers three tiers of access when you add a co host. Choosing the right one matters because it controls what the co host can actually do:

| Permission Level | What the Co Host Can Do | Best For |

|---|---|---|

| Full Access | Everything: edit listing details, upload photos, adjust pricing, manage the calendar, message guests, handle managing bookings, view the earnings dashboard, access payouts | Professional co hosts managing the entire operation |

| Calendar and Messaging Access | View and edit the calendar, message guests through the inbox, manage check-ins and checkout, respond with quick replies | Co hosts who handle guest communication and scheduling but not listing optimization |

| Calendar Only | View and edit calendar availability. No guest messaging, no listing edits | Cleaning teams or a family member helping with scheduling |

My recommendation? If you’re co-hosting as a business, push for full access. You can’t optimize what you can’t control. Limited permissions mean you’re constantly asking the owner to make changes, and that slows everything down.

The Airbnb Co-Host Network

In 2024, Airbnb launched the Co-Host Network, a marketplace that connects property owners with experienced hosts who want to co host. Think of it as Airbnb’s built-in matchmaking service for co-hosting.

Here’s how the Co-Host Network works:

- Property owners browse profiles of local co hosts who have hosting experience and strong guest reviews

- Co hosts set their own services offered, rates, and the area they cover

- Owners can view a co host’s track record, including ratings and how many units they manage listings for

- Once both parties agree, the owner adds the co host directly through the platform

The Co-Host Network is currently available in Australia, Brazil, Canada, France, Germany, Italy, Japan, Mexico, Puerto Rico, South Korea, Spain, the United Kingdom, and the United States. Airbnb has been expanding to additional countries, so check availability in your local area.

Getting listed on the Co-Host Network is a legitimate way to find property owners without cold outreach. You need a strong Airbnb profile with positive feedback, verified identity, and ideally some hosting experience. For people just starting as an Airbnb co host, it’s one channel among several (more on that below).

Want to Start Co-Listing on Airbnb?

Learn the proven system that helps beginners land their first property in 30 days.

How Much Do Airbnb Co-Hosts Charge?

Most co hosts charge between 10% and 30% of the gross booking revenue. The exact percentage depends on what services you provide, the local area, the property type, and how hands-on you are.

Here’s a breakdown of typical rates depending on service level:

| Service Level | What You Handle | Typical Rate |

|---|---|---|

| Basic (Guest Communication Only) | Guest messaging, inbox management, booking confirmations, quick replies, answer questions | 10-15% |

| Standard (Communication + Operations) | Everything above + cleaning coordination, check-ins, checkout, calendar management, restocking essentials (toilet paper, soap, supplies) | 15-20% |

| Full-Service (Complete Management) | Everything above + pricing optimization, listing optimization, upload photos, coordinate repairs, manage reviews, handle all operations | 20-30% |

What co hosts charge also varies by market. In higher-demand areas like Nashville, Austin, or Miami, experienced hosts can command 20-25% because the nightly rate is higher and guests expect more. In smaller markets, 15-20% is standard.

How Payouts Work

When you’re set up as a co host on Airbnb, the platform can automatically share payouts with you. Here’s how:

- The primary host sets your payout percentage when adding you

- After each booking, Airbnb calculates the split based on the nightly rate minus fees

- Your share goes directly to your linked bank account through the earnings dashboard

- Both co host and owner can view transaction history and earnings reports

This automatic split is one of the biggest advantages of being a formal co host versus an informal arrangement. No chasing payments. No awkward money conversations. Airbnb handles it.

Real Income Examples

Here’s what actual earnings look like at different scales:

| Properties Managed | Avg Monthly Revenue per Property | Your Cut (20%) | Monthly Income |

|---|---|---|---|

| 3 | $3,500 | $700 | $2,100 |

| 5 | $3,500 | $700 | $3,500 |

| 10 | $3,500 | $700 | $7,000 |

| 20 | $3,500 | $700 | $14,000 |

| 30 | $4,000 | $800 | $24,000 |

These aren’t hypothetical numbers. Our 10XBNB students hit these levels regularly. The real question isn’t whether the income is possible. It’s whether you can find and retain enough property owners. (Spoiler: the supply of overwhelmed Airbnb owners is enormous.)

What Does an Airbnb Co-Host Actually Do?

Cohosting is not passive income. Let me be direct about that. You’re running a service business, and the work is real. But it’s manageable work, especially once you set up the right systems and automation tools. A cohost who invests time building processes early will spend less time per property as the portfolio grows.

Here’s what a typical day looks like for an active co host taking care of 10 units:

Guest Messaging and Inbox Management

This is the biggest time commitment, especially early on. You’ll message guests before, during, and after their stay. Pre-booking inquiries, check-in instructions, mid-stay questions (“Where’s the nearest grocery store?”), checkout reminders, and post-stay follow-ups for reviews.

The key to managing your inbox efficiently: quick replies and automation. Airbnb lets you set up saved messages for common questions. Third-party automation tools like Hospitable, Guesty, or Host Tools can auto-send messages based on triggers (booking confirmed, day before check-in, checkout morning).

Most experienced hosts answer questions within 15 minutes during the day. Fast response times directly improve your guest experience and help you earn Superhost status.

Check-Ins and Checkout

Depending on the property, check-ins might be self-service (smart lock with a code) or hands-on (meeting guests in person). Self-check-in is the standard now. You send the code via automated message, and guests let themselves in.

Checkout is similar. Send a message the morning of checkout with instructions: strip the beds, start a load of laundry, take out the trash, leave the key on the counter. Simple tasks that keep turnover smooth.

For properties without smart locks, you’ll need to coordinate key handoffs. This is one area where being a local co host in your area matters. You can’t manage check-ins from across the country if they require physical presence.

Cleaning Coordination

Cleaning is the backbone of co-hosting operations. After every checkout, the property needs to be turned over before the next guest arrives. As a co host, you typically:

- Hire and manage a reliable cleaning team (1-2 cleaners per property)

- Schedule cleaning based on the calendar (same-day turnovers are common)

- Create a detailed cleaning checklist with photos

- Restock essentials: toilet paper, soap, paper towels, coffee, and other supplies

- Inspect the property after cleaning (in person or via photos from the cleaner)

Good cleaners are worth their weight in gold. Pay them well. A bad cleaning leads to a bad review, and bad guest reviews tank your listing faster than anything else.

Pricing and Calendar Management

Setting the right nightly rate is where co hosts can add serious value. Most property owners either price too high (and sit empty) or too low (and leave money on the table). As a co host, you should:

- Use dynamic pricing tools like PriceLabs, Beyond, or Wheelhouse to adjust rates based on demand, seasonality, and similar listings in the area

- Manage the calendar to avoid double bookings and optimize minimum stay requirements

- Block dates for owner use or maintenance

- Adjust pricing for weekends, holidays, and local events

Dynamic pricing alone can increase a property’s revenue by 15-40%. That’s a fact I’ve seen play out across hundreds of our students’ properties. It’s often the single biggest value-add you bring as a co host.

Maintenance, Repairs, and Restocking

Things break. The toilet runs. The WiFi goes down. A guest locks themselves out at 11pm. As a co host, you’re the first point of contact for these situations.

Build a roster of trusted vendors: a handyman, a plumber, an electrician, an HVAC tech. You won’t need them often, but when you do, you need them fast. The ability to handle repairs and maintenance quickly separates amateur co hosts from professionals.

Reviews and Guest Experience

Guest reviews are the lifeblood of any Airbnb listing. As a co host, you’re directly responsible for the guest experience, which means you’re directly responsible for reviews.

After every stay, leave a review for the guest (this prompts them to review you back). Respond to all feedback, positive or negative. If a guest had a bad experience, address it publicly and show future guests you take concerns seriously.

A listing with 50+ five-star reviews will consistently outperform a listing with 10 reviews, even if the property itself is nicer. Reviews build trust, and trust drives bookings.

How to Get Started with Airbnb Co-Listing

You don’t need experience, certifications, or a real estate license to start co-hosting. What you need is a system, some hustle, and a willingness to learn the operations side of short-term rentals.

Step 1: Learn the Fundamentals

Before you pitch a single property owner, understand how Airbnb works inside and out. Study:

- How to create and optimize a listing that ranks well in Airbnb search

- Guest messaging best practices and quick replies

- Pricing strategies and how the algorithm favors certain listings

- Cleaning standards and turnover operations

- How to start an Airbnb business from scratch

Our free masterclass covers the complete system, including co-listing specifically. But regardless of how you learn, don’t skip this step. Property owners can tell when someone doesn’t know what they’re talking about.

Step 2: Find Property Owners Who Need Help

This is the part most people overcomplicate. Owners who need support are everywhere. You just have to know where to look. Taking a systematic approach to prospecting makes all the difference.

The Airbnb Co-Host Network. If it’s available in your area, create a strong profile and list yourself. Owners will come to you. This is the easiest channel because the intent is already there.

Facebook Groups. Search for local Airbnb host groups, property management groups, and real estate investor groups. Owners post asking for help regularly. Offer value in comments before pitching your services.

Craigslist and local classifieds. Look for “vacation rental help wanted” or “property management” posts. You can also post your own ad offering co-hosting services.

Real estate agents. Agents who work with investment properties often know owners with rentals that need management. Build relationships with 3-5 agents in your area. One good agent can refer you 5-10 properties over time.

Direct outreach to struggling listings. Search Airbnb for listings in your area with low reviews, bad photos, or inconsistent availability. These owners need help and often don’t know it. Reach out with a specific offer: “I noticed your listing at [address]. I can help you increase bookings by improving your photos, pricing, and guest communication. Here’s what I charge.”

Your personal network. Friends, family, neighbors, coworkers. You’d be surprised how many people own a second home or rental property and would love someone to manage it. Even a trusted friend or family member who has a spare bedroom might be interested.

Step 3: Sign a Co-Hosting Agreement

Never start managing a property on a handshake. Get a written co-hosting agreement that covers:

- Your payout percentage and how you share payouts

- Specific duties and responsibilities

- Permission level on the Airbnb platform

- How expenses are handled (cleaning costs, supplies, repairs)

- Termination terms (30-day notice is standard)

- Liability and insurance requirements

A clear agreement protects both you and the property owner. It also makes you look professional, which helps you land more properties.

Step 4: Set Up the Listing and Systems

Once you’re added as a co host with the right permissions, get the property ready:

- Upload photos (professional photos increase bookings 20-30%)

- Write a compelling listing description with relevant keywords

- Set up dynamic pricing through a tool like PriceLabs

- Create message templates for every touchpoint (booking confirmation, check-in, mid-stay, checkout, review request)

- Hire a cleaning team and create a detailed checklist

- Set up a lockbox or smart lock for self-check-in

- Stock the property with essentials (soap, toilet paper, coffee, paper towels)

Step 5: Manage, Optimize, and Scale

Your first unit will take the most time because you’re building systems from scratch. By your third, you’ll have templates, processes, and vendor relationships that make each new onboarding faster. Taking on more work gets easier because you’re making the same playbook better each time.

The scaling path:

- Properties 1-3: Build your systems, learn operations, earn your first guest reviews as co host

- Properties 4-7: Optimize pricing, hire support (virtual assistant for messaging), focus on finding more owners

- Properties 8-15: You’re now running a real business. Systematize everything. Collaborate with other co hosts in your area. Consider forming an LLC

- Properties 15+: Hire a team. You’re spending most of your time on growth and owner relationships, not day-to-day tasks

Check startup costs for Airbnb to budget your initial investment. It’s surprisingly low compared to buying or leasing property.

Tips for Successful Co-Hosting

After working with hundreds of cohost partners through the 10XBNB program, here are the tips that separate someone making $2K/month from someone making $20K+. These aren’t random tips either. They come from watching what our top performers do differently.

Automate Everything You Can

Your time is your most limited resource. Every task you can automate frees you to take on more properties. Use automation for:

- Guest messaging (automated check-in/checkout messages, quick replies)

- Pricing (dynamic pricing tools adjust your nightly rate daily)

- Cleaning scheduling (auto-notify cleaners when a booking ends)

- Review requests (auto-send after checkout)

A good automation stack costs $20-50/month per unit but saves you 10+ hours per week across your portfolio. That’s the difference between making $3,500/month and making $14,000/month with the same amount of effort.

Treat Guest Reviews Like Currency

Every five-star review makes your next booking easier. Every bad review makes it harder. Obsess over the guest experience. Respond to messages fast. Keep properties clean. Fix problems before guests even report them.

View every stay as an opportunity to earn a review. Follow up personally after checkout. A simple “Thanks for staying with us! If you enjoyed your stay, we’d love a review” works better than you’d think. One more tip: respond to every review the guest leaves, even the five-star ones. It shows future guests and the owner that you’re taking the role seriously.

Communicate Transparently with Property Owners

Send your property owner a monthly report. Include: revenue, occupancy rate, guest reviews, maintenance issues, and any recommendations. Owners who feel informed are owners who stay with you. Owners who feel in the dark start looking for someone else.

Know Your Local Market

Understand what makes your area attractive to guests. Are they visiting for business? Tourism? Events? Tailor your approach accordingly and offer tips to your owners on how to improve their spaces for the local market. Research the best states for Airbnb and top cities for rental arbitrage to find high-demand markets near you.

Offer More Value Than You Charge

The cohost partners who scale fastest are the ones property owners brag about. Go beyond the basics. Suggest home improvements that boost the nightly rate. Find ways to reduce expenses. Offer support when the owner has questions about taxes or regulations. When you’re making the owner more money than they’d make without you, your position is secure. You stop taking orders and start giving recommendations.

Want to Start Co-Listing on Airbnb?

Learn the proven system that helps beginners land their first property in 30 days.

Is Airbnb Co-Listing Legal?

Yes, Airbnb co-hosting is legal. But (and this matters) you still need to follow local short-term rental regulations in your area. Whether you’re an Airbnb co host in Texas or California, the legality depends on where the unit is located, not where you live.

Here’s what to check before you start managing properties in any market:

Local Regulations and Permits

- Short-term rental permits: Many cities require permits or licenses for Airbnb listings. Some cities require the co host to hold a permit separately from the owner. Check your city and county government websites, or visit the SBA’s license and permit guide

- Zoning restrictions: Some neighborhoods or zones prohibit short-term rentals entirely. Verify before you take on a property

- HOA rules: Homeowner associations can ban or restrict Airbnb use. The property owner should confirm HOA compliance before you list

- Business license: If you’re managing multiple properties as a business, most states require a general business license. Consider forming an LLC for liability protection

For a state-by-state breakdown of Airbnb regulations, see our guide on understanding Airbnb regulations before you launch.

Taxes and Insurance

Co-hosting income is taxable. Track all your earnings through the Airbnb earnings dashboard and report them accurately. You may also need:

- General liability insurance (protects you if a guest is injured)

- Professional liability insurance (protects against management errors)

- The property owner should maintain their own homeowner’s or landlord insurance with short-term rental coverage

Airbnb provides some coverage through AirCover for Hosts, but it has limitations. Read our Airbnb insurance guide for specifics on what’s covered and what gaps to fill.

Common Mistakes New Co-Hosts Make

I’ve seen these mistakes derail cohosting businesses over and over. Taking shortcuts early on costs you later. Avoid these and you’ll be ahead of 90% of people trying to do this.

1. No Written Agreement

Managing a property on a verbal agreement is asking for trouble. What happens when the owner wants to change your percentage? Or blames you for damage you didn’t cause? Get everything in writing before you manage a single listing.

2. Underpricing to Win Properties

Charging 10% when you should charge 20% means you’ll burn out before you scale. You can’t provide full-service management at bargain rates. Owners who won’t pay fair rates for quality co-hosting aren’t clients you want.

3. Ignoring Automation

Manually sending every message, manually scheduling every cleaning, manually adjusting pricing every day. It works for one or two properties. At five properties, you’ll drown. Invest in automation tools from day one.

4. Poor Cleaning Standards

Cleanliness is the single most-mentioned factor in negative guest reviews. One hair on a pillowcase can trigger a one-star review. Hire good cleaners, create detailed checklists, and inspect regularly. This is not the area to cut costs.

5. Not Vetting Property Owners

Not every property owner is a good partner. Some have unrealistic expectations. Some have properties in bad condition. Some will micromanage every decision while paying you 12%. Before you sign on, ask yourself: “Will this property generate enough revenue to be worth my time, and is this owner someone I can collaborate with?”

6. Neglecting Legal Requirements

Operating without proper permits, licenses, or insurance puts both you and the property owner at risk. Fines for unlicensed short-term rentals can be $1,000 to $10,000+ per violation depending on the city. Taking the time to research local rules before you sign a single agreement is worth every minute. Offer support to your property owner on compliance too.

7. Trying to Do Everything Alone

Cohosting is a team sport. You need cleaners, handymen, possibly a virtual assistant for guest messaging, and a support network of other hosts. Trying to handle every task yourself limits your growth to 3-5 units maximum. Making connections with other local hosts gives you backup support when you need coverage.

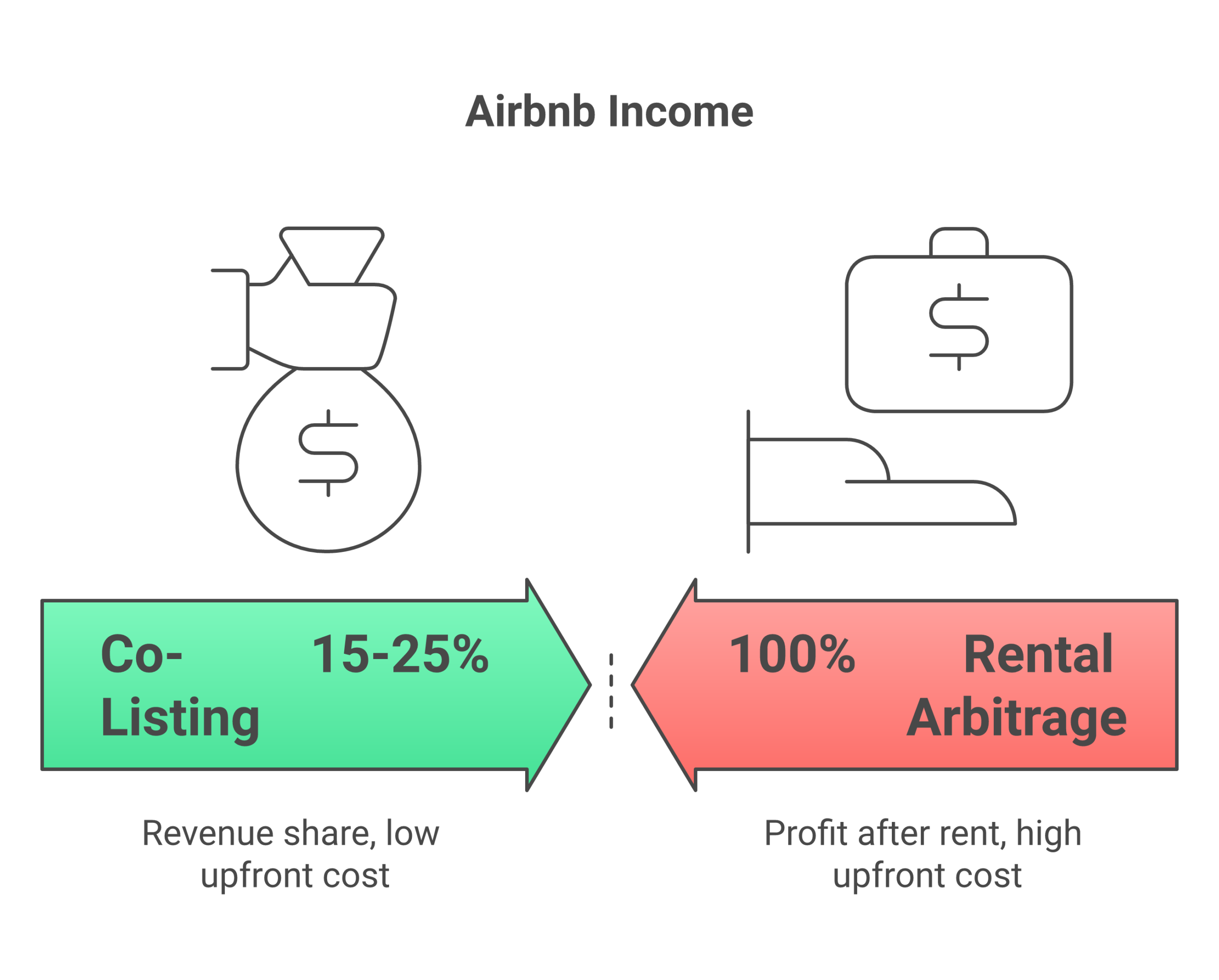

Co-Listing vs Rental Arbitrage: Which Model Is Better?

Co-listing and rental arbitrage are two different ways to make money on Airbnb without owning property. Here’s how they compare:

| Factor | Co-Listing | Rental Arbitrage |

|---|---|---|

| Upfront cost | $0 to $500 (tools, insurance) | $3,000 to $10,000+ (first month, last month, deposit, furnishing) |

| Monthly risk | Low (no rent to pay if vacant) | Higher (you owe rent regardless of bookings) |

| Income per property | Lower (15-25% of revenue) | Higher (you keep profit after rent) |

| Control | Shared (owner has final say) | Full (you hold the lease) |

| Scalability | Faster (no capital needed per property) | Slower (capital-intensive per property) |

| Legal complexity | Lower | Higher (lease restrictions, subletting rules) |

Many successful hosts start with co-listing to build experience and cash flow, then add rental arbitrage units as they grow. The two models aren’t mutually exclusive. In fact, making the jump from co-listing to arbitrage is easier because you already know operations inside out. You’re taking a proven skill set and applying it to a higher-margin model. For a detailed look at rental arbitrage pros and cons, see our full breakdown.

Frequently Asked Questions

How much money can you make as an Airbnb co-host?

Most co hosts earn $500 to $1,500 per property per month, depending on the nightly rate, occupancy, and your percentage. At 20% of a property making $3,500/month, that’s $700 per property. Manage 10 properties and you’re at $7,000/month. Co hosts in our program have scaled to $15,000 to $30,000 per month managing 15-30+ listings.

Do you need experience to become a co-host?

No. Many successful co hosts started with zero hosting experience. What you do need is willingness to learn the operations (guest messaging, cleaning, pricing), a strong work ethic, and good communication skills. The Airbnb Co-Host Network does favor experienced hosts for visibility, but direct outreach to property owners doesn’t require a track record.

Can you be a co-host on multiple listings?

Yes. There’s no limit to how many listings you can co host on Airbnb. Most professional co hosts manage anywhere from 5 to 50+ properties. The constraint is your capacity to deliver quality services, not platform limitations.

What’s the difference between a co-host and a property manager?

Functionally, they’re similar. A co host is specifically integrated into the Airbnb platform with shared permissions and automatic payout splitting. A property manager may work across multiple platforms (Airbnb, Vrbo, Booking.com) and typically operates under a formal management contract. Many co hosts also list on Vrbo and other sites as part of their services.

Is the Airbnb Co-Host Network worth joining?

If it’s available in your area, absolutely. The Co-Host Network puts you in front of property owners who are actively looking for help. It’s passive lead generation. That said, don’t rely on it as your only source of clients. Combine it with direct outreach, networking, and Facebook groups for the best results.

How do I handle taxes as a co-host?

Co-hosting income is reported as self-employment income. Track all earnings through your Airbnb earnings dashboard and any additional payments from owners. Deductible expenses include mileage, tools and software, phone bills (business portion), cleaning supplies, and home office costs. Consult a tax professional familiar with short-term rental income for your specific situation.

What happens if a guest damages the property?

Airbnb’s AirCover for Hosts provides up to $3 million in damage protection. As a co host, you should document the property condition before each stay (photos help). If damage occurs, file a claim through Airbnb’s Resolution Center within 14 days. Your co-hosting agreement should clarify who handles the claim process and how deductibles or unrecovered costs are split between you and the owner.

Can a co-host be removed at any time?

Yes. The primary host can remove a co host from a listing at any time through the platform. This is why a written co-hosting agreement with a notice period (typically 30 days) is essential. It protects both parties and ensures a smooth transition if the arrangement ends.